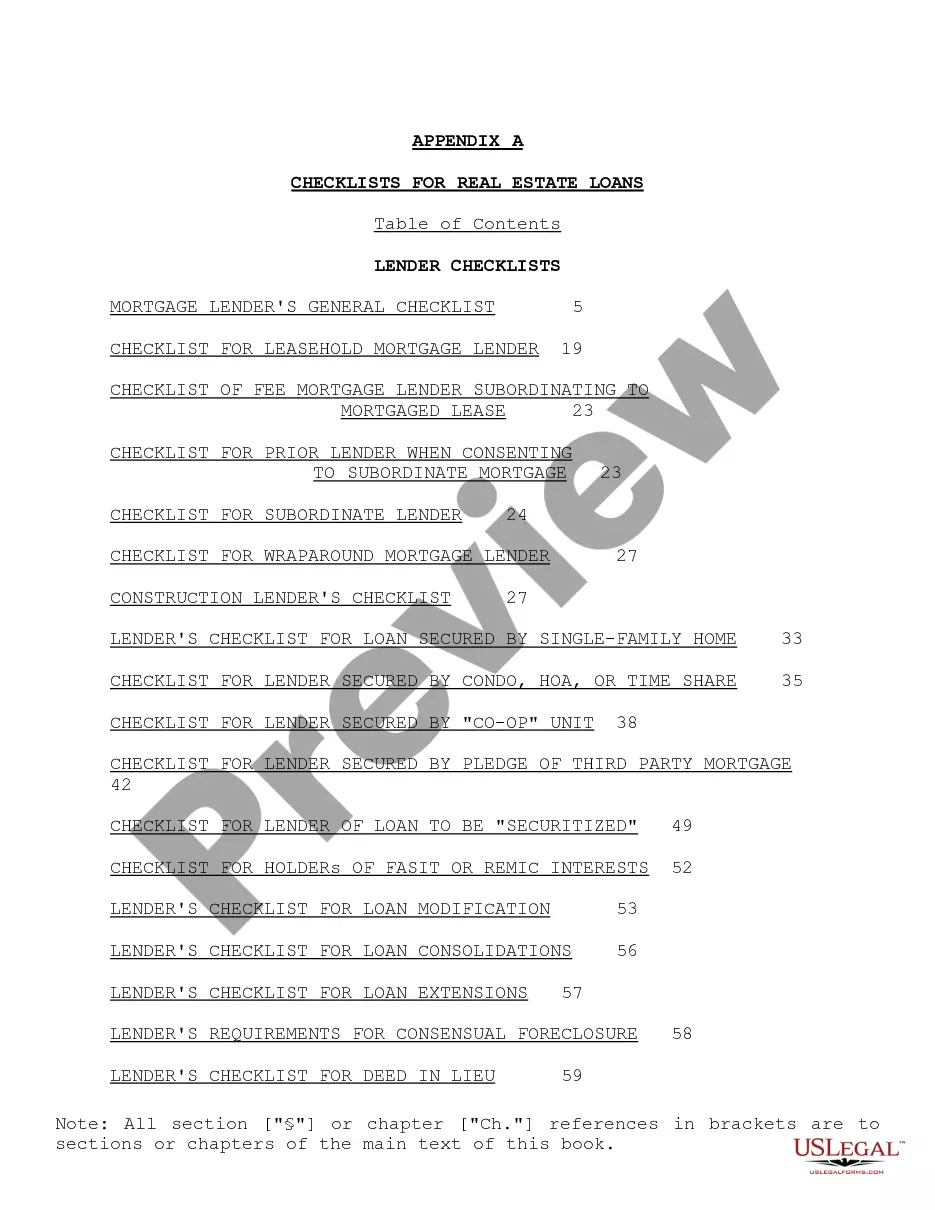

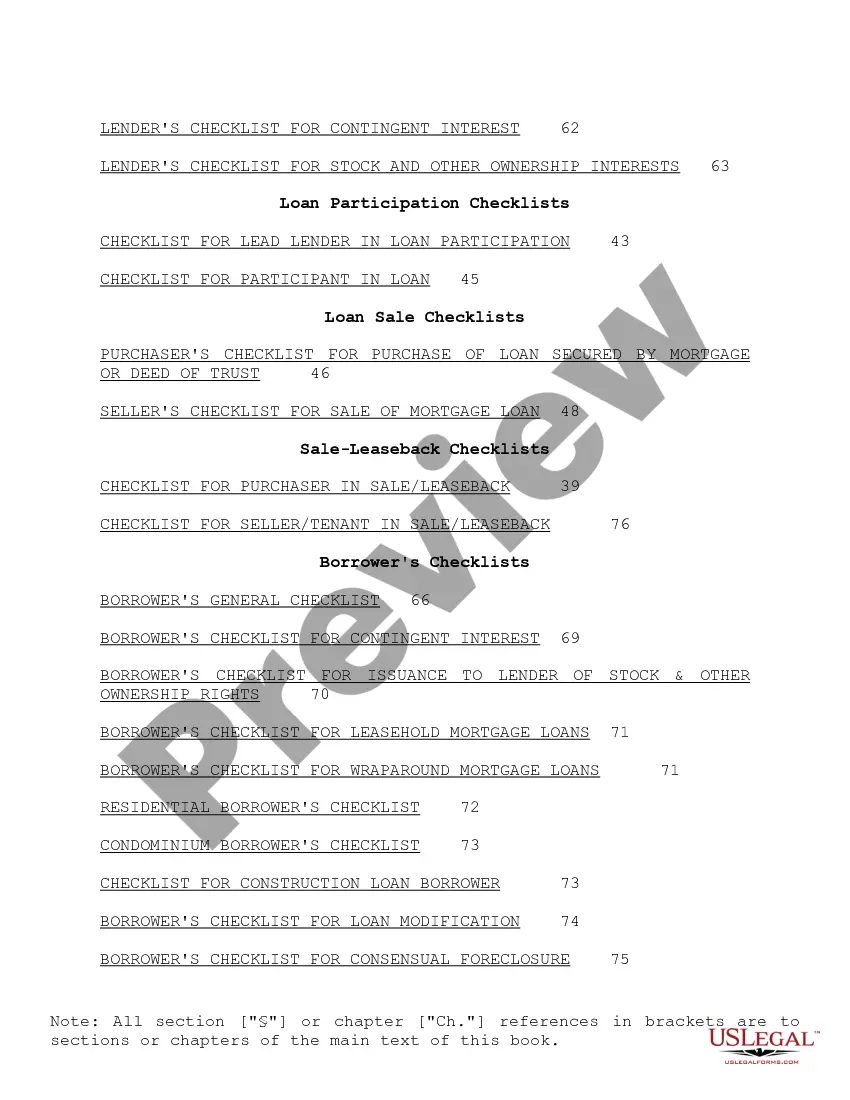

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

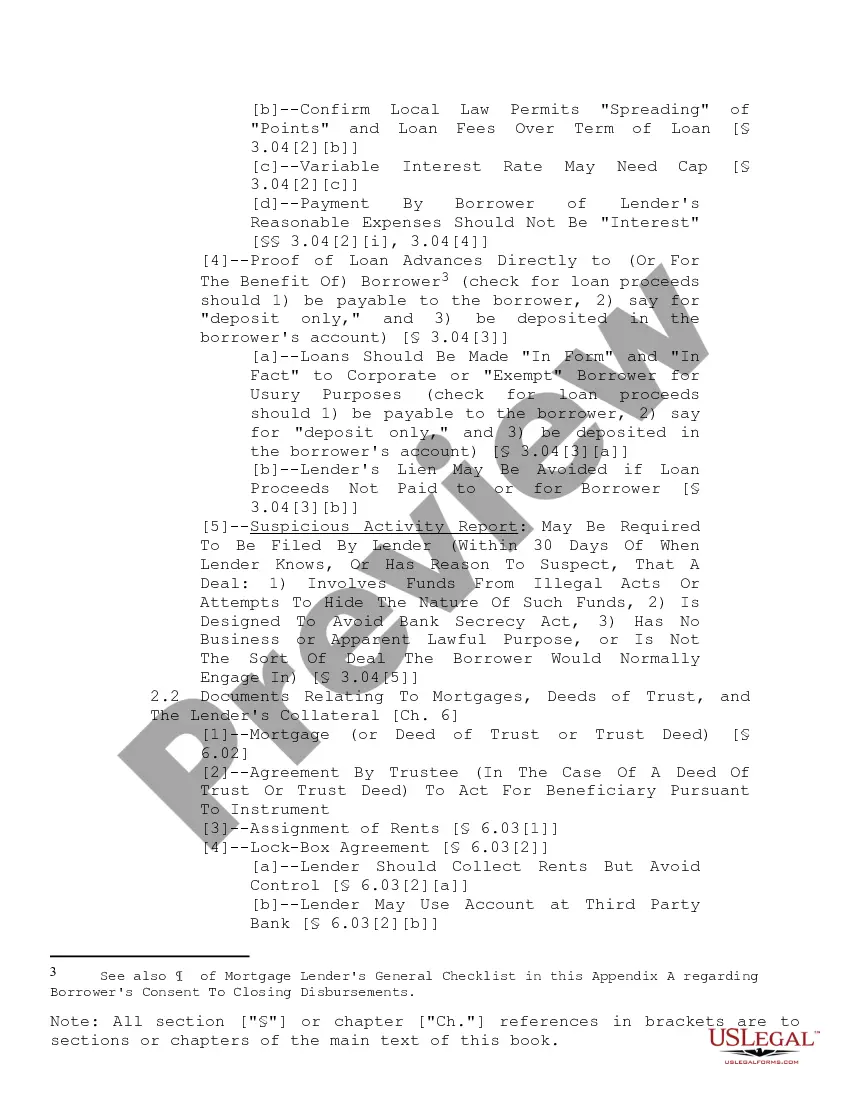

Fairfax Virginia Checklist for Real Estate Loans: A Comprehensive Guide for Homebuyers Introduction: If you are planning to purchase a property in Fairfax, Virginia, it is essential to understand the checklist for real estate loans to ensure a smooth and successful home buying experience. This comprehensive guide will provide you with detailed information about the various aspects of the Fairfax Virginia checklist for real estate loans, along with relevant keywords to help you navigate through the process. 1. Credit Score and Financial Health: One of the key factors for securing a real estate loan is a healthy credit score. Check and improve your credit score before applying for a loan in Fairfax. Keywords: credit score improvement, credit score check, financial health assessment. 2. Mortgage Pre-Approval: Before starting your home search in Fairfax, it's wise to obtain a mortgage pre-approval. This process evaluates your financial standing, income, and debt obligations, helping you determine a suitable mortgage amount. Keywords: mortgage pre-approval, mortgage pre-qualification, financial assessment. 3. Down Payment Options: Research the down payment options available for real estate loans in Fairfax, as they can vary depending on your financial situation. Keywords: down payment assistance, down payment requirements, loan-to-value ratio. 4. Loan Types: Familiarize yourself with different types of real estate loan options in Fairfax, such as fixed-rate mortgages, adjustable-rate mortgages (ARM's), FHA loans, VA loans, and jumbo loans. Keywords: loan types, mortgage options, financing choices. 5. Interest Rates and Terms: Review current interest rates and loan terms offered by various lenders in Fairfax. Understanding the impact of interest rates on your monthly mortgage payment is crucial in making an informed decision. Keywords: interest rates, loan terms, mortgage rate comparison. 6. Loan Application Process: Be prepared to complete a thorough loan application that includes providing detailed information about your income, assets, employment history, and tax records. Keywords: loan application process, documentation, information required. 