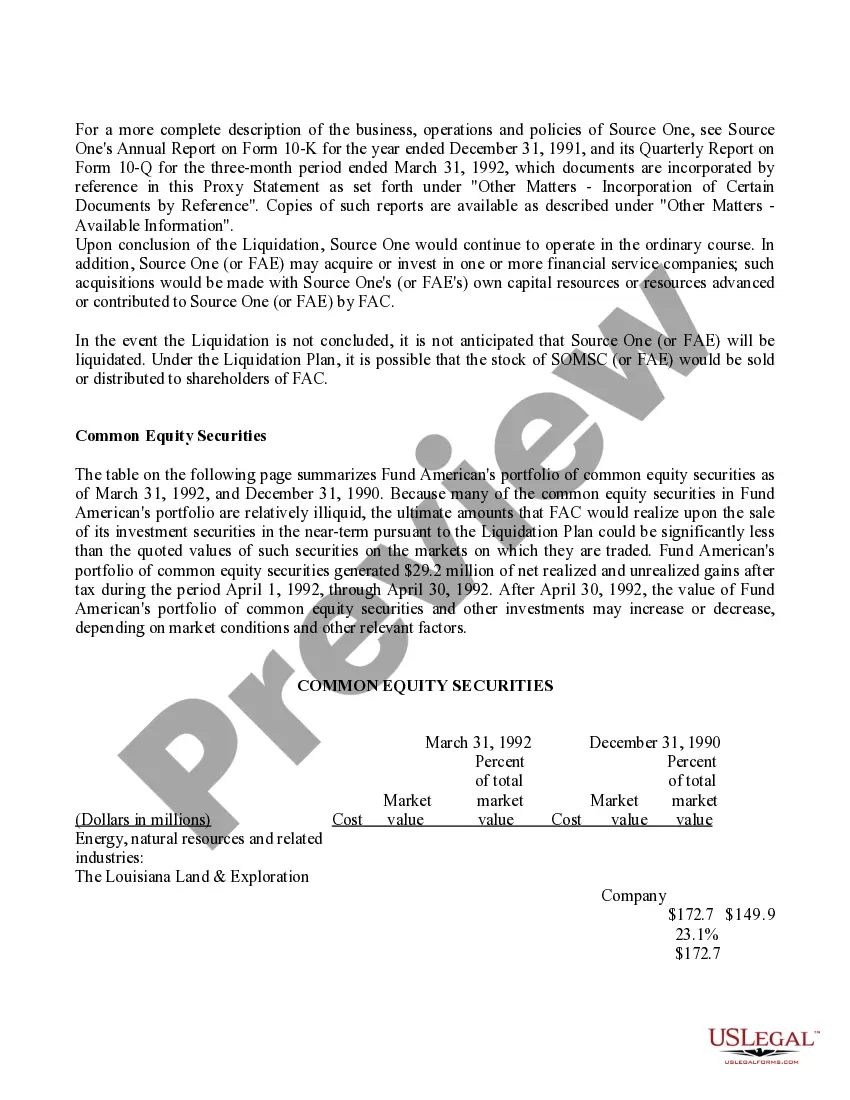

Queens New York Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Queens New York Proposal - Conclusion Of The Liquidation With Exhibit?

