Wake North Carolina Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds is a legal complaint filed by individuals or companies against a bank in Wake County, North Carolina. This type of complaint is usually made when a bank attempts to recover funds from a borrower even after the borrower has provided security for the loan. In this type of complaint, the plaintiff accuses the bank of breaching its contractual obligations by pursuing further recovery on a loan that has already been secured by collateral or other assets. The complaint typically highlights the bank's failure to adhere to the terms and conditions agreed upon in the loan agreement. Keywords: Wake North Carolina, complaint, action, bank, recover, note, application, security proceeds, legal, contractual obligations, borrower, collateral, loan agreement. Types of Wake North Carolina Complaints regarding Action by Bank to Recover on Note After Application of Security Proceeds may include: 1. Unfair Debt Collection Practices: This complaint alleges that the bank has engaged in unfair or abusive debt collection practices by attempting to collect on the note even after sufficient security proceeds have been applied. 2. Breach of Contract: This type of complaint claims that the bank is breaching the terms of the loan agreement by seeking additional recovery beyond what was agreed upon when security was provided. 3. Defamation: Some plaintiffs might argue that the bank's actions in pursuing further recovery despite the application of security proceeds have damaged their reputation or creditworthiness, leading to potential defamation claims. 4. Negligence: This complaint alleges that the bank, in its pursuit of note recovery, has acted negligently by disregarding the proper application of security proceeds and causing financial harm to the borrower. 5. Fraudulent Misrepresentation: Depending on the circumstances, a plaintiff may assert that the bank knowingly or intentionally misrepresented the loan terms or its intentions regarding security application, leading to false expectations and harm. 6. Violation of Consumer Protection Laws: Plaintiffs may argue that the bank's actions violate consumer protection laws in Wake County, North Carolina, which are designed to safeguard borrowers from unfair practices and ensure fair treatment in financial transactions. 7. Breach of Fiduciary Duty: In some cases, plaintiffs might assert that the bank violated its fiduciary duty to act in the best interests of the borrower by pursuing further recovery that is unnecessary or improper. It is important to note that the specific types of complaints may vary based on the unique circumstances of each case, and other relevant legal issues may be raised in Wake North Carolina Complaints regarding Action by Bank to Recover on Note After Application of Security Proceeds.

Wake North Carolina Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

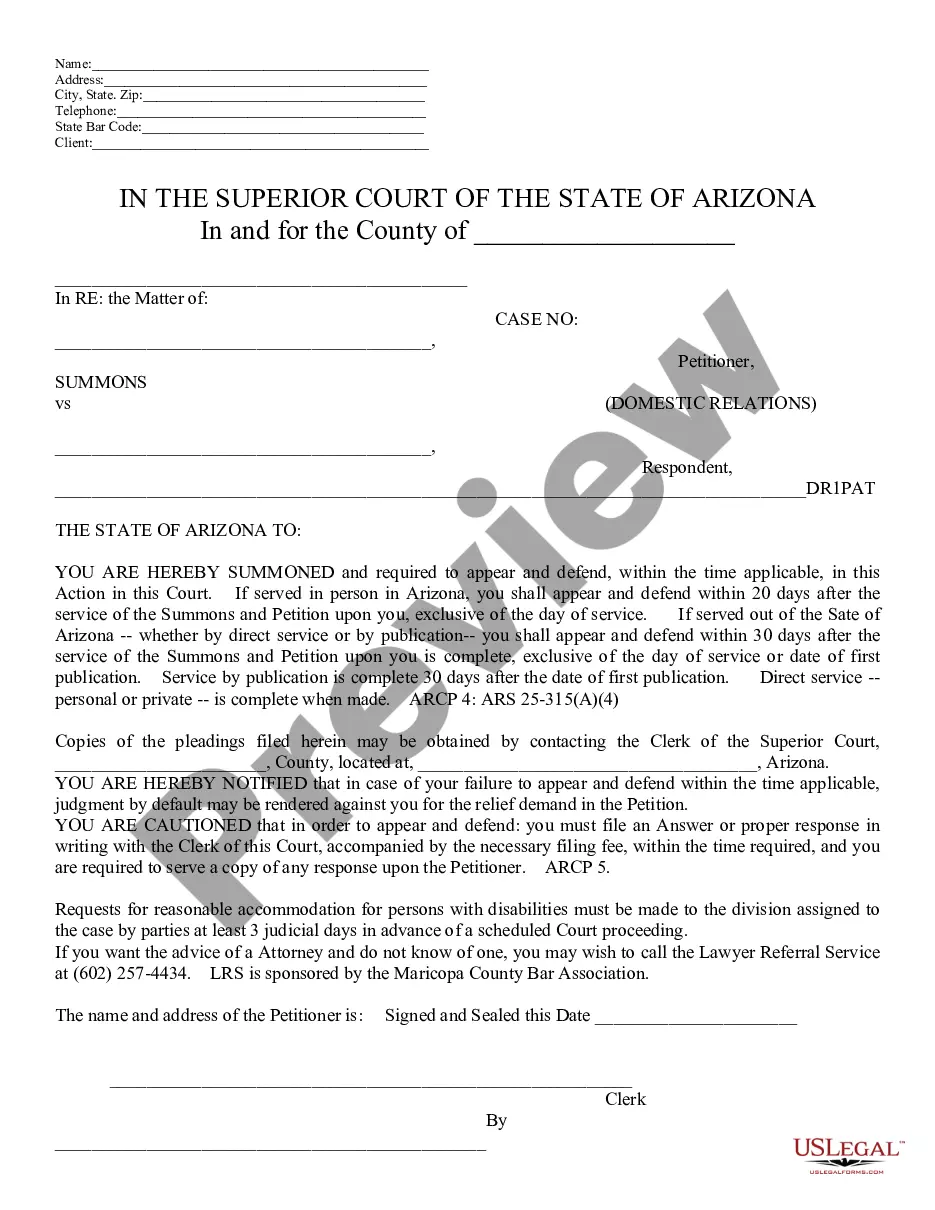

How to fill out Wake North Carolina Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Wake Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any tasks associated with document execution straightforward.

Here's how you can locate and download Wake Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the related document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Wake Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Wake Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you have to cope with an extremely complicated case, we advise getting an attorney to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant documents with ease!