7. Home Appraisal: A vital step in the real estate loan process is the home appraisal, conducted by a professional appraiser to determine the fair market value of the property in Fairfax. Keywords: home appraisal, property valuation, appraisal process. 8. Title Search and Insurance: Ensure that a comprehensive title search is conducted to identify any potential issues or claims on the property's title. Additionally, secure title insurance to protect yourself from any unforeseen complications. Keywords: title search, title insurance, property title review. 9. Closing Costs: Be aware of the various closing costs associated with a real estate loan in Fairfax, including lender fees, appraisal fees, inspection fees, and attorney fees. Keywords: closing costs, fees, settlement charges. 10. Post-Closing Responsibilities: Once the loan is approved, understand your responsibilities as a homeowner in Fairfax, such as paying property taxes, homeowner's insurance, and maintaining the property. Keywords: post-closing responsibilities, property taxes, homeowner responsibilities. Types of Fairfax Virginia Checklist for Real Estate Loans: 1. First-Time Homebuyer Checklist: Specifically designed for individuals purchasing their first property in Fairfax, this checklist provides step-by-step guidance, including special loan programs and grants available for first-time buyers. Keywords: first-time homebuyer, special loan programs, grants. 2. Investment Property Checklist: Tailored for individuals interested in buying investment properties in Fairfax, this checklist highlights specific requirements and considerations related to financing investment properties. Keywords: investment property, financing options, rental income analysis. 3. New Construction Checklist: Ideal for those planning to buy a newly constructed property in Fairfax, this checklist focuses on additional steps to consider, such as builder approvals, warranty terms, and lender requirements. Keywords: new construction, builder approvals, warranty terms. Conclusion: The Fairfax Virginia checklist for real estate loans is a crucial tool for homebuyers, providing them with essential guidance to navigate the loan application process seamlessly. By understanding the checklist and its associated components, prospective buyers can make informed