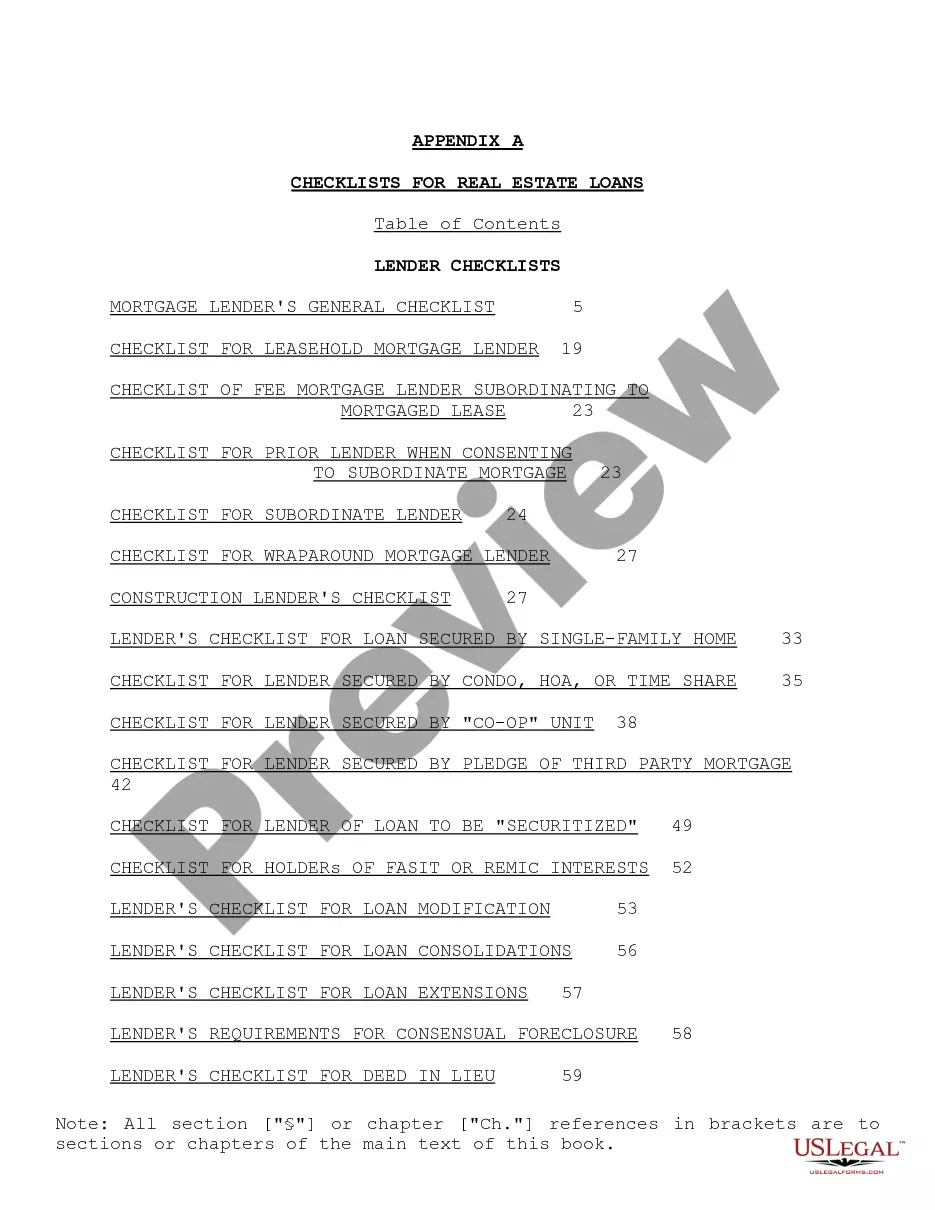

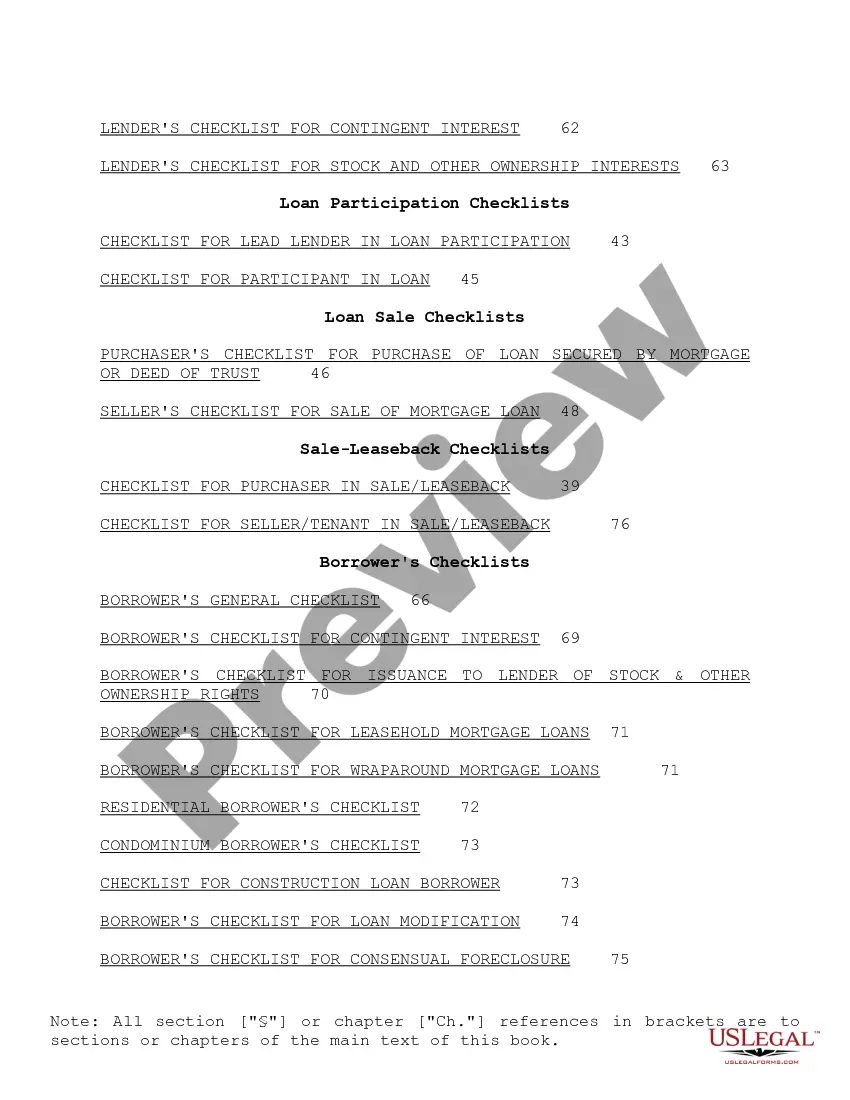

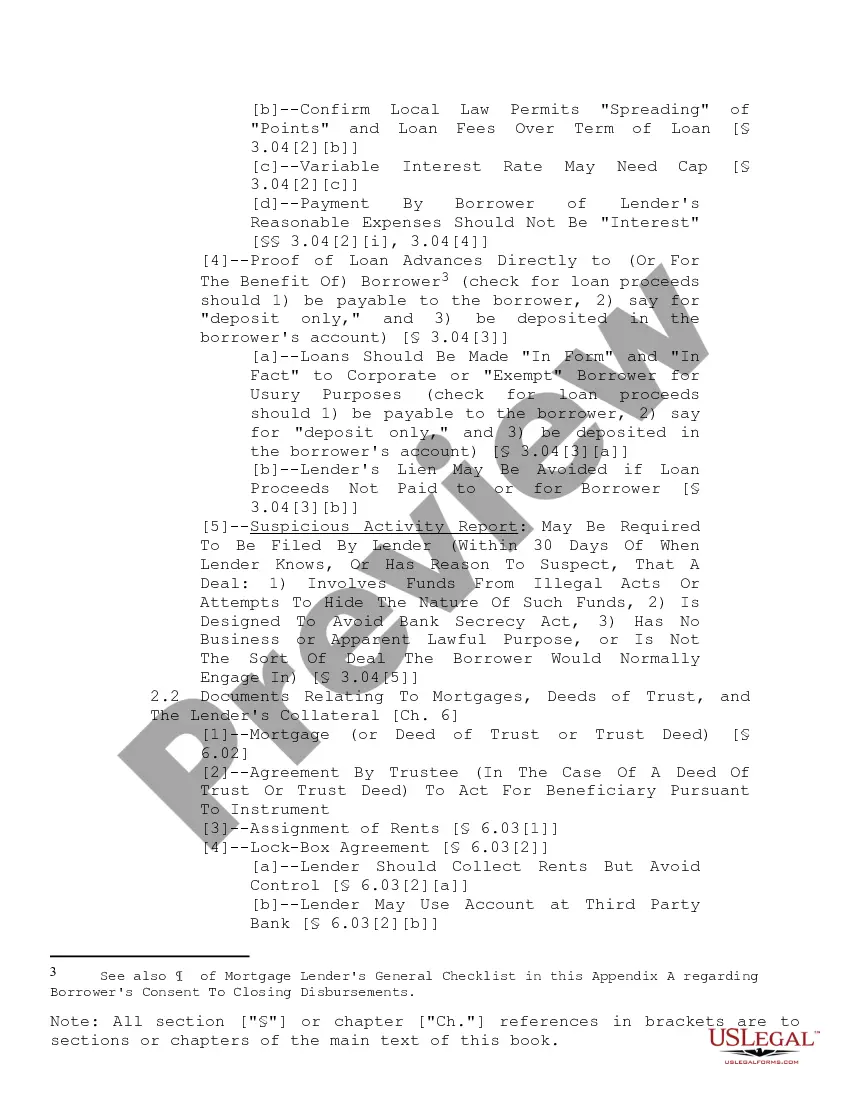

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

Suffolk New York Checklist for Real Estate Loans: A Comprehensive Guide to Streamlining the Borrowing Process When embarking on the journey of obtaining a real estate loan in Suffolk, New York, it is crucial to be well-prepared to ensure a smooth and successful transaction. This detailed checklist guides prospective borrowers through the necessary steps, documentation, and considerations involved in securing a real estate loan in Suffolk County. By following this checklist, borrowers can streamline the loan application process and increase their chances of loan approval. Below is an outline of the key aspects covered in the Suffolk New York Checklist for Real Estate Loans: 1. Financial Readiness Assessment: — Evaluate personal financial standing, credit score, and debt-to-income ratio to determine affordability and eligibility. — Consider obtaining a pre-approval letter from a lending institution to enhance credibility and negotiate better loan terms. 2. Loan Type Research: — Familiarize yourself with different loan types available in Suffolk, New York, such as fixed-rate mortgages, adjustable-rate mortgages, government-insured loans (e.g., FHA or VA loans), and jumbo loans. — Conduct research to identify the loan type best suited to your specific needs and financial situation. 3. Loan Requirements: — Gather essential documents required for the loan application process, including tax returns, pay stubs, bank statements, employment verification, and identification documents. — Prepare a comprehensive package of these documents to present to potential lenders. 4. Down Payment Considerations: — Determine the appropriate down payment amount based on loan type and lenders' requirements. — Explore down payment assistance programs available in Suffolk, New York, like grants or forgivable loans for first-time homebuyers. 5. Comparison Shopping: — Research local lenders and financial institutions to compare interest rates, loan terms, lender fees, and closing costs. — Request loan estimates from multiple lenders to secure the most favorable loan terms. 