Title: Understanding the Houston, Texas Proposal to Adopt Plan of Dissolution and Liquidation Introduction: In this article, we will delve into the intricacies of the Houston, Texas proposal to adopt a plan of dissolution and liquidation. We will explore its significance, process, potential types, and keywords associated with this proposal. Whether you are a stakeholder, a curious citizen, or a legal enthusiast, this content aims to provide a comprehensive understanding of the topic. 1. Houston, Texas Proposal to Adopt Plan of Dissolution and Liquidation: The Houston, Texas proposal to adopt a plan of dissolution and liquidation refers to a formal procedure undertaken by an organization, typically a corporation, registered in the state of Texas, to wind up its affairs and distribute its assets to its shareholders. This proposal is considered when circumstances warrant the cessation of the organization's operations due to financial, legal, or strategic reasons. 2. Importance of the Proposal: This proposal holds significant importance as it allows the organization to conclude its activities in an orderly manner while ensuring equitable distribution of its assets among the stakeholders. The plan of dissolution and liquidation ensures compliance with legal obligations, protects the interests of the organization's shareholders, and paves the way for a smooth transition to an inactive or dissolved state. 3. Process of Adopting the Proposal: The process of adopting the proposal involves several steps that are generally followed in specific order: a. Initial Resolution: The organization's board of directors proposes the plan of dissolution and liquidation, which is then subject to approval by the shareholders. b. Special Meeting: A special meeting of the shareholders is conducted to discuss and vote on the proposed plan. If the plan is approved by the majority of shareholders, it moves forward. c. Notice to Creditors: Once approved, the organization is required to provide notice to its creditors, allowing them to submit their claims against the organization's assets. d. Asset Liquidation: The organization's assets are then liquidated, converting them into cash. This involves selling properties, settling liabilities, collecting outstanding debts, etc. e. Distribution: The proceeds from the liquidation are distributed among the shareholders based on their ownership interests, following proper legal guidelines. 4. Potential Types of Houston, Texas Proposals to Adopt Plan of Dissolution and Liquidation: While the general process remains the same, there may be specific types of dissolution and liquidation plans tailored to different circumstances. These can include: a. Voluntary Dissolution: When the organization voluntarily decides to cease its operations due to financial difficulties, loss of relevance, or restructuring efforts. b. Involuntary Dissolution: When the organization is forced to dissolve due to legal or regulatory requirements, such as failure to comply with the Texas state laws or court orders. c. Administrative Dissolution: When the Texas Secretary of State administratively dissolves the organization due to non-compliance with statutory obligations, such as failure to file annual reports or pay franchise taxes. d. Creditors' Dissolution: In situations where the organization's liabilities exceed its available assets, creditors may petition for dissolution to recover their debts. Conclusion: The Houston, Texas proposal to adopt a plan of dissolution and liquidation is a crucial process that allows organizations to wind up their affairs, distribute assets, and conclude their operations legally and equitably. By understanding the relevant keywords and the potential types of proposals associated with this process, stakeholders and professionals can navigate this area with confidence, ensuring compliance and protection of interests.

Houston Texas Proposal to adopt plan of dissolution and liquidation

Description

How to fill out Houston Texas Proposal To Adopt Plan Of Dissolution And Liquidation?

