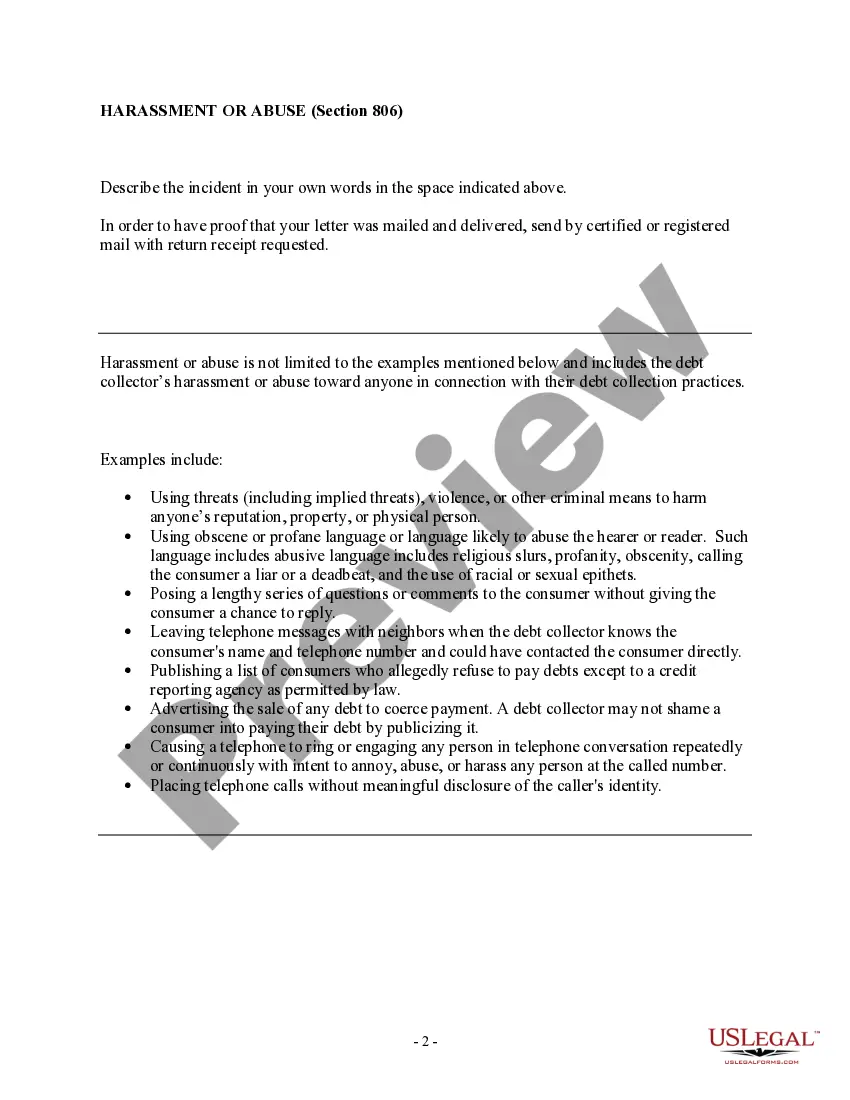

A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt.

Examples include:

Use this form to get a debt collector to stop harassing, opressing, or abusing you.

