Los Angeles, California is a vibrant city known for its diverse culture, entertainment industry, and beautiful coastline. As the second-most populous city in the United States, Los Angeles has a rich history and is a hub for entertainment, business, and tourism. From the world-famous Hollywood Walk of Fame to iconic landmarks like the Griffith Observatory and the Santa Monica Pier, there is always something to explore and enjoy in Los Angeles. Now, turning our attention to Equifax, one of the three major credit reporting agencies in the US, it is essential to understand the process of obtaining a free copy of your credit report if you have faced a denial of credit. When a lender denies your credit application, they are required by law to inform you of the reason and provide information on how to request your credit report. Equifax, being a major credit agency, plays a crucial role in this process. Writing a letter to Equifax requesting a free copy of your credit report after being denied credit is a proactive step towards understanding the factors that led to the decision. It allows you to gain insights into your credit history and identify any potential errors or areas for improvement. Here are some essential elements to include in your letter: 1. Your Contact Information: Begin by providing your full name, current address, telephone number, and email address. This information ensures that Equifax can properly identify and communicate with you. 2. Date of Denial: Clearly state the date you were denied credit and include any reference number of details related to the application. 3. Reason for Denial: Mention the reason provided by the lender for the credit denial. This information helps Equifax in investigating the specific factors that led to the unfavorable decision. 4. Request for Free Credit Report: Politely request a free copy of your Equifax credit report, emphasizing that it is based on the denial of credit. Be sure to explicitly mention that you are requesting a free report as per your rights under the Fair Credit Reporting Act (FCRA). 5. Supporting Documentation: Attach copies of relevant documents, such as the denial letter received from the lender, any supporting documents you may have submitted during the application process, and proof of identity (e.g., a copy of your driver's license or passport). 6. Contact Information for Further Assistance: Provide your preferred contact method (phone, email, or both) and request that Equifax contacts you in case they require any additional information or have updates regarding your request. It is important to remember that the content of the letter should be concise, polite, and clear. Make sure to proofread it before sending to avoid any errors or misunderstandings. Different types of Los Angeles, California letters to Equifax requesting a free copy of your credit report based on denial of credit may include variations in the denial reason, supporting documentation, or any specific circumstances relevant to the individual's situation. However, the core elements mentioned above should be present in each letter. By submitting this letter, you are taking a proactive step towards understanding your creditworthiness and ensuring the accuracy of your credit report. It empowers you to make informed financial decisions and strive towards improving your credit standing.

Los Angeles California Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

How to fill out Los Angeles California Letter To Equifax Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

