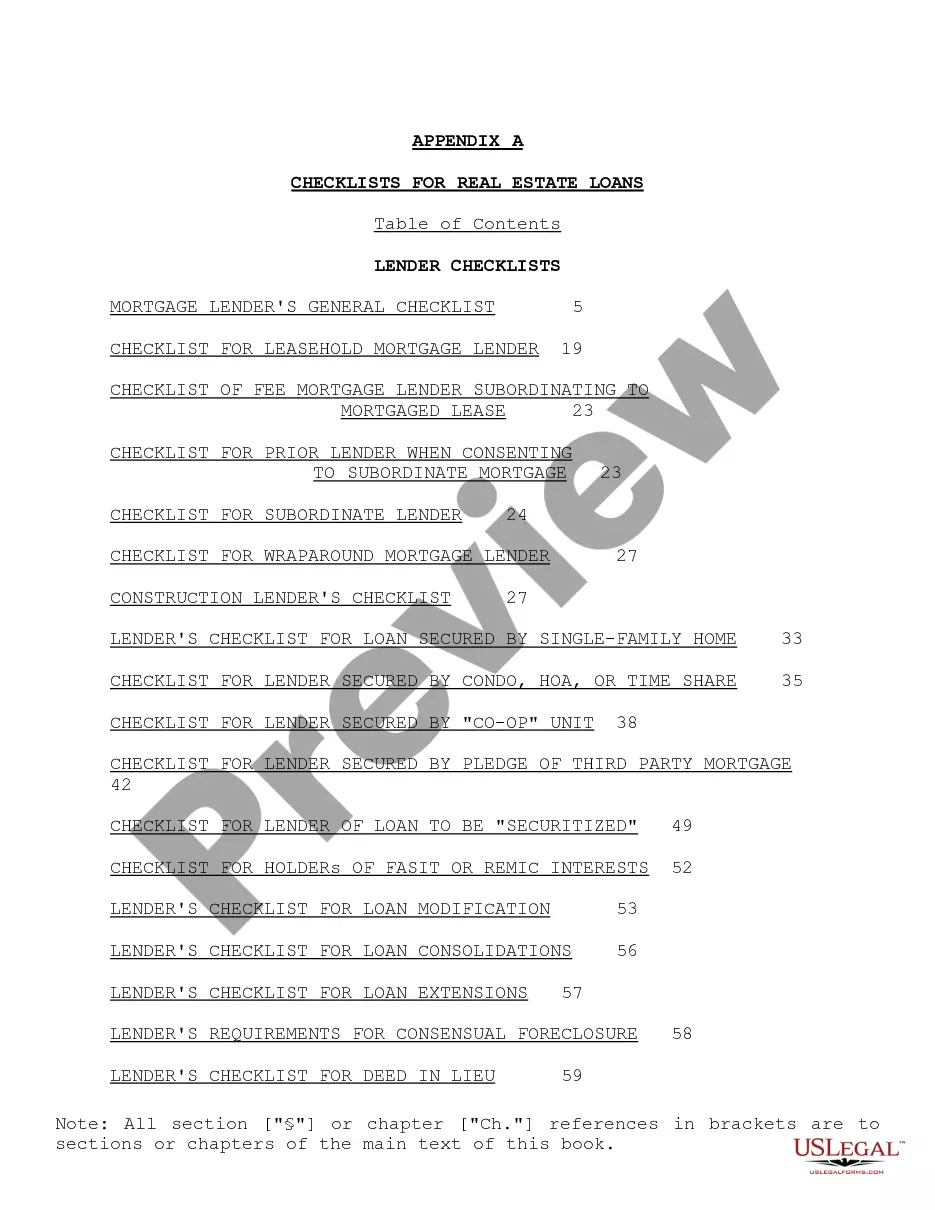

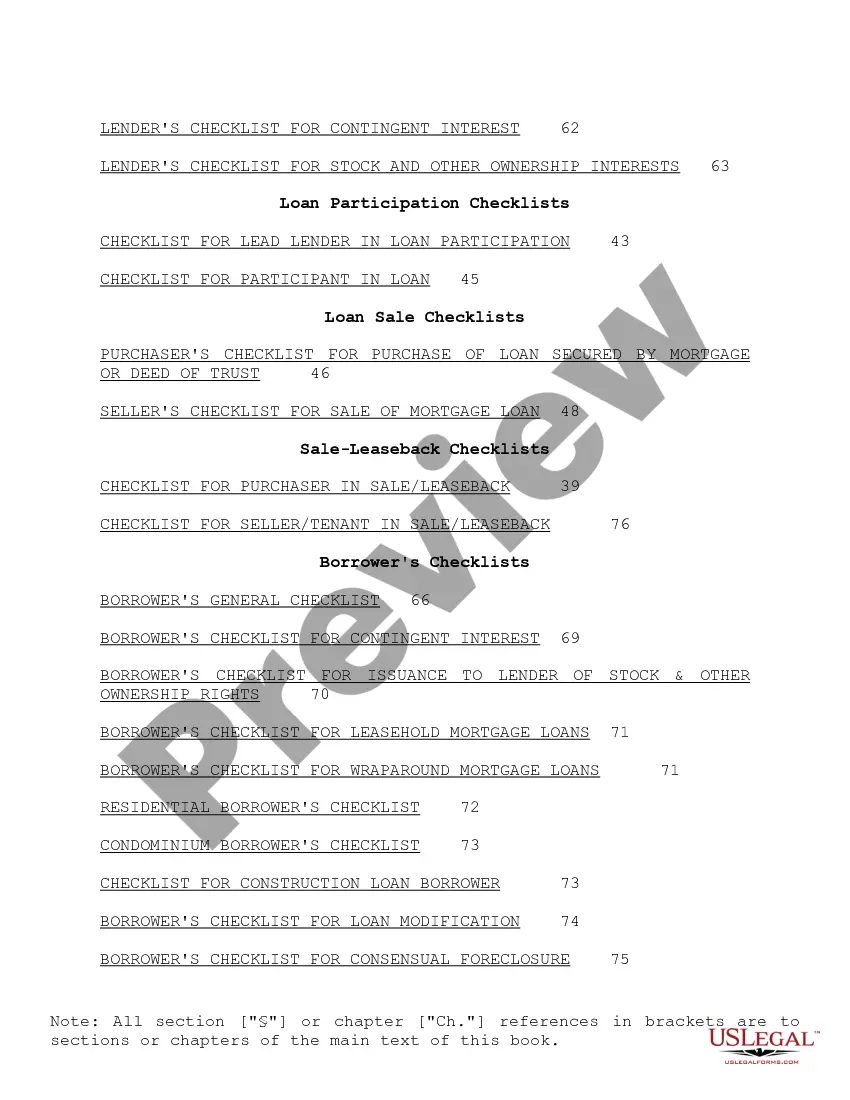

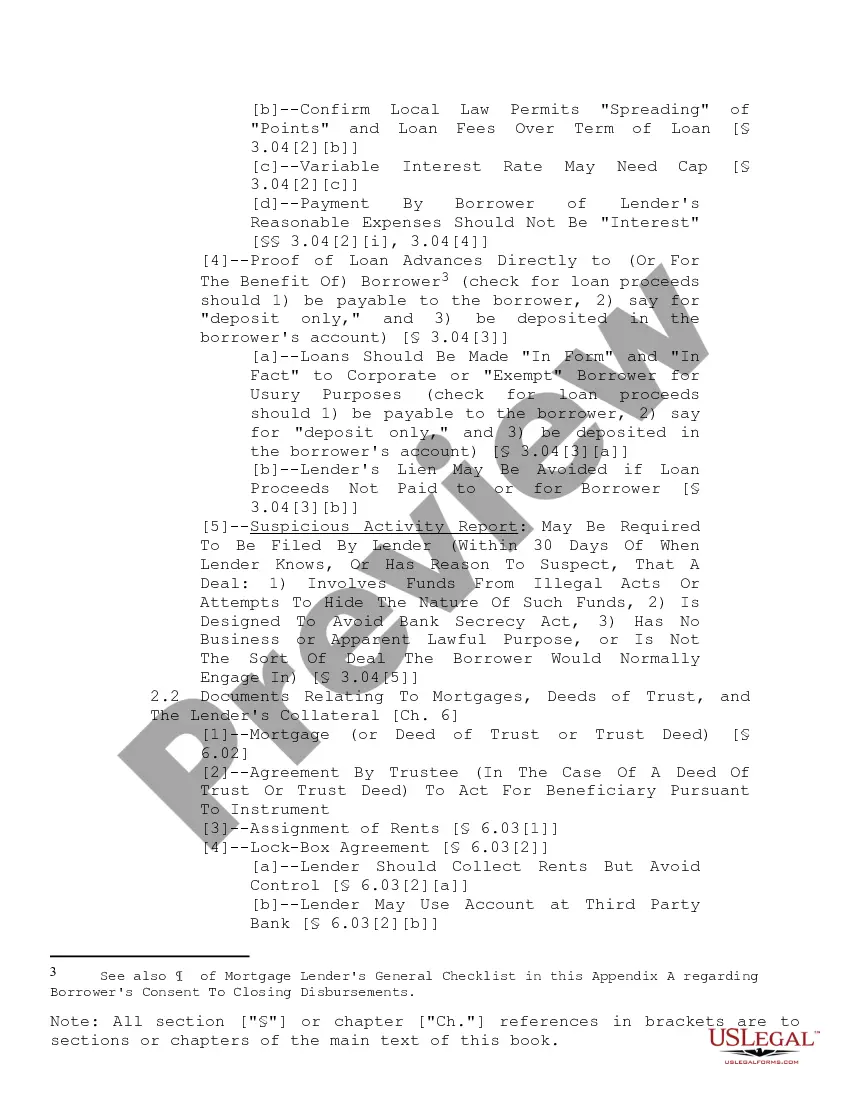

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

Phoenix Arizona Checklist for Real Estate Loans: A Comprehensive Guide If you're considering real estate investment in Phoenix, Arizona, it is crucial to be well-informed about the various aspects and requirements of obtaining a loan. A Phoenix Arizona Checklist for Real Estate Loans can assist you in navigating this process smoothly. Below, we'll discuss the essential criteria and factors to consider when applying for real estate loans in Phoenix, Arizona. 1. Credit Score: Lenders in Phoenix consider credit scores a vital metric in determining your loan eligibility. It's imperative to review your credit report and ensure that your score meets the lender's requirements. 2. Income Documentation: Lenders will require thorough documentation of your income, including tax returns, pay stubs, and bank statements. Prepare these documents well in advance to expedite the loan application process. 3. Down Payment: Ensure you have a sufficient down payment ready. Different loan programs may have varying down payment requirements. Research lenders offering programs suitable for your financial capabilities and consider options such as FHA loans, conventional loans, or VA loans. 4. Property Appraisal: Phoenix lenders will typically require a professional appraisal to ascertain the property's fair market value. Engage a qualified appraiser to evaluate the property accurately. 5. Title Search: To facilitate a smooth loan process, secure a title search to identify any liens or encumbrances on the property. This search ensures clear ownership, reducing the potential for complications. 6. Debt-to-Income Ratio (DTI): Lenders evaluate your DTI to assess your ability to handle additional debt. Seek professional financial advice to determine your ideal DTI ratio and plan your loan acquisition accordingly. 