6. Professional Assistance: — Seek advice from a reputable real estate agent and mortgage broker who are familiar with the Suffolk, New York, market and have extensive experience in facilitating real estate loans. — These professionals can guide borrowers through the complexities of the loan process, negotiate on their behalf, and provide valuable insights. Types of Suffolk New York Checklist for Real Estate Loans: 1. Suffolk New York Checklist for Residential Real Estate Loans: — This checklist specifically caters to borrowers seeking loans for residential properties in Suffolk County. 2. Suffolk New York Checklist for Commercial Real Estate Loans: — Geared towards borrowers who intend to finance commercial properties, such as office spaces, retail outlets, or warehouses, in Suffolk County. By utilizing the Suffolk New York Checklist for Real Estate Loans, borrowers can navigate the loan application process with confidence and efficiency. Following this checklist not only ensures compliance with necessary documentation but also maximizes the likelihood of securing the most favorable loan terms and successfully financing a property in Suffolk, New York.Suffolk New York Checklist for Real Estate Loans: A Comprehensive Guide to Streamlining the Borrowing Process When embarking on the journey of obtaining a real estate loan in Suffolk, New York, it is crucial to be well-prepared to ensure a smooth and successful transaction. This detailed checklist guides prospective borrowers through the necessary steps, documentation, and considerations involved in securing a real estate loan in Suffolk County. By following this checklist, borrowers can streamline the loan application process and increase their chances of loan approval. Below is an outline of the key aspects covered in the Suffolk New York Checklist for Real Estate Loans: 1. Financial Readiness Assessment: — Evaluate personal financial standing, credit score, and debt-to-income ratio to determine affordability and eligibility. — Consider obtaining a pre-approval letter from a lending institution to enhance credibility and negotiate better loan terms. 