The Tarrant Texas Uniform Residential Loan Application (UCLA) is an essential document used in the mortgage lending process to gather information from borrowers applying for a home loan in Tarrant County, Texas. It is a standardized form that conforms to the guidelines established by Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation). The Tarrant Texas UCLA collects comprehensive details about the borrower's personal, financial, and employment history, as well as the property being financed. It typically includes the following sections: 1. Borrower Information: This section captures the borrower's name, current address, Social Security number, contact details, marital status, and information about dependents. 2. Employment and Income: Here, the borrower is required to provide details about their current and past employment history, including the name of the employer, position held, and length of employment. Additionally, income information such as salary, bonuses, commissions, and other sources of income must be stated. 3. Assets and Liabilities: This section requires the borrower to disclose their assets, including bank accounts, investments, real estate owned, and details of any outstanding debts or liabilities such as credit cards, student loans, and mortgages. 4. Details about the Property: The UCLA also gathers specific information about the property for which the loan application is being made, including the address, estimated value, and purpose of the loan (purchase, refinance, etc.). 5. Declarations and Authorizations: This section includes declarations regarding the borrower's intent to occupy the property, any bankruptcy history, pending lawsuits, or other legal matters. The borrower's authorization for the lender to obtain a credit report and verify the information provided is also given. The Tarrant Texas UCLA is the primary form used for conventional home loans. However, variations may exist for other types of loans, such as those offered by the Federal Housing Administration (FHA), Department of Veterans Affairs (VA), or the United States Department of Agriculture (USDA). These variations are designed to meet the specific requirements and guidelines set forth by these government agencies. In conclusion, the Tarrant Texas Uniform Residential Loan Application is a comprehensive document that serves as a crucial tool in the mortgage lending process. Its standardized format streamlines the loan application process by gathering all necessary borrower and property information in one place. Whether it's a conventional loan or a specialized loan program, utilizing a thorough and accurate UCLA helps lenders make informed decisions while ensuring compliance with industry regulations.

Tarrant Texas Uniform Residential Loan Application

Description

How to fill out Tarrant Texas Uniform Residential Loan Application?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Tarrant Uniform Residential Loan Application, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Tarrant Uniform Residential Loan Application from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Tarrant Uniform Residential Loan Application:

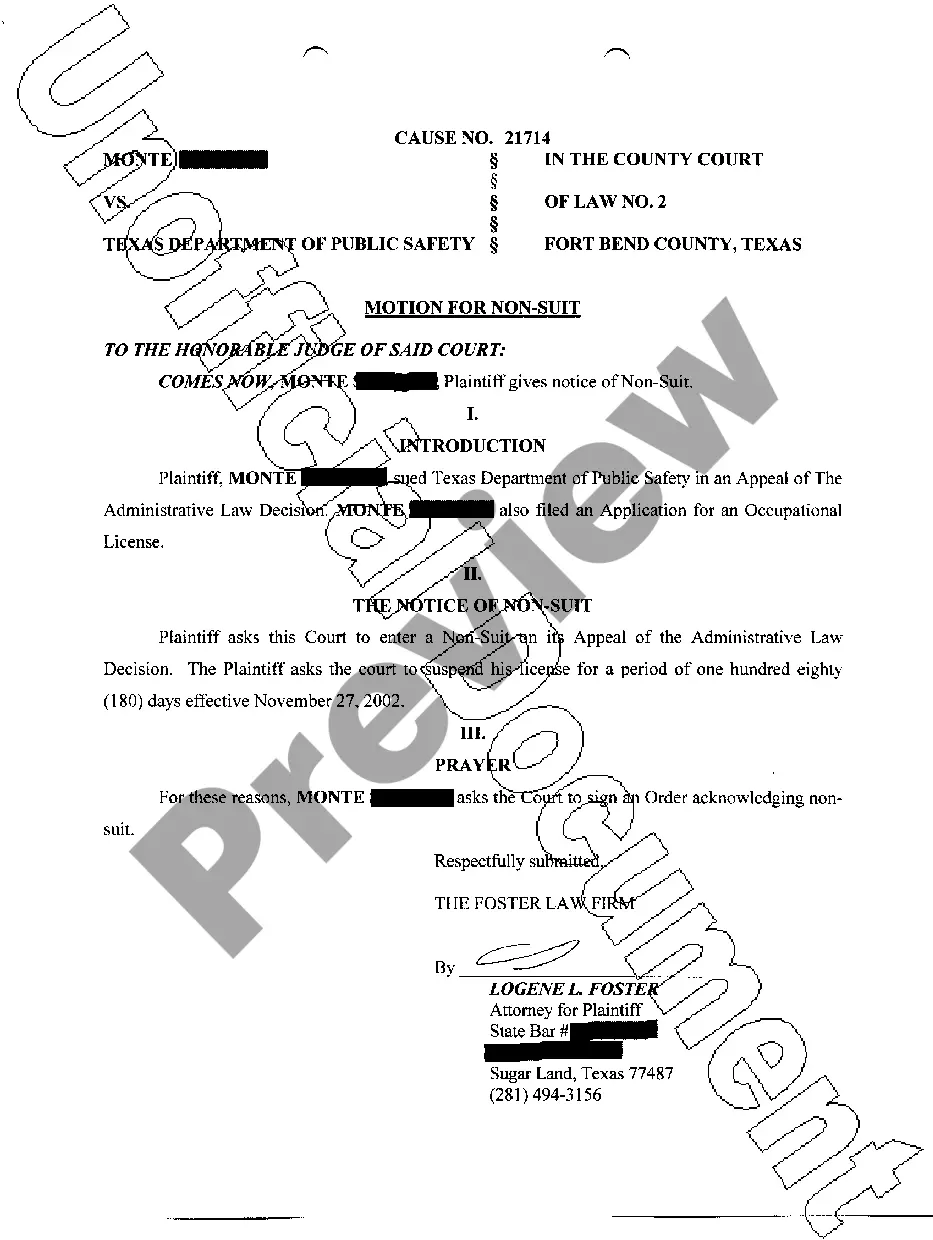

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!