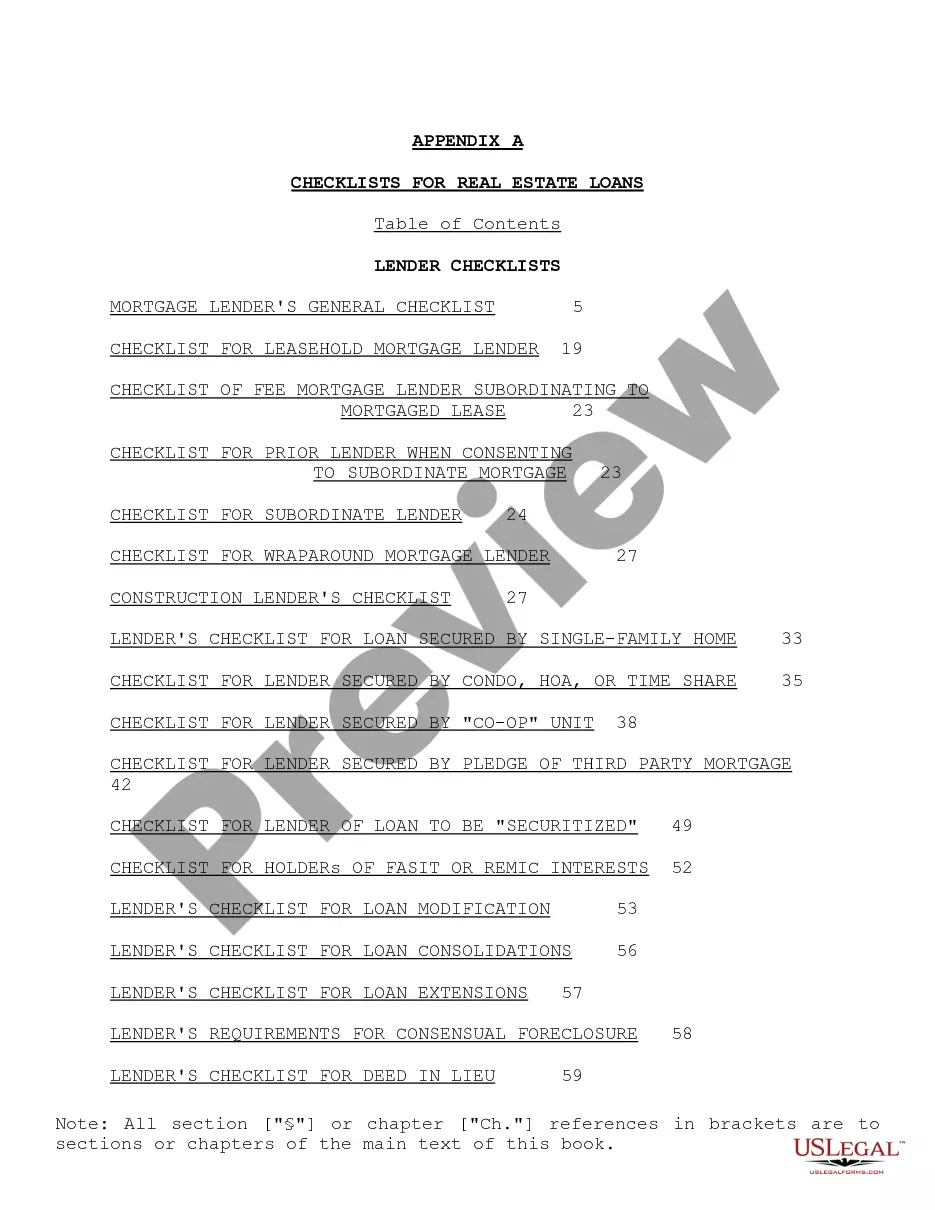

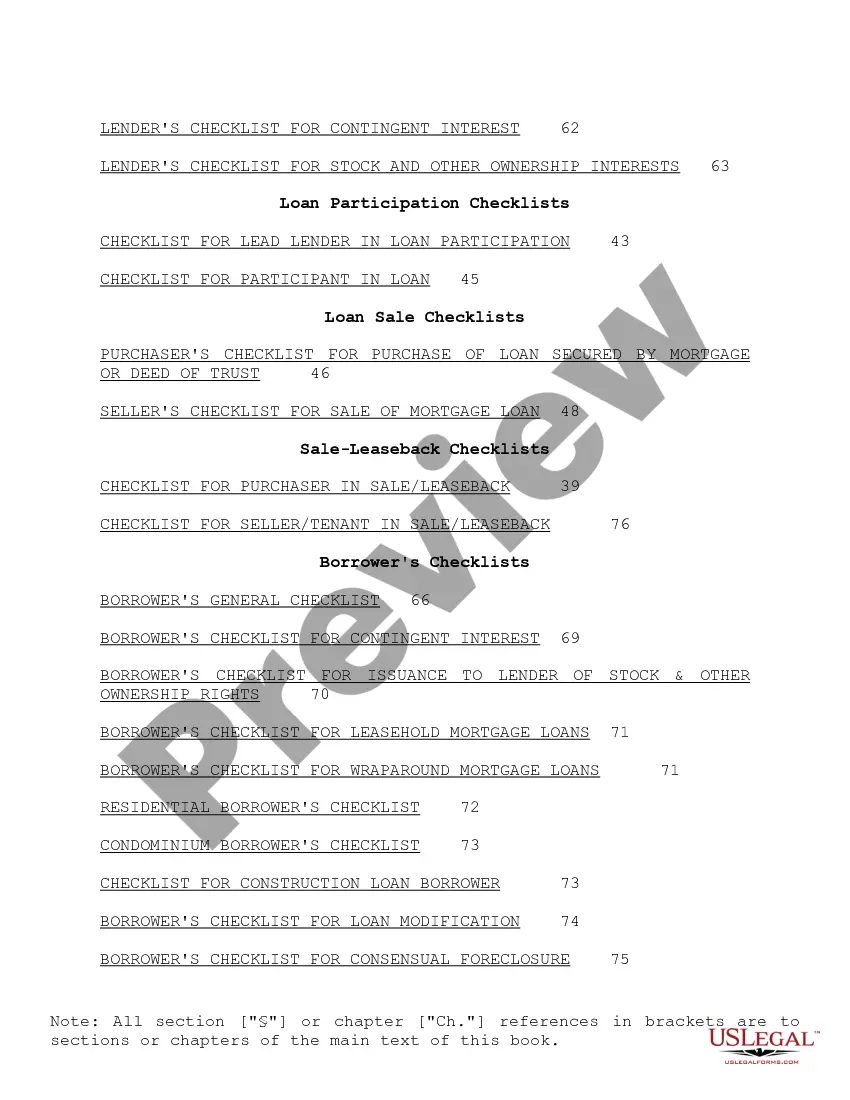

