A Nassau New York Complex Will — Max. Credit Shelter Marital Trust to Children is a legal document that enables individuals to leave assets to their children through a comprehensive estate planning strategy. This type of trust is utilized to maximize the available estate tax exemptions for both spouses, while ensuring the financial well-being and protection of their children. The key purpose of a Nassau New York Complex Will — Max. Credit Shelter Marital Trust to Children is to establish a trust fund that holds the assets of the deceased spouse, known as the decedent, for the benefit of their children. By utilizing this type of trust, the surviving spouse can maintain the income generated by the trust assets while preserving the principal for the ultimate distribution to the children. Here are some essential elements and features of a Nassau New York Complex Will — Max. Credit Shelter Marital Trust to Children: 1. Estate Tax Planning: This trust aims to maximize the estate tax exemption amount for each spouse, ensuring that the couple's combined assets are protected from estate taxes to the maximum extent allowed by the law. 2. Credit Shelter Trust: Also known as a bypass or family trust, this trust shelters a specific amount of assets from estate taxes upon the death of the first spouse. This amount is equal to the current estate tax exemption limit, which is adjusted periodically. 3. Marital Trust: The surviving spouse receives income distributions generated by the trust assets for the rest of their life. However, the principal remains intact and eventually passes on to the children upon the surviving spouse's death. 4. Transfer of Wealth: The Nassau New York Complex Will — Max. Credit Shelter Marital Trust to Children facilitates the transfer of wealth from one generation to the next while minimizing estate tax liability. 5. Asset Protection: By placing assets in a trust, they are shielded from potential creditors or unforeseen legal claims, providing an additional layer of protection for the children's inheritances. It is important to note that there may be variations or additional complexities within the framework of a Nassau New York Complex Will — Max. Credit Shelter Marital Trust to Children depending on the specific circumstances and goals of the individual or couple creating the estate plan. Working with an experienced estate planning attorney is essential to design a tailored trust that best suits the needs and objectives of the decedent and their family. Other types of trusts that may be related to or utilized in conjunction with a Nassau New York Complex Will — Max. Credit Shelter Marital Trust to Children include Irrevocable Life Insurance Trusts (Slits), Qualified Personnel Residence Trusts (Parts), and Generation-Skipping Trusts (GSTs). Each of these trusts serves a unique purpose and can contribute to a comprehensive estate plan that maximizes tax efficiency and protects family wealth.

Marital Trust

Description

How to fill out Nassau New York Complex Will - Max. Credit Shelter Marital Trust To Children?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business objective utilized in your region, including the Nassau Complex Will - Max. Credit Shelter Marital Trust to Children.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Nassau Complex Will - Max. Credit Shelter Marital Trust to Children will be accessible for further use in the My Forms tab of your profile.

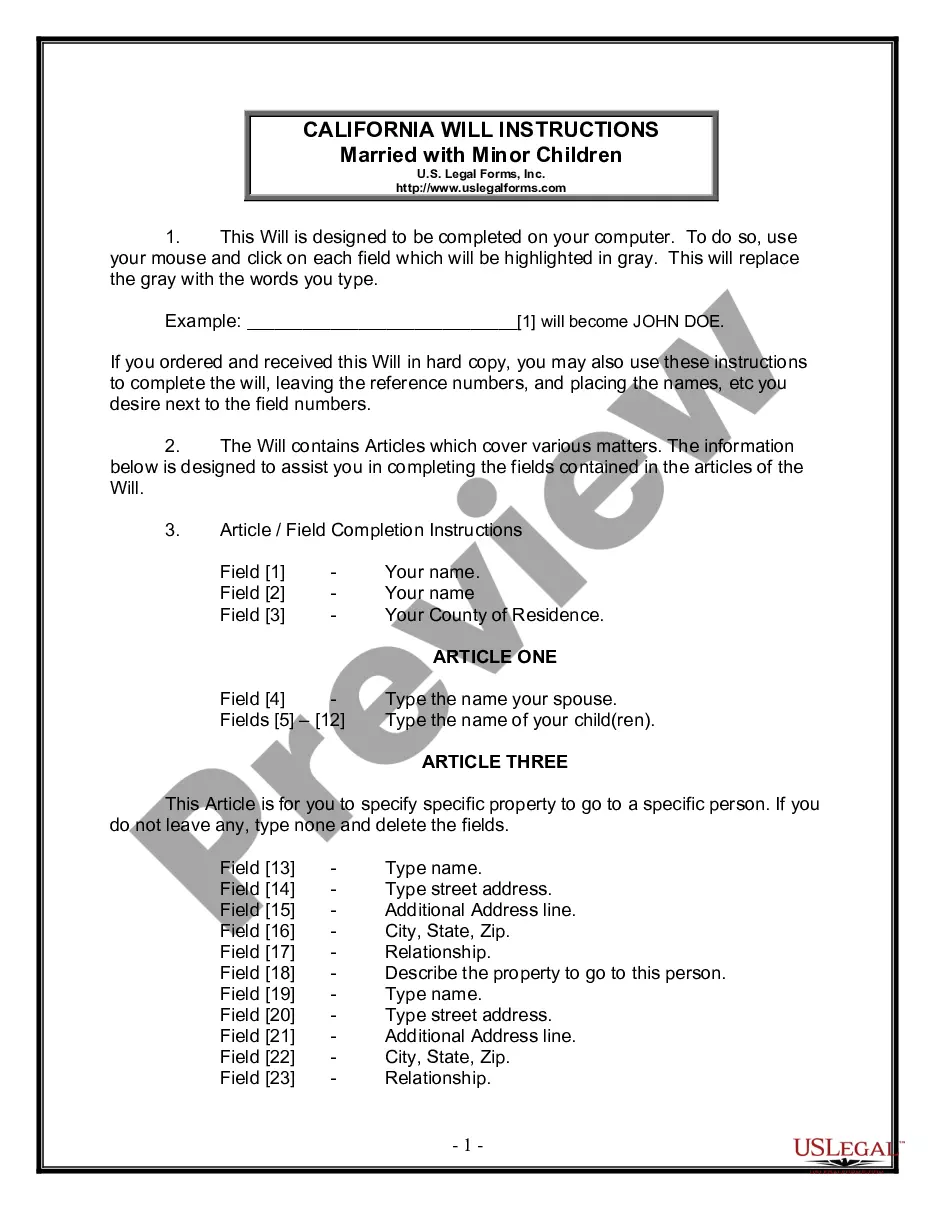

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Nassau Complex Will - Max. Credit Shelter Marital Trust to Children:

- Ensure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Nassau Complex Will - Max. Credit Shelter Marital Trust to Children on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!