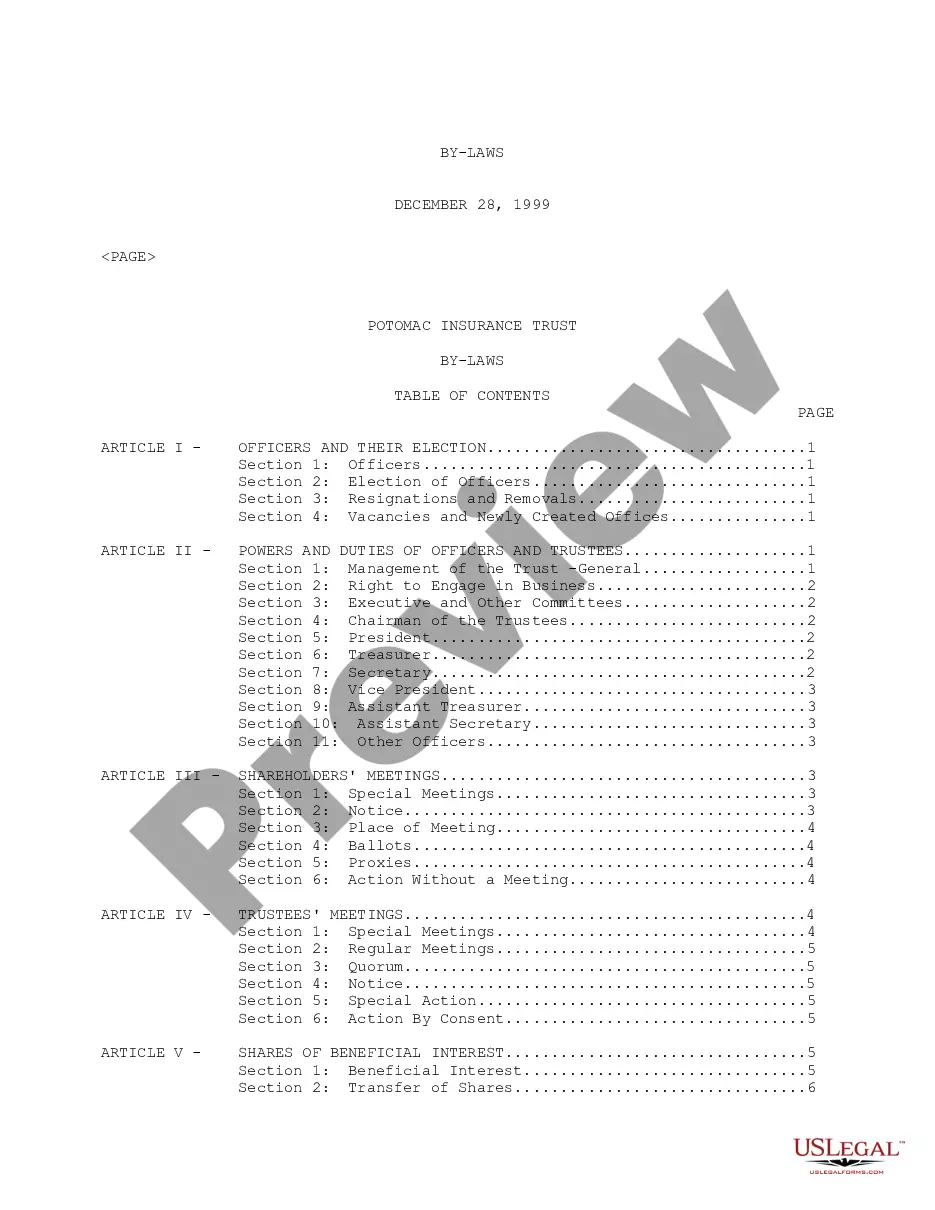

If you need to get a reliable legal paperwork supplier to obtain the Los Angeles Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of supporting resources, and dedicated support team make it simple to locate and complete different documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Los Angeles Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Los Angeles Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less expensive and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Los Angeles Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit - all from the comfort of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

You will need to contact each credit bureau individually by mail: Equifax Complaint Department, P.O. Box 740241, Atlanta, GA 30374-0241. Experian National Consumer Assistance Center, P.O. Box 9532, Allen, TX 75013.

The lender must give you instructions for requesting your credit report from that particular credit reporting company. Those instructions are usually included with the declination notice. If an Experian credit report was used, you can request your free report at .

Here are six actions you can take to improve your chances for success the next time around. Review the Reason for the Denial.Plead Your Case.Check Your Credit Report and Credit Score.Address Credit Concerns.Apply With a Different Lender.Continue to Monitor Your Credit.Maintain a Long-Term Mindset.

Both hard and soft inquiries are automatically removed from credit reports after two years. Credit reporting agencies such as Experian are not notified about whether your application for credit is approved or denied, so credit reports do not maintain a record of credit denials.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies - Experian, Equifax® and TransUnion® - once every 12 months. To get your Experian annual credit report online, and by phone or mail, visit .

You may already know that you're entitled to a free credit report from each of the three credit bureaus every 12 months. In addition, you can sign up to receive six free credit reports from Equifax with a myEquifax2122 account.

Annual Credit Report Access The credit report you get when you're denied credit is in addition to the annual credit report that you can order once a year from the three credit bureaus through AnnualCreditReport.com.

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can request a copy from AnnualCreditReport.com.

To get the free credit report authorized by law, go to AnnualCreditReport.com or call (877) 322-8228.