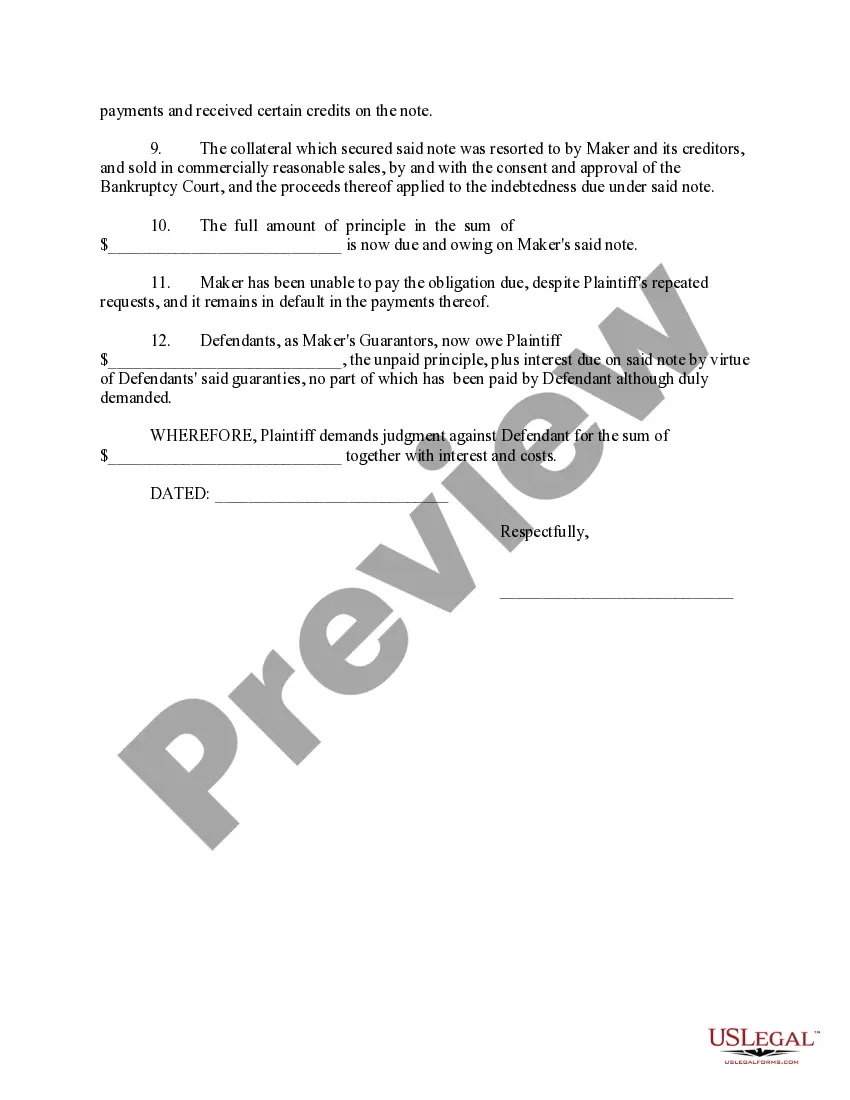

Hennepin County, located in Minnesota, can be subject to various types of complaints regarding actions taken by banks to recover on notes after the application of security proceeds. These complaints may arise in different situations, each with its own set of relevant keywords. Here is a detailed description of one such type of complaint: Title: Hennepin Minnesota Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds Description: A Hennepin Minnesota complaint regarding action by a bank to recover on a note after the application of security proceeds refers to a legal dispute wherein a bank is accused of engaging in unjust or improper practices when attempting to collect the outstanding debt even after applying the proceeds obtained from the borrower's pledged collateral. This type of complaint typically arises when a bank, despite having received adequate security in the form of assets or property to cover the loan, takes further action to recover the debt, causing financial burden or distress to the borrower. Keywords: 1. Hennepin County 2. Minnesota's complaint 3. Action by bank 4. Recover on note 5. Application of security proceeds 6. Legal dispute 7. Unjust practices 8. Improper practices 9. Outstanding debt 10. Pledged collateral 11. Financial burden 12. Financial distress 13. Borrower 14. Loan 15. Collection practices Different types of Hennepin Minnesota Complaints regarding Action by Bank to Recover on Note After Application of Security Proceeds may include: 1. Alleged violation of fair debt collection practices 2. Breach of contract claims 3. Unlawful repossession or sale of pledged collateral 4. Improper calculation of remaining debt after security application 5. Harassment or intimidation tactics used by the bank 6. Unfair or deceptive practices during the debt recovery process These various types of complaints validate the need for legal action and emphasize the importance of seeking professional advice to protect the rights and interests of the borrower involved.

Hennepin Minnesota Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

How to fill out Hennepin Minnesota Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Hennepin Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Hennepin Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Hennepin Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds:

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Your letter of Complaint should be addressed to the director, Consumer Protection Department. You can submit your letter at the CBN head office or at any of the CBN branches nationwide, The CBN deals with all financial related complaints insofar as it is against a Financial Institution within its regulatory purview.

If you think a bank has been unfair or deceptive in its dealings with you, or has violated a law or regulation, you have the right to file a complaint. The Federal Reserve is particularly concerned that state member banks comply with federal laws and regulations that prohibit discrimination in lending.

Just write your complaint on a paper and mail it to the Banking Ombudsman along with the required documents. This is the unified portal for NBFC, Banking, and Digital Transactions related grievances. You can access the CMS portal at the official website of RBI to file a complaint.

To file a complaint, you need to visit . After that, click on file a complaint link. CMS is accessible on desktop and there is app as well that you can use. Select the language from the dropdown and then 'File a complaint with ombudsman against an eligible regulated entity'.

4 steps to handling a customer complaint Identify the problem. The first thing to do in the case of a complaint is identify the problem.Rectify the problem.Follow up on the problem.Learn from the problem.

The Federal Reserve urges you to file a complaint if you think a bank has been unfair or misleading, discriminated against you in lending, or violated a federal consumer protection law or regulation. You can file a complaint online through the Federal Reserve's Consumer Complaint Form.

What is the procedure to file a complaint in the Consumer Court? STEP 1: Intimation via Notice:STEP 2: Get the Consumer Complaint Drafted:STEP 3: Attach Relevant Documents:STEP 4: Appropriate Forum:STEP 5: Pay Requisite Court Fees:STEP 6: Submit an Affidavit:

Just write your complaint on a paper and mail it to the Banking Ombudsman along with the required documents. This is the unified portal for NBFC, Banking, and Digital Transactions related grievances. You can access the CMS portal at the official website of RBI to file a complaint.

If the customer's complaint is not resolved within a given time or if he is not satisfied with the solution provided by the bank, he can approach 'banking Ombudsman' with his complaints or other legal avenues for grievances redress.

To file a complaint, you need to visit . After that, click on file a complaint link. CMS is accessible on desktop and there is app as well that you can use. Select the language from the dropdown and then 'File a complaint with ombudsman against an eligible regulated entity'.