The Franklin Ohio Complex Will — Max. Credit Shelter Marital Trust to Children is a legally binding document that allows individuals residing in Franklin, Ohio to ensure their assets are distributed according to their wishes upon their death. This estate planning tool is specifically designed to maximize the amount of assets that can be passed on to children while minimizing estate taxes. The Max. Credit Shelter Marital Trust, also known as the bypass trust or family trust, is one of the key components of this complex will. It allows the granter, or the person creating the will, to set aside a specific amount of assets or property in a trust for their surviving spouse's benefit. The surviving spouse has access to income generated from the trust and is usually the trustee. However, the assets within this trust will not be included in the surviving spouse's estate upon their death. Instead, these assets will pass directly to the designated beneficiaries, typically the couple's children. The primary objective of the Max. Credit Shelter Marital Trust is to make use of the estate tax exemption available under federal law. By allocating assets into this trust, the granter can effectively shield a significant portion of their estate from estate taxes, ensuring these assets are preserved for their children's benefit. This trust arrangement helps to maximize the overall value of assets transferred to children, as the estate tax savings can be substantial. Different types of Franklin Ohio Complex Will — Max. Credit Shelter Marital Trust to Children may include: 1. Individualized Asset Allocation: This type allows the granter to customize the allocation of different assets or properties into the marital trust, taking into consideration their specific financial situation, goals, and preferences. 2. Testamentary Credit Shelter Trust: In this case, the Marital Trust is created upon the death of the granter through the provisions in their will. The assets are transferred to the trust, and the terms and conditions are set forth in the will itself. 3. Living Trust: This type, also known as a revocable trust, is created during the granter's lifetime and allows for more flexibility and control over the assets. It can be modified or revoked in the event of changing circumstances. 4. Dynasty Trust: This type of trust extends beyond the granter's immediate children, allowing assets to provide for multiple generations. It enables the preservation and growth of wealth while minimizing estate and generation-skipping transfer taxes. Overall, the Franklin Ohio Complex Will — Max. Credit Shelter Marital Trust to Children provides individuals with a robust estate planning solution to protect their assets and ensure their children receive the maximum benefit possible while reducing the impact of estate taxes. It is crucial to consult with estate planning professionals and attorneys to determine the most suitable type of trust for specific circumstances and goals.

