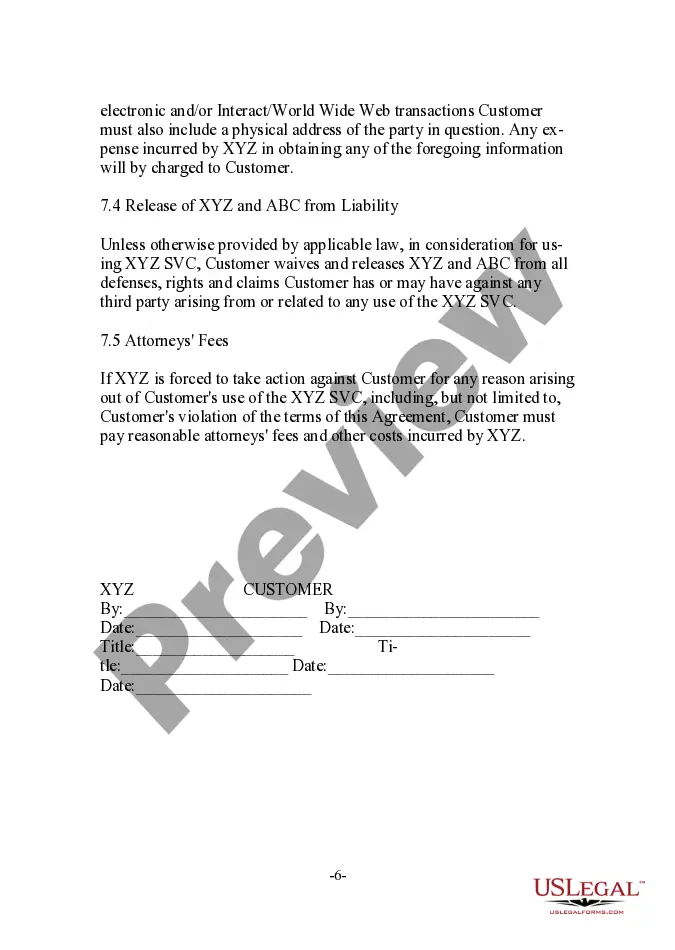

San Diego California Stored Value Product Agreement and Disclosures are legal documents that outline the terms and conditions associated with the use of stored value products (SVP) provided by financial institutions in San Diego, California. These agreements and disclosures serve as a contractual agreement between the institution and the consumer or account holder. The San Diego California Stored Value Product Agreement and Disclosures provide comprehensive details regarding the features, rights, limitations, and obligations of both the financial institution and the consumer when using SVPs. These documents typically clarify the rights of the consumer in using the stored value funds, including account access, usage, and potential fees that may be applicable. Some key points covered in San Diego California Stored Value Product Agreement and Disclosures may include: 1. Account Opening: This section describes the process and requirements for opening an SVP account with the financial institution. 2. Usage and Access: It details the permitted uses of the SVP, such as making purchases, bill payments, and accessing funds through ATMs or other electronic means. 3. Fees and Charges: The document outlines the fees associated with the SVP, including transaction fees, inactivity fees, balance inquiry fees, reload fees, and other relevant charges. 4. Limitations and Exclusions: This section specifies any limitations or exclusions on the SVP usage, including the maximum balance, daily spending limit, and restrictions on certain types of transactions. 5. Card Replacement and Security: It provides information on the procedures and fees associated with replacing lost or stolen SVP cards, as well as guidelines for safeguarding the card and personal identification number (PIN) to prevent unauthorized access. 6. Termination and Closure: The agreement and disclosures specify the conditions under which the financial institution can terminate or close the SVP account, including reasons such as suspected fraud or violation of terms. It is important to note that the specific San Diego California Stored Value Product Agreement and Disclosures may vary between different financial institutions and the type of stored value products they offer. For example, there may be separate agreements and disclosures for prepaid debit cards, gift cards, or electronic wallets. These variations may include different terms, conditions, and disclosure requirements tailored to each type of SVP. To ensure compliance with regulatory guidelines and enhance transparency, financial institutions in San Diego, California, are legally required to provide customers with a copy of the San Diego California Stored Value Product Agreement and Disclosures when opening an SVP account. Customers are advised to carefully review these agreements to understand their rights, responsibilities, and any associated fees before using the stored value products provided by the institution.

San Diego California Stored Value Product Agreement and Disclosures

Description

How to fill out San Diego California Stored Value Product Agreement And Disclosures?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the San Diego Stored Value Product Agreement and Disclosures.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the San Diego Stored Value Product Agreement and Disclosures will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the San Diego Stored Value Product Agreement and Disclosures:

- Ensure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the San Diego Stored Value Product Agreement and Disclosures on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!