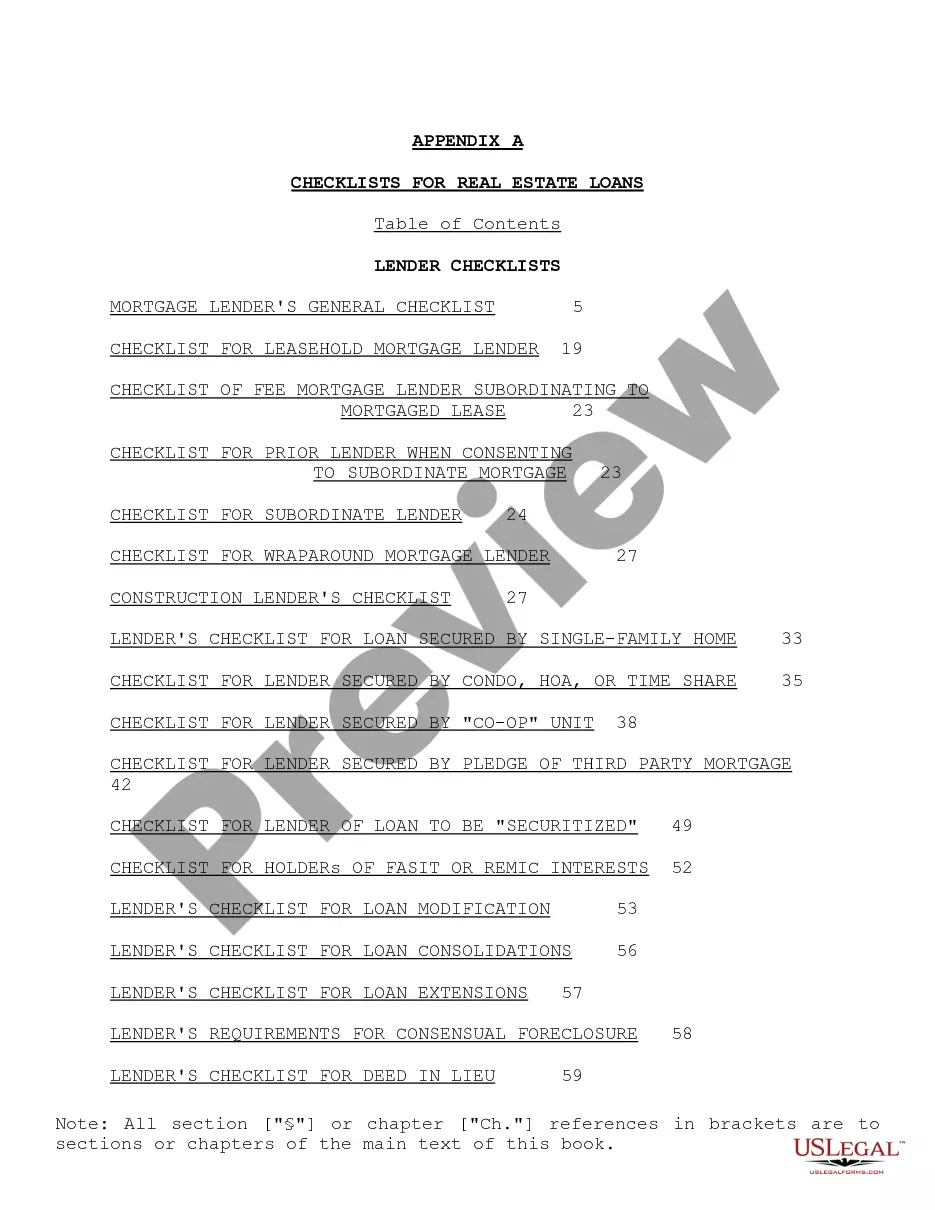

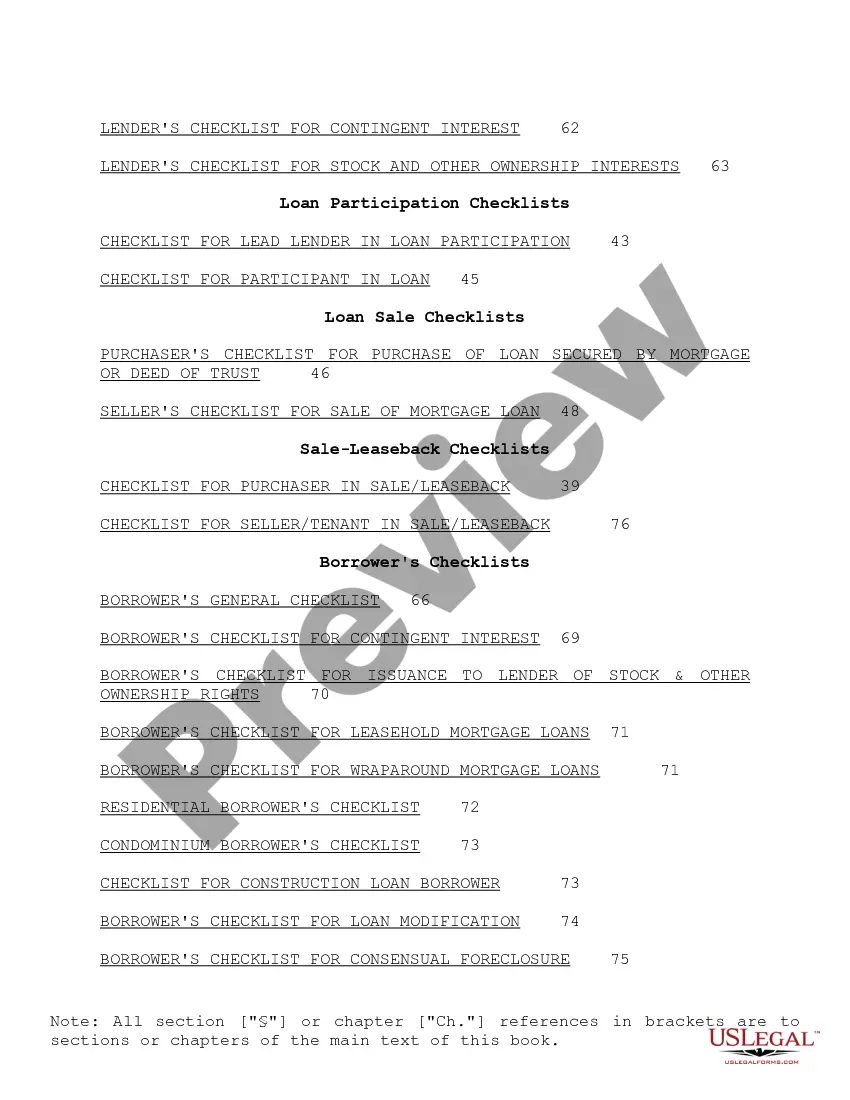

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

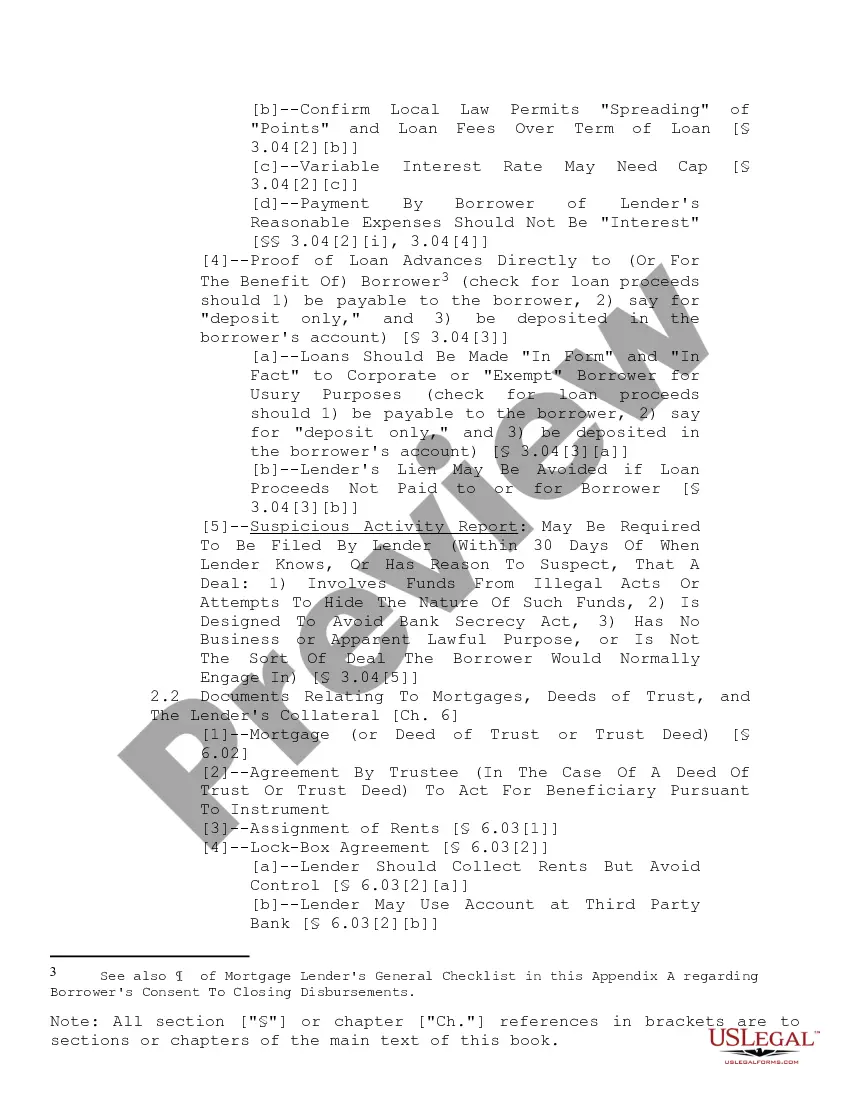

Fulton Georgia Checklist for Real Estate Loans: A Comprehensive Guide When it comes to purchasing real estate in Fulton, Georgia, securing a loan is often a crucial part of the process. To help borrowers navigate through the complexities of real estate financing, it is essential to understand the Fulton Georgia Checklist for Real Estate Loans. This detailed guide aims to provide a comprehensive overview of the key factors to consider when applying for a real estate loan in Fulton, Georgia, ensuring a smooth and successful transaction. 1. Creditworthiness: One of the primary aspects lenders will review is the borrower's creditworthiness. This includes evaluating credit scores, credit history, and debt-to-income ratio. Ensuring a strong credit profile by maintaining a good payment history and reducing outstanding debts is crucial to secure favorable loan terms. 2. Down Payment: Determining the down payment amount is a critical step in the real estate loan checklist. Fulton, Georgia, offers various loan options, each requiring different down payment percentages. These options include conventional loans, FHA loans, and VA loans, each with their specifications regarding down payment requirements. 3. Loan Pre-Approval: Before embarking on the home-buying journey, it is highly recommended obtaining pre-approval from lenders. This involves submitting essential financial documents, such as income statements, tax returns, and bank statements. Once pre-approved, borrowers have a clearer understanding of their budget and can make confident purchase offers. 4. Finding a Reliable Lender: Selecting a reputable lender with experience in Fulton, Georgia, is crucial for a successful real estate loan. Researching lenders by reading reviews, consulting with real estate agents, and comparing interest rates and loan terms ensures that borrowers find the best-fit lender for their needs. 