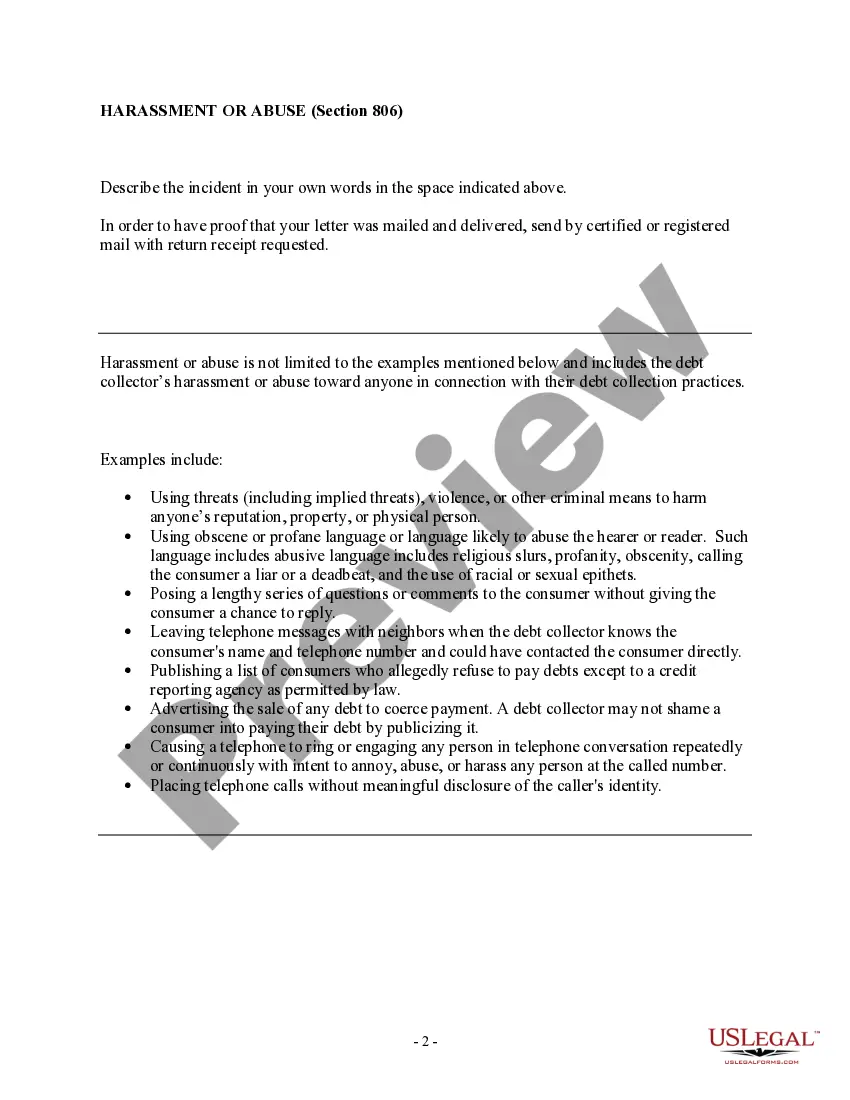

A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt.

Examples include:

Use this form to get a debt collector to stop harassing, opressing, or abusing you.

