The Contra Costa California Uniform Residential Loan Application is a standardized form that is used by lenders to collect essential information from borrowers applying for a mortgage loan in Contra Costa County, California. This application serves as a comprehensive document that gathers the necessary details about the borrower, property, income, and employment history, credit history, and other related information. Keywords: Contra Costa California, Uniform Residential Loan Application, lenders, borrowers, mortgage loan, property, income, employment history, credit history. Different types of Contra Costa California Uniform Residential Loan Applications include: 1. Conventional Loan Application: This type of loan application is used by individuals seeking a traditional mortgage loan offered by private lenders or financial institutions. It requires applicants to meet specific lending criteria, including a good credit score, stable income, and a down payment typically ranging from 3% to 20% of the property's purchase price. 2. FHA Loan Application: The Federal Housing Administration (FHA) offers government-insured loans to borrowers with lower credit scores or limited financial resources. The FHA loan application process follows specific guidelines set by the FHA, allowing individuals with less favorable financial profiles to have access to homeownership opportunities. 3. VA Loan Application: Reserved for eligible military veterans, active-duty service members, and their surviving spouses, the VA loan application aims to provide favorable terms and conditions for veterans. This type of loan is guaranteed by the U.S. Department of Veterans Affairs, enabling borrowers to obtain mortgages with no down payment, competitive interest rates, and flexible credit requirements. 4. USDA Loan Application: The United States Department of Agriculture (USDA) provides loan programs designed for low- to moderate-income borrowers in rural areas. The USDA loan application allows individuals to purchase or refinance properties in eligible rural zones with minimal or no down payment requirement. 5. Jumbo Loan Application: For borrowers seeking larger loan amounts that exceed the conforming loan limits set by government-sponsored enterprises like Fannie Mae and Freddie Mac, the jumbo loan application is required. These loans typically cater to high-income earners or individuals purchasing high-value properties in expensive real estate markets. By using the Contra Costa California Uniform Residential Loan Application, lenders can gather all the necessary information required to evaluate a borrower's creditworthiness and make informed lending decisions. Note: The information provided in this response is based on general knowledge and may vary. It is always recommended consulting with professionals or specific financial institutions for accurate and current information regarding the Contra Costa California Uniform Residential Loan Application and its various types.

