San Diego, California, is a vibrant city located in the southern part of the state. Known for its stunning coastline, pleasant weather, and diverse cultural scene, it offers a plethora of attractions and opportunities for both residents and visitors. Home to numerous world-class museums, such as the San Diego Museum of Art and the USS Midway Museum, history and art enthusiasts will find plenty to explore here. Nature lovers can revel in the stunning landscapes of Balboa Park or enjoy a day at the renowned San Diego Zoo, one of the largest and most famous zoos in the world. The city's beautiful beaches, including the iconic Pacific Beach and La Jolla Cove, provide a haven for surfers, sunbathers, and beach goers. Water activities like kayaking, paddleboarding, and whale-watching tours are also popular among locals and tourists alike. San Diego is a hub for various industries, including biotechnology, telecommunications, and tourism. The presence of renowned universities like the University of California, San Diego, and research institutions like Scripts Institution of Oceanography contribute to its status as a center for innovation and academic excellence. Now, let's delve into the different types of San Diego, California, letters to Equifax that can be written when requesting a free copy of your credit report based on denial of credit: 1. Standard San Diego, California, Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit: This type of letter should include personal and contact information, such as full name, address, phone number, and your Social Security number. Clearly state that you are writing to obtain a free copy of your credit report as you were recently denied credit. 2. Formal San Diego, California, Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit: This letter should follow formal letter-writing conventions. Include a concise introduction, the denial of credit situation, a request for a free copy of your credit report, and a polite conclusion expressing gratitude for their assistance. 3. Urgent San Diego, California, Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit: If you require expedited assistance, highlight the urgent nature of your request in this letter. Emphasize the time sensitivity and the need for a prompt response. 4. Detailed San Diego, California, Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit: This type of letter should include a comprehensive explanation of the denial of credit incident, providing supporting details and any relevant documentation. It should articulate the reasons for requesting a copy of your credit report and stress the importance of obtaining it promptly. Remember, when writing any of these letters, it is essential to maintain a professional and respectful tone throughout. Clearly communicate your situation and the purpose of your letter, and be sure to include any necessary identification information required by Equifax.

San Diego California Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

How to fill out San Diego California Letter To Equifax Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including San Diego Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information resources and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how you can locate and download San Diego Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit.

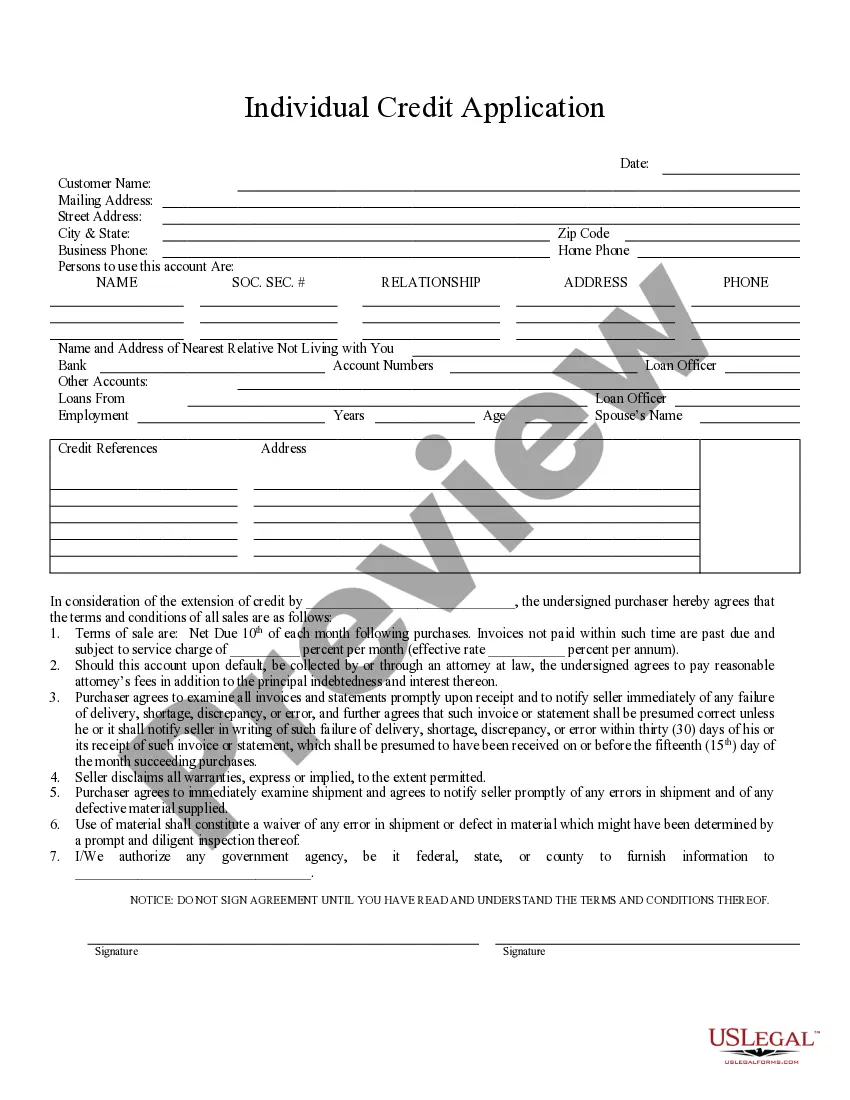

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the similar forms or start the search over to find the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment gateway, and purchase San Diego Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed San Diego Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you have to deal with an exceptionally difficult situation, we advise getting a lawyer to review your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

You may already know that you're entitled to a free credit report from each of the three credit bureaus every 12 months. In addition, you can sign up to receive six free credit reports from Equifax with a myEquifax2122 account.

The lender must give you instructions for requesting your credit report from that particular credit reporting company. Those instructions are usually included with the declination notice. If an Experian credit report was used, you can request your free report at .

Experian, Equifax and TransUnion are now offering free credit reports to all Americans on a weekly basis for the next year so you can protect your financial health during hardships from the coronavirus.

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can request a copy from AnnualCreditReport.com.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

You can send a credit report dispute letter to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

Getting your credit reports You're entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus by visiting . You can also create a myEquifax account to get six free Equifax credit reports each year.

You will need to contact each credit bureau individually by mail: Equifax Complaint Department, P.O. Box 740241, Atlanta, GA 30374-0241. Experian National Consumer Assistance Center, P.O. Box 9532, Allen, TX 75013.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies - Experian, Equifax® and TransUnion® - once every 12 months. To get your Experian annual credit report online, and by phone or mail, visit .