5. Property Appraisal: Lenders require a property appraisal to determine its market value and assess its condition. An appraisal is crucial to ensure that the loan amount aligns with the property's worth, protecting both the borrower and the lender. 6. Loan Documents: Fulton Georgia Checklist for Real Estate Loans emphasizes the importance of reviewing and understanding loan documents before signing. These documents may include the loan agreement, promissory note, deed of trust, and other legal paperwork. Seeking legal advice to comprehend the terms and conditions thoroughly is advised. 7. Title Search and Insurance: Conducting a comprehensive title search is essential to verify the property's ownership history and uncover any potential liens or encumbrances. Acquiring title insurance safeguards against any financial loss due to unforeseen issues related to the property's title. 8. Closing Costs: Understanding the closing costs associated with real estate loans is crucial for budgeting purposes. These costs typically include fees for loan origination, title insurance, appraisal, inspections, and attorney services. The Fulton Georgia Checklist for Real Estate Loans encourages borrowers to request a Loan Estimate form from lenders to understand the estimated closing costs accurately. Different types of Fulton Georgia Checklist for Real Estate Loans may include specific loan programs targeted to first-time homebuyers, low-income households, or veterans. For example, the Georgia Dream Homeownership Program offers financial assistance and down payment assistance to qualifying homebuyers in Fulton, Georgia. In summary, the Fulton Georgia Checklist for Real Estate Loans is a comprehensive guide for prospective buyers considering purchasing property in Fulton, Georgia. Following this checklist ensures borrowers have a thorough understanding of the loan application process, enabling a smooth and successful real estate transaction. By paying attention to creditworthiness, down payment requirements, loan pre-approval, property appraisal, loan documents, title search and insurance, closing costs, and selecting the right lender, borrowers can