Contra Costa California Uniform Residential Loan Application

Description

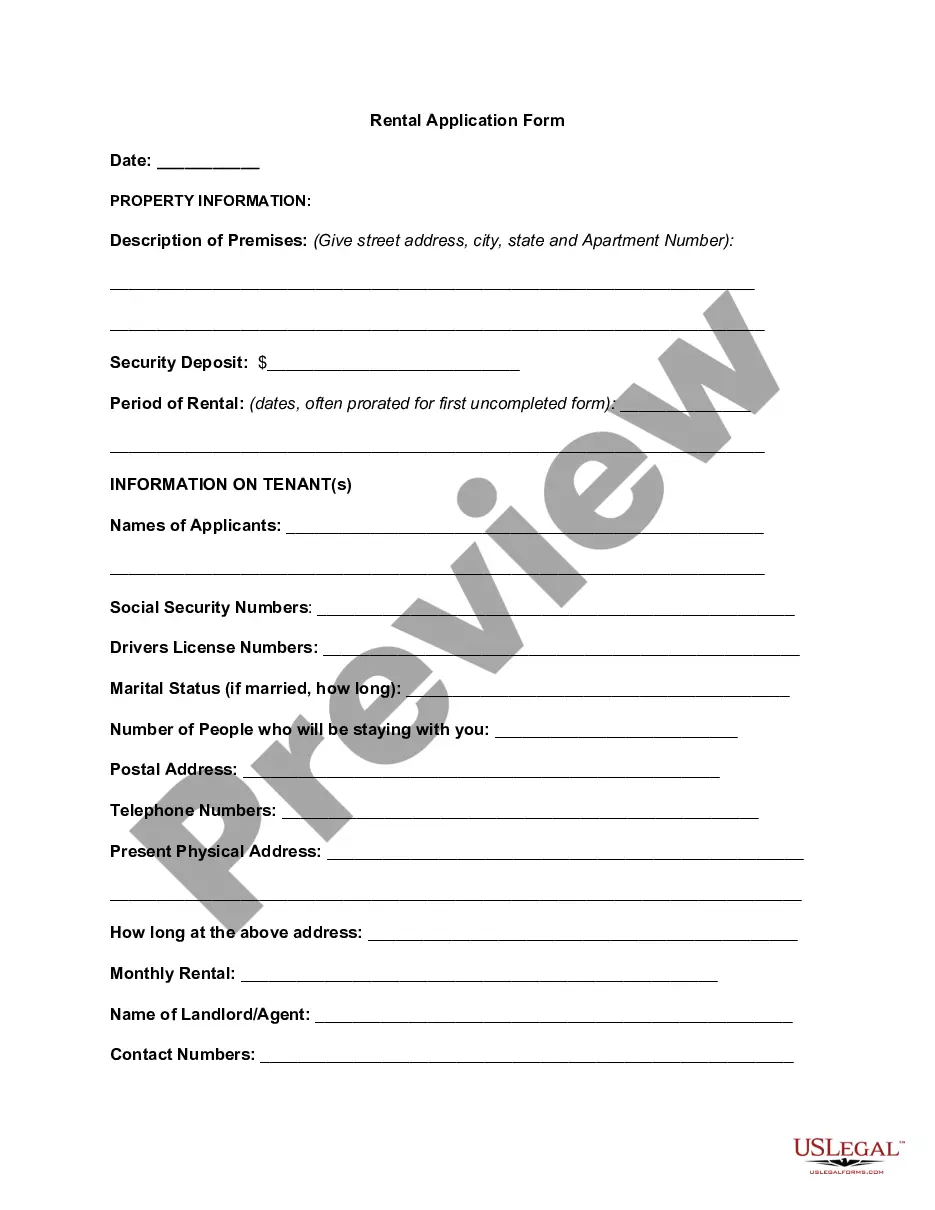

How to fill out Contra Costa California Uniform Residential Loan Application?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Contra Costa Uniform Residential Loan Application, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Contra Costa Uniform Residential Loan Application from the My Forms tab.

For new users, it's necessary to make some more steps to get the Contra Costa Uniform Residential Loan Application:

