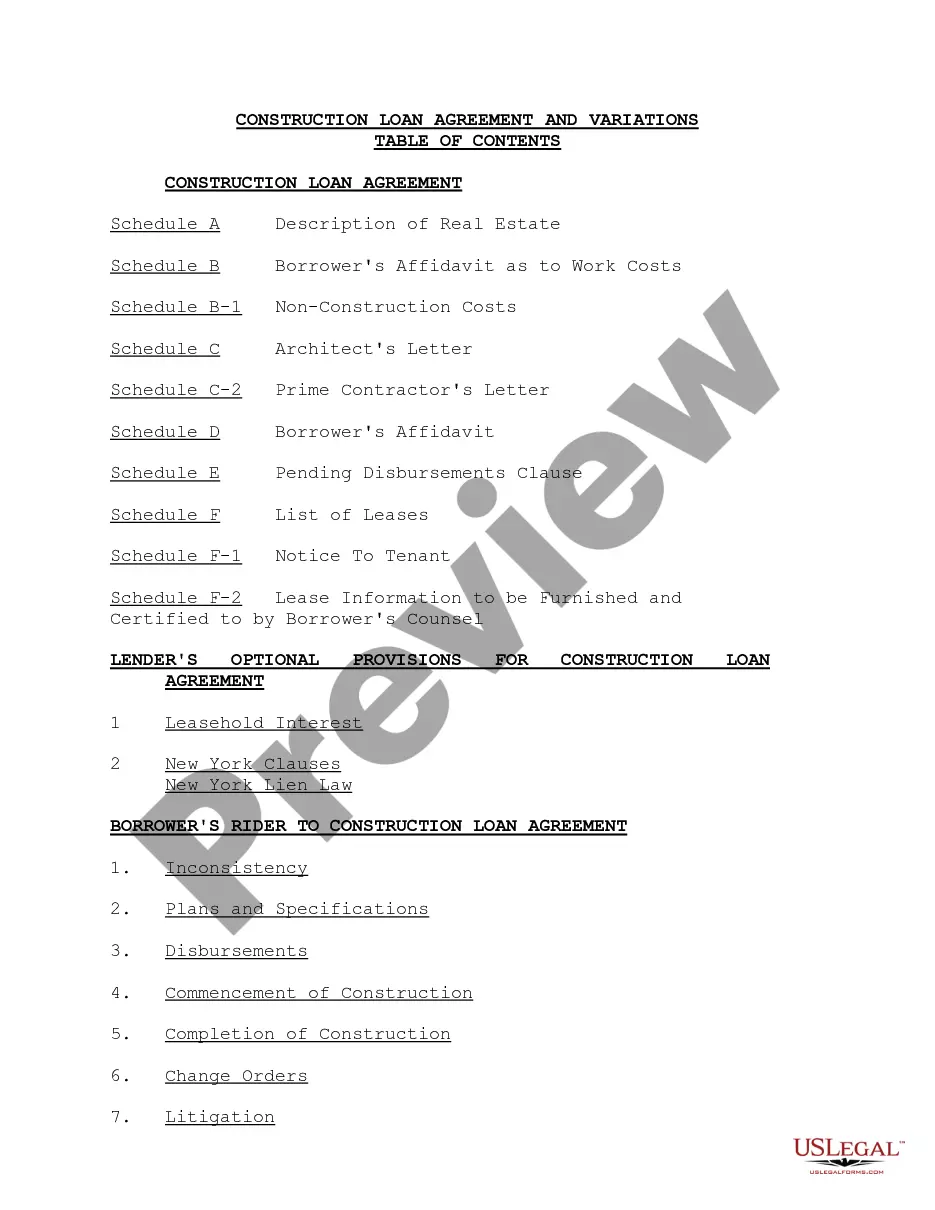

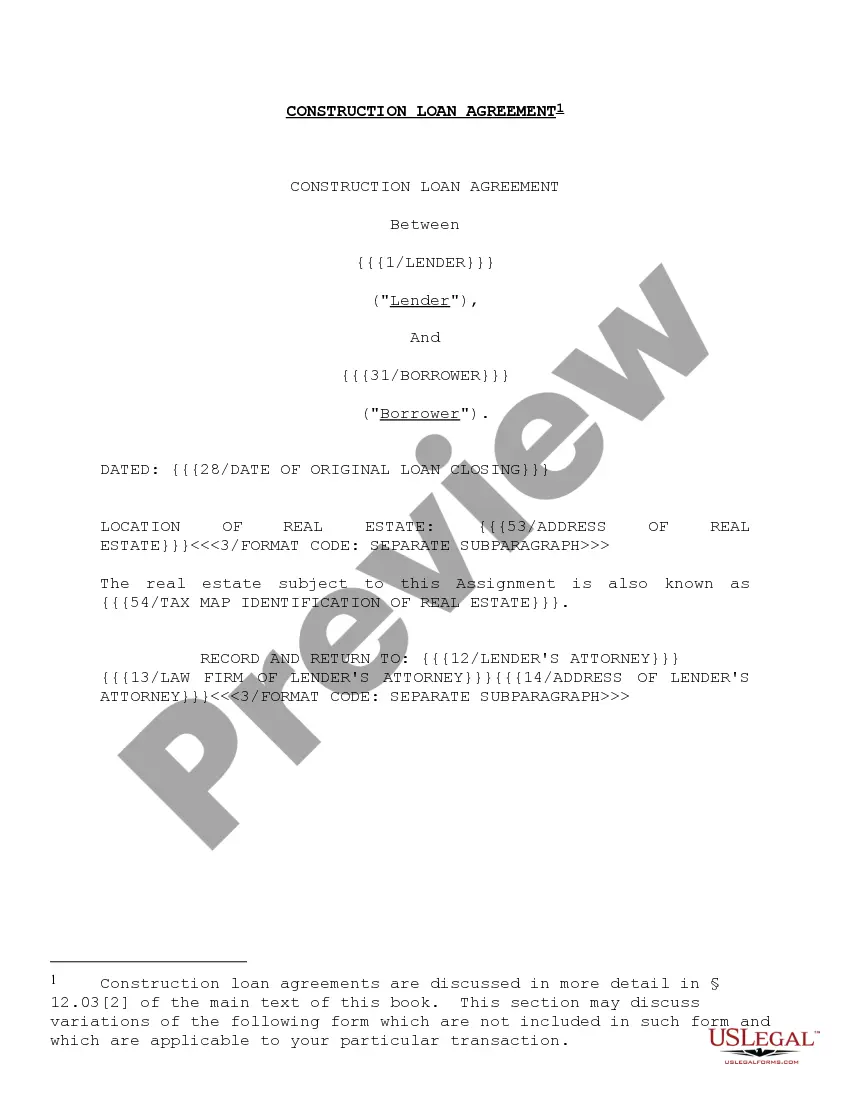

"Construction Loan Agreements and Variations" is a American Lawyer Media form. This form is to be used as a construction loan agreement.

