Bexar Texas Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office

Description

How to fill out Bexar Texas Notice Of Violation Of Fair Debt Act - Letter To Attorney Generals Office?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Bexar Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Aside from the Bexar Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Bexar Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office:

- Examine the content of the page you’re on.

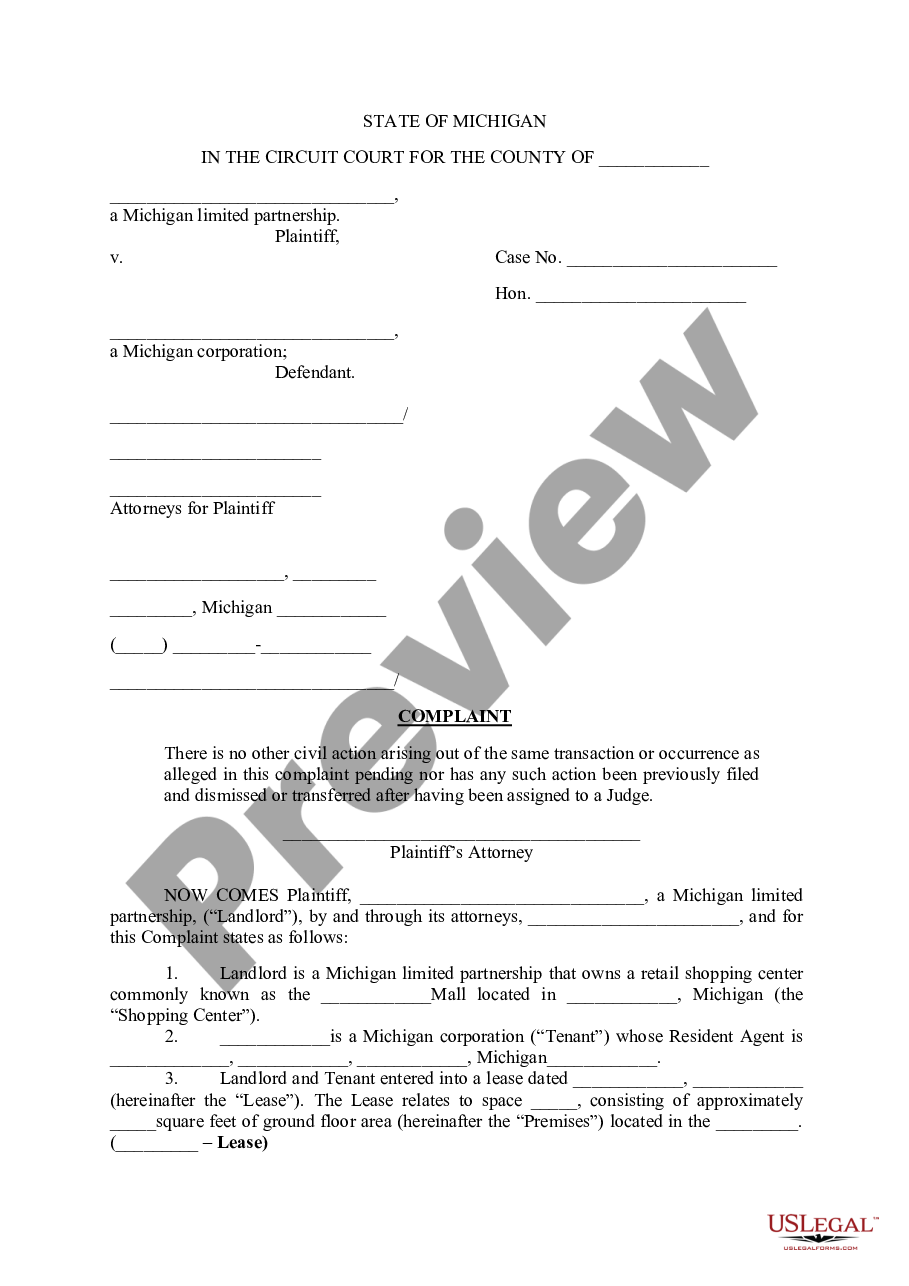

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Bexar Notice of Violation of Fair Debt Act - Letter To Attorney Generals Office.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

Start your complaint with the seller or manufacturer. If they don't help, seek help from your local government or a consumer organization.

Filing a Lawsuit If contacting you to get you to pay the debt has not worked, the next step for a debt collector is to file a lawsuit. The debt collector has a certain amount of time to file the suit, called the "statute of limitations." In Texas, the statute of limitations for debt is 4 years.

Complaints are used by the Attorney General's Office to learn about misconduct and to determine whether to investigate a company. However, the Attorney General's Office cannot provide legal advice or assistance to individuals.

In a motion to dismiss, you can ask the judge to throw out any or all of the claims in the lawsuit. The judge will review your claims and issue a ruling. Use SoloSuit to respond to a debt collection lawsuit and win your case.

In Texas, debt collectors only have four years to bring a lawsuit on debtthe statute of limitations on debt in Texas. Most of the time, the debt collection statute of limitations in Texas is counted from the last payment, or first default, on the debt.

Debt cases filed in a Texas JP/Justice Court have a deadline of 14 days after the summons is served. If you were served with a summons, but do not file an answer before the deadline, the judge will issue a default judgment against you.

File Complaint Having a problem with a business? NYC Department of Consumer and Worker Protection (DCWP) Has Your Back.Online: Mail/Fax: Mailing Address: NYC Department of Consumer and Worker Protection.Fax: (212) 487-4482.

The lawsuit process is the same in small claims courts in Texas: the plaintiff will serve you with the Summons and Petition for debt, and you have to respond before the deadline to avoid default judgment. So, the first step to beating a debt collector in court is to file your Answer.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.