Dallas Texas Complex Will — Credit Shelter Marital Trust for Spouse is a legal instrument that allows individuals in Dallas, Texas, to protect their assets and provide for their spouse in the event of their passing. This estate planning tool provides several benefits and safeguards for married couples, ensuring that their assets are preserved and taxes are minimized. The Dallas Texas Complex Will — Credit Shelter Marital Trust for Spouse involves two key components: the credit shelter trust and the marital trust. 1. Credit Shelter Trust: Also known as a bypass trust or a family trust, the credit shelter trust is designed to maximize estate tax savings. When the first spouse dies, a specific amount of assets, up to the estate tax exemption limit, will fund the credit shelter trust. This trust helps to shelter these assets from estate taxes, as they are not directly inherited by the surviving spouse but are held within the trust for their benefit. The surviving spouse can access income generated by the trust, and the principal remains protected. Upon the death of the surviving spouse, the remaining assets in the credit shelter trust pass to the designated beneficiaries, such as children or other heirs, without being subjected to additional estate taxes. 2. Marital Trust: A marital trust, also referred to as a TIP trust (Qualified Terminable Interest Property), is established to provide for the surviving spouse. Assets exceeding the estate tax exemption limit or those not allocated to the credit shelter trust are transferred into the marital trust. The surviving spouse can receive income generated by the trust during their lifetime. The assets within the marital trust are included in the surviving spouse's estate, but they can be protected from estate tax by utilizing their own estate tax exemption. This trust also allows the original spouse to maintain control over the ultimate distribution of the assets after the surviving spouse's death, ensuring the family's long-term financial security. The Dallas Texas Complex Will — Credit Shelter Marital Trust for Spouse is a powerful estate planning tool that combines the benefits of asset protection, tax planning, and providing for the surviving spouse. It enables married individuals in Dallas, Texas, to strategically protect their wealth and minimize estate taxes, ultimately preserving their financial legacy for future generations. Keywords: Dallas, Texas, Complex Will, Credit Shelter Trust, Marital Trust, estate planning, asset protection, estate tax, bypass trust, family trust, TIP trust, estate tax exemption, surviving spouse, tax planning.

