A Cook Illinois letter to Experian, formerly known as TRY, requesting a free copy of your credit report is a written document used to obtain a credit report after facing denial of credit. This letter is essential for individuals who have been denied credit and want to understand the reasons behind the denial by reviewing their credit report. Using relevant keywords, the content can highlight the purpose of the letter, the process to request the credit report, and potential variations of the letter based on specific situations. Here's an example: Title: Cook Illinois Letter to Experian formerlyYR— - Requesting Free Copy of Your Credit Report based on Denial of Credit Introduction: — Understand your credit status: A detailed guide on requesting a free credit report from Experian (formerly TRY) with a Cook Illinois letter, in case of credit denial. — Seeking clarity after facing credit denial: Take control of your financial reputation by utilizing the Cook Illinois letter to request a free copy of your credit report from Experian. — Access crucial financial information: Learn how to request a credit report from Experian (formerly TRY) through a Cook Illinois letter to understand the reasons for credit denial and take steps towards credit improvement. Section 1: Importance of the Cook Illinois Letter — The significance of credit reports: Explore the role of credit reports in the lending and credit approval process while understanding how it impacts your financial future. — Unveiling the reasons behind credit denial: Discover how a Cook Illinois letter can assist in uncovering the factors that led to the denial of credit applications, providing insights into areas requiring improvement. — Empower yourself with accurate information: By requesting a credit report using the Cook Illinois letter, individuals can identify potential errors, ensure data accuracy, and rectify any discrepancies. Section 2: How to Write a Cook Illinois Letter — Format and structure: Understand the essential components of the Cook Illinois letter, including heading, salutation, body, and closing. — Required information: Highlight key details that must be included in the letter, such as personal identifying information, denial of credit notification, and other relevant details. — Professional tone and clarity: Emphasize the importance of using a clear and concise language to convey the request effectively, promoting a professional approach throughout the letter. Section 3: Variations of the Cook Illinois Letter — Recent credit denial: Customize the letter format for individuals who have recently experienced credit denial and wish to request a credit report from Experian (formerly TRY) to understand the specific reasons. — Annual credit report renewal: Discuss a variation of the Cook Illinois letter to obtain the free annual credit report provided by Experian (formerly TRY) strictly for monitoring and credit management purposes. — Dispute resolution process: Explore how individuals can modify the letter in the case of credit report errors, initiating a dispute resolution process with Experian (formerly TRY) to rectify inaccuracies and enhance creditworthiness. Conclusion: — Taking control of your financial health: Seamlessly request your credit report with a Cook Illinois letter, gain insights into credit decisions, and lay the foundation for better financial management. — Empowerment through knowledge: Acquire a comprehensive understanding of your credit status by utilizing the Cook Illinois letter to access your credit report from Experian (formerly TRY) based on denial of credit. Note: The Cook Illinois letter here refers to a hypothetical letter template customized as per the location and requirements of Cook County, Illinois.

Cook Illinois Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

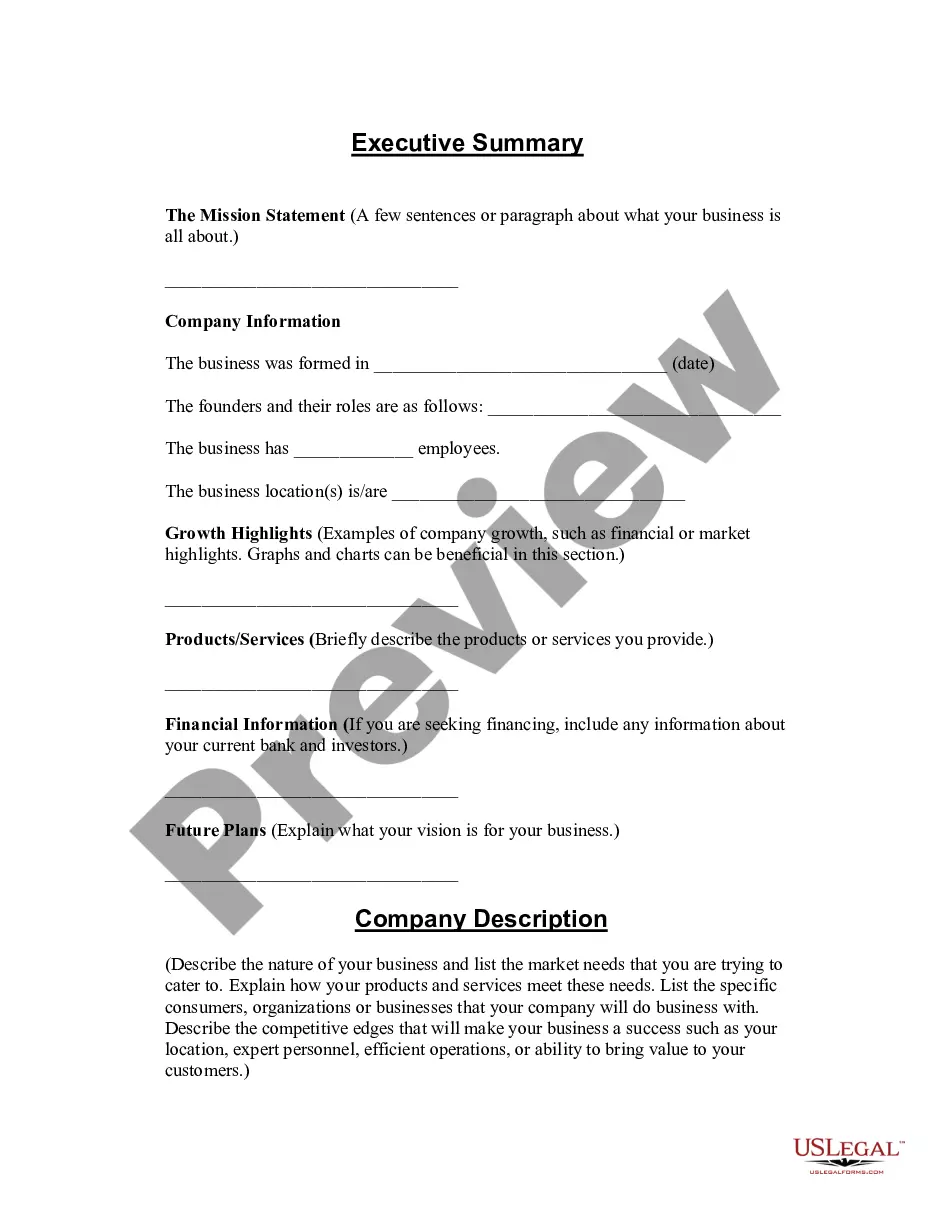

How to fill out Cook Illinois Letter To Experian - Formerly TRW - Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cook Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the latest version of the Cook Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Cook Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit and save it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!