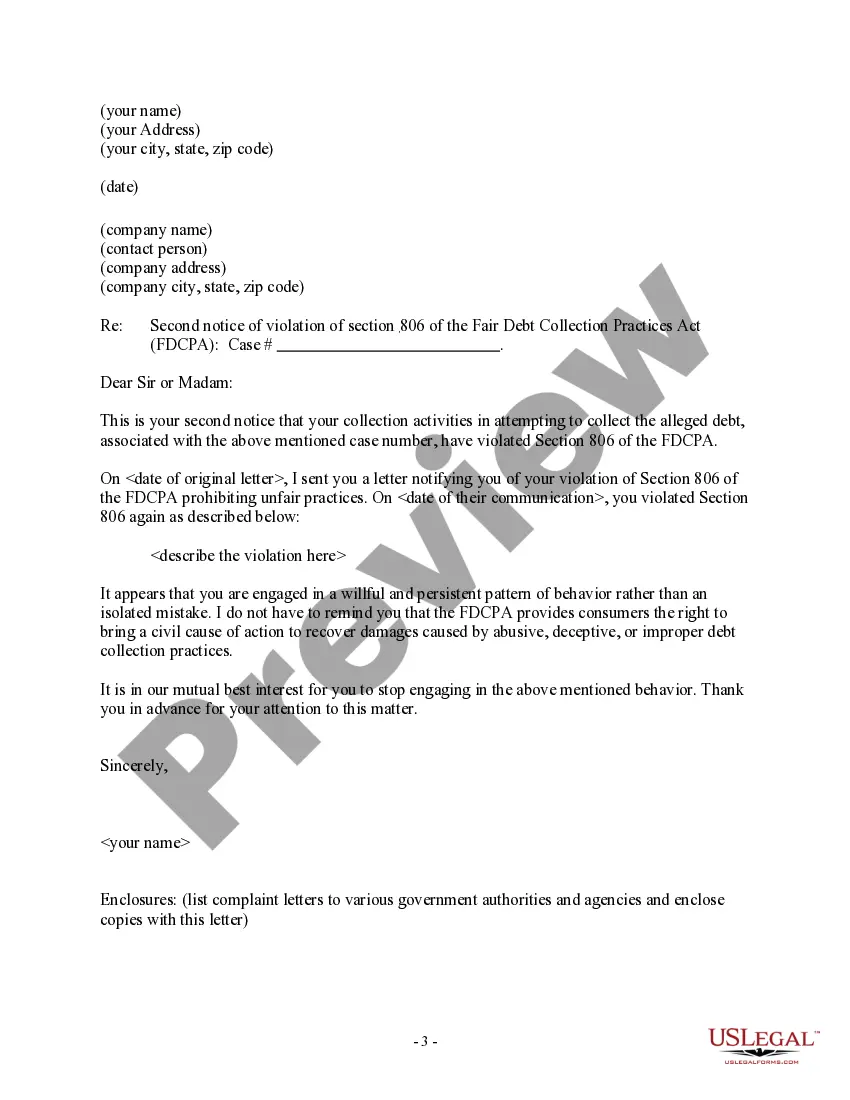

This form also also includes follow-up letters containing a warning that the debt collector may face going to court if they continue engaging in behavior that violates the FDCPA. Mecklenburg County, located in the state of North Carolina, is a vibrant and diverse area known for its rich history, thriving economy, and picturesque landscapes. It encompasses the city of Charlotte, which serves as its county seat and is the largest city in the state. Mecklenburg County boasts a population of over 1 million residents and offers a wide range of amenities, attractions, and recreational opportunities. From its bustling downtown area filled with modern skyscrapers and cultural institutions to its serene natural areas and parks, there is something for everyone to enjoy. The county is home to many renowned educational institutions, including the University of North Carolina at Charlotte, which contributes to its vibrant and innovative atmosphere. The region also hosts several professional sports teams, such as the Charlotte Hornets (NBA) and the Carolina Panthers (NFL), providing ample entertainment options for sports enthusiasts. Now, let's focus on the different types of Mecklenburg North Carolina Notice letters to debt collectors of Section 806 violation — harassment: 1. Cease and Desist Notice: This type of notice is used to inform the debt collector that their actions constitute harassment under Section 806 of the Fair Debt Collection Practices Act (FD CPA). It demands an immediate cessation of all forms of communication, including phone calls, letters, and emails. 2. Dispute and Validation Request: This notice serves to contest the validity of the debt in question and seeks detailed information and documentation to validate the debt collector's claims. It also highlights any harassing behavior or violations of the FD CPA that have been observed. 3. Record keeping and Documentation Request: This type of notice requests that the debt collector provide copies of all communications and records related to the debt, including call logs, collection letters, and any other relevant documents. It emphasizes the debt collector's obligation to maintain accurate and complete records as mandated by law. 4. Notice of Intent to Sue: In cases where the debt collector's harassment persists despite previous notices, this notice informs them of the intention to pursue legal action to seek remedies for the violations. It highlights the specific sections of the FD CPA that have been violated and serves as a final warning before initiating a lawsuit. It is important to consult with an attorney or a legal professional experienced in debt collection matters when drafting any notice letter to ensure its effectiveness and accuracy. These letters hold the potential to protect individuals from harassment and uphold their rights under the FD CPA.

Mecklenburg County, located in the state of North Carolina, is a vibrant and diverse area known for its rich history, thriving economy, and picturesque landscapes. It encompasses the city of Charlotte, which serves as its county seat and is the largest city in the state. Mecklenburg County boasts a population of over 1 million residents and offers a wide range of amenities, attractions, and recreational opportunities. From its bustling downtown area filled with modern skyscrapers and cultural institutions to its serene natural areas and parks, there is something for everyone to enjoy. The county is home to many renowned educational institutions, including the University of North Carolina at Charlotte, which contributes to its vibrant and innovative atmosphere. The region also hosts several professional sports teams, such as the Charlotte Hornets (NBA) and the Carolina Panthers (NFL), providing ample entertainment options for sports enthusiasts. Now, let's focus on the different types of Mecklenburg North Carolina Notice letters to debt collectors of Section 806 violation — harassment: 1. Cease and Desist Notice: This type of notice is used to inform the debt collector that their actions constitute harassment under Section 806 of the Fair Debt Collection Practices Act (FD CPA). It demands an immediate cessation of all forms of communication, including phone calls, letters, and emails. 2. Dispute and Validation Request: This notice serves to contest the validity of the debt in question and seeks detailed information and documentation to validate the debt collector's claims. It also highlights any harassing behavior or violations of the FD CPA that have been observed. 3. Record keeping and Documentation Request: This type of notice requests that the debt collector provide copies of all communications and records related to the debt, including call logs, collection letters, and any other relevant documents. It emphasizes the debt collector's obligation to maintain accurate and complete records as mandated by law. 4. Notice of Intent to Sue: In cases where the debt collector's harassment persists despite previous notices, this notice informs them of the intention to pursue legal action to seek remedies for the violations. It highlights the specific sections of the FD CPA that have been violated and serves as a final warning before initiating a lawsuit. It is important to consult with an attorney or a legal professional experienced in debt collection matters when drafting any notice letter to ensure its effectiveness and accuracy. These letters hold the potential to protect individuals from harassment and uphold their rights under the FD CPA.