Dallas Texas Complex Will - Credit Shelter Marital Trust for Spouse

Description

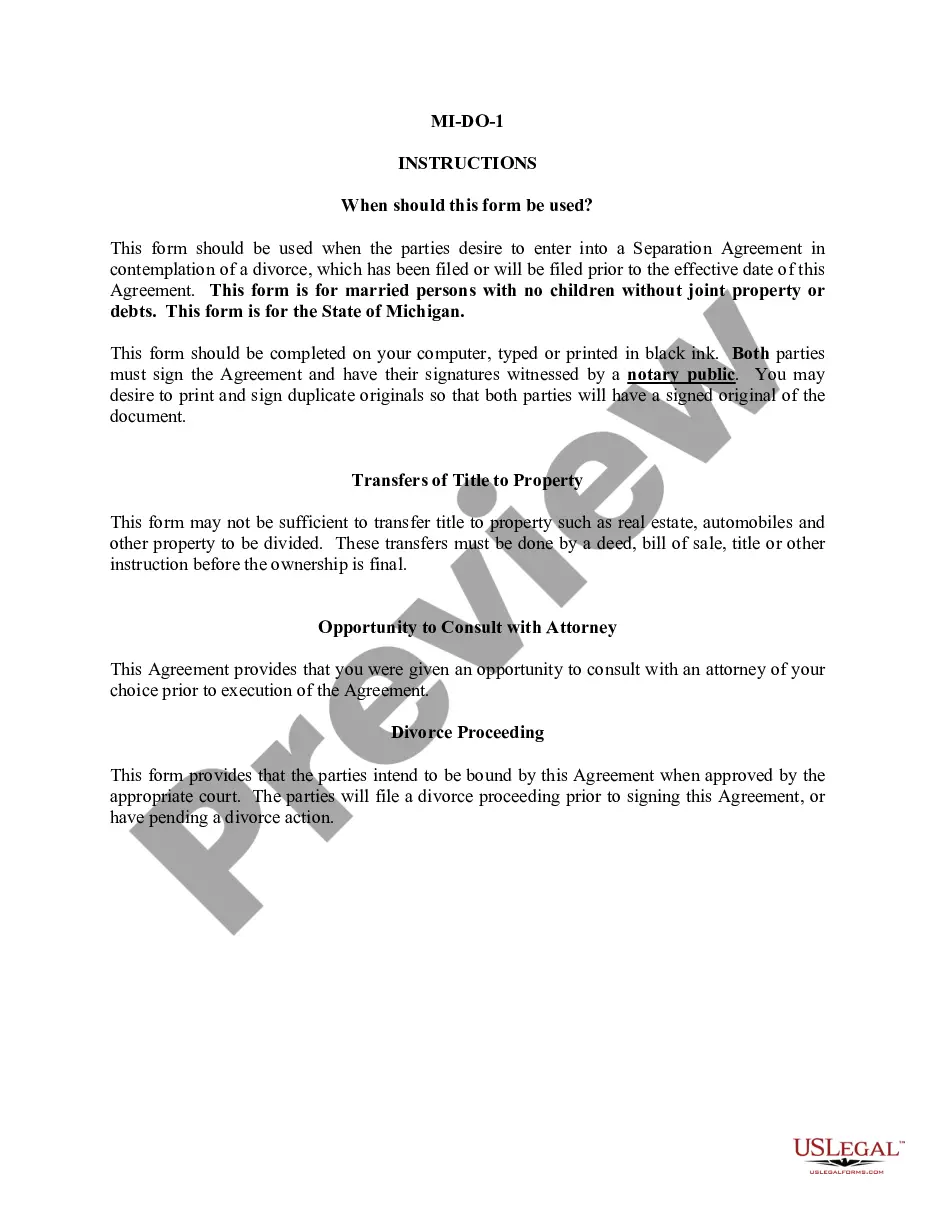

How to fill out Dallas Texas Complex Will - Credit Shelter Marital Trust For Spouse?

