A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt.

Examples include:

Use this form to get a debt collector to stop harassing, opressing, or abusing you.