navigate the complex world of real estate loans with confidence and make informed decisions.Fulton Georgia Checklist for Real Estate Loans: A Comprehensive Guide When it comes to purchasing real estate in Fulton, Georgia, securing a loan is often a crucial part of the process. To help borrowers navigate through the complexities of real estate financing, it is essential to understand the Fulton Georgia Checklist for Real Estate Loans. This detailed guide aims to provide a comprehensive overview of the key factors to consider when applying for a real estate loan in Fulton, Georgia, ensuring a smooth and successful transaction. 1. Creditworthiness: One of the primary aspects lenders will review is the borrower's creditworthiness. This includes evaluating credit scores, credit history, and debt-to-income ratio. Ensuring a strong credit profile by maintaining a good payment history and reducing outstanding debts is crucial to secure favorable loan terms. 2. Down Payment: Determining the down payment amount is a critical step in the real estate loan checklist. Fulton, Georgia, offers various loan options, each requiring different down payment percentages. These options include conventional loans, FHA loans, and VA loans, each with their specifications regarding down payment requirements. 3. Loan Pre-Approval: Before embarking on the home-buying journey, it is highly recommended obtaining pre-approval from lenders. This involves submitting essential financial documents, such as income statements, tax returns, and bank statements. Once pre-approved, borrowers have a clearer understanding of their budget and can make confident purchase offers. 4. Finding a Reliable Lender: Selecting a reputable lender with experience in Fulton, Georgia, is crucial for a successful real estate loan. Researching lenders by reading reviews, consulting with real estate agents, and comparing interest rates and loan terms ensures that borrowers find the best-fit lender for their needs. 5. Property Appraisal: Lenders require a property appraisal to determine its market value and assess its condition. An appraisal is crucial to ensure that the loan amount aligns with the property's worth, protecting both the borrower and the lender. 