7. Mortgage Pre-Approval: Consider getting pre-approved for a mortgage. With a pre-approval letter in hand, you'll gain a competitive advantage during property negotiations and demonstrate your seriousness as a buyer. 8. Loan Programs: Familiarize yourself with the different loan programs available in Phoenix, Arizona. This includes conventional loans, FHA loans for first-time buyers, VA loans for veterans, and USDA loans for rural property purchases. Educate yourself on the criteria, benefits, and limitations of each program to make an informed decision. 9. Closing Costs: Budget for closing costs, including appraisal fees, title insurance, origination fees, and more. Review the estimated closing costs provided by the lender to adequately prepare for this expense. 10. Loan Repayment Terms: Understand the repayment terms associated with the loan programs you are interested in. Evaluate factors such as interest rates, fixed or adjustable rates, and loan duration to choose an option that aligns with your long-term financial goals. Different Types of Phoenix Arizona Checklist for Real Estate Loans: 1. First-Time Homebuyer Loan Checklist: This checklist focuses on the specific requirements and programs available for individuals purchasing their first property in Phoenix, Arizona. 2. Investment Property Loan Checklist: For those looking to invest in rental properties, this checklist highlights the key considerations unique to purchasing investment properties in Phoenix. 3. Refinancing Loan Checklist: When refinancing your existing mortgage, ensure you have a checklist that covers essential points such as obtaining the current property value and comparing interest rates. By utilizing a Phoenix Arizona Checklist for Real Estate Loans, you can streamline your loan application process, improve your chances