Chicago Illinois Complex Will — Max. Credit Shelter Marital Trust to Children is a type of estate planning instrument that ensures the protection and distribution of assets in the most efficient manner possible. This type of trust is commonly used by individuals residing in Chicago, Illinois, who have considerable assets and wish to provide financial stability and security for their children and loved ones after their demise. The Chicago Illinois Complex Will is a comprehensive legal document that outlines the distribution of assets and the establishment of various trusts, including the Max. Credit Shelter Marital Trust for the benefit of children. It strives to maximize tax benefits while providing for the surviving spouse and safeguarding the interests of the children. A Max. Credit Shelter Marital Trust is one component of the complex will that allows the granter to transfer assets up to the maximum amount allowed by law to the trust upon their death, without incurring estate taxes. The surviving spouse is then entitled to receive income generated by the trust during their lifetime, ensuring their financial security. Upon the spouse's death, any remaining assets in the trust are distributed to the children, or other named beneficiaries, as specified in the will. This type of trust offers several advantages, such as: 1. Tax benefits: By utilizing the Max. Credit Shelter Marital Trust, the granter can take advantage of applicable estate tax exemptions, potentially reducing or eliminating the burden of estate taxes on the overall estate. 2. Asset protection: Assets held in the trust are protected from potential creditors, ensuring that the children receive their rightful inheritance without the risk of losing it to financial obligations or lawsuits. 3. Control and flexibility: The granter can establish specific guidelines within the trust to ensure that assets are used for specific purposes, such as education or healthcare expenses, providing a level of control over how funds are distributed. 4. Long-term financial security: The establishment of a Max. Credit Shelter Marital Trust provides a structured plan for the management and distribution of assets, ensuring the long-term financial stability of the surviving spouse and children. 5. Preservation of wealth: By utilizing the tax benefits and asset protection offered by this type of trust, the granter can preserve and pass on their wealth to future generations, allowing for legacy planning. It is important to note that the creation of a Chicago Illinois Complex Will — Max. Credit Shelter Marital Trust to Children requires careful consideration of various factors, such as federal and state tax laws, family dynamics, and individual financial goals. Seeking the assistance of an experienced estate planning attorney in Chicago, Illinois, is highly recommended ensuring the trust is created and administered in accordance with legal requirements and the granter's intentions.

Chicago Illinois Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Chicago Illinois Complex Will - Max. Credit Shelter Marital Trust To Children?

Draftwing forms, like Chicago Complex Will - Max. Credit Shelter Marital Trust to Children, to manage your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms intended for different cases and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Chicago Complex Will - Max. Credit Shelter Marital Trust to Children template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before getting Chicago Complex Will - Max. Credit Shelter Marital Trust to Children:

- Make sure that your form is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

