Keywords: Fulton Georgia, complaint, Action by Bank, recover, note, security proceeds Title: Understanding Fulton Georgia Complaints Involving Actions by Banks to Recover on Notes after Application of Security Proceeds Introduction: In Fulton, Georgia, complaints regarding actions by banks to recover on notes after the application of security proceeds have become increasingly prevalent. This article aims to provide a detailed description of these complaints, their significance, and the various types that exist in Fulton, Georgia. 1. Allegations of Improper Application of Security Proceeds: One type of complaint frequently lodged against banks involves allegations of improper application of security proceeds. Borrowers may claim that the bank applied the security proceeds to the wrong loan or failed to credit them appropriately, causing a discrepancy in the balance owed on the note. 2. Disputes over Security Proceeds Calculation: Another common issue in Fulton, Georgia complaints is disputes over how banks calculate security proceeds. Borrowers may argue that the bank undervalued the collateral, resulting in an inadequate application of security proceeds and an unjustifiably high note balance remaining. 3. Failure to Comply with Disclosure Requirements: Complaints may arise when banks fail to comply with disclosure requirements related to the application of security proceeds. Borrowers may allege that the bank did not provide sufficient details or notifications explaining how the security proceeds were applied to their note, leading to confusion or disputes. 4. Inadequate Communication about Security Proceeds Application: Borrowers often raise concerns about banks failing to communicate effectively regarding the application of security proceeds. Complaints may involve allegations that the bank did not provide timely or accurate information about how the security proceeds were applied, making it difficult for borrowers to understand the remaining obligations on their note. 5. Errors in Documentation: Complaints may be filed if there are errors in the documentation related to the application of security proceeds. Borrowers might claim that incorrect or misleading information in the agreements or loan documents contributed to misunderstandings about how the security proceeds would be allocated. Conclusion: Fulton, Georgia complaints regarding actions by banks to recover on notes after the application of security proceeds cover a range of issues. These may include claims of improper application, disputes over calculation, failure to comply with disclosure requirements, inadequate communication, or errors in documentation. It is essential for both borrowers and banks to work towards resolving these complaints through open communication and, if necessary, legal avenues to ensure fair and transparent handling of security proceeds and note recovery attempts.

Fulton Georgia Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

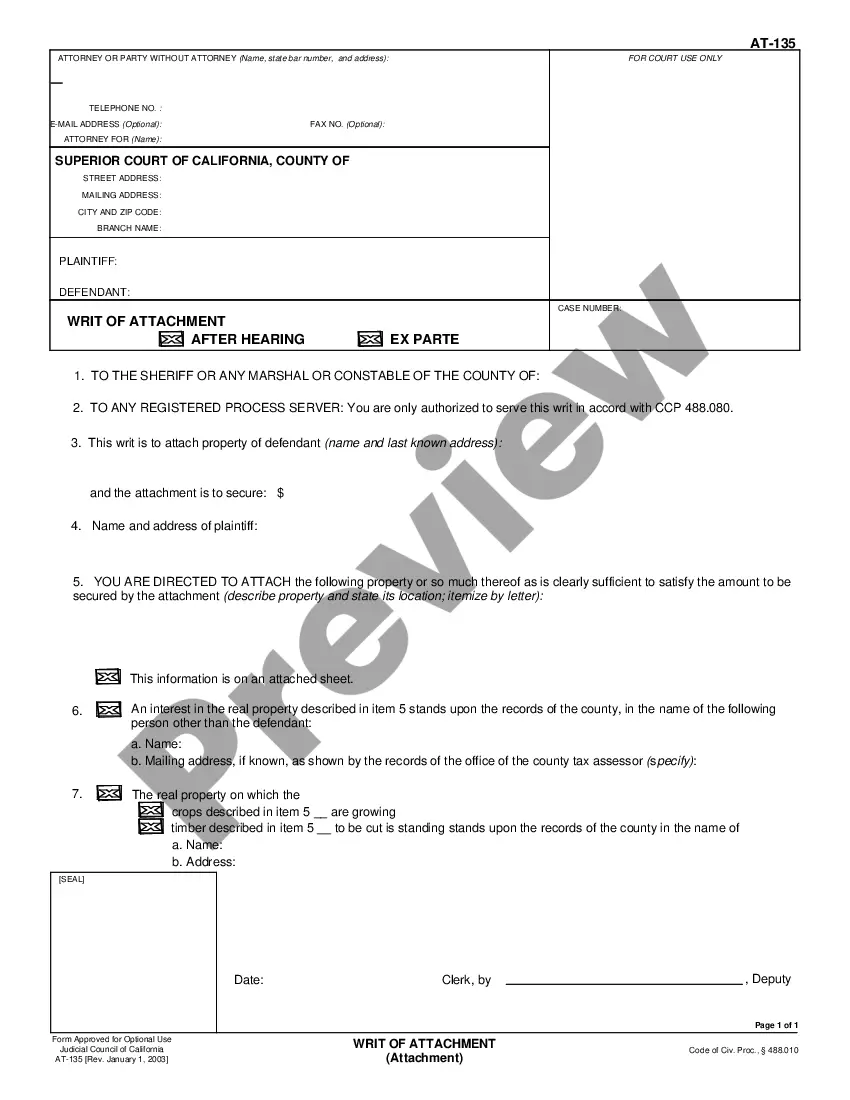

How to fill out Fulton Georgia Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

How much time does it typically take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, finding a Fulton Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Fulton Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Fulton Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Fulton Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Approach the banking ombudsman All scheduled commercial banks, regional rural banks and scheduled primary cooperative banks are covered under the scheme. So far, there are 15 ombudsmen, whose offices are located mostly in state capitals. Their addresses and contact details are available on the RBI website.

Complain to the Consumer Financial Protection Bureau (CFPB) about: credit reports. debt collection.

Sir/ Madam, I am an account holder in your bank since last 2 years. My saving/ current number is (mention your account number). I want to bring this to your kind attention that the staff in your bank branch does not behave properly with its valuable customers.

The Federal Reserve urges you to file a complaint if you think a bank has been unfair or misleading, discriminated against you in lending, or violated a federal consumer protection law or regulation. You can file a complaint online through the Federal Reserve's Consumer Complaint Form.

If your institution is a state bank, chartered (headquartered) in a state other than Georgia, you should send your complaint or inquiry to the home state regulator....State Banks. Hours of Operation: am to pm ET; Monday-FridayToll Free Number:1-877-275-3342 (1-877-ASK-FDIC)2 more rows

The Department of Banking and Finance regulates and examines banks, credit unions and trust companies chartered by the state.

Just write your complaint on a paper and mail it to the Banking Ombudsman along with the required documents. This is the unified portal for NBFC, Banking, and Digital Transactions related grievances. You can access the CMS portal at the official website of RBI to file a complaint.

In that case, you have two options: you can go to the banking ombudsman or take the bank to court. If you get an unsatisfactory response from your bank and want to escalate the issue, you can approach the banking ombudsman. It is appointed by the RBI to resolve customers' complaints regarding banking services.

You can submit your complaint or inquiry online at the FDIC Information and Support Center at . Alternatively, you can submit a complaint via mail to the Consumer Response Unit at 1100 Walnut Street, Box#11, Kansas City, MO 64106.

One can file a complaint with the Banking Ombudsman simply by writing on a plain paper. One can also file it online at (click here to lodge a complaint) or by sending an email to the Banking Ombudsman. There is a form along with details of the scheme in our website.