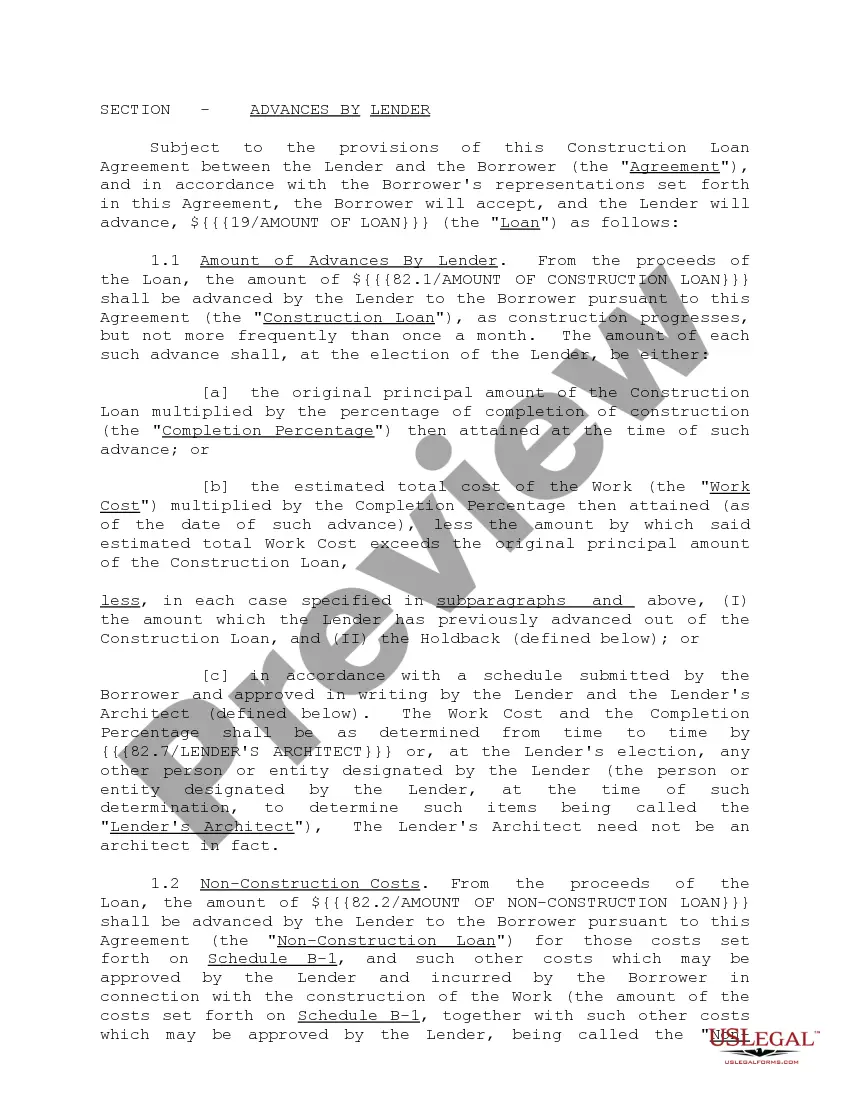

Houston Texas Construction Loan Agreements and Variations: A Comprehensive Guide Introduction: Houston, Texas is a thriving city with a strong real estate market, making it an ideal place for construction projects. To fund these projects, developers often turn to construction loan agreements, which provide the necessary financing for the construction process. This article will provide a detailed description of Houston Texas construction loan agreements and explore the various variations available to borrowers. 1. What is a Construction Loan Agreement? A construction loan agreement is a financial contract between a borrower (usually a developer or builder) and a lender (typically a bank or financial institution) that outlines the terms and conditions associated with funding a construction project in Houston, Texas. This agreement serves as the roadmap for the project's financing and outlines how funds will be disbursed throughout the construction process. 2. Key Components of a Construction Loan Agreement: — Loan Amount: Specifies the total amount the borrower is eligible to receive for the construction project. — Interest Rate and Terms: Outlines the interest rate, repayment terms, and schedule for the loan. — Completion Timeline: Defines the time period within which the project must be completed to maintain loan eligibility. — Draw Schedule: Details how funds will be released to the borrower in stages or "draws" based on specific construction milestones. — Conditions Precedent: Lists any conditions that must be met by the borrower before receiving loan disbursements. — Collateral: Identifies the property or assets to be used as collateral to secure the loan. 3. Types of Houston Texas Construction Loan Agreements: a. Single-Close Construction Loan: This type of loan combines the funding for purchasing the land and constructing the property into a single loan, streamlining the borrowing process. b. Two-Time Close Construction Loan: In this approach, separate loans are taken out for acquiring the land and construction, allowing for greater flexibility in choosing lenders and interest rates. c. Mini-Perm Construction Loan: A mini-perm loan provides short-term financing for a construction project, typically ranging from 1-3 years. Once the project is completed, the borrower can seek more permanent financing. d. Renovation or Rehab Construction Loan: Designed for renovating or rehabilitating existing structures, these loans cater to projects aimed at improving or restoring older buildings. 4. Variations and Customization of Construction Loan Agreements: — Loan-to-Cost (LTC) Ratio: The ratio between the loan amount and the total cost of construction can vary, depending on the lender's risk appetite and project specifics. — Interest Rate Options: Fixed-rate, adjustable-rate, or interest-only options can be negotiated depending on the borrower's preferences and market conditions. — Prepayment Options: Borrowers can negotiate prepayment penalties or the ability to make early loan repayments without penalties. — Contingency Funds: Lenders may require the inclusion of contingency funds in the loan agreement to account for unexpected construction costs or scope changes. Conclusion: Houston, Texas construction loan agreements are indispensable tools that enable developers to finance their construction projects efficiently. With variations such as single-close, two-time close, mini-perm, and renovation loans, borrowers have options tailored to their specific needs. By understanding the components and variations of construction loan agreements, developers can navigate the Houston market with confidence and successfully complete their projects.Houston Texas Construction Loan Agreements and Variations: A Comprehensive Guide Introduction: Houston, Texas is a thriving city with a strong real estate market, making it an ideal place for construction projects. To fund these projects, developers often turn to construction loan agreements, which provide the necessary financing for the construction process. This article will provide a detailed description of Houston Texas construction loan agreements and explore the various variations available to borrowers. 