Wayne, Michigan Notice of Violation of Fair Debt Act — Notice to Stop Contact: A Comprehensive Overview In Wayne, Michigan, the Fair Debt Act is designed to protect individuals from unfair practices and harassment by debt collectors. If you believe that a debt collector has violated your rights, you can file a Wayne Michigan Notice of Violation of Fair Debt Act — Notice to Stop Contact. This notice serves as a formal request for the debt collector to cease all communication with you concerning the debt in question. There are several types of Wayne Michigan Notice of Violation of Fair Debt Act — Notice to Stop Contact, each addressing specific situations and violations. These notices typically contain relevant keywords that are crucial to ensure their effectiveness. Some of these keywords include: 1. Unauthorized Contact: If a debt collector contacts you without your consent, or after you have explicitly expressed your desire for them to stop contacting you, this type of notice addresses the unauthorized contact. Debt collectors are legally required to respect your wishes and stop communicating with you upon receiving such a notice. 2. False or Misleading Representation: If a debt collector provides false or misleading information about the debt, your rights, or their intentions, you can utilize this type of notice to address the violation. Debt collectors are prohibited from making false statements or engaging in deceptive practices during debt collection. 3. Harassment or Abuse: If a debt collector engages in conduct that is threatening, abusive, or harassing, this type of notice is appropriate. Examples of such behavior may include the use of obscene language, frequent and unnecessary phone calls, or making continuous calls outside reasonable hours. 4. Unfair Practices: Debt collectors must adhere to ethical practices while attempting to collect a debt. This type of notice is relevant when a debt collector engages in unfair practices, such as misrepresenting the amount owed, adding unauthorized charges, or attempting to collect fees not permitted by law. By filing a Wayne Michigan Notice of Violation of Fair Debt Act — Notice to Stop Contact, individuals can assert their rights and request that debt collectors cease any further communication regarding the debt in question. However, it is important to consult with legal professionals or organizations specializing in debt collection laws to ensure the appropriate notice is filed correctly and within the designated time frame. Remember, the Fair Debt Act exists to protect consumers like you from harassment and unfair practices when dealing with debt collectors. Familiarizing yourself with your rights under this act can empower you to take appropriate action if you believe these rights have been violated.

Wayne Michigan Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Wayne Michigan Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

