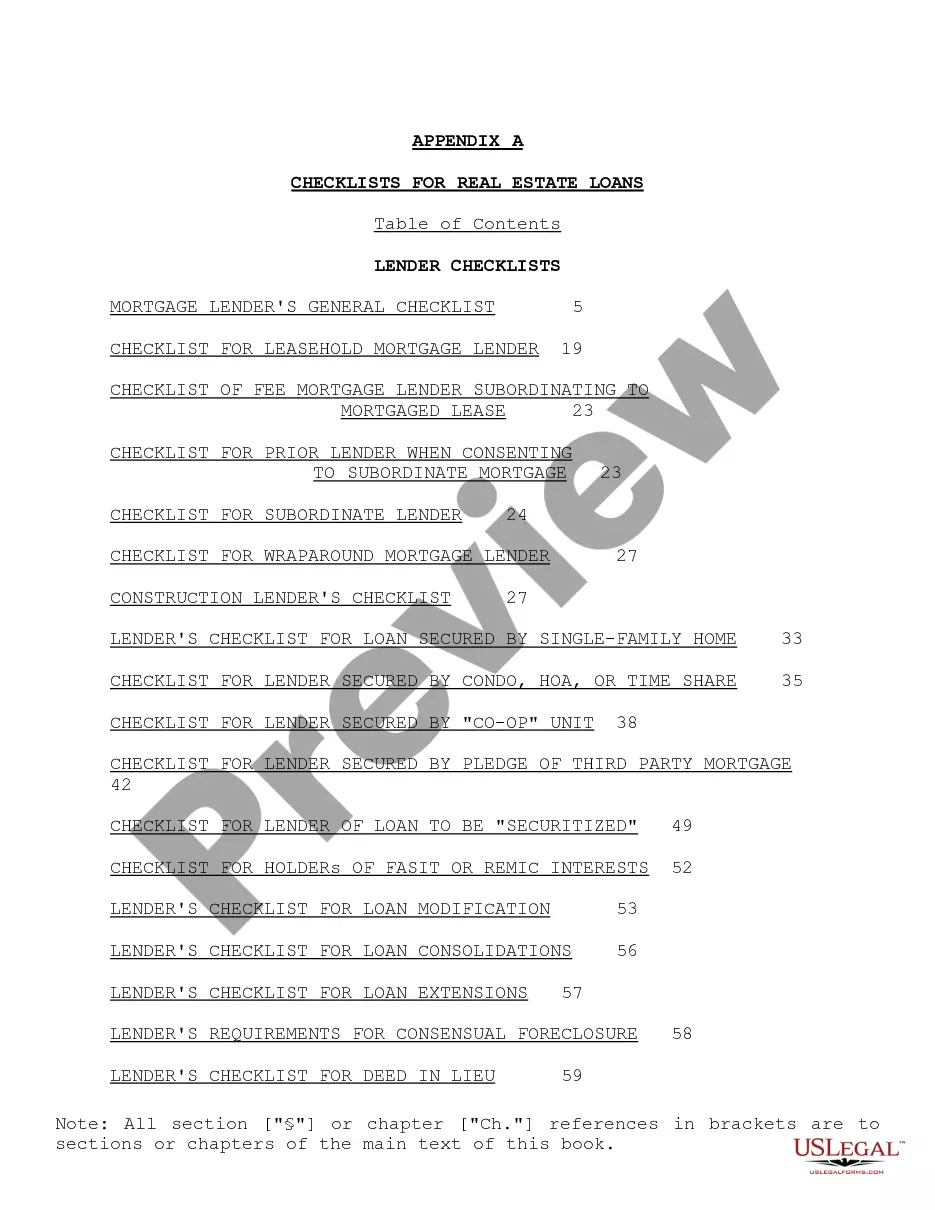

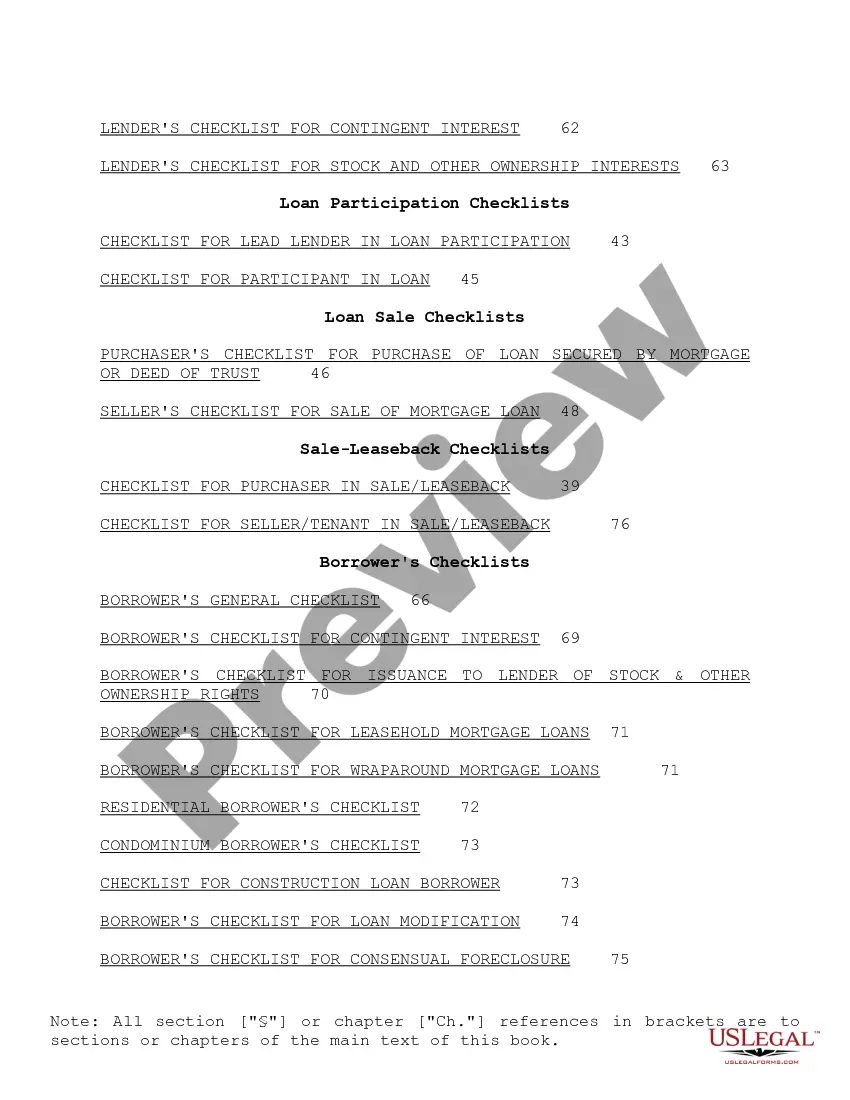

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

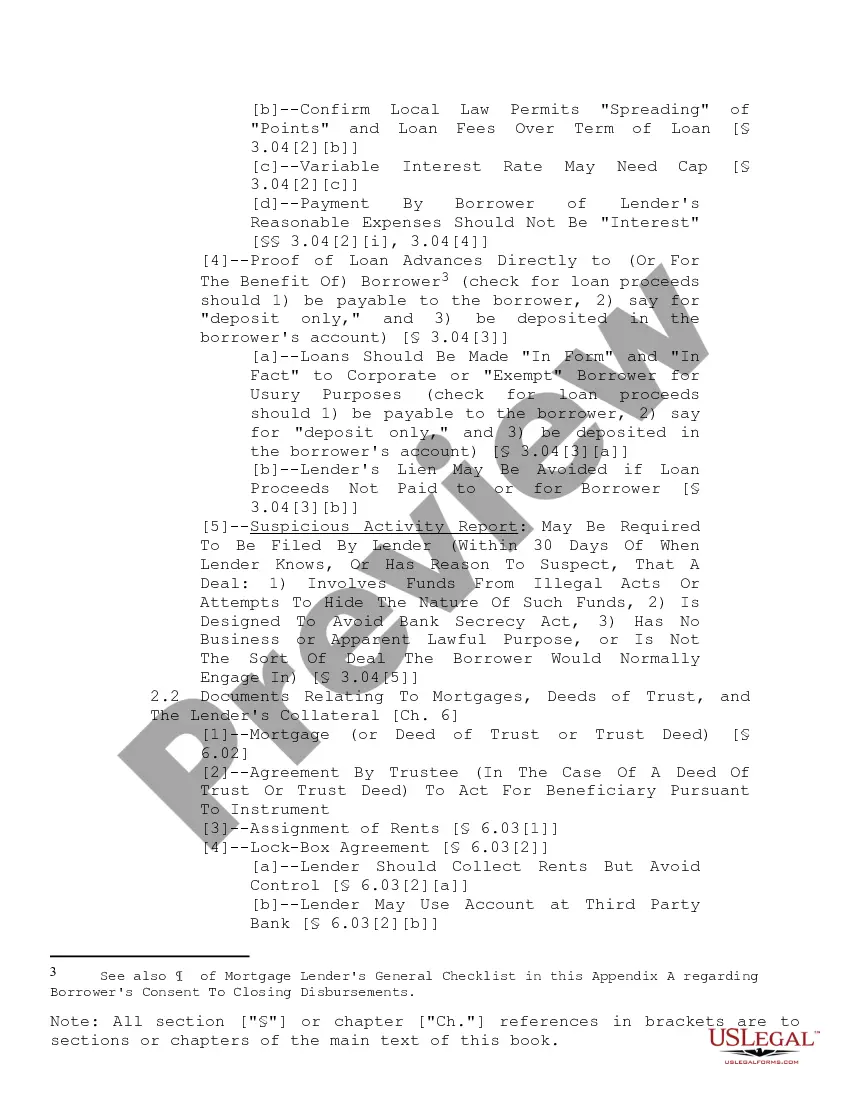

Oakland Michigan Checklist for Real Estate Loans: A Comprehensive Guide When it comes to real estate loans in Oakland, Michigan, there are essential checklists that borrowers, lenders, and real estate professionals need to consider. These checklists help ensure a smooth loan process while minimizing potential risks and meeting legal requirements. Below, we provide a detailed description of what an Oakland Michigan Checklist for Real Estate Loans entails, along with related keywords: 1. Loan Application Checklist: The loan application checklist is the initial stage of the real estate loan process. It includes gathering all the necessary documents and information required by lenders to assess the borrower's creditworthiness and evaluate the property's value. Key items in this checklist include: — Personal information (name, address, social security number, etc.) — Employment and incomverificationio— - Tax returns for the past few years — Bank statements and other financial statements — Documentation of assets (property deeds, investment portfolios, etc.) — Credit history and credit scores 2. Property Evaluation Checklist: Before approving a real estate loan, lenders need to ensure that the property meets specific criteria. This checklist helps evaluate the property's value, condition, and marketability. Key items in this checklist include: — Property appraisal report— - Title search and title insurance — Proof of property insuranccoverageag— - Environmental assessment reports (if applicable) — Inspection reports (structural, pest, and any other relevant inspections) — Survey reports and legal