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

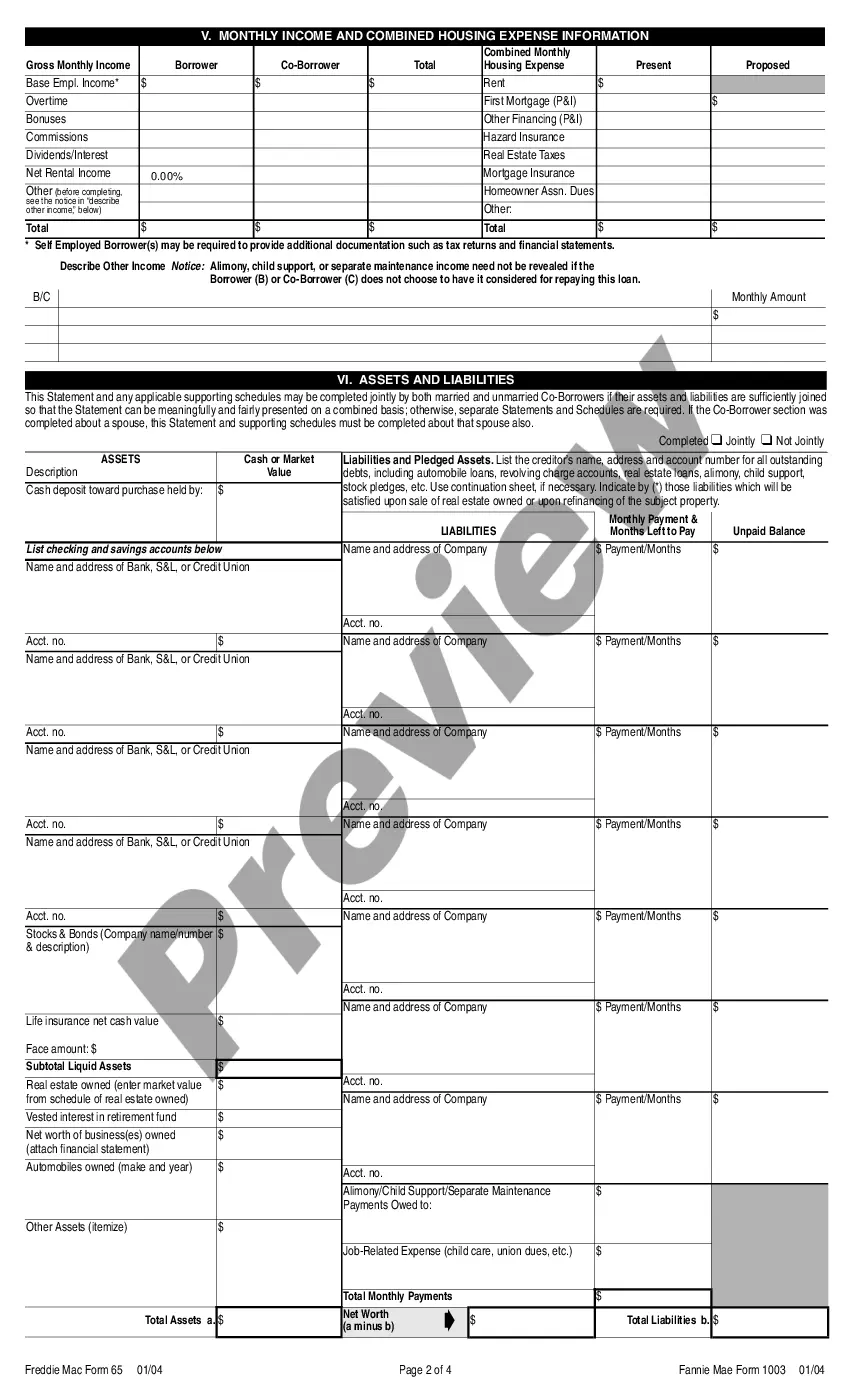

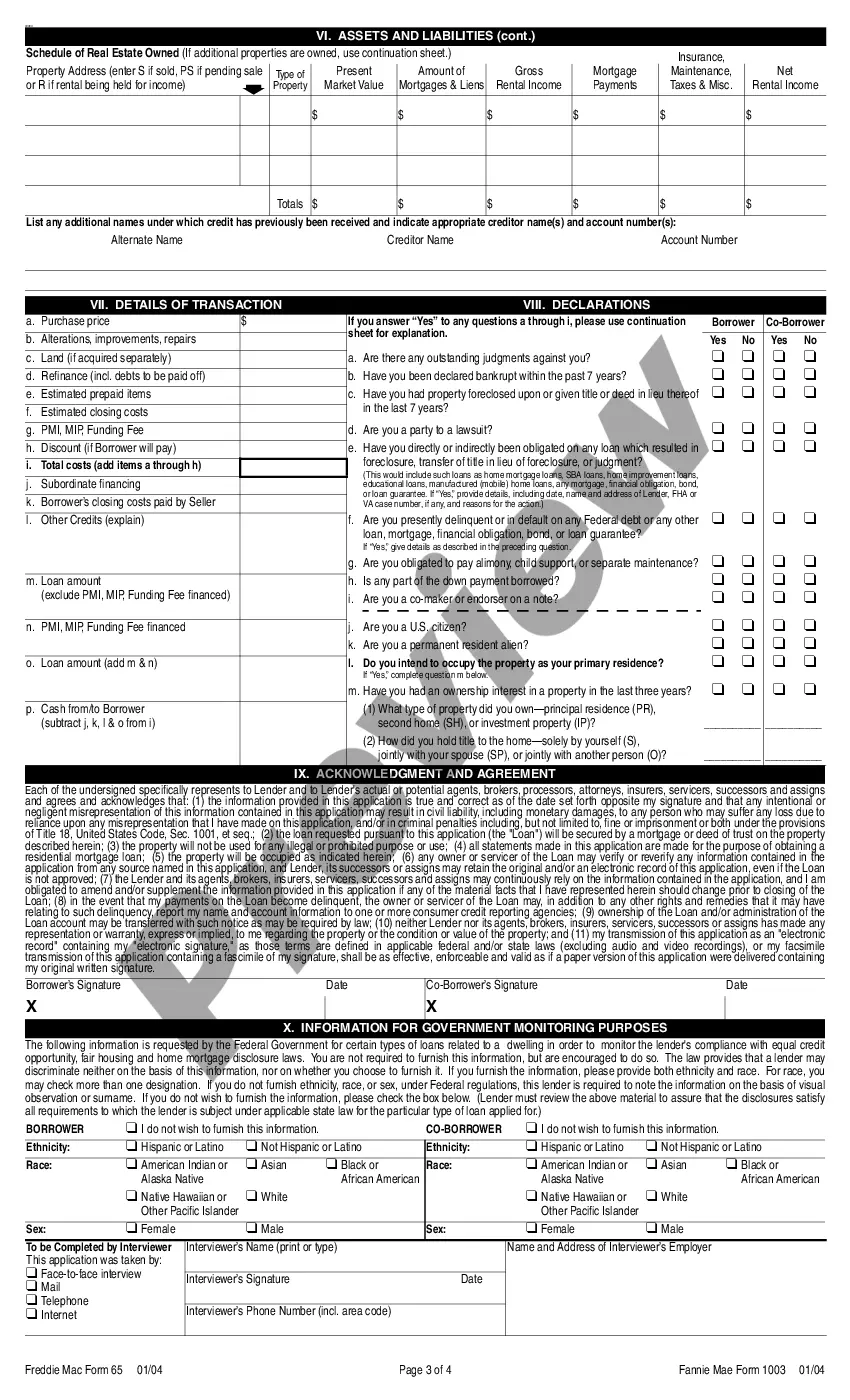

The Uniform Residential Loan Application is used by lenders to determine your creditworthiness for a home loan. It's known within the mortgage industry as Fannie Mae Form 1003, and borrowers enter income, asset credit and other personal financial information into the redesigned form's nine sections.

Which of the following is true of the Uniform Residential Loan Application? It must be used for all residential loans, regardless of the size of the property. It is FNMA form 1003 or FHLMC form 65, and it may be used for conforming, nonconforming, FHA and VA loans.

The application is known as Fannie Mae Form 1003 or Freddie Mac Form 65. Fannie Mae and Freddie Mac are government-sponsored companies that buy and sell home loans, freeing money for lenders to extend more loans to homebuyers.

No. of Units. Subject Property Address (street, city, state & ZIP) Legal Description of Subject Property (attach description if necessary)Borrower's Name (include Jr. or Sr. if applicable) Co-Borrower's Name (include Jr.Dates (from to) Dates (from to) Name & Address of Employer.Gross. Monthly Income. Borrower.

When filling out this application, you'll be asked to supply an array of personal information, including your Social Security number, date of birth, marital status, address, monthly income, work history, assets and liabilities. Lenders in the U.S. have used the URLA for more than 20 years.

Borrower information: You will need to provide your name, date of birth, Social Security number, phone number, address, and marital status. You may also need to provide your resident status and citizenship. If there is a co-borrower, they will need to provide this as well.

How to Fill Out and Read Form 1003 Property information: Address, year built, intended property use. Loan information: Type and purpose of loan, amount, length of the loan. Borrower and co-borrower information: Name, Social Security number, marital status, address, phone number, date of birth.

Fannie Mae. "Uniform Residential Loan Application (Form 1003)."

The Uniform Residential Loan Application is used by lenders to determine your creditworthiness for a home loan. It's known within the mortgage industry as Fannie Mae Form 1003, and borrowers enter income, asset credit and other personal financial information into the redesigned form's nine sections.

What information do I have to provide a lender in order to receive a Loan Estimate? your name, your income, your Social Security number (so the lender can pull a credit report), the property address, an estimate of the value of the property, and. the desired loan amount.