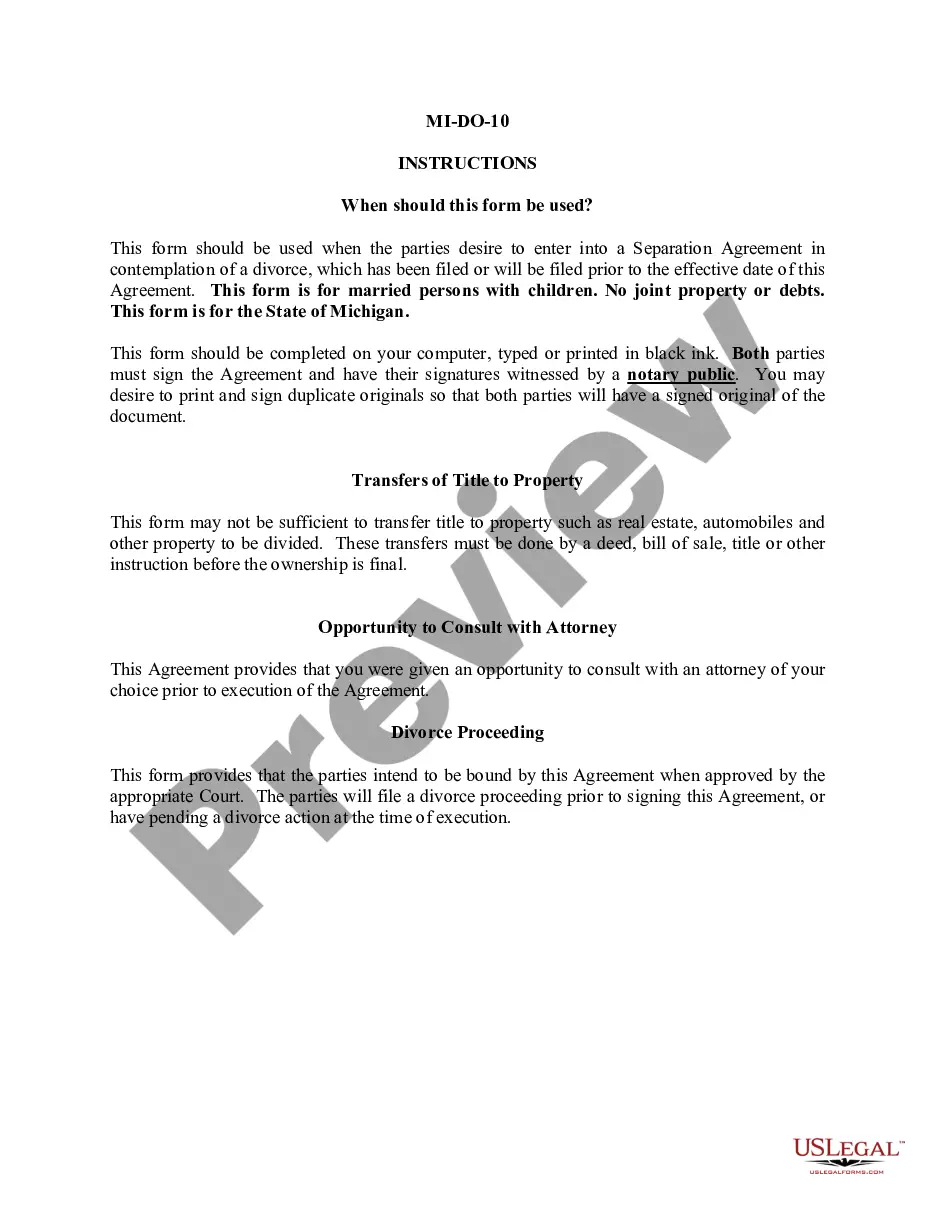

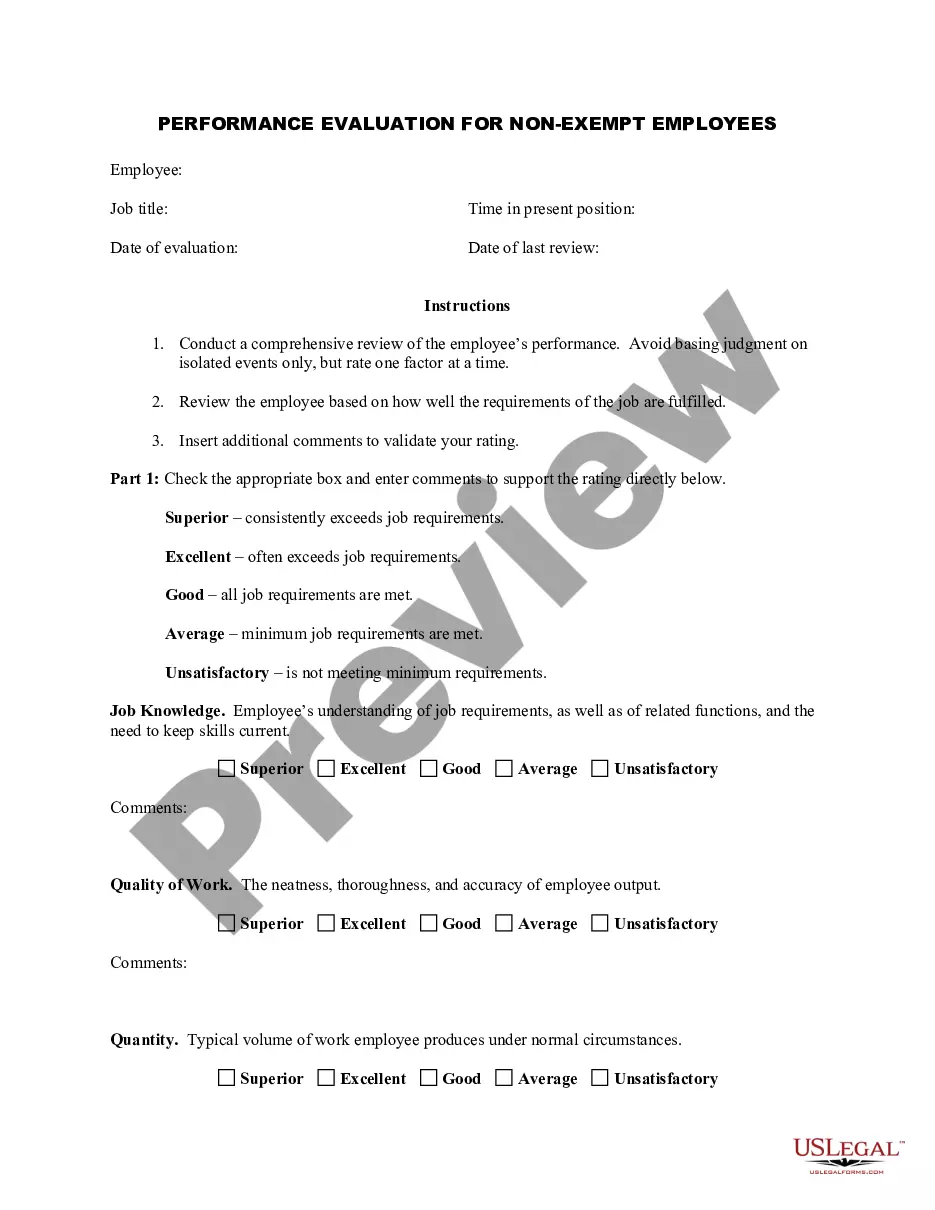

How much time does it usually take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Dallas Complex Will - Credit Shelter Marital Trust for Spouse suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Dallas Complex Will - Credit Shelter Marital Trust for Spouse, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Dallas Complex Will - Credit Shelter Marital Trust for Spouse:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Dallas Complex Will - Credit Shelter Marital Trust for Spouse.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

However, Illinois law allows your executor to make a special election, called a QTIP election, to defer the Illinois estate tax on any portion of your estate passing to a credit shelter trust for a surviving spouse so long as the credit shelter trust contains certain provisions.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax-free. It can also shield the estate of the surviving spouse before the remaining assets pass on to their children.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.

A Family Bank Trust, also known as Spousal Lifetime Access Trust (SLAT) is a lifetime trust for your spouse's benefit using annual exclusion gifts and the lifetime gift tax exemption. Again, these trusts can provide asset protection plus a reduction in overall estate taxes.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouseunder some arrangements, the surviving spouse can also receive principal payments.

An Inter Vivos Trust is one created by a living person for the benefit of another person. Also known as a living trust, this trust has a duration that is determined at the trust's creation and can entail the distribution of assets to the beneficiary during or after the trustor's lifetime.

The most common technique used by married couples to reduce their estate tax bill and pass more on to their beneficiaries is the use of a Credit Shelter Trust, also referred to as a Bypass or Family Trust, coupled with a Marital Trust, also referred to as a Marital Deduction Trust or QTIP Trust.

A credit shelter trust is a trust that is established in the will or living trust of the first to die of a married couple, most often for the benefit of a surviving spouse. It is generally created to avoid estate taxes at a first spouse's death by taking advantage of the available federal estate tax credit.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.