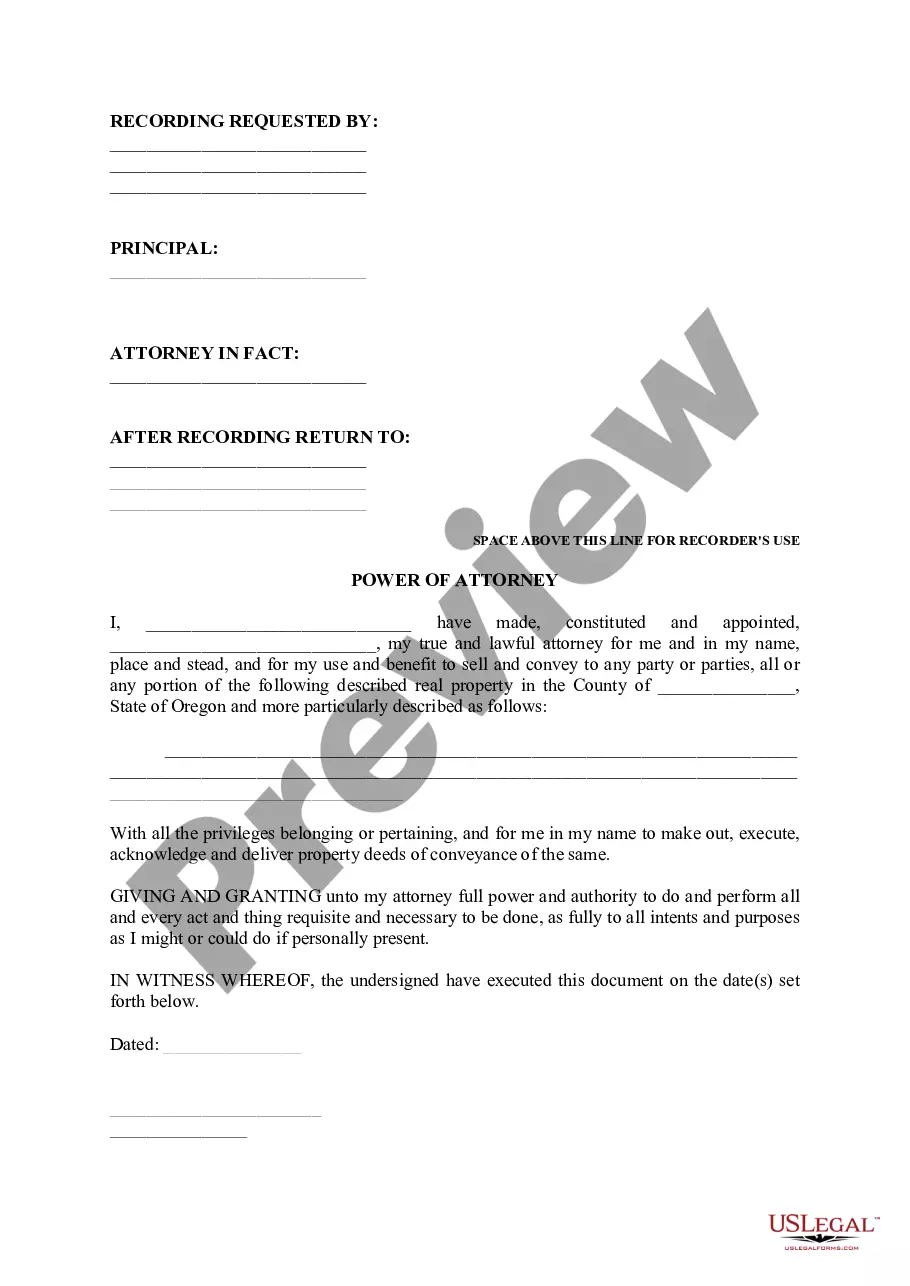

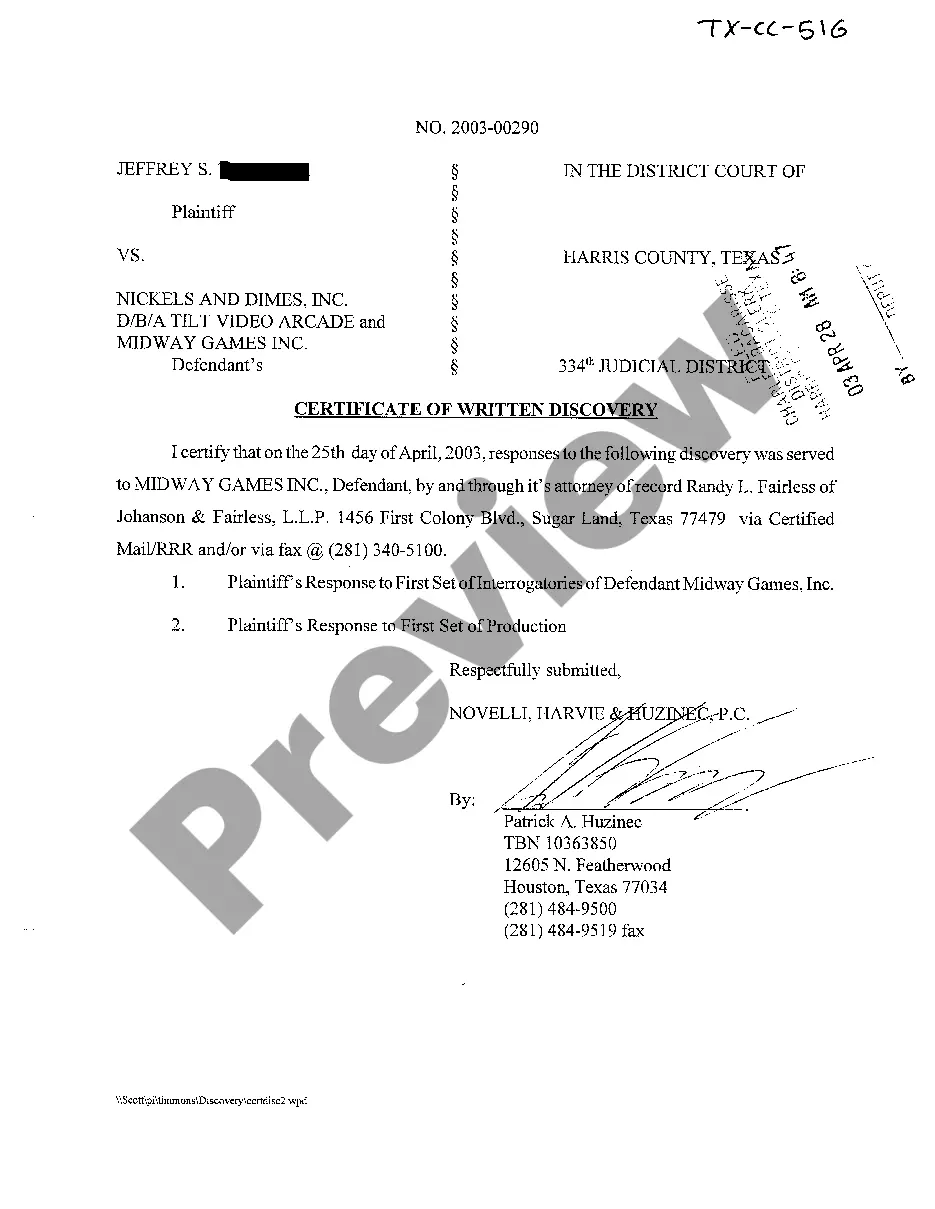

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Wayne Notice of Violation of Fair Debt Act - Notice to Stop Contact, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the latest version of the Wayne Notice of Violation of Fair Debt Act - Notice to Stop Contact, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wayne Notice of Violation of Fair Debt Act - Notice to Stop Contact:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Wayne Notice of Violation of Fair Debt Act - Notice to Stop Contact and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Statute of Limitations and Your Credit Report Late payments, for example, can stay on your report for seven years from the original delinquency. Collection accounts can remain on your report for seven years and 180 days from the original delinquency.

For example, if a person tells a debt collector to "stop calling," this statement means the person has requested that the debt collector not use telephone calls to communicate with the person and prohibits the debt collector from communicating or attempting to communicate through telephone calls.

Fortunately, there are legal actions you can take to stop this harassment: Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

Under the FDCPA, you can tell a debt collector to stop contacting you; but it's not always a good idea. The federal Fair Debt Collection Practices Act (FDCPA) gives you the right to force a debt collector to stop communicating with you.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter.

Here's how you stop debt collection calls for someone else's debt: Answer the phone and explain you're not the person they're looking for. Tell them that they are calling the wrong number. Send a cease and desist letter to them. If they continue to call, file a complaint with the FTC.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

3 Things You Should NEVER Say To A Debt Collector Additional Phone Numbers (other than what they already have) Email Addresses. Mailing Address (unless you intend on coming to a payment agreement) Employer or Past Employers. Family Information (ex.Bank Account Information. Credit Card Number. Social Security Number.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Interesting Questions

More info

Students who have been asked to move into an apartment or housing complex can find themselves in a catch 22 situations — if they do well enough to maintain a place to live, it may be difficult for them to move once their school is over. For example, the University of Purdue is on track to house a lot of graduate and undergrad students over the next four years. Purdue's Office of Housing provides this list of addresses for students seeking to live in the off-campus dorms during this period. If you want to stay at a Purdue residence after school ends, and move out during the summer, please review this list. This list includes all addresses and rooms associated with the university. It does not include off-campus locations and apartments. So the University of Purdue is your first reference for off-campus apartments, and the next one will be the one you end up with, unless you move within the school year. Please let us know if you have any questions.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.