This form is a follow-up letter containing a warning that the debt collector's continued violation of the Fair Debt Collection Practices Act may result in a law suit being filed against the debt collector.

Palm Beach Florida Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor

Description

How to fill out Palm Beach Florida Second Notice To Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Palm Beach Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any activities related to document completion simple.

Here's how to find and download Palm Beach Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor.

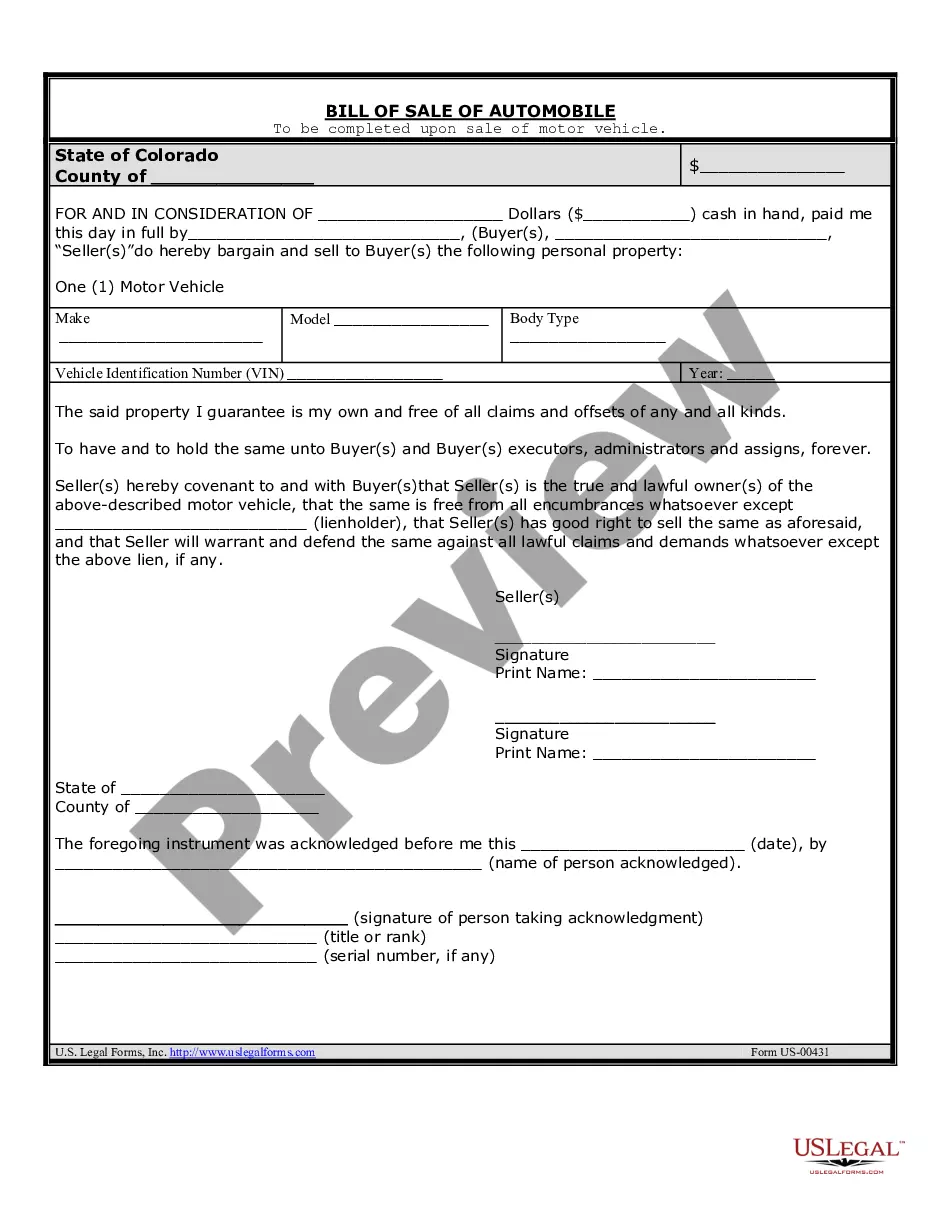

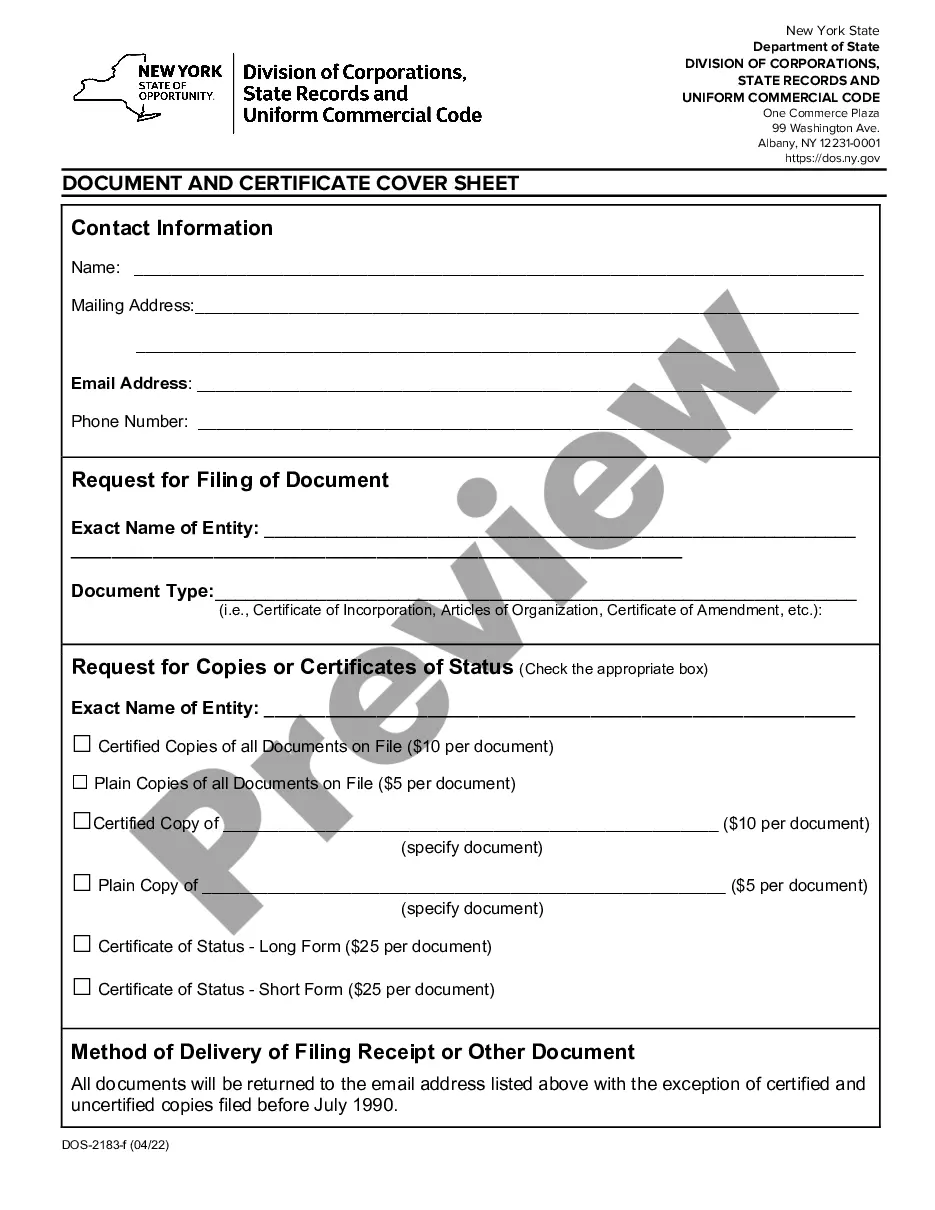

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the related document templates or start the search over to find the appropriate file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a needed payment gateway, and purchase Palm Beach Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Palm Beach Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an exceptionally difficult case, we advise using the services of an attorney to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!

Form popularity

FAQ

Yes. The federal Fair Debt Collection Practices Act specifically gives you the right to sue a debt collector for harassment. If a debt collector is found to have engaged in harassing behavior, you are entitled to up to $1,000 in damages, along with court costs and attorney fees.

The Administration of Justice Act prevents debt collectors from being allowed to harass you.

Fortunately, there are legal actions you can take to stop this harassment: Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

Repetitive phone calls, foul language, threats, and any other behavior used to annoy, abuse, or harass you can be considered creditor harassment. The Fair Debt Collection Practices Act (FDCPA) makes creditor harassment illegal, so it is important for you to know your rights when a creditor calls.

Report Them to the Authorities You can complain about rude and abusive debt collectors to the Federal Trade Commission and the Consumer Financial Protection Bureau. With enough complaints about a particular collector, legal action may be taken against the collection agency.

Harassment and Call Restrictions Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

The definition of debt collector harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment also could come in the form of emails, texts, social media, direct mail or talking to friends or neighbors about your debt.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter.