Title: Understanding the Chicago Illinois Proposal to Adopt Plan of Dissolution and Liquidation Introduction: A Chicago Illinois Proposal to Adopt Plan of Dissolution and Liquidation refers to the formal resolution put forth by an organization or entity based in Chicago, Illinois, outlining the framework for winding down its operations and distributing its assets. When facing financial distress, legal obligations, or other compelling reasons, this proposal provides a structured approach to dissolve and liquidate the entity while ensuring the fair distribution of its remaining resources. Different types of such proposals can be distinguished based on the nature of the organization undergoing dissolution and liquidation. Let's delve into the key aspects and relevant keywords associated with this topic. Key Components: 1. Definition and Purpose: The Chicago Illinois Proposal to Adopt Plan of Dissolution and Liquidation lays out the purpose, scope, and reasons behind the decision to dissolve and liquidate the entity. It highlights the specific goals, legal requirements, and procedures to be followed during this process. 2. Liquidation Plan: This proposal encompasses a detailed liquidation plan that outlines how the entity's assets, both tangible and intangible, will be assessed, valued, and distributed. The liquidation plan may also include provisions for settling outstanding debts, liabilities, and obligations. 3. Identification of Stakeholders: It is crucial to identify the stakeholders affected by the dissolution and liquidation proposal. These may include shareholders, investors, creditors, employees, customers, and other relevant parties. The proposal defines how their interests will be safeguarded and how they will participate in the distribution of assets. 4. Legal Compliance: The Chicago Illinois Proposal to Adopt Plan of Dissolution and Liquidation ensures compliance with all applicable federal, state, and local laws, regulations, and reporting requirements. It may involve submitting necessary documentation, notifying authorities, and addressing tax implications. 5. Timelines and Milestones: The proposal sets realistic timelines and milestones for the completion of various tasks involved in the dissolution and liquidation process. This ensures a smooth and efficient transition, minimizing disruptions and maximizing asset preservation. 6. Dispute Resolution: In cases where disputes arise during the dissolution and liquidation, the proposal may include a dispute resolution mechanism, such as arbitration or mediation. This ensures fair resolution and avoids unnecessary delays. 7. Reporting and Communications: The proposal defines the requirements for regular reporting and communication, ensuring transparency and accountability throughout the dissolution and liquidation process. This may involve periodic updates to stakeholders and public disclosures as necessary. Types of Chicago Illinois Proposals to Adopt Plan of Dissolution and Liquidation: 1. Business Dissolution and Liquidation: This type of proposal is relevant for corporations, partnerships, limited liability companies (LCS), and other business entities ceasing their operations due to financial distress, strategic decisions, mergers and acquisitions, or the expiration of a predetermined business term. 2. Nonprofit Organization Dissolution and Liquidation: Nonprofit organizations seeking to dissolve and liquidate may require a specialized proposal tailored to their unique legal and tax-exempt status. This involves the distribution of assets to other charitable organizations or causes following legal procedures. 3. Estate Dissolution and Liquidation: Individuals or families seeking to dissolve and liquidate a trust, estate, or family-owned entity may formulate a distinct proposal to address estate planning, asset distribution, tax implications, and any relevant legal requirements. Conclusion: The Chicago Illinois Proposal to Adopt Plan of Dissolution and Liquidation is a critical document that guides the organized wind-down of an entity based in Chicago, Illinois. It ensures compliance with legal obligations, fair distribution of assets, and effective communication with stakeholders. Whether for businesses, nonprofit organizations, or estates, understanding the relevant aspects of this proposal is essential for a smooth and legally compliant dissolution and liquidation process.