1. What is a Construction Loan Agreement? A construction loan agreement is a financial contract between a borrower (usually a developer or builder) and a lender (typically a bank or financial institution) that outlines the terms and conditions associated with funding a construction project in Houston, Texas. This agreement serves as the roadmap for the project's financing and outlines how funds will be disbursed throughout the construction process. 2. Key Components of a Construction Loan Agreement: — Loan Amount: Specifies the total amount the borrower is eligible to receive for the construction project. — Interest Rate and Terms: Outlines the interest rate, repayment terms, and schedule for the loan. — Completion Timeline: Defines the time period within which the project must be completed to maintain loan eligibility. — Draw Schedule: Details how funds will be released to the borrower in stages or "draws" based on specific construction milestones. — Conditions Precedent: Lists any conditions that must be met by the borrower before receiving loan disbursements. — Collateral: Identifies the property or assets to be used as collateral to secure the loan. 3. Types of Houston Texas Construction Loan Agreements: a. Single-Close Construction Loan: This type of loan combines the funding for purchasing the land and constructing the property into a single loan, streamlining the borrowing process. b. Two-Time Close Construction Loan: In this approach, separate loans are taken out for acquiring the land and construction, allowing for greater flexibility in choosing lenders and interest rates. c. Mini-Perm Construction Loan: A mini-perm loan provides short-term financing for a construction project, typically ranging from 1-3 years. Once the project is completed, the borrower can seek more permanent financing. d. Renovation or Rehab Construction Loan: Designed for renovating or rehabilitating existing structures, these loans cater to projects aimed at improving or restoring older buildings. 4. Variations and Customization of Construction Loan Agreements: — Loan-to-Cost (LTC) Ratio: The ratio between the loan amount and the total cost of construction can vary, depending on the lender's risk appetite and project specifics. — Interest Rate Options: Fixed-rate, adjustable-rate, or interest-only options can be negotiated depending on the borrower's preferences and market conditions. — Prepayment Options: Borrowers can negotiate prepayment penalties or the ability to make early loan repayments without penalties. — Contingency Funds: Lenders may require the inclusion of contingency funds in the loan agreement to account for unexpected construction costs or scope changes. Conclusion: Houston, Texas construction loan agreements are indispensable tools that enable developers to finance their construction projects efficiently. With variations such as single-close, two-time close, mini-perm, and renovation loans, borrowers have options tailored to their specific needs. By understanding the components and variations of construction loan agreements, developers can navigate the Houston market with confidence and successfully complete their projects.