decisions and secure the most suitable loan option for their Fairfax property purchase.Fairfax Virginia Checklist for Real Estate Loans: A Comprehensive Guide for Homebuyers Introduction: If you are planning to purchase a property in Fairfax, Virginia, it is essential to understand the checklist for real estate loans to ensure a smooth and successful home buying experience. This comprehensive guide will provide you with detailed information about the various aspects of the Fairfax Virginia checklist for real estate loans, along with relevant keywords to help you navigate through the process. 1. Credit Score and Financial Health: One of the key factors for securing a real estate loan is a healthy credit score. Check and improve your credit score before applying for a loan in Fairfax. Keywords: credit score improvement, credit score check, financial health assessment. 2. Mortgage Pre-Approval: Before starting your home search in Fairfax, it's wise to obtain a mortgage pre-approval. This process evaluates your financial standing, income, and debt obligations, helping you determine a suitable mortgage amount. Keywords: mortgage pre-approval, mortgage pre-qualification, financial assessment. 3. Down Payment Options: Research the down payment options available for real estate loans in Fairfax, as they can vary depending on your financial situation. Keywords: down payment assistance, down payment requirements, loan-to-value ratio. 4. Loan Types: Familiarize yourself with different types of real estate loan options in Fairfax, such as fixed-rate mortgages, adjustable-rate mortgages (ARM's), FHA loans, VA loans, and jumbo loans. Keywords: loan types, mortgage options, financing choices. 5. Interest Rates and Terms: Review current interest rates and loan terms offered by various lenders in Fairfax. Understanding the impact of interest rates on your monthly mortgage payment is crucial in making an informed decision. Keywords: interest rates, loan terms, mortgage rate comparison. 6. Loan Application Process: Be prepared to complete a thorough loan application that includes providing detailed information about your income, assets, employment history, and tax records. Keywords: loan application process, documentation, information required. 