A Philadelphia Pennsylvania Complex Will — Max. Credit Shelter Marital Trust to Children is a legal document that contains specific provisions to protect and pass on assets to children while minimizing estate taxes. It is designed to ensure that both spouses can maximize their combined estate tax exemptions, also known as the unified credit. The complex will create a trust upon the death of the first spouse, known as the credit shelter trust or bypass trust. This trust allows the deceased spouse to pass their assets to their children or other beneficiaries, up to the maximum allowable exemption amount, without incurring estate taxes. In Philadelphia, Pennsylvania, there are several types of complex wills and trusts that can be utilized to provide for children while minimizing tax liabilities: 1. Marital Trust: This trust is established to provide financial support to the surviving spouse while preserving the assets for the ultimate benefit of the children. The surviving spouse can receive income or even access the principal of the trust if necessary for their maintenance and support. 2. Credit Shelter Trust: Also referred to as a bypass trust or A/B trust, this trust ensures that the deceased spouse's assets pass to the children or other beneficiaries, bypassing the surviving spouse's estate. By doing so, the assets in the trust are not subject to estate taxes when the surviving spouse later passes away. 3. Generation-Skipping Trust: This trust is created to benefit the grandchildren or future generations. By skipping a generation, estate taxes can be minimized or even avoided altogether. It allows a portion of the estate to pass directly to the grandchildren without incurring additional estate tax liabilities. 4. Irrevocable Life Insurance Trust (IIT): This trust holds life insurance policies outside the insured's estate, preventing them from being subject to estate taxes. The IIT can provide funds to support the surviving spouse and children while keeping the insurance proceeds shielded from estate tax calculations. By utilizing a Philadelphia Pennsylvania Complex Will — Max. Credit Shelter Marital Trust to Children, individuals can ensure their assets are distributed in accordance with their wishes while minimizing the tax burden on their loved ones. It is important to consult with an experienced estate planning attorney to determine the most suitable trust structure based on individual circumstances and objectives.

Philadelphia Pennsylvania Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Philadelphia Pennsylvania Complex Will - Max. Credit Shelter Marital Trust To Children?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Philadelphia Complex Will - Max. Credit Shelter Marital Trust to Children is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Philadelphia Complex Will - Max. Credit Shelter Marital Trust to Children. Follow the guide below:

- Make sure the sample meets your personal needs and state law regulations.

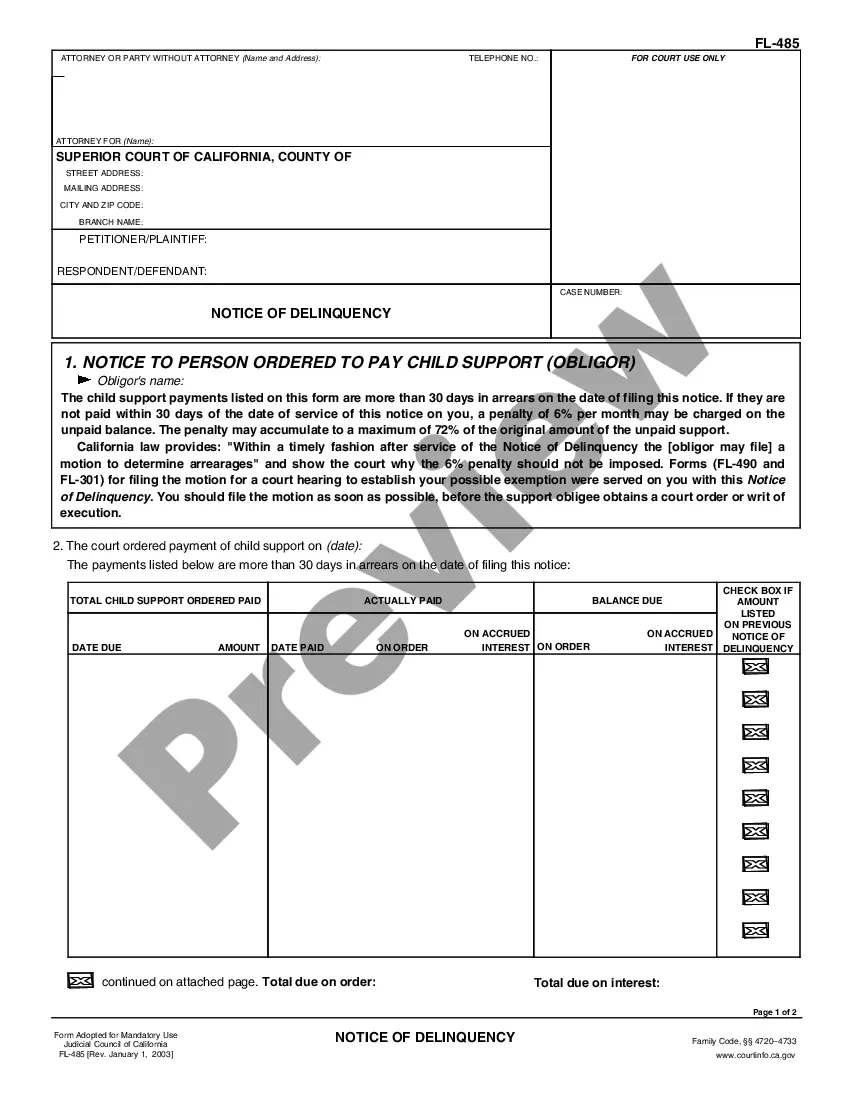

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Complex Will - Max. Credit Shelter Marital Trust to Children in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!