description of the property 3. Legal and Regulatory Compliance Checklist: To protect both the borrower and the lender, real estate loans in Oakland, Michigan, must comply with various legal and regulatory requirements. This checklist ensures both parties adhere to these standards. Key items in this checklist include: — Ensuring compliance with local zoning regulations — Reviewing the loan agreement for legal clarity and transparency — Confirming the loan's interest rate and terms comply with state laws — Adhering to fair housing laws and anti-discrimination policies — Verifying that the loan does not breach any predatory lending laws — Complying with federal and state disclosure requirements (Truth in Lending Act, Real Estate Settlement Procedures Act, etc.) 4. Financial Viability Checklist: Lenders need to assess the borrower's financial ability to repay the loan. This checklist helps evaluate the borrower's financial health and risk factors. Key items in this checklist include: — Debt-to-income ratio— - Cash reserves and down payment capability — Adequate income stability and consistency — Verificatioemploymenten— - Creditworthiness evaluation — Documentation of any bankruptcy or foreclosure history By following these comprehensive checklists, borrowers, lenders, and real estate professionals can ensure a smoother loan process, mitigate risks, and comply with the necessary legal obligations in the Oakland, Michigan real estate market. Keywords: Oakland, Michigan real estate loans, loan application checklist, property evaluation checklist, legal and regulatory compliance checklist, financial viability checklist, real estate loan process, borrower's creditworthiness, property appraisal, title search, environmental assessment, loan agreement review, fair housing laws, predatory