Nassau New York Proposal to Adopt Plan of Dissolution and Liquidation — Exploring the Path to Closure The Nassau New York Proposal to Adopt Plan of Dissolution and Liquidation aims to provide a comprehensive strategy for the dissolution and liquidation of designated entities within Nassau County, New York. This proposed plan aims to facilitate an efficient and orderly process, ensuring that all assets, liabilities, and legal obligations are appropriately addressed. Keywords: Nassau New York, Proposal, Adopt, Plan, Dissolution, Liquidation I. Introduction: Under the Nassau New York Proposal to Adopt Plan of Dissolution and Liquidation, various entities within Nassau County, New York will take part in a structured and well-defined process of winding down their operations. This proposal encompasses both public and private entities, including corporations, organizations, associations, and other legal entities. II. Objectives: 1. Orderly Dissolution: The proposed plan aims to ensure that each entity proceeds through the dissolution process in an orderly and lawful manner, minimizing any potential disruption to stakeholders and the community. 2. Asset Evaluation: Comprehensive evaluation of all assets owned by the entity, including real estate, intellectual property, equipment, and financial holdings. 3. Liabilities Assessment: Careful review of all outstanding debts, contracts, and legal obligations to be meticulously addressed during the liquidation process. 4. Employee Support: Provisions for assisting affected employees during the dissolution process, which may include job training, reassignment, severance packages, or other support measures. 5. Governance: Establishing a governance framework to oversee the dissolution and liquidation process and ensure transparency, accountability, and compliance with applicable laws and regulations. III. Process: 1. Formation of Dissolution Committee: Following the proposal's adoption, a dissolution committee would be formed, consisting of experienced professionals from relevant sectors, tasked with overseeing the entire dissolution and liquidation process. 2. Inventory and Audit: A comprehensive inventory will be conducted to identify and evaluate all assets, including tangible and intangible ones. An audit will also assess the entity's financial status, aiming to provide a clear picture of its financial obligations. 3. Liabilities and Obligations: All outstanding liabilities, such as debts, contracts, lawsuits, or claims, will be meticulously assessed and addressed in compliance with applicable laws and regulations. 4. Communication and Stakeholder Management: A communication plan will be enacted to keep stakeholders informed throughout the process, including employees, shareholders, suppliers, customers, and the public, ensuring transparency and minimizing any negative impact. 5. Asset Liquidation: Assets identified during the inventory and audit process will be liquidated through appropriate channels, including sales, auctions, or transfers to interested parties, aiming to maximize their value. 6. Closure and Documentation: Once all assets are liquidated, outstanding liabilities addressed, and legal requirements fulfilled, the entity will undergo the necessary legal procedures to finalize its dissolution, discontinue operations, and officially close its doors. IV. Types of Entities: The Nassau New York Proposal to Adopt Plan of Dissolution and Liquidation is applicable to various types of entities, including but not limited to: 1. Corporations 2. Non-Profit Organizations 3. Limited Liability Companies (LCS) 4. Associations 5. Partnerships 6. Trusts Conclusion: The Nassau New York Proposal to Adopt Plan of Dissolution and Liquidation offers a clear roadmap for winding down designated entities within Nassau County, New York. Through a well-defined process, this proposal aims to facilitate an efficient, transparent, and lawful dissolution and liquidation while addressing the needs of stakeholders, employees, and the community.

Nassau New York Proposal to adopt plan of dissolution and liquidation

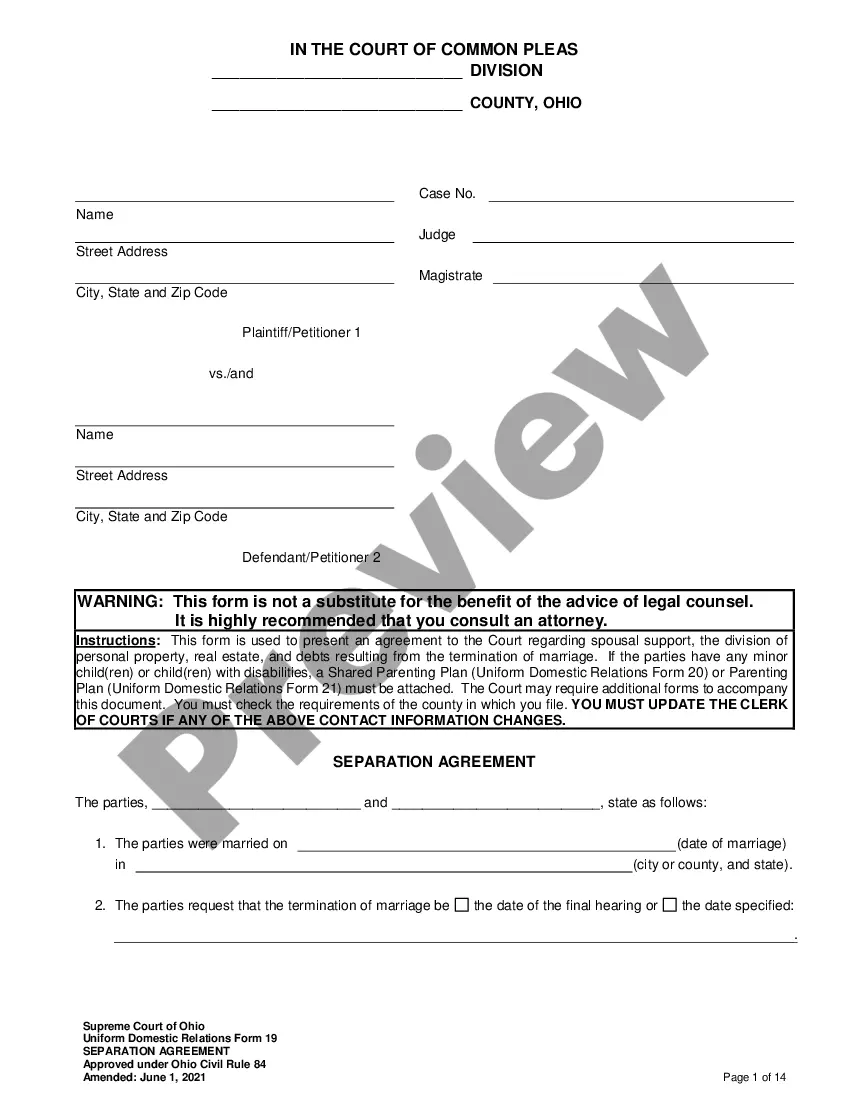

Description

How to fill out Nassau New York Proposal To Adopt Plan Of Dissolution And Liquidation?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Nassau Proposal to adopt plan of dissolution and liquidation.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Nassau Proposal to adopt plan of dissolution and liquidation will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Nassau Proposal to adopt plan of dissolution and liquidation:

- Make sure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Nassau Proposal to adopt plan of dissolution and liquidation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!