Orange California Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds is a legal complaint filed by individuals or businesses residing or operating in Orange, California. This particular type of complaint arises when a bank initiates legal action to recover the outstanding balance on a promissory note after the application of security proceeds. Keywords: Orange California, complaint, action by bank, recover, note, application, security proceeds. Different types of Orange California Complaints regarding Action by Bank to Recover on Note After Application of Security Proceeds may include: 1. Individual Complaint: This type of complaint is filed by an individual borrower who has taken a loan from a bank in Orange, California. The individual alleges that the bank is improperly attempting to recover on the promissory note after the application of security proceeds. 2. Business Complaint: A business operating in Orange, California may file this type of complaint against a bank. The business asserts that the bank is unlawfully pursuing the recovery of the remaining loan balance, which they claim has been satisfied by the application of security proceeds. 3. Joint Plaintiff Complaint: In some cases, multiple individuals or businesses can come together as joint plaintiffs to file a complaint. They collectively challenge the bank's actions in trying to recover the note balance after the security proceeds have been applied. 4. Class Action Complaint: When multiple parties have faced similar situations with a bank's attempt to recover on notes after applying security proceeds, a class action complaint may be filed in Orange, California. This type of complaint represents a larger group's interests and seeks to hold the bank accountable for its actions. 5. Counterclaim Complaint: In response to a bank's legal action to recover on a note, the borrower(s) or debtor(s) can file a counterclaim complaint. They argue against the bank's right to pursue further recovery after the security proceeds have been utilized. Regardless of the specific type, all Orange California Complaints regarding Action by Bank to Recover on Note After Application of Security Proceeds generally involve allegations of improper or unjust attempts by banks to collect on outstanding loan balances despite the application of security proceeds. These complaints aim to seek legal remedies, such as stopping the bank's action, obtaining damages, or declaring the note satisfied.

Orange California Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

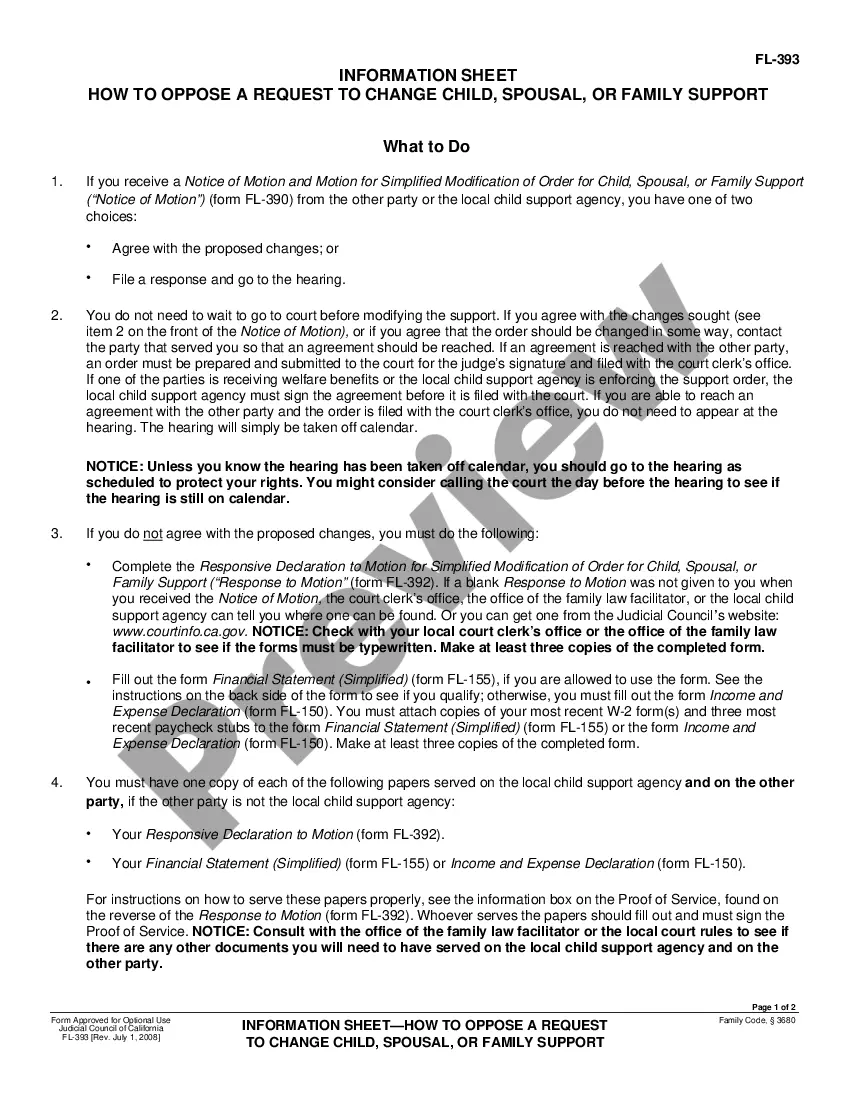

How to fill out Orange California Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Orange Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Orange Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Orange Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds:

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

AFCA can be contacted by: phone on 1800 931 678, or. lodging a complaint online at the AFCA website.

Complaints can be raised about various reasons, including delay in payments or non-payment, remittances by banks, collection of cheques towards bills, non-acceptance of small denomination notes or coins, and charging of commission.

You can complain to a private sector ombudsman if you have an unresolved complaint about a commercial business that is a member of the ombudsman scheme. You might need a letter from the trader saying you couldn't sort out the problem - this is called a 'letter of deadlock'.

A bank begins a debt recovery process when it seeks money it is owed. A bank takes recovery action for a number of reasons, but the most common is when a customer fails to make loan repayments. Debt recovery may include: referring the matter to a specialist debt recovery team within the bank.

In that case, you have two options: you can go to the banking ombudsman or take the bank to court. If you get an unsatisfactory response from your bank and want to escalate the issue, you can approach the banking ombudsman. It is appointed by the RBI to resolve customers' complaints regarding banking services.

Obtain a written response from your Bank's Dispute Resolution Unit. 1.5. For banks not listed above, please phone our call centre on 0860 800 900. 2.1.

Approach the banking ombudsman All scheduled commercial banks, regional rural banks and scheduled primary cooperative banks are covered under the scheme. So far, there are 15 ombudsmen, whose offices are located mostly in state capitals. Their addresses and contact details are available on the RBI website.

We can ask a bank to put a hold on recovering a debt if a customer complains to us, but only in specific circumstances. A bank typically takes debt recovery action because a customer owes it money and is not making repayments.

Recovery Actions means, collectively and individually, preference actions, fraudulent conveyance actions, rights of setoff, and other claims or causes of action under chapter 5 of the Bankruptcy Code and other applicable bankruptcy or nonbankruptcy law.

The Australian Financial Complaints Authority (AFCA) is an independent complaints scheme that is free for consumers. It provides an accessible way of resolving disputes, without having to go to court. The decision of the AFCA is binding on the bank.