Franklin Ohio Complex Will - Max. Credit Shelter Marital Trust to Children

Description

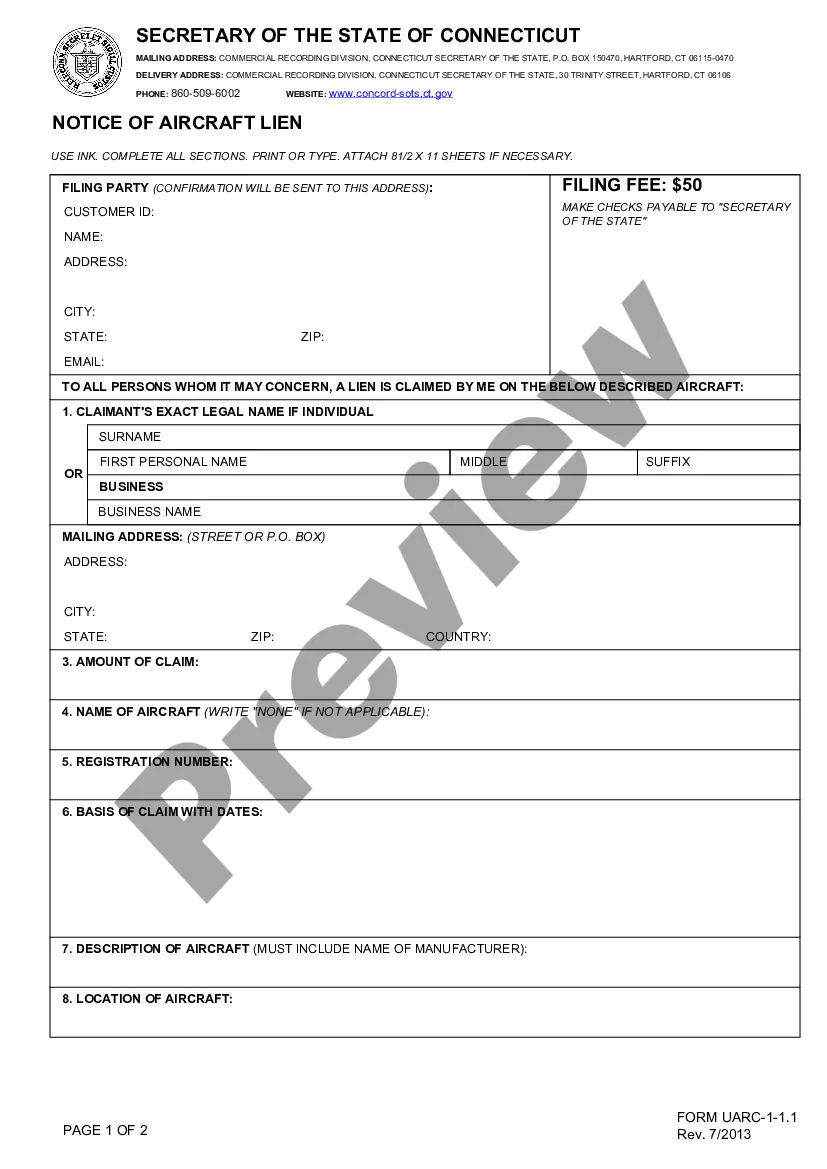

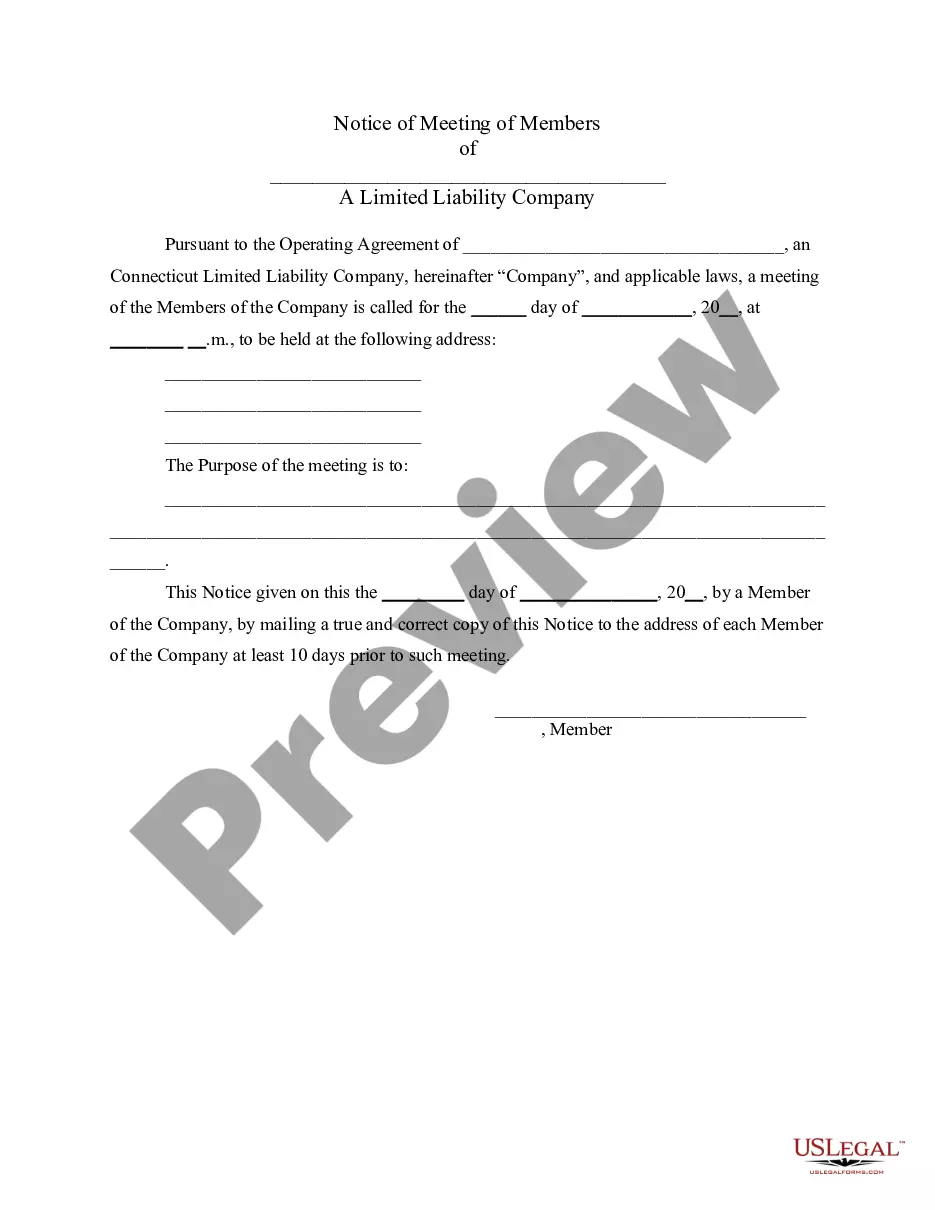

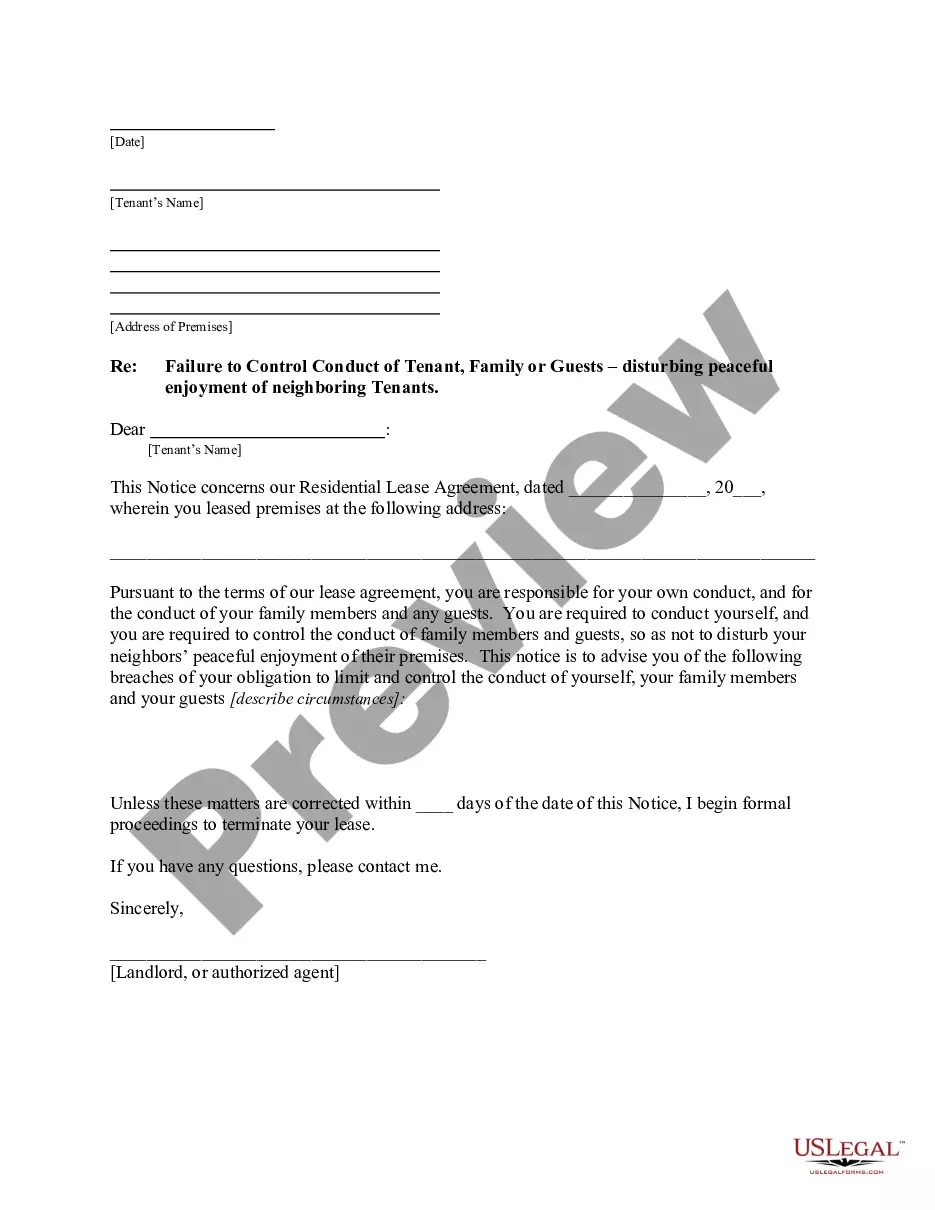

How to fill out Franklin Ohio Complex Will - Max. Credit Shelter Marital Trust To Children?

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Franklin Complex Will - Max. Credit Shelter Marital Trust to Children is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Franklin Complex Will - Max. Credit Shelter Marital Trust to Children. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Complex Will - Max. Credit Shelter Marital Trust to Children in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!