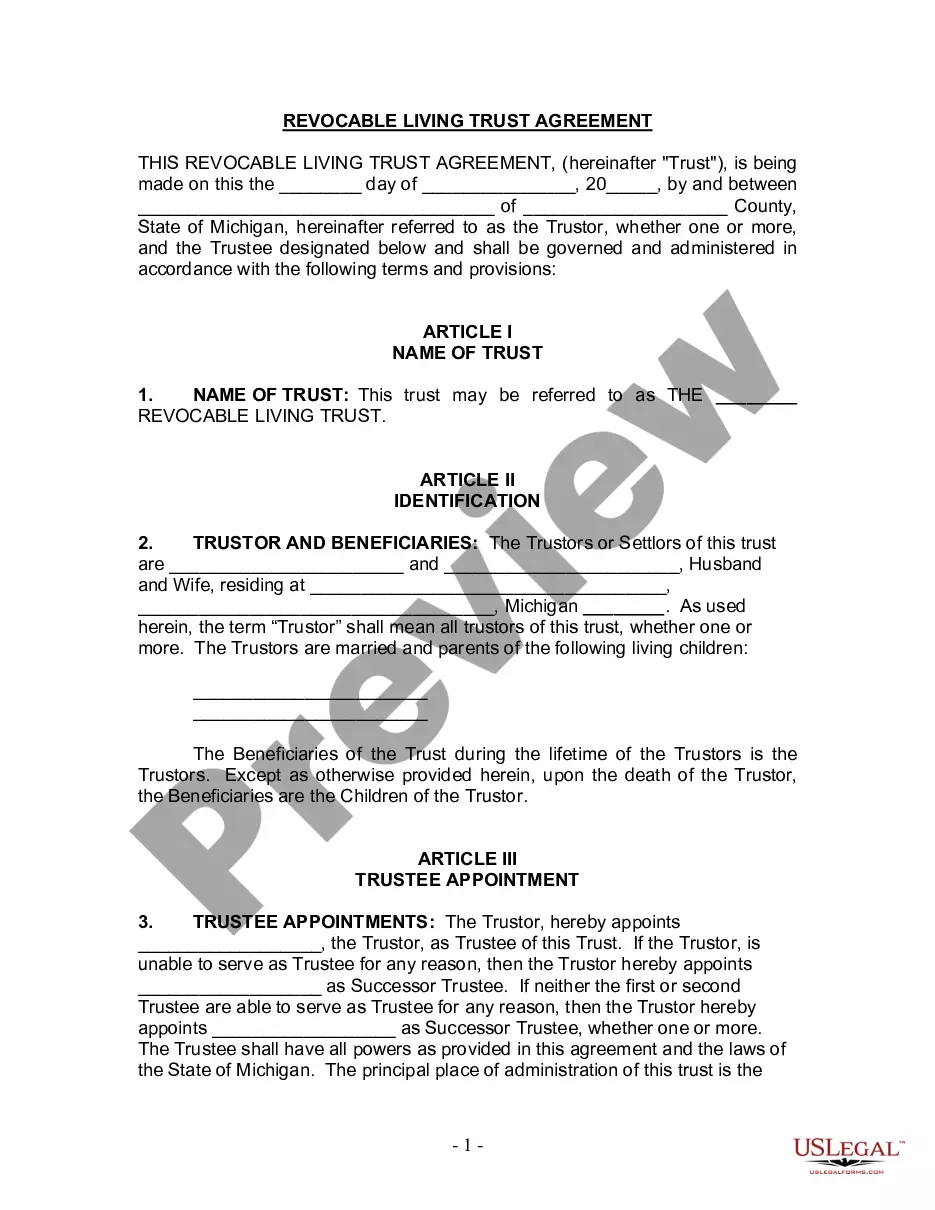

A Dallas Texas Complex Will — Max. Credit Shelter Marital Trust to Children is an estate planning tool utilized by married couples to protect and manage their assets for the benefit of their children while maximizing tax savings. This legal structure allows for the creation of a trust that takes full advantage of the maximum credit and shelter allowances under tax laws, ensuring that the wealth accumulated by the couple is preserved and transferred in the most efficient manner. The Max. Credit Shelter Marital Trust to Children is specifically designed to address the unique needs and circumstances of each family. There are different types of Dallas Texas Complex Wills — Max. Credit Shelter Marital Trust to Children, including: 1. Revocable Trust: This type of trust can be modified or terminated by the granter during their lifetime. It provides flexibility and control, allowing the granter to make changes as needed. 2. Irrevocable Trust: Unlike a revocable trust, an irrevocable trust cannot be altered or revoked once it is established. This type of trust offers increased asset protection and tax benefits, making it a popular choice for many individuals. 3. Testamentary Trust: This trust is established within a will and only goes into effect upon the death of the granter. It allows for the coordinated distribution of assets to the children while simultaneously minimizing estate taxes. 4. Generation-Skipping Trust: This type of trust transfers assets directly to grandchildren, bypassing the children. It can be an effective strategy for preserving wealth and minimizing estate taxes over multiple generations. 5. Qualified Terminable Interest Property (TIP) Trust: A TIP trust provides income to a surviving spouse while ensuring that the remaining assets ultimately pass to the children. It is often utilized when there are blended families or concerns about protecting the rights of the surviving spouse. In summary, a Dallas Texas Complex Will — Max. Credit Shelter Marital Trust to Children is a powerful estate planning tool that helps parents protect and preserve their wealth for the benefit of their children. There are various types of trusts available, each suited to address different personal and financial circumstances. Consulting with an experienced estate planning attorney in Dallas, Texas is essential to ensure that the complex will and trust structure are tailored to meet the individual needs and goals of the family.

Dallas Texas Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Dallas Texas Complex Will - Max. Credit Shelter Marital Trust To Children?

Draftwing documents, like Dallas Complex Will - Max. Credit Shelter Marital Trust to Children, to manage your legal matters is a challenging and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for various scenarios and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Dallas Complex Will - Max. Credit Shelter Marital Trust to Children template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting Dallas Complex Will - Max. Credit Shelter Marital Trust to Children:

- Ensure that your template is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Dallas Complex Will - Max. Credit Shelter Marital Trust to Children isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our website and get the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

What Is a Credit Shelter Trust? A Credit Shelter Trust (CST) is designed to allow affluent couples to reduce or completely avoid estate taxes when passing assets on to heirs, typically, the couple's children.

Two of the more popular trusts are the Qualified Terminable Interest Property trust (QTIP) and the marital gift trust. Both of these trusts are considered credit shelter trusts because they preserve the estate tax exemption of the donor to be utilized at a later date by the trust beneficiaries.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.

The current federal estate tax exemption is $11.7 million. This means individuals can gift up to the federal exemption amount during their lifetime or after death without incurring a federal the death and lifetime gift tax is combined.

An Inter Vivos Trust is one created by a living person for the benefit of another person. Also known as a living trust, this trust has a duration that is determined at the trust's creation and can entail the distribution of assets to the beneficiary during or after the trustor's lifetime.

The most common technique used by married couples to reduce their estate tax bill and pass more on to their beneficiaries is the use of a Credit Shelter Trust, also referred to as a Bypass or Family Trust, coupled with a Marital Trust, also referred to as a Marital Deduction Trust or QTIP Trust.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax-free. It can also shield the estate of the surviving spouse before the remaining assets pass on to their children.

However, Illinois law allows your executor to make a special election, called a QTIP election, to defer the Illinois estate tax on any portion of your estate passing to a credit shelter trust for a surviving spouse so long as the credit shelter trust contains certain provisions.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.