7. Home Appraisal: A vital step in the real estate loan process is the home appraisal, conducted by a professional appraiser to determine the fair market value of the property in Fairfax. Keywords: home appraisal, property valuation, appraisal process. 8. Title Search and Insurance: Ensure that a comprehensive title search is conducted to identify any potential issues or claims on the property's title. Additionally, secure title insurance to protect yourself from any unforeseen complications. Keywords: title search, title insurance, property title review. 9. Closing Costs: Be aware of the various closing costs associated with a real estate loan in Fairfax, including lender fees, appraisal fees, inspection fees, and attorney fees. Keywords: closing costs, fees, settlement charges. 10. Post-Closing Responsibilities: Once the loan is approved, understand your responsibilities as a homeowner in Fairfax, such as paying property taxes, homeowner's insurance, and maintaining the property. Keywords: post-closing responsibilities, property taxes, homeowner responsibilities. Types of Fairfax Virginia Checklist for Real Estate Loans: 1. First-Time Homebuyer Checklist: Specifically designed for individuals purchasing their first property in Fairfax, this checklist provides step-by-step guidance, including special loan programs and grants available for first-time buyers. Keywords: first-time homebuyer, special loan programs, grants. 2. Investment Property Checklist: Tailored for individuals interested in buying investment properties in Fairfax, this checklist highlights specific requirements and considerations related to financing investment properties. Keywords: investment property, financing options, rental income analysis. 3. New Construction Checklist: Ideal for those planning to buy a newly constructed property in Fairfax, this checklist focuses on additional steps to consider, such as builder approvals, warranty terms, and lender requirements. Keywords: new construction, builder approvals, warranty terms. Conclusion: The Fairfax Virginia checklist for real estate loans is a crucial tool for homebuyers, providing them with essential guidance to navigate the loan application process seamlessly. By understanding the checklist and its associated components, prospective buyers can make informed decisions and secure the most suitable loan option for their Fairfax property purchase.