Title: Harris Texas Letter to Experian — Requesting Free Copy of Your Credit Report based on Denial of Credit Introduction: In this article, we will provide a detailed description of what a Harris Texas Letter to Experian, formerly known as TRY, entails when requesting a free copy of your credit report based on denial of credit. This letter serves as an important tool to obtain a comprehensive overview of your credit history and address any potential issues. 1. Understanding the Harris Texas Letter: The Harris Texas Letter is a written request to Experian, a major credit reporting agency, formerly known as TRY, in which a Texas resident asks for a free copy of their credit report. This letter is specifically catered to individuals who have been denied credit and wish to review the information that led to their denial. 2. Purpose of the Letter: The main purpose of the Harris Texas Letter is to exercise the rights granted under the Fair Credit Reporting Act (FCRA). This act allows individuals to request a free copy of their credit report from the credit reporting companies responsible for the denial of credit. 3. Key Components of the Letter: — Header: The letter should include your name, address, and contact details as well as the recipient's information. — Date: Indicate the date the letter is being sent. — Subject: Mention the purpose of the letter, such as "Requesting Free Copy of Credit Report based on Denial of Credit." — Explanation: Clearly state that you are requesting a copy of your credit report due to a recent denial of credit. — Additional Details: Include any pertinent information, such as the name of the creditor who denied you credit, the date of the denial, and any reference numbers if available. — Proof of Identity: Provide a photocopy of your government-issued identification (e.g., driver's license, passport) and a recent utility bill to verify your address. — Signature: Sign the letter to serve as authorization for the credit reporting agency to release your credit report. 4. Types of Harris Texas Letter to Experian: There may be variations of the Harris Texas Letter, depending on specific requirements or circumstances. Here are a few examples: — Harris Texas LetteExpediaia— - Denial of Mortgage Loan: This letter is tailored for individuals who have been denied a mortgage loan and need to request their credit report to evaluate the reason for denial. — Harris Texas LetteExpediaia— - Denial of Auto Loan: Designed for individuals who have faced denial for an auto loan and need detailed credit information to address the issue and potentially reapply. — Harris Texas LetteExpediaia— - Denial of Credit Card: This letter is specific to those who have been denied a credit card and need a comprehensive credit report to analyze the reasons behind the denial. Conclusion: Submitting a Harris Texas Letter to Experian based on the denial of credit is an important step in understanding your creditworthiness and addressing any challenges. By following the guidelines and including the necessary information, individuals can obtain their credit report for free and take appropriate actions to improve their credit standing.

Harris Texas Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

How to fill out Harris Texas Letter To Experian - Formerly TRW - Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your county, including the Harris Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Harris Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Harris Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit:

- Make sure you have opened the correct page with your localised form.

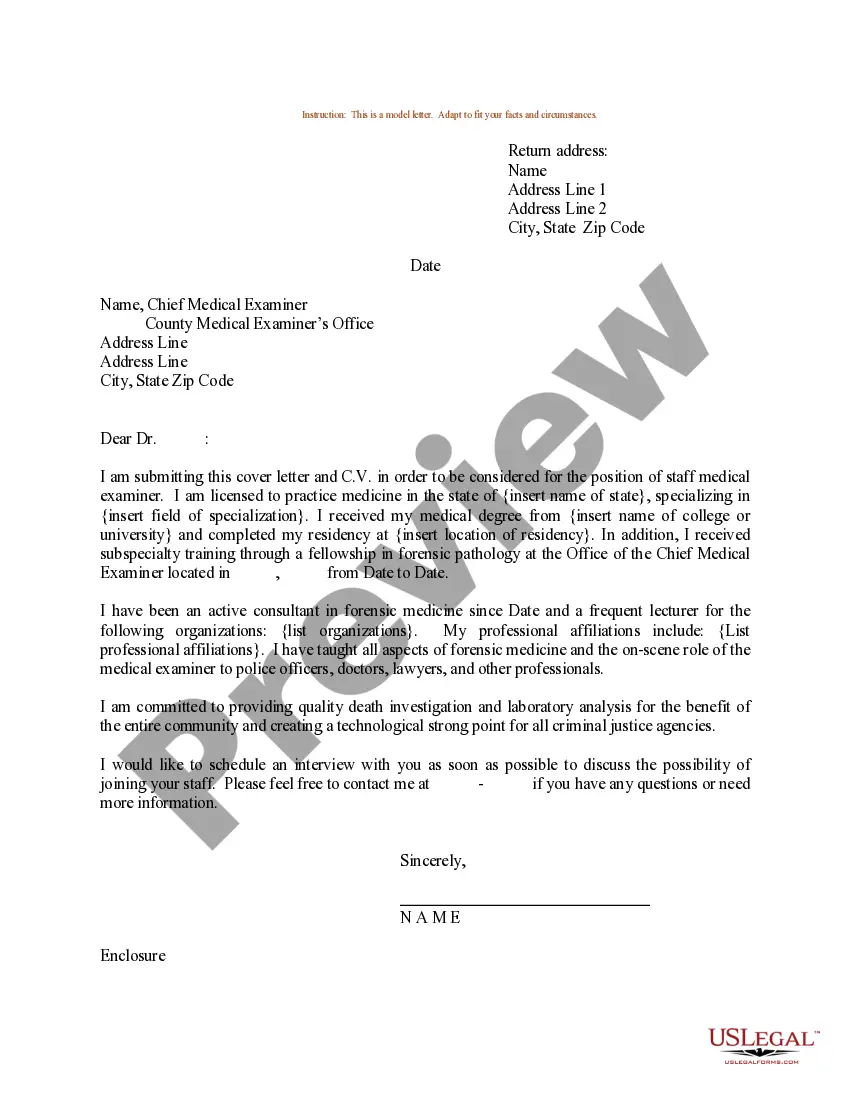

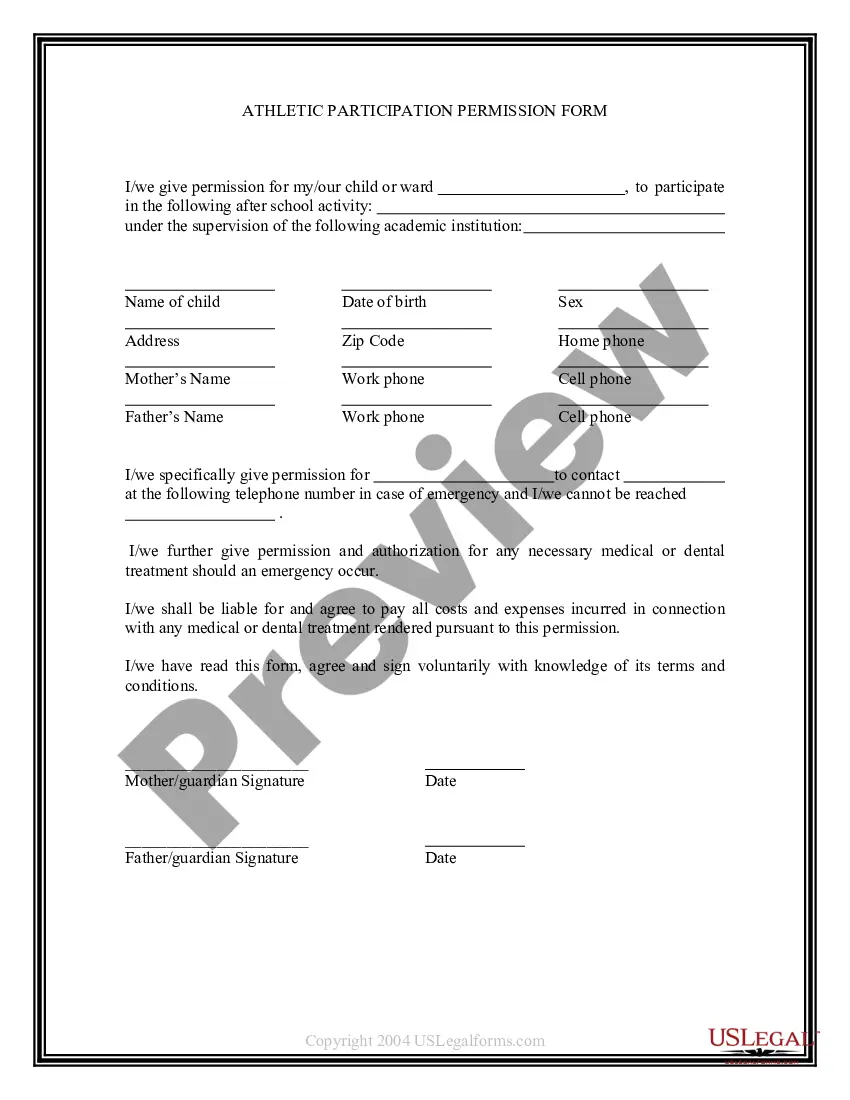

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Harris Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!