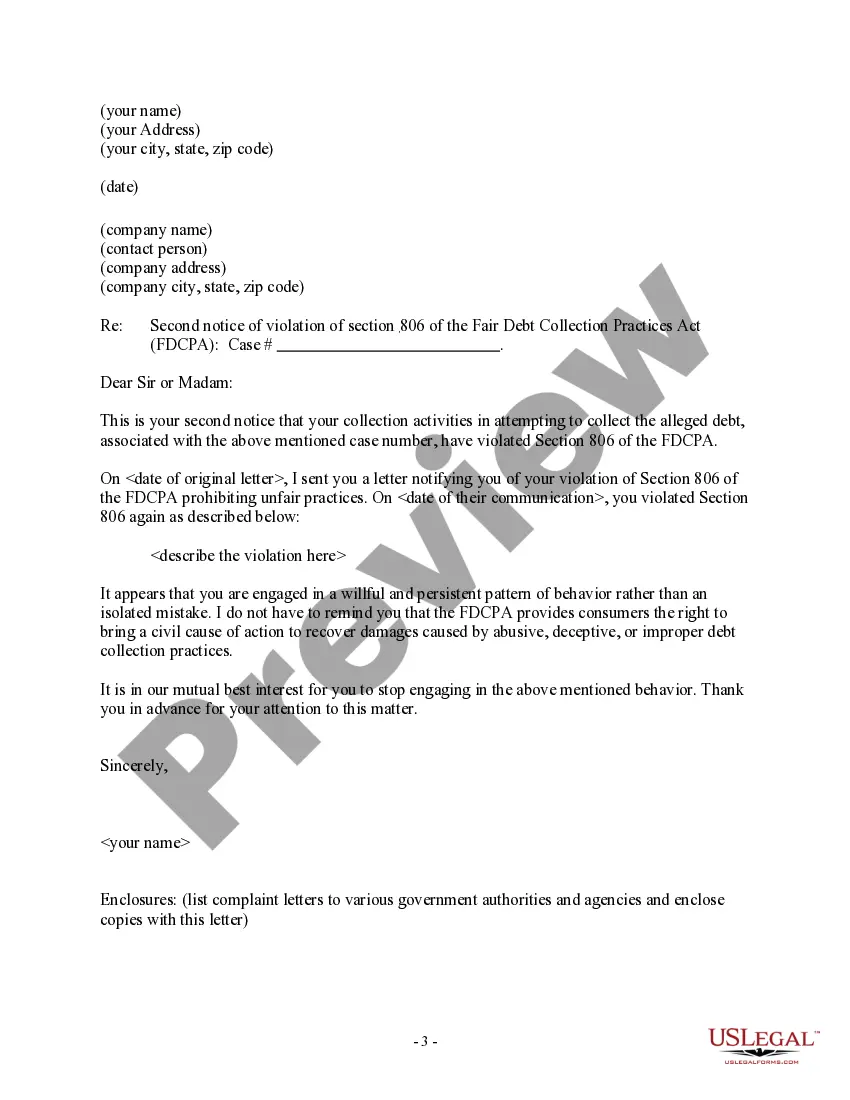

This form also also includes follow-up letters containing a warning that the debt collector may face going to court if they continue engaging in behavior that violates the FDCPA. Fairfax Virginia, located in the northeastern part of the United States, is a city with a rich history and a vibrant community. It is widely known for its proximity to Washington, D.C., and its historical significance during the Civil War. With its beautiful neighborhoods, thriving businesses, and top-notch educational institutions, Fairfax Virginia is a great place to live, work, and raise a family. Now, turning our attention to the issue of debt collectors and their actions that may violate Section 806 of the Fair Debt Collection Practices Act (FD CPA), it is important for individuals to be aware of their rights and take the necessary steps to protect themselves from harassment. In the unfortunate event that you have encountered harassment from a debt collector, it is crucial to familiarize yourself with Fairfax Virginia Notice Letter options to address a Section 806 violation. The letter serves as a formal notice to the debt collector, making them aware of their wrongdoing and demanding that they cease their harassing behavior immediately. Some possible types of Fairfax Virginia Notice Letters to debt collectors of Section 806 violation — harassment may include: 1. Initial Notice Letter: This is the first formal communication sent to a debt collector, explicitly highlighting the specific incidents of harassment experienced and emphasizing their violation of Section 806 of the FD CPA. It asserts the recipient's rights and demands appropriate action to rectify the situation. 2. Follow-up Notice Letter: In cases where the initial notice has not been acknowledged or the harassment continues despite the warning, a follow-up notice letter can be drafted. This letter reiterates the previous complaints and demands further action be taken, emphasizing the seriousness of the violation. 3. Cease and Desist Notice Letter: If the debt collector persists in their harassment even after receiving previous notice letters, a cease and desist notice letter may be necessary. This firmly instructs the debt collector to cease all communication immediately, warning of potential legal action if their behavior continues. 4. Legal Action Notice Letter: In instances where the previous notices have been ignored, a legal action notice letter may be appropriate. This letter informs the debt collector that should they fail to comply with the FD CPA, legal proceedings will be initiated against them, seeking compensation for damages suffered due to the harassment. 5. Record keeping Notice Letter: Maintaining a thorough record of all interactions with the debt collector is crucial in cases of Section 806 violations. A record keeping notice letter serves to remind the debt collector of their obligation to appropriately document all communication and provide any requested documentation or verification of debt. Remember, it is essential to consult with a qualified attorney or a legal professional when drafting any Fairfax Virginia Notice Letters to ensure they are tailored to your specific situation and adhere to the applicable laws and regulations.

Fairfax Virginia, located in the northeastern part of the United States, is a city with a rich history and a vibrant community. It is widely known for its proximity to Washington, D.C., and its historical significance during the Civil War. With its beautiful neighborhoods, thriving businesses, and top-notch educational institutions, Fairfax Virginia is a great place to live, work, and raise a family. Now, turning our attention to the issue of debt collectors and their actions that may violate Section 806 of the Fair Debt Collection Practices Act (FD CPA), it is important for individuals to be aware of their rights and take the necessary steps to protect themselves from harassment. In the unfortunate event that you have encountered harassment from a debt collector, it is crucial to familiarize yourself with Fairfax Virginia Notice Letter options to address a Section 806 violation. The letter serves as a formal notice to the debt collector, making them aware of their wrongdoing and demanding that they cease their harassing behavior immediately. Some possible types of Fairfax Virginia Notice Letters to debt collectors of Section 806 violation — harassment may include: 1. Initial Notice Letter: This is the first formal communication sent to a debt collector, explicitly highlighting the specific incidents of harassment experienced and emphasizing their violation of Section 806 of the FD CPA. It asserts the recipient's rights and demands appropriate action to rectify the situation. 2. Follow-up Notice Letter: In cases where the initial notice has not been acknowledged or the harassment continues despite the warning, a follow-up notice letter can be drafted. This letter reiterates the previous complaints and demands further action be taken, emphasizing the seriousness of the violation. 3. Cease and Desist Notice Letter: If the debt collector persists in their harassment even after receiving previous notice letters, a cease and desist notice letter may be necessary. This firmly instructs the debt collector to cease all communication immediately, warning of potential legal action if their behavior continues. 4. Legal Action Notice Letter: In instances where the previous notices have been ignored, a legal action notice letter may be appropriate. This letter informs the debt collector that should they fail to comply with the FD CPA, legal proceedings will be initiated against them, seeking compensation for damages suffered due to the harassment. 5. Record keeping Notice Letter: Maintaining a thorough record of all interactions with the debt collector is crucial in cases of Section 806 violations. A record keeping notice letter serves to remind the debt collector of their obligation to appropriately document all communication and provide any requested documentation or verification of debt. Remember, it is essential to consult with a qualified attorney or a legal professional when drafting any Fairfax Virginia Notice Letters to ensure they are tailored to your specific situation and adhere to the applicable laws and regulations.