2. Loan Type Research: — Familiarize yourself with different loan types available in Suffolk, New York, such as fixed-rate mortgages, adjustable-rate mortgages, government-insured loans (e.g., FHA or VA loans), and jumbo loans. — Conduct research to identify the loan type best suited to your specific needs and financial situation. 3. Loan Requirements: — Gather essential documents required for the loan application process, including tax returns, pay stubs, bank statements, employment verification, and identification documents. — Prepare a comprehensive package of these documents to present to potential lenders. 4. Down Payment Considerations: — Determine the appropriate down payment amount based on loan type and lenders' requirements. — Explore down payment assistance programs available in Suffolk, New York, like grants or forgivable loans for first-time homebuyers. 5. Comparison Shopping: — Research local lenders and financial institutions to compare interest rates, loan terms, lender fees, and closing costs. — Request loan estimates from multiple lenders to secure the most favorable loan terms. 6. Professional Assistance: — Seek advice from a reputable real estate agent and mortgage broker who are familiar with the Suffolk, New York, market and have extensive experience in facilitating real estate loans. — These professionals can guide borrowers through the complexities of the loan process, negotiate on their behalf, and provide valuable insights. Types of Suffolk New York Checklist for Real Estate Loans: 1. Suffolk New York Checklist for Residential Real Estate Loans: — This checklist specifically caters to borrowers seeking loans for residential properties in Suffolk County. 2. Suffolk New York Checklist for Commercial Real Estate Loans: — Geared towards borrowers who intend to finance commercial properties, such as office spaces, retail outlets, or warehouses, in Suffolk County. By utilizing the Suffolk New York Checklist for Real Estate Loans, borrowers can navigate the loan application process with confidence and efficiency. Following this checklist not only ensures compliance with necessary documentation but also maximizes the likelihood of securing the most favorable loan terms and successfully financing a property in Suffolk, New York.