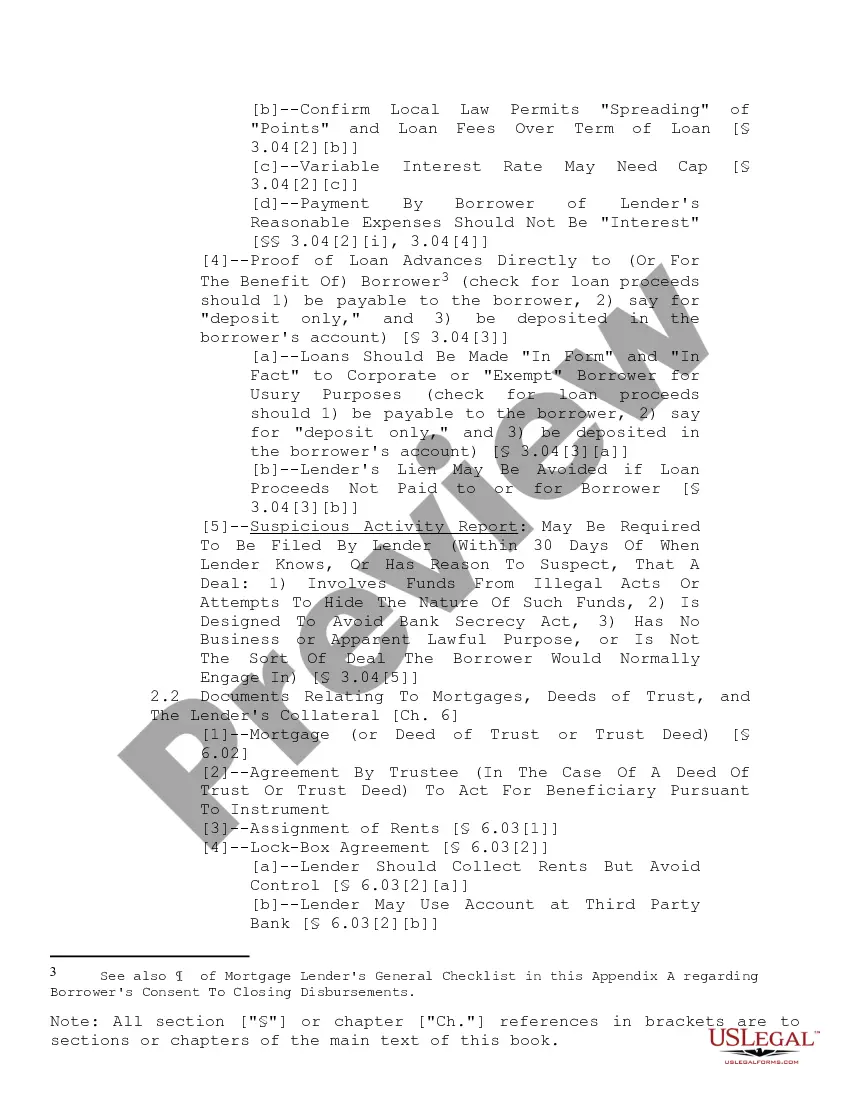

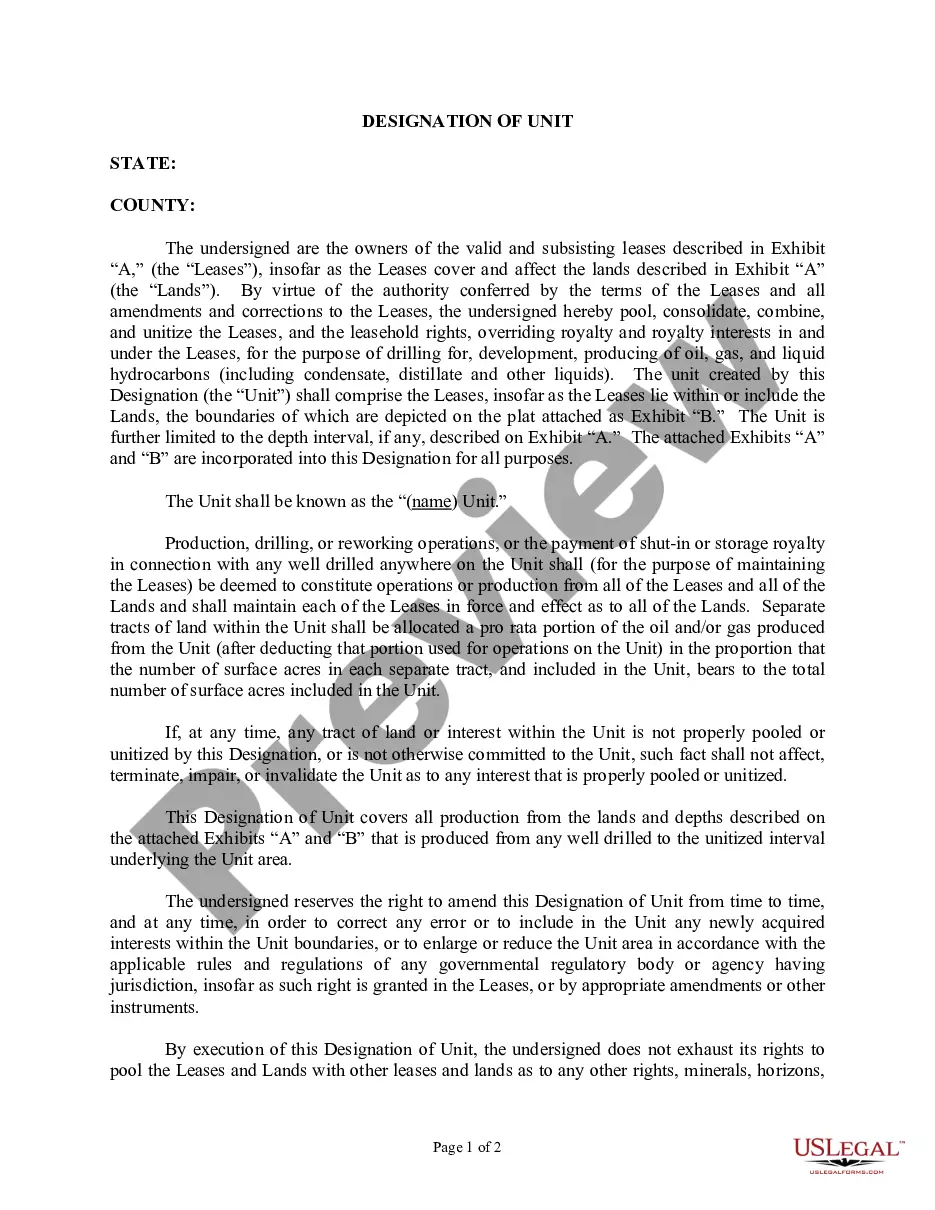

"Checklist for Real Estate Loans" is a American Lawyer Media form. This consist of many checklist that can be used for real estate loans.

