A Los Angeles California Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds is a legal document filed in court when a bank seeks to collect the remaining balance on a promissory note after applying the proceeds from a security. This type of complaint arises when a debtor defaults on a loan, and the bank has previously obtained a security interest in collateral to secure the loan. In this complaint, the bank alleges that the debtor has failed to fulfill their contractual obligation to repay the loan, and as a result, the bank has enforced its rights under the security agreement by liquidating the collateral. Despite the sale of the security, there remains an outstanding balance on the note that the bank seeks to recover from the debtor. The Los Angeles California Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds typically contains the following sections: 1. Title and Caption: The document's title identifies it as a "Complaint" and includes the bank's name as the "Plaintiff" and the debtor's name as the "Defendant." The caption includes the court's name, the case number, and the division or department. 2. Jurisdiction and Venue: This section describes the court's authority to hear the case, typically specifying that it falls within the jurisdiction of Los Angeles County. It also specifies the appropriate venue where the complaint is being filed. 3. Parties: The complaint identifies the plaintiff (the bank) and the defendant (the debtor) by their legal names, addresses, and any other relevant contact information. 4. Factual Background: This section outlines the loan agreement between the bank and the debtor, including the terms of the promissory note, the security agreement, and the collateral obtained by the bank. 5. Loan Default: Here, the complaint explains how the debtor has defaulted on their repayment obligations under the promissory note, providing specific details such as missed payments, late payments, or non-payment. 6. Security Application: This section details the bank's enforcement of its rights under the security agreement, including the sale or disposition of the collateral. 7. Remaining Balance: The complaint specifies the remaining amount due on the promissory note after applying the proceeds from the sale of the security. 8. Cause of Action: The bank asserts a legal claim against the debtor, typically citing the breach of contract for non-payment, along with any other relevant causes of action such as unjust enrichment or conversion. 9. Prayer for Relief: This section lists the specific remedies sought by the plaintiff, including the outstanding balance owed, interests, legal fees, costs, and any other relief deemed appropriate by the court. 10. Verification and Signatures: The complaint is typically signed by the bank's attorney, affirming that the allegations are true to the best of their knowledge and belief. Different types of Los Angeles California Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds may include variations in the cause of action or specific facts of the case, but the overall structure and content remain similar. It is essential to consult legal counsel or refer to specific court rules when drafting and filing a complaint to ensure compliance with local laws and regulations.

Los Angeles California Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

How to fill out Los Angeles California Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your county, including the Los Angeles Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Los Angeles Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Los Angeles Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds:

- Make sure you have opened the right page with your local form.

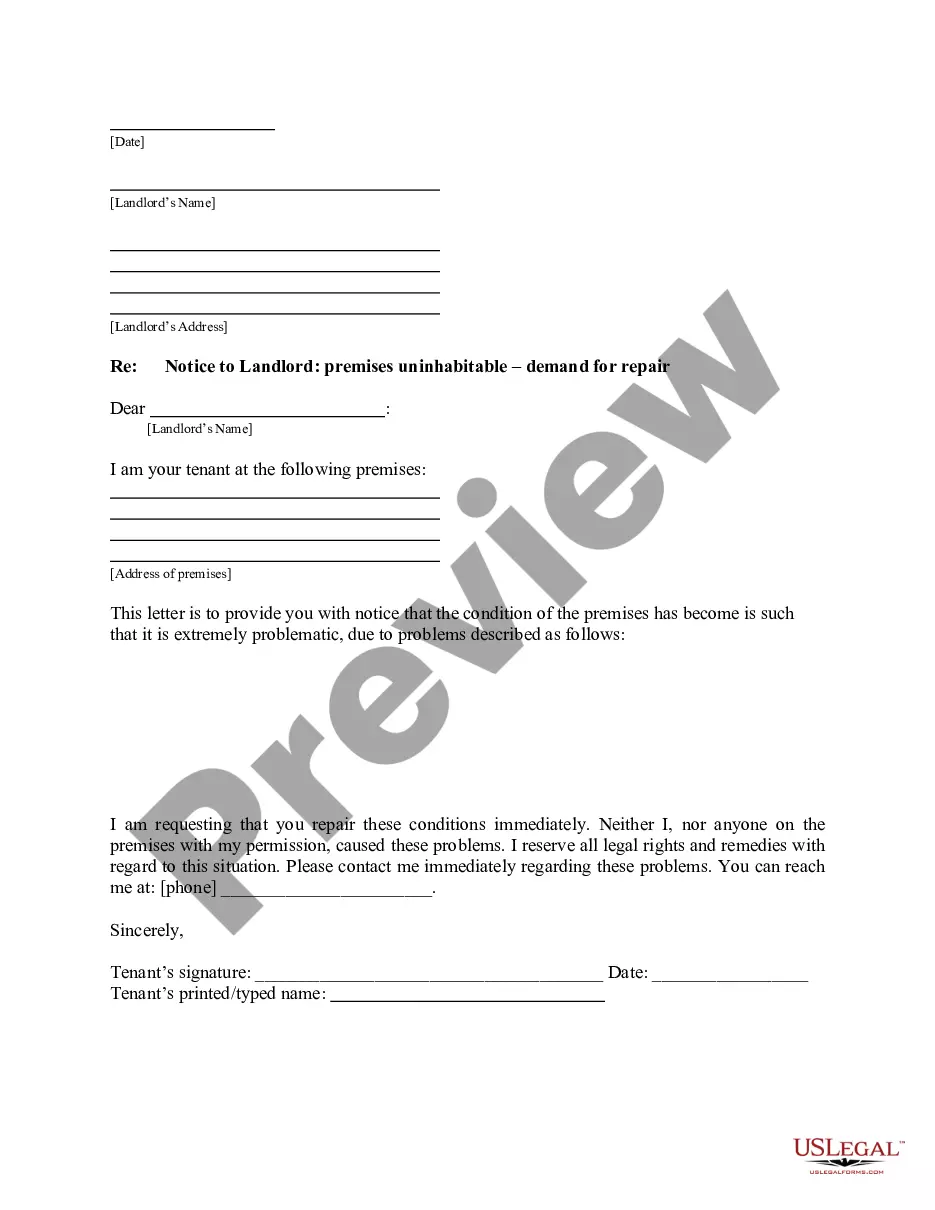

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Los Angeles Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!