of approval, and make an informed decision when investing in the Phoenix real estate market.Phoenix Arizona Checklist for Real Estate Loans: A Comprehensive Guide If you're considering real estate investment in Phoenix, Arizona, it is crucial to be well-informed about the various aspects and requirements of obtaining a loan. A Phoenix Arizona Checklist for Real Estate Loans can assist you in navigating this process smoothly. Below, we'll discuss the essential criteria and factors to consider when applying for real estate loans in Phoenix, Arizona. 1. Credit Score: Lenders in Phoenix consider credit scores a vital metric in determining your loan eligibility. It's imperative to review your credit report and ensure that your score meets the lender's requirements. 2. Income Documentation: Lenders will require thorough documentation of your income, including tax returns, pay stubs, and bank statements. Prepare these documents well in advance to expedite the loan application process. 3. Down Payment: Ensure you have a sufficient down payment ready. Different loan programs may have varying down payment requirements. Research lenders offering programs suitable for your financial capabilities and consider options such as FHA loans, conventional loans, or VA loans. 4. Property Appraisal: Phoenix lenders will typically require a professional appraisal to ascertain the property's fair market value. Engage a qualified appraiser to evaluate the property accurately. 5. Title Search: To facilitate a smooth loan process, secure a title search to identify any liens or encumbrances on the property. This search ensures clear ownership, reducing the potential for complications. 6. Debt-to-Income Ratio (DTI): Lenders evaluate your DTI to assess your ability to handle additional debt. Seek professional financial advice to determine your ideal DTI ratio and plan your loan acquisition accordingly. 