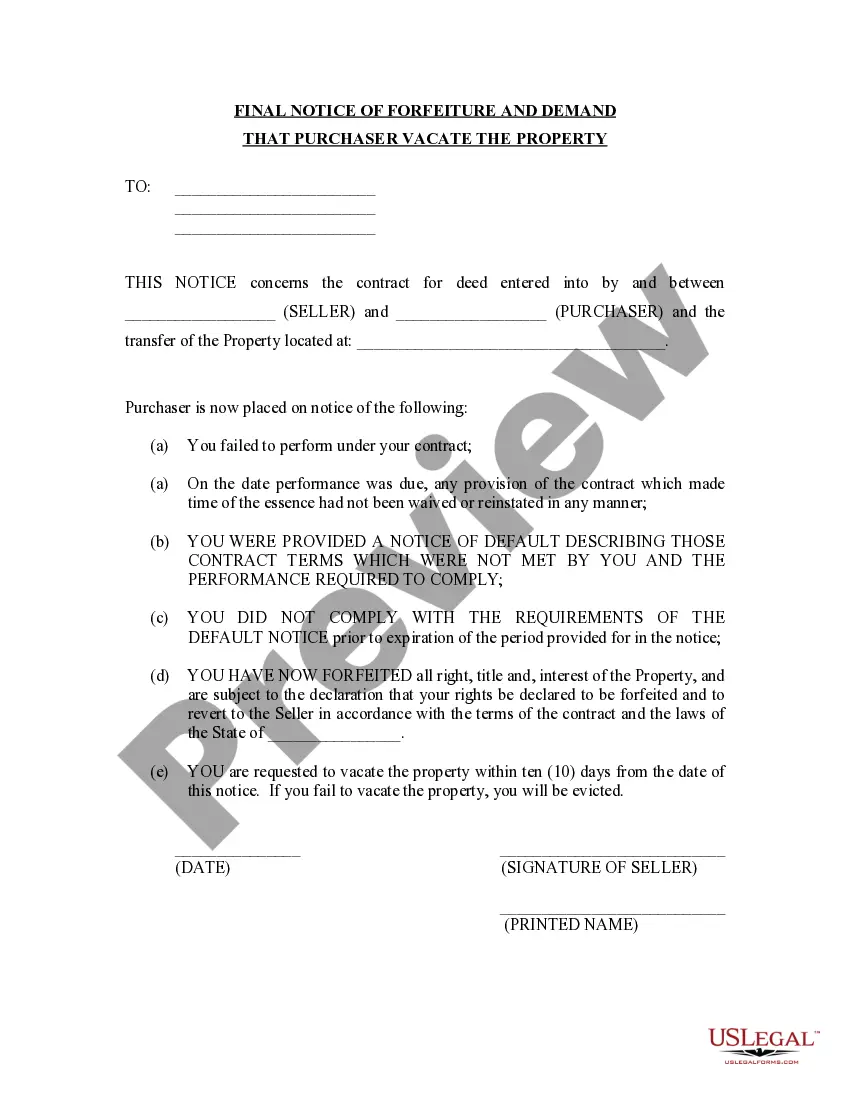

Whether you plan to start your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Queens Proposal - Conclusion of the Liquidation with exhibit is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Queens Proposal - Conclusion of the Liquidation with exhibit. Adhere to the instructions below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Queens Proposal - Conclusion of the Liquidation with exhibit in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

In any case, the first step in the liquidation process is for the company directors to seek impartial advice from an insolvency expert, before convening a meeting with shareholders to announce the intended liquidation.

The administration of the liquidation begins. selling or closing the business. identifying and selling the company's assets. contacting and receiving claims from creditors. sending progress reports to creditors.

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.

Company Liquidation of an insolvent company has two types Creditors Voluntary Liquidation and Compulsory Liquidation. Business continuity or business restart can only usually take place through Creditors Voluntary Liquidation. Such a restart is sometimes known as a phoenix company.

There is no legal time limit on business liquidation. From beginning to end, it usually takes between six and 24 months to fully liquidate a company. Of course, it does depend on your company's position and the form of liquidation you're undertaking.

The definition of liquidation is the act of turning assets into cash. When a business closes and sells all of its merchandise because it is bankrupt, this is an example of liquidation. When you sell your investment to free up the cash, this is an example of liquidation of the investment.

Step 1 - A Creditor Issues a Statutory Payment Demand. Step 2 A Winding Up Petition is Issued. Step 3 A winding up order is granted. Step 4 The Company is Liquidated. Step 5 Post-Liquidation Investigation.

3 Types of Liquidation The most common types of liquidation are compulsory liquidation, members' voluntary liquidation, and creditors' voluntary liquidation.

Simply put, a dissolution is a (typically) voluntary legal closure of a business while a liquidation involves the selling of a company's assets in order to pay creditors.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.