Allegheny Pennsylvania Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds If you have found yourself in a situation where a bank is attempting to recover on a note after the application of security proceeds in Allegheny, Pennsylvania, it is essential to understand the details and potential types of complaints you may encounter. The Allegheny Pennsylvania Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds can arise in various scenarios, such as: 1. Improper Application of Security Proceeds: If the bank has incorrectly applied the security proceeds towards the note, resulting in an inaccurate balance and their subsequent attempt to recover on the remaining amount, you can file a complaint based on the bank's negligence or error. 2. Discrepancies in Security Proceeds Application: When there are discrepancies or inconsistencies in the way the bank has applied the security proceeds towards the note, leading to an unjust or inflated balance, a complaint can be filed to address the bank's unfair actions. 3. Breach of Agreement: If the bank has breached the agreement between the borrower and the bank regarding the application of security proceeds, and is now attempting to recover on the note in violation of the agreed terms, a complaint can be filed to hold the bank accountable for their actions. 4. Failure to Provide Notice: In situations where the bank has failed to provide proper notice to the borrower regarding the application of security proceeds towards the note, resulting in a surprise attempt to recover on the remaining balance, a complaint can be filed to seek redress for the bank's lack of communication. 5. Lack of Transparency: If the bank has not been transparent about how the security proceeds were applied to the note and fails to provide clear documentation or explanations, a complaint can be filed to address the bank's lack of transparency and demand clarity and fairness. When filing an Allegheny Pennsylvania Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, it is crucial to gather all relevant documentation, including copies of the note, security agreement, and any correspondence with the bank. Additionally, consulting with an attorney experienced in banking laws and consumer protection is advisable to navigate the legal complexities and strengthen your case. Remember, each complaint may vary in its specific circumstances, but they all revolve around the bank's action to recover on a note after the application of security proceeds. By understanding the potential types of complaints and seeking appropriate legal guidance, you can take the necessary steps to protect your rights and effectively resolve the issue.

Allegheny Pennsylvania Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

How to fill out Allegheny Pennsylvania Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