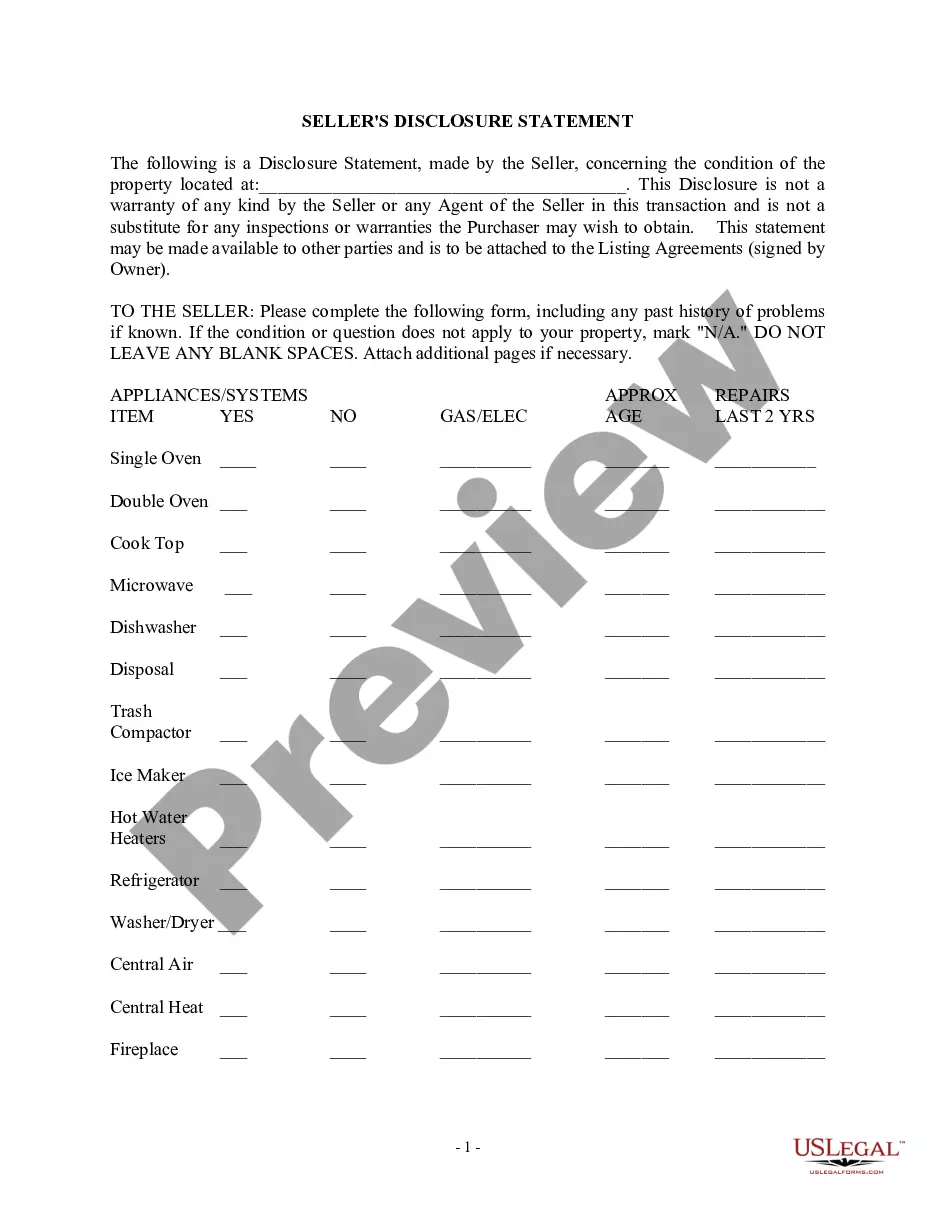

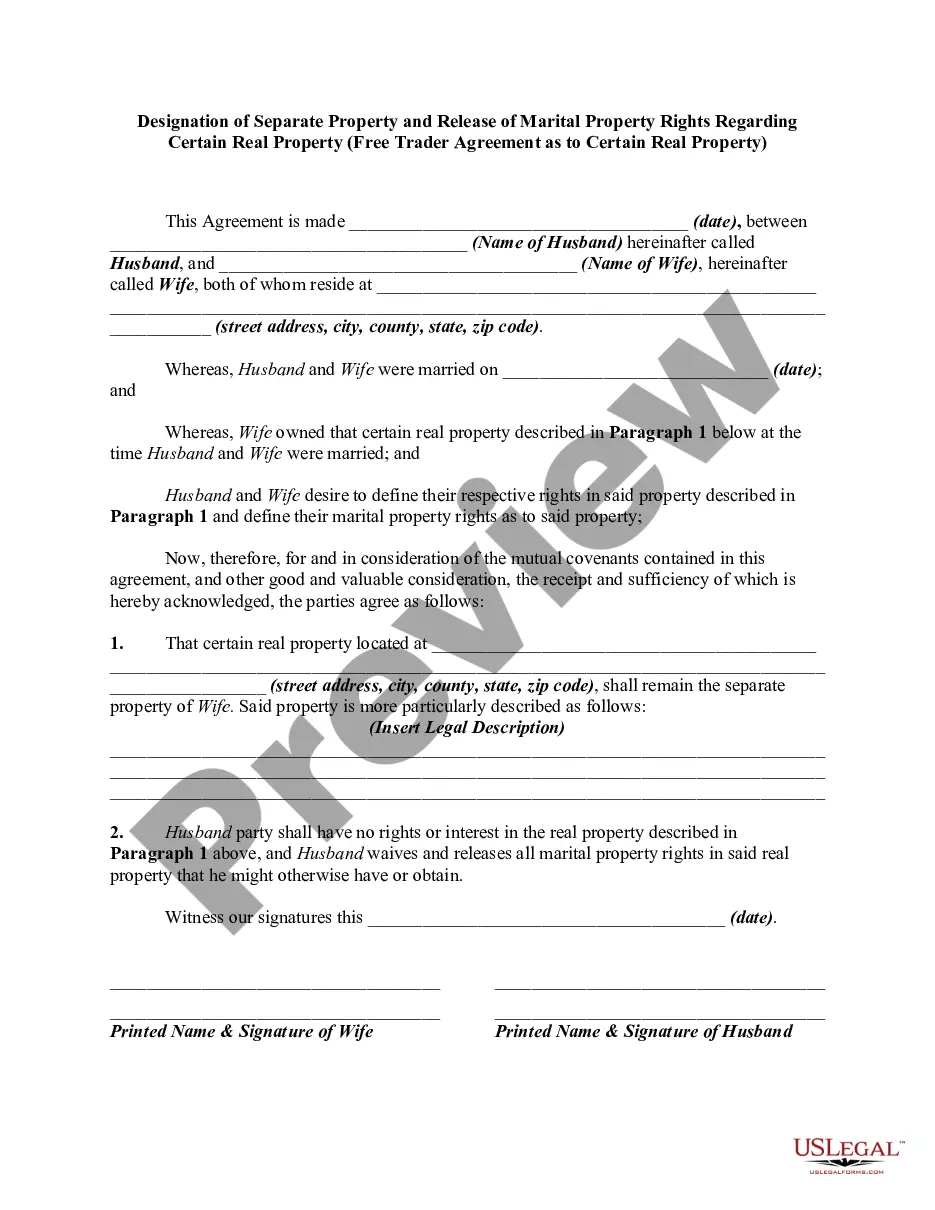

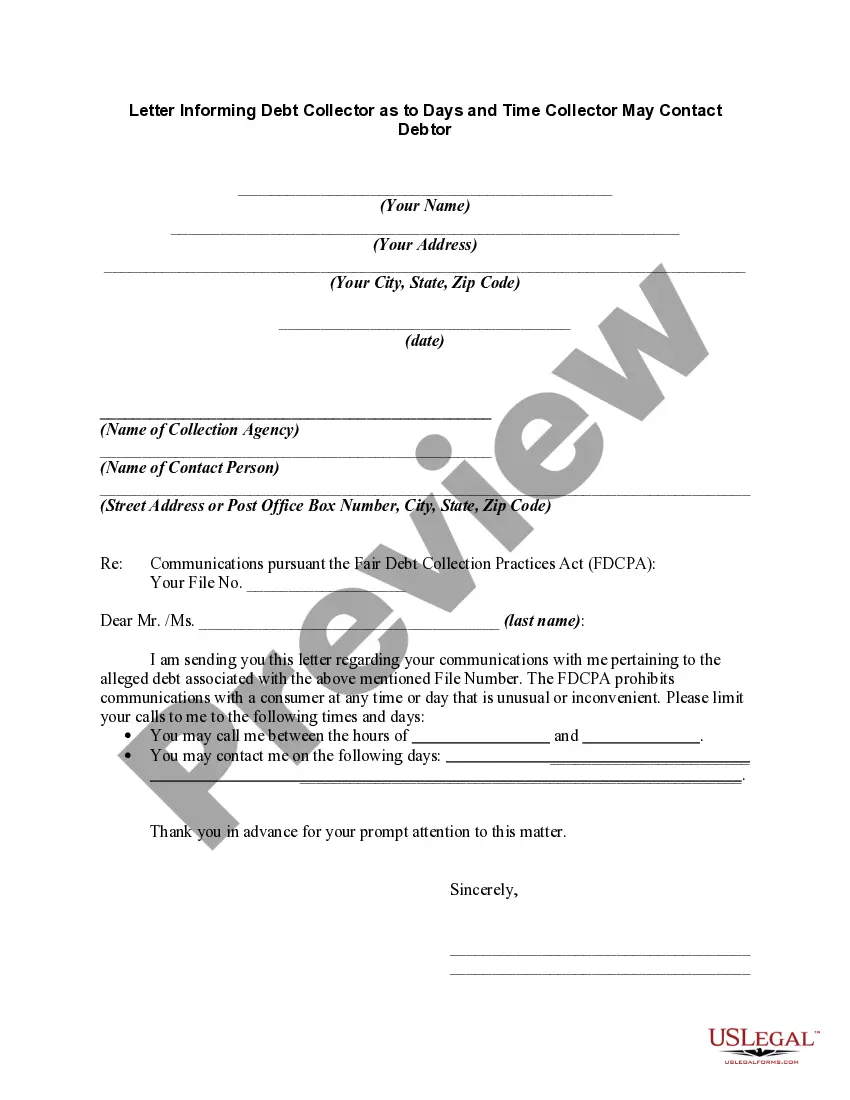

- Learn more about the form by previewing it or going through a brief description. If the Chicago Complex Will - Max. Credit Shelter Marital Trust to Children isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start using our service and download the form.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!