The Mecklenburg North Carolina Uniform Residential Loan Application is an essential document used in the mortgage lending process within Mecklenburg County, North Carolina. This application is designed to collect detailed information about borrowers and their financial circumstances when applying for a residential loan. When completing the Mecklenburg North Carolina Uniform Residential Loan Application, it is crucial to provide accurate and comprehensive details to ensure the lender can evaluate the borrower's creditworthiness effectively. The form requests information such as personal details, employment history, income, assets, liabilities, and property information. It helps lenders assess whether borrowers meet the necessary criteria for loan approval and determine the terms and conditions of the loan. Keyword variations for the Mecklenburg North Carolina Uniform Residential Loan Application include: — Mecklenburg County residential loan application — North Carolina Uniform Residential Loan Application — Mecklenburg residential mortgage application — NC Uniform Residential Loan Application — Mecklenburg mortgage loaapplicationio— - Mecklenburg residential financing application Though there may not be different specific types of the Mecklenburg North Carolina Uniform Residential Loan Application, it is worth mentioning that various versions of the application form may be used based on updates by government agencies or lending institutions. It is essential for borrowers and lenders to use the most current and relevant version of the form to ensure compliance with the latest regulations. Completing the Mecklenburg North Carolina Uniform Residential Loan Application accurately and thoroughly is crucial for a smooth loan approval process. Prospective borrowers in Mecklenburg County must ensure they provide all requested information truthfully and furnish any supporting documents that may be required by the lender. Collaborating closely with lenders and mortgage professionals can facilitate the completion of this application and increase the chances of a successful loan application.

Mecklenburg North Carolina Uniform Residential Loan Application

Description

How to fill out Mecklenburg North Carolina Uniform Residential Loan Application?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Mecklenburg Uniform Residential Loan Application is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the Mecklenburg Uniform Residential Loan Application. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

