The Alameda California Complex Will with Credit Shelter Marital Trust for Spouse is a legal instrument designed to protect assets and minimize estate taxes for married couples residing in Alameda, California. This comprehensive estate planning tool provides a detailed framework for the distribution of assets and establishes a mechanism to provide for the surviving spouse while preserving the wealth for future generations. The Alameda California Complex Will utilizes a Credit Shelter Marital Trust, also known as a bypass trust or a family trust, to maximize estate tax exemptions for both spouses. This type of trust enables the surviving spouse to access income and, in some cases, principal from the trust's assets, while the remaining wealth is sheltered from estate taxes. This strategy ensures that heirs and beneficiaries can receive the maximum financial benefit from the estate without unnecessary tax liabilities. One variation of the Alameda California Complex Will is the AB Trust or the A/B Trust. This legal arrangement divides the deceased spouse's assets into two separate trusts upon their passing: the A Trust or Marital Trust and the B Trust or Bypass Trust. The Trust holds the assets that qualify for the unlimited marital deduction, allowing the surviving spouse to use and manage them during their lifetime. The B Trust, on the other hand, contains the remaining assets that exceed the estate tax exemption amount and provides tax benefits for future generations. Another type of trust commonly associated with the Alameda California Complex Will is the TIP Trust, which stands for Qualified Terminable Interest Property Trust. This trust is often used when there are children from a previous marriage or other beneficiaries to protect their interests. The TIP Trust allows the surviving spouse to receive income generated by the trust's assets during their lifetime and ensures that the principal will eventually pass to the designated beneficiaries. In summary, the Alameda California Complex Will with Credit Shelter Marital Trust for Spouse is a sophisticated estate planning tool designed to protect assets and minimize estate taxes. Different variations, such as the AB Trust and TIP Trust, offer specific benefits and cater to unique family situations. Consulting with an experienced estate planning attorney in Alameda, California is essential to ensure proper implementation and customization of these complex legal instruments.

Alameda California Complex Will - Credit Shelter Marital Trust for Spouse

Description

How to fill out Alameda California Complex Will - Credit Shelter Marital Trust For Spouse?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Alameda Complex Will - Credit Shelter Marital Trust for Spouse, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed materials and tutorials on the website to make any activities related to document execution simple.

Here's how you can find and download Alameda Complex Will - Credit Shelter Marital Trust for Spouse.

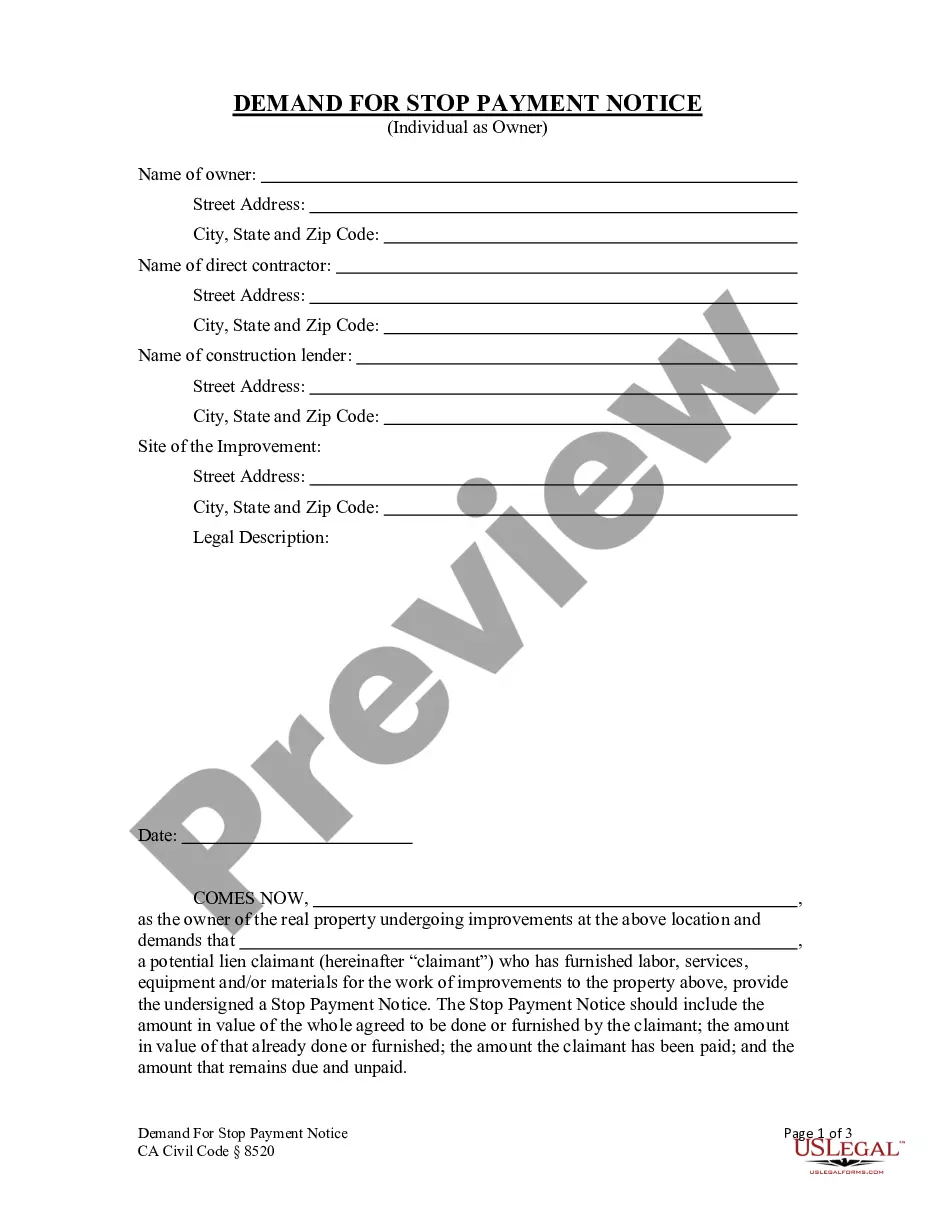

- Take a look at the document's preview and description (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the related forms or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and buy Alameda Complex Will - Credit Shelter Marital Trust for Spouse.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Alameda Complex Will - Credit Shelter Marital Trust for Spouse, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you have to cope with an exceptionally challenging case, we advise getting an attorney to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant documents with ease!