Chicago Illinois Proposal to adopt plan of dissolution and liquidation

Description

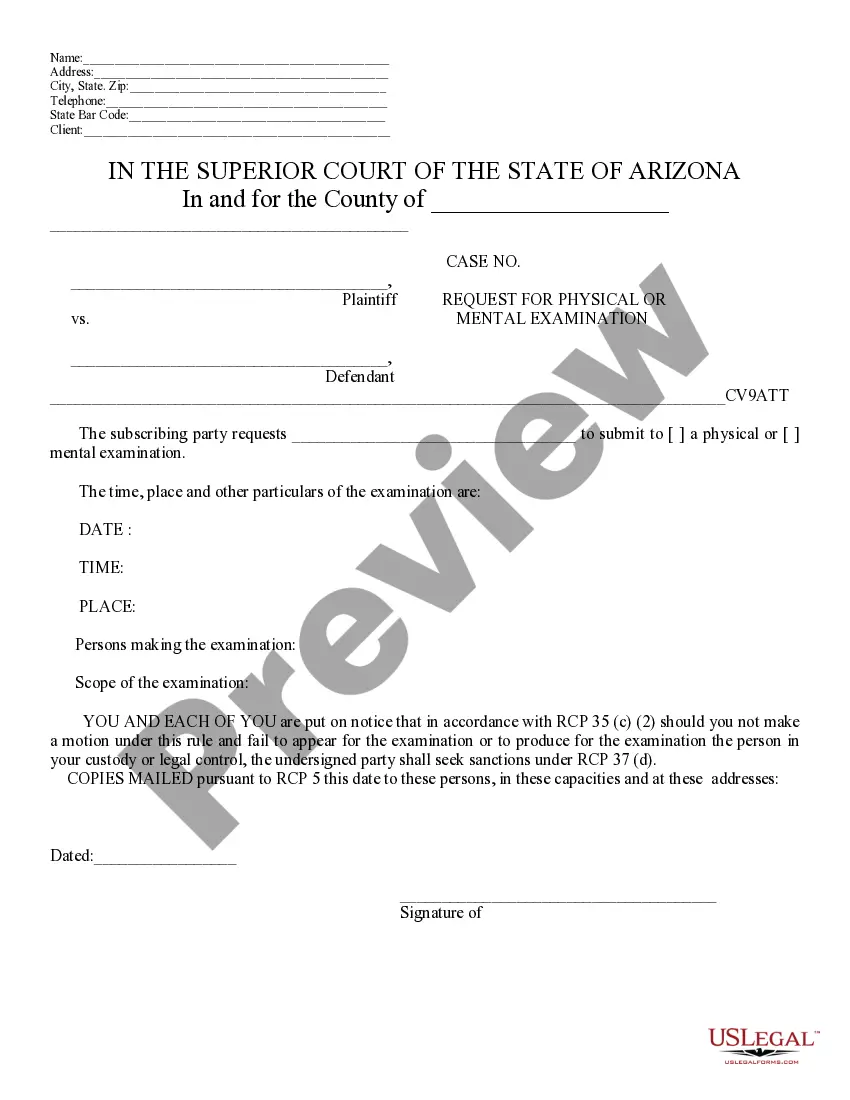

How to fill out Chicago Illinois Proposal To Adopt Plan Of Dissolution And Liquidation?

Drafting papers for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Chicago Proposal to adopt plan of dissolution and liquidation without expert assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Chicago Proposal to adopt plan of dissolution and liquidation on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Chicago Proposal to adopt plan of dissolution and liquidation:

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

The dissolution process is more than just closing down your LLC. It also includes filling out paperwork to officially terminate the company's status in the eyes of the state. Once the LLC is dissolved, you'll be taxed as an individual and no more business reporting will be required.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

If the leadership of the organization decides that winding down is the best option, the organization will need a ?plan of dissolution.? A ?plan of dissolution? is essentially a written description of how the nonprofit intends to distribute its remaining assets and address its remaining liabilities.

Generally called articles of dissolution, it usually states the LLC's name, the date it was formed, the fact the LLC is dissolving, and the event triggering the dissolution. Upon the effective date of this document, the LLC is considered dissolved and must stop doing its regular business and start winding up.

Dissolution is the noun form of dissolve, but it's a much less common word. Still, we refer to the fact that the dissolution of American marriages became far more common in the later 20th century. Or that when India won its independence in 1947, the dissolution of the once-global British empire was all but complete.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

Dissolution is the end of the legal existence of a corporation. It usually occurs after liquidation, which is the process of paying debts and distributing assets. There are several methods by which a corporation may be dissolved. The first is voluntary dissolution, which is an elective decision to dissolve the entity.

By Practical Law Corporate & Securities. A plan for dissolving a New Jersey for-profit corporation. This document can be used as a separate agreement or incorporated into a resolution for the corporation.

A certified copy of a resolution to dissolve a corporation is an important document to maintain when it comes time to dissolve a company. This form is required by the IRS along with Form 966.

The quick answer Liquidate means a formal closing down by a liquidator when there are still assets and liabilities to be dealt with. Dissolving a company is where the business is struck off the register at Companies House because it is now inactive. The two are very different processes.