Title: Hennepin, Minnesota — Requesting a Free Copy of Your Credit Report from TransUnion after Credit Denial Introduction: If you have recently been denied credit and reside in Hennepin, Minnesota, it's essential to understand your options for obtaining a free copy of your credit report from TransUnion. This detailed guide will walk you through the process of drafting a letter to TransUnion, requesting a copy of your credit report as per federal law. Keyword phrases: Hennepin Minnesota, TransUnion, free copy, credit report, denial of credit, letter 1. Understanding the Importance of Your Credit Report: Your credit report has a significant impact on your financial well-being. It provides a detailed overview of your credit history, accounts, payment history, and other relevant information that lenders use to evaluate your creditworthiness. 2. Reasons for Credit Denial and Its Consequences: Credit denials can result from various factors, such as a low credit score, insufficient income, high debt-to-income ratio, or inaccurate information on your credit report. Denials may affect your ability to secure loans, credit cards, and even housing or job opportunities. 3. The Rights of Hennepin Residents: As a resident of Hennepin, Minnesota, you are entitled to a free copy of your credit report from each of the three major credit reporting bureaus under the federal law known as the Fair Credit Reporting Act (FCRA), specifically section 612. 4. Drafting Your Hennepin Minnesota Letter to TransUnion: Begin your request letter by addressing TransUnion, including your personal information such as name, current address, and Social Security number. Clearly state that you were recently denied credit and request a free copy of your credit report. Mention that you are a Hennepin resident, and therefore the FCRA allows you to obtain this free report. 5. Providing Proof of Identity: To verify your identity, be sure to enclose a copy of your driver's license, passport, or any other government-issued identification card. This step is crucial to protect your personal information from unauthorized access. 6. Supporting Documents: If you have any additional documentation, such as denial letters or correspondence from creditors, include copies of these along with your request. This may provide further context for TransUnion to review your credit report accurately. 7. Certified Mail and Proof of Delivery: To ensure that your letter is received and processed, it is recommended to send it via certified mail with a return receipt requested. This way, you will have evidence that the letter was delivered to TransUnion. 8. Follow-Up and Exercising Your Rights: If TransUnion fails to provide your free credit report within the specified timeframe or if you encounter any issues, it is essential to know your rights. Consider reaching out to a credit counselor or attorney specializing in credit disputes to ensure your rights are upheld. Optional variations of the Hennepin, Minnesota Letter to TransUnion Requesting a Free Copy of Your Credit Report: 1. Hennepin Minnesota Joint Letter to TransUnion: If you are applying for credit jointly with someone and both individuals were denied credit, you may need to draft a joint letter requesting the free copies of credit reports for both parties. 2. Hennepin Minnesota Letter to Equifax and Experian: While this guide focuses on requesting a credit report from TransUnion, it's important to note that you have the right to request free copies of your credit reports from Equifax and Experian as well. Adapt the letter and follow the same essential steps outlined above for each bureau.

Hennepin Minnesota Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit

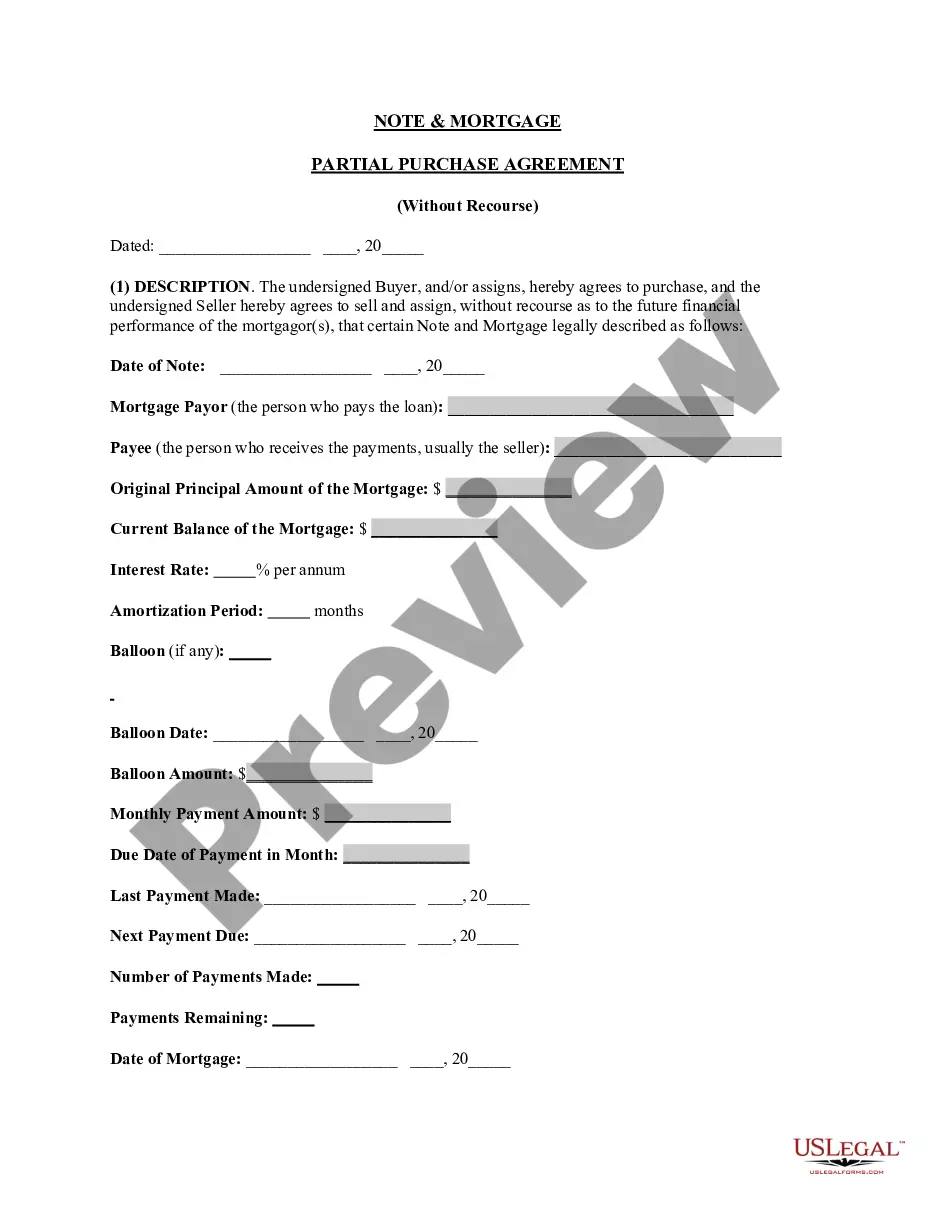

Description

How to fill out Hennepin Minnesota Letter To Trans Union Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Preparing paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Hennepin Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit without expert assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Hennepin Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Hennepin Letter to Trans Union Requesting Free Copy of Your Credit Report based on Denial of Credit:

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any use case with just a couple of clicks!