Wake North Carolina Checklist for Real Estate Loans is a comprehensive document that outlines the essential requirements and steps involved in obtaining real estate loans in Wake County, North Carolina. This checklist acts as a convenient reference guide for homebuyers, real estate investors, and individuals seeking financing options for property acquisitions or refinancing existing loans. Here are some relevant keywords to incorporate into the content: 1. Wake County, North Carolina: This checklist specifically caters to the real estate loan procedures in Wake County, North Carolina, ensuring its relevance to the area. 2. Real Estate Loans: The checklist primarily focuses on real estate loans, encompassing various types such as mortgages, construction loans, bridge loans, and refinancing. 3. Documentation: The checklist emphasizes the importance of gathering and organizing the necessary documentation for loan applications. This may include proof of income, tax returns, bank statements, credit reports, and employment history. 4. Credit Score: Explaining the significance of a good credit score is vital in qualifying for a real estate loan. The checklist may highlight the minimum credit score requirements set by lenders and the impact of credit history on loan approval. 5. Loan Pre-approval: Describing the benefits of obtaining pre-approval for a loan before searching for properties can be pivotal. The checklist may mention that pre-approval strengthens purchase offers and provides a clear understanding of the loan amount one can afford. 6. Property Appraisal: The checklist may emphasize the importance of property appraisal, as lenders require an accurate valuation to determine loan eligibility and terms. It can explain the process and encourage borrowers to hire a qualified appraiser. 7. Down Payment: Describing the typical down payment requirements is essential. The checklist should outline the percentage expected by lenders and any available programs assisting first-time buyers or those with limited funds. 8. Types of Loans: The checklist can briefly introduce different types of real estate loans available in Wake County. These may include conventional loans, FHA loans, VA loans, USDA loans, and jumbo loans, with a brief explanation of each. 9. Loan Term and Interest Rates: The checklist may explain various loan term options (e.g., 15, 20, or 30 years) and how they affect monthly payments. Additionally, it can highlight the significance of comparing interest rates from multiple lenders to secure the best terms. 10. Closing Costs: Outlining the potential closing costs involved in obtaining a real estate loan is crucial. This may include lender fees, appraisal fees, title insurance, attorney fees, and recording fees. By providing a detailed checklist that covers these key aspects, potential borrowers in Wake County, North Carolina, can navigate the real estate loan process more efficiently.Wake North Carolina Checklist for Real Estate Loans is a comprehensive document that outlines the essential requirements and steps involved in obtaining real estate loans in Wake County, North Carolina. This checklist acts as a convenient reference guide for homebuyers, real estate investors, and individuals seeking financing options for property acquisitions or refinancing existing loans. Here are some relevant keywords to incorporate into the content: 1. Wake County, North Carolina: This checklist specifically caters to the real estate loan procedures in Wake County, North Carolina, ensuring its relevance to the area. 2. Real Estate Loans: The checklist primarily focuses on real estate loans, encompassing various types such as mortgages, construction loans, bridge loans, and refinancing. 3. Documentation: The checklist emphasizes the importance of gathering and organizing the necessary documentation for loan applications. This may include proof of income, tax returns, bank statements, credit reports, and employment history. 4. Credit Score: Explaining the significance of a good credit score is vital in qualifying for a real estate loan. The checklist may highlight the minimum credit score requirements set by lenders and the impact of credit history on loan approval. 5. Loan Pre-approval: Describing the benefits of obtaining pre-approval for a loan before searching for properties can be pivotal. The checklist may mention that pre-approval strengthens purchase offers and provides a clear understanding of the loan amount one can afford. 6. Property Appraisal: The checklist may emphasize the importance of property appraisal, as lenders require an accurate valuation to determine loan eligibility and terms. It can explain the process and encourage borrowers to hire a qualified appraiser. 7. Down Payment: Describing the typical down payment requirements is essential. The checklist should outline the percentage expected by lenders and any available programs assisting first-time buyers or those with limited funds. 8. Types of Loans: The checklist can briefly introduce different types of real estate loans available in Wake County. These may include conventional loans, FHA loans, VA loans, USDA loans, and jumbo loans, with a brief explanation of each. 9. Loan Term and Interest Rates: The checklist may explain various loan term options (e.g., 15, 20, or 30 years) and how they affect monthly payments. Additionally, it can highlight the significance of comparing interest rates from multiple lenders to secure the best terms. 10. Closing Costs: Outlining the potential closing costs involved in obtaining a real estate loan is crucial. This may include lender fees, appraisal fees, title insurance, attorney fees, and recording fees. By providing a detailed checklist that covers these key aspects, potential borrowers in Wake County, North Carolina, can navigate the real estate loan process more efficiently.