7. Mortgage Pre-Approval: Consider getting pre-approved for a mortgage. With a pre-approval letter in hand, you'll gain a competitive advantage during property negotiations and demonstrate your seriousness as a buyer. 8. Loan Programs: Familiarize yourself with the different loan programs available in Phoenix, Arizona. This includes conventional loans, FHA loans for first-time buyers, VA loans for veterans, and USDA loans for rural property purchases. Educate yourself on the criteria, benefits, and limitations of each program to make an informed decision. 9. Closing Costs: Budget for closing costs, including appraisal fees, title insurance, origination fees, and more. Review the estimated closing costs provided by the lender to adequately prepare for this expense. 10. Loan Repayment Terms: Understand the repayment terms associated with the loan programs you are interested in. Evaluate factors such as interest rates, fixed or adjustable rates, and loan duration to choose an option that aligns with your long-term financial goals. Different Types of Phoenix Arizona Checklist for Real Estate Loans: 1. First-Time Homebuyer Loan Checklist: This checklist focuses on the specific requirements and programs available for individuals purchasing their first property in Phoenix, Arizona. 2. Investment Property Loan Checklist: For those looking to invest in rental properties, this checklist highlights the key considerations unique to purchasing investment properties in Phoenix. 3. Refinancing Loan Checklist: When refinancing your existing mortgage, ensure you have a checklist that covers essential points such as obtaining the current property value and comparing interest rates. By utilizing a Phoenix Arizona Checklist for Real Estate Loans, you can streamline your loan application process, improve your chances of approval, and make an informed decision when investing in the Phoenix real estate market.