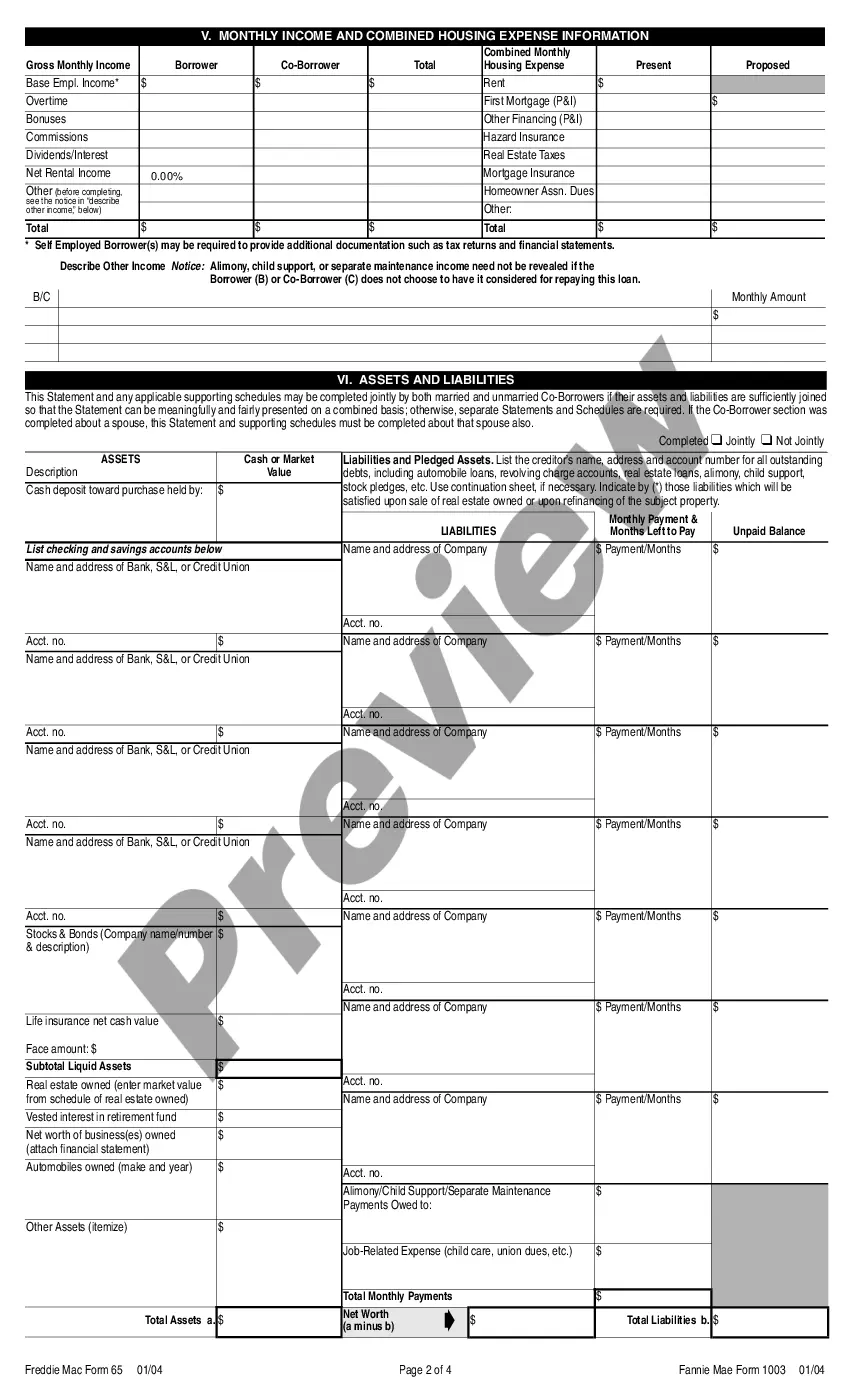

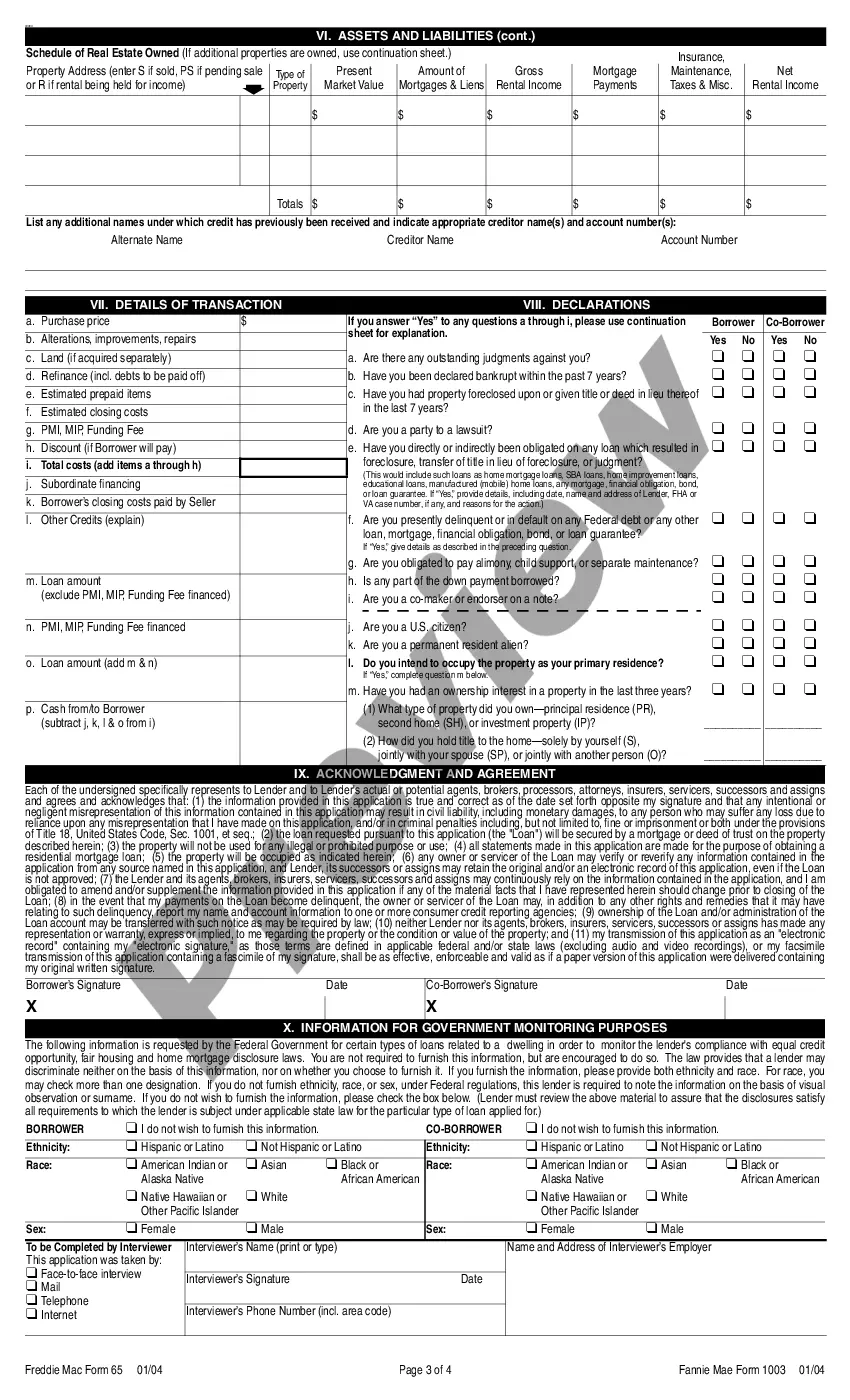

The Bronx New York Uniform Residential Loan Application (UCLA) is a standardized form used by lenders to collect important information from borrowers who are seeking a residential loan in the Bronx, New York area. This comprehensive application form serves as a part of the loan process and helps lenders and mortgage brokers assess the borrower's ability to repay the loan. The Bronx New York UCLA consists of several sections that capture vital details such as the borrower's personal information, employment history, income, assets, liabilities, and the property being financed. It also includes sections for co-borrower details, if applicable. This loan application contains relevant keywords such as: 1. Bronx, New York: Refers to the specific location where the loan application is applicable, namely the Bronx borough in New York City. 2. Uniform Residential Loan Application: Indicates that the form adheres to a standardized format accepted by various lenders and mortgage institutions nationwide. 3. Residential Loan: Emphasizes that the loan being applied for is meant for residential purposes, such as purchasing or refinancing a home. 4. Lenders/Mortgage Brokers: Specifies the entities involved in the loan process, responsible for reviewing and approving loan applications. 5. Borrower's Personal Information: Involves the borrower's name, contact details, social security number, birthdate, and other identifying information. 6. Employment History: Covers the borrower's employment background, including current and previous employers, job titles, and duration of employment. 7. Income: Focuses on the borrower's sources of income, such as employment wages, self-employment earnings, investments, and alimony. 8. Assets: Encompasses the borrower's assets, including cash, bank accounts, real estate, vehicles, retirement accounts, stocks, and bonds. 9. Liabilities: Refers to the borrower's outstanding debts, including mortgages, credit card balances, student loans, and other financial obligations. 10. Property: Identifies the property being financed, including its address, type (single-family, condominium, etc.), and appraised value. While the Bronx New York URL Atypically follows a standard format, there may be variations or supplemental forms depending on the specific lender or mortgage broker. These variations may include documentation related to income verification, credit history, and additional disclosures required by the lender. It's crucial for borrowers to ensure accurate and complete information while filling out the Bronx New York UCLA to facilitate a smooth loan approval process.

Bronx New York Uniform Residential Loan Application

Description

How to fill out Bronx New York Uniform Residential Loan Application?

Are you looking to quickly create a legally-binding Bronx Uniform Residential Loan Application or maybe any other form to handle your personal or corporate affairs? You can select one of the two options: hire a professional to draft a legal document for you or create it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific form templates, including Bronx Uniform Residential Loan Application and form packages. We provide documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, double-check if the Bronx Uniform Residential Loan Application is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Bronx Uniform Residential Loan Application template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the documents we offer are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!