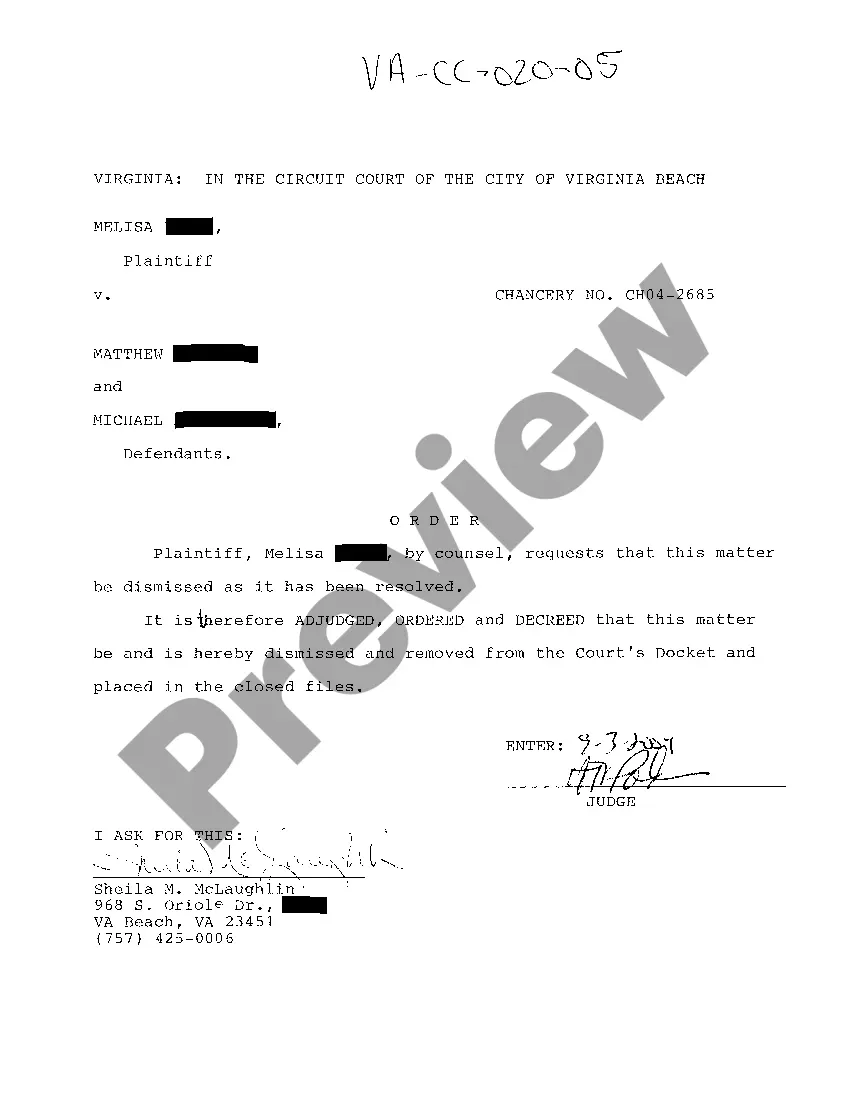

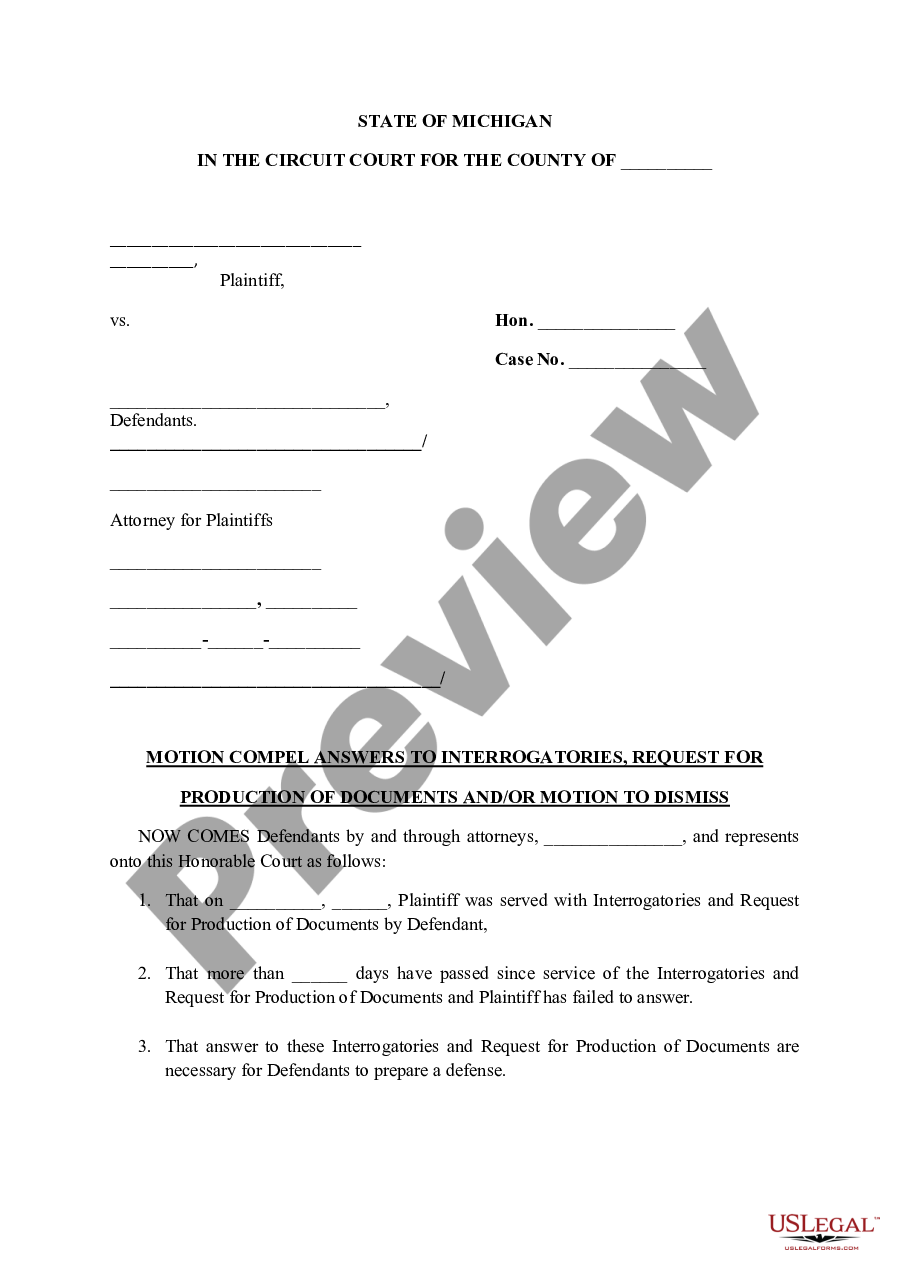

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Houston Proposal to adopt plan of dissolution and liquidation, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the current version of the Houston Proposal to adopt plan of dissolution and liquidation, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Houston Proposal to adopt plan of dissolution and liquidation:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Houston Proposal to adopt plan of dissolution and liquidation and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Section references are to the Internal Revenue Code unless otherwise noted. A corporation (or a farmer's cooperative) must file Form 966 if it adopts a resolution or plan to dissolve the corporation or liquidate any of its stock.

There is no direct Form 966 penalty for non-filing or late filing, but by not properly notifying the IRS of a dissolution or liquidation, it may result in collateral damage and other penalties.

You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

However, filing these dissolution papers is one part of closing a limited liability company. The LLC is registered with the state where the articles of organization were filed. Dissolution resolution, Articles of dissolution, and IRS form 966 are required to cancel a LLC.

If a business is not properly dissolved, it continues to exist as a legal entity under state law. This means that it will be remain subject to corporation or LLC filing requirements, such as annual reports and franchise taxes.

Form 941, Employer's Quarterly Federal Tax Return, or Form 944, Employer's Annual Federal Tax Return, for the quarter in which you make final wage payments. Check the box to tell the IRS your business has closed and enter the date final wages were paid on line 17 of Form 941 or line 14 of Form 944.

An authorized person must sign and date the bottom of the form, which can be submitted electronically, in the mail, or at an IRS service center.

File Form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If the resolution or plan is amended or supplemented after Form 966 is filed, file another Form 966 within 30 days after the amendment or supplement is adopted.

There is no direct Form 966 penalty for non-filing or late filing, but by not properly notifying the IRS of a dissolution or liquidation, it may result in collateral damage and other penalties.

File Form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If the resolution or plan is amended or supplemented after Form 966 is filed, file another Form 966 within 30 days after the amendment or supplement is adopted.