lending laws, financial health, debt-to-income ratios, cash reserves, bankruptcy history.Oakland Michigan Checklist for Real Estate Loans: A Comprehensive Guide When it comes to real estate loans in Oakland, Michigan, there are essential checklists that borrowers, lenders, and real estate professionals need to consider. These checklists help ensure a smooth loan process while minimizing potential risks and meeting legal requirements. Below, we provide a detailed description of what an Oakland Michigan Checklist for Real Estate Loans entails, along with related keywords: 1. Loan Application Checklist: The loan application checklist is the initial stage of the real estate loan process. It includes gathering all the necessary documents and information required by lenders to assess the borrower's creditworthiness and evaluate the property's value. Key items in this checklist include: — Personal information (name, address, social security number, etc.) — Employment and incomverificationio— - Tax returns for the past few years — Bank statements and other financial statements — Documentation of assets (property deeds, investment portfolios, etc.) — Credit history and credit scores 2. Property Evaluation Checklist: Before approving a real estate loan, lenders need to ensure that the property meets specific criteria. This checklist helps evaluate the property's value, condition, and marketability. Key items in this checklist include: — Property appraisal report— - Title search and title insurance — Proof of property insuranccoverageag— - Environmental assessment reports (if applicable) — Inspection reports (structural, pest, and any other relevant inspections) — Survey reports and legal description of the property 3. Legal and Regulatory Compliance Checklist: To protect both the