6. Loan Documents: Fulton Georgia Checklist for Real Estate Loans emphasizes the importance of reviewing and understanding loan documents before signing. These documents may include the loan agreement, promissory note, deed of trust, and other legal paperwork. Seeking legal advice to comprehend the terms and conditions thoroughly is advised. 7. Title Search and Insurance: Conducting a comprehensive title search is essential to verify the property's ownership history and uncover any potential liens or encumbrances. Acquiring title insurance safeguards against any financial loss due to unforeseen issues related to the property's title. 8. Closing Costs: Understanding the closing costs associated with real estate loans is crucial for budgeting purposes. These costs typically include fees for loan origination, title insurance, appraisal, inspections, and attorney services. The Fulton Georgia Checklist for Real Estate Loans encourages borrowers to request a Loan Estimate form from lenders to understand the estimated closing costs accurately. Different types of Fulton Georgia Checklist for Real Estate Loans may include specific loan programs targeted to first-time homebuyers, low-income households, or veterans. For example, the Georgia Dream Homeownership Program offers financial assistance and down payment assistance to qualifying homebuyers in Fulton, Georgia. In summary, the Fulton Georgia Checklist for Real Estate Loans is a comprehensive guide for prospective buyers considering purchasing property in Fulton, Georgia. Following this checklist ensures borrowers have a thorough understanding of the loan application process, enabling a smooth and successful real estate transaction. By paying attention to creditworthiness, down payment requirements, loan pre-approval, property appraisal, loan documents, title search and insurance, closing costs, and selecting the right lender, borrowers can navigate the complex world of real estate loans with confidence and make informed decisions.