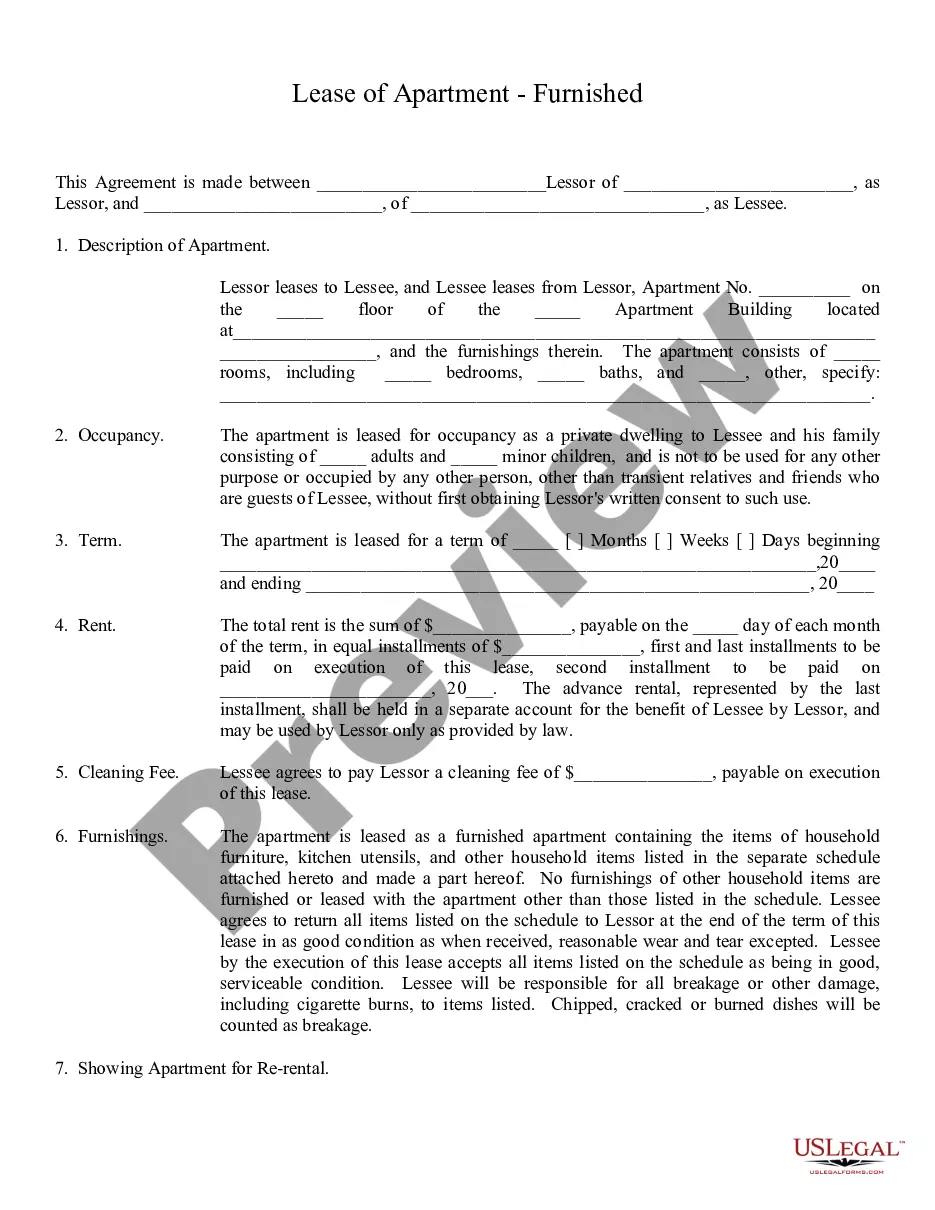

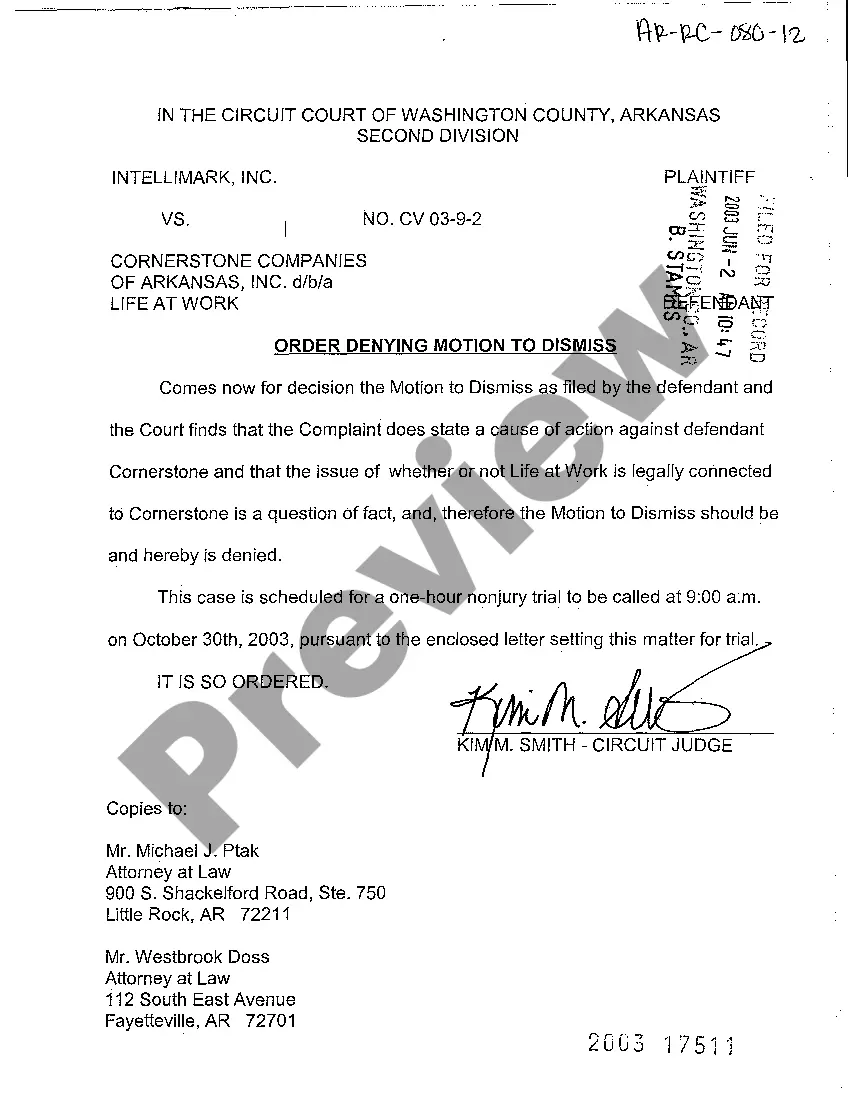

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Mecklenburg Uniform Residential Loan Application in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!