borrower and the lender, real estate loans in Oakland, Michigan, must comply with various legal and regulatory requirements. This checklist ensures both parties adhere to these standards. Key items in this checklist include: — Ensuring compliance with local zoning regulations — Reviewing the loan agreement for legal clarity and transparency — Confirming the loan's interest rate and terms comply with state laws — Adhering to fair housing laws and anti-discrimination policies — Verifying that the loan does not breach any predatory lending laws — Complying with federal and state disclosure requirements (Truth in Lending Act, Real Estate Settlement Procedures Act, etc.) 4. Financial Viability Checklist: Lenders need to assess the borrower's financial ability to repay the loan. This checklist helps evaluate the borrower's financial health and risk factors. Key items in this checklist include: — Debt-to-income ratio— - Cash reserves and down payment capability — Adequate income stability and consistency — Verificatioemploymenten— - Creditworthiness evaluation — Documentation of any bankruptcy or foreclosure history By following these comprehensive checklists, borrowers, lenders, and real estate professionals can ensure a smoother loan process, mitigate risks, and comply with the necessary legal obligations in the Oakland, Michigan real estate market. Keywords: Oakland, Michigan real estate loans, loan application checklist, property evaluation checklist, legal and regulatory compliance checklist, financial viability checklist, real estate loan process, borrower's creditworthiness, property appraisal, title search, environmental assessment, loan agreement review, fair housing laws, predatory lending laws, financial health, debt-to-income ratios, cash reserves, bankruptcy history.