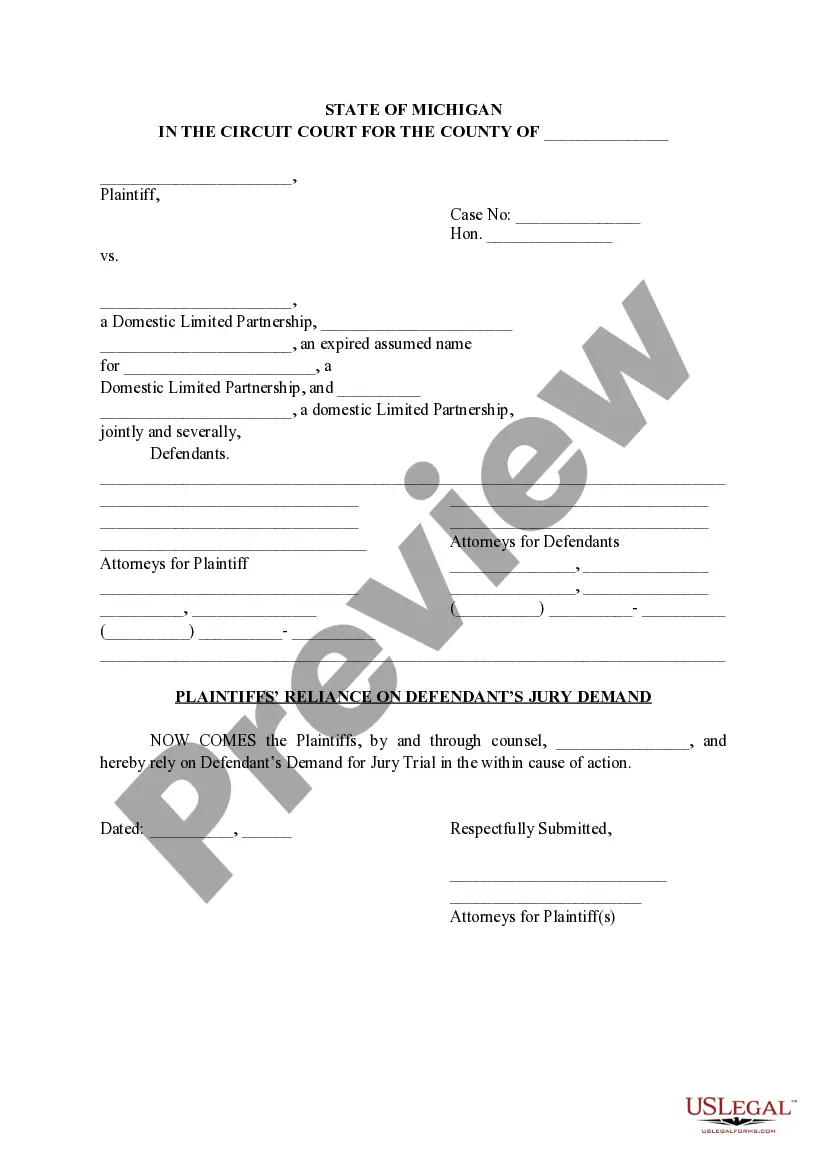

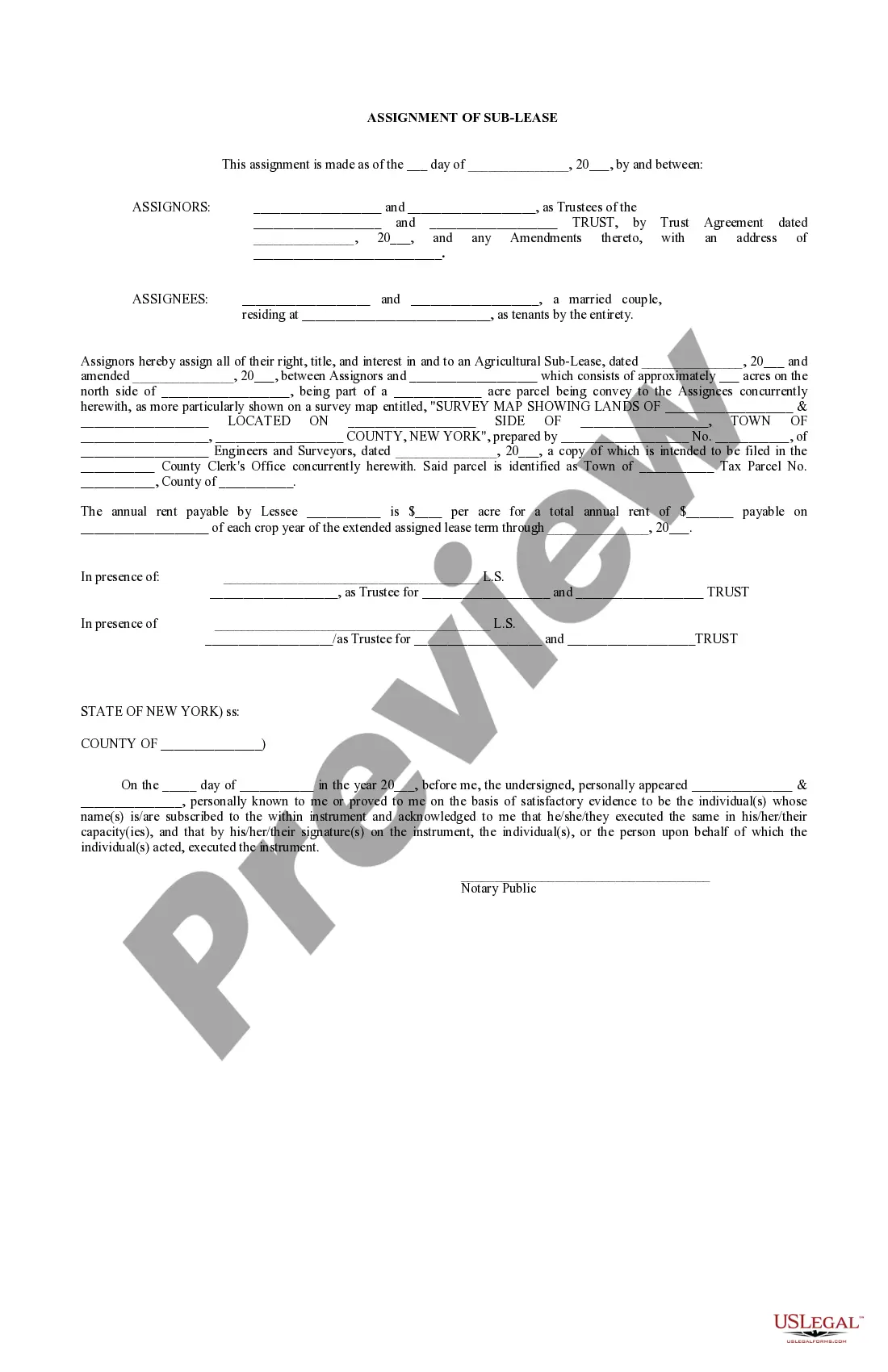

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Allegheny Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the Allegheny Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, here you can find any specific document to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Allegheny Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Allegheny Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Sir/ Madam, I am an account holder in your bank since last 2 years. My saving/ current number is (mention your account number). I want to bring this to your kind attention that the staff in your bank branch does not behave properly with its valuable customers.

Approach the banking ombudsman All scheduled commercial banks, regional rural banks and scheduled primary cooperative banks are covered under the scheme. So far, there are 15 ombudsmen, whose offices are located mostly in state capitals. Their addresses and contact details are available on the RBI website.

Sir/ Madam, I am an account holder in your bank since last 2 years. My saving/ current number is (mention your account number). I want to bring this to your kind attention that the staff in your bank branch does not behave properly with its valuable customers.

Tips for writing a successful complaint letter Structure.Address the letter to a real person.Be honest and straightforward.Maintain a firm but respectful tone, and avoid aggressive, accusing language.Include your contact information.Tell them what you want.Do not threaten action.Keep copies and records.

When writing a complaint letter you should: describe your problem and the outcome you want. include key dates, such as when you purchased the goods or services and when the problem occurred. identify what action you've already taken to fix the problem and what you will do if you and the seller cannot resolve the problem.

Simply call 1.800. PA. BANKS (800.722. 2657 ) or use our online complaint form and a trained professional will respond within 24 hours during the week.

The bank or building society must investigate your complaint and give you a clear answer within eight weeks. They may send you: an initial response.

The bureau typically requires a financial company to respond to the consumer within 15 days of a complaint.

I wish to complain about (name of product or service, with serial number or account number) that I purchased on (date and location of transaction). I am complaining because (the reason you are dissatisfied). To resolve this problem I would like you to (what you want the business to do).

If the customer's complaint is not resolved within a given time or if he is not satisfied with the solution provided by the bank, he can approach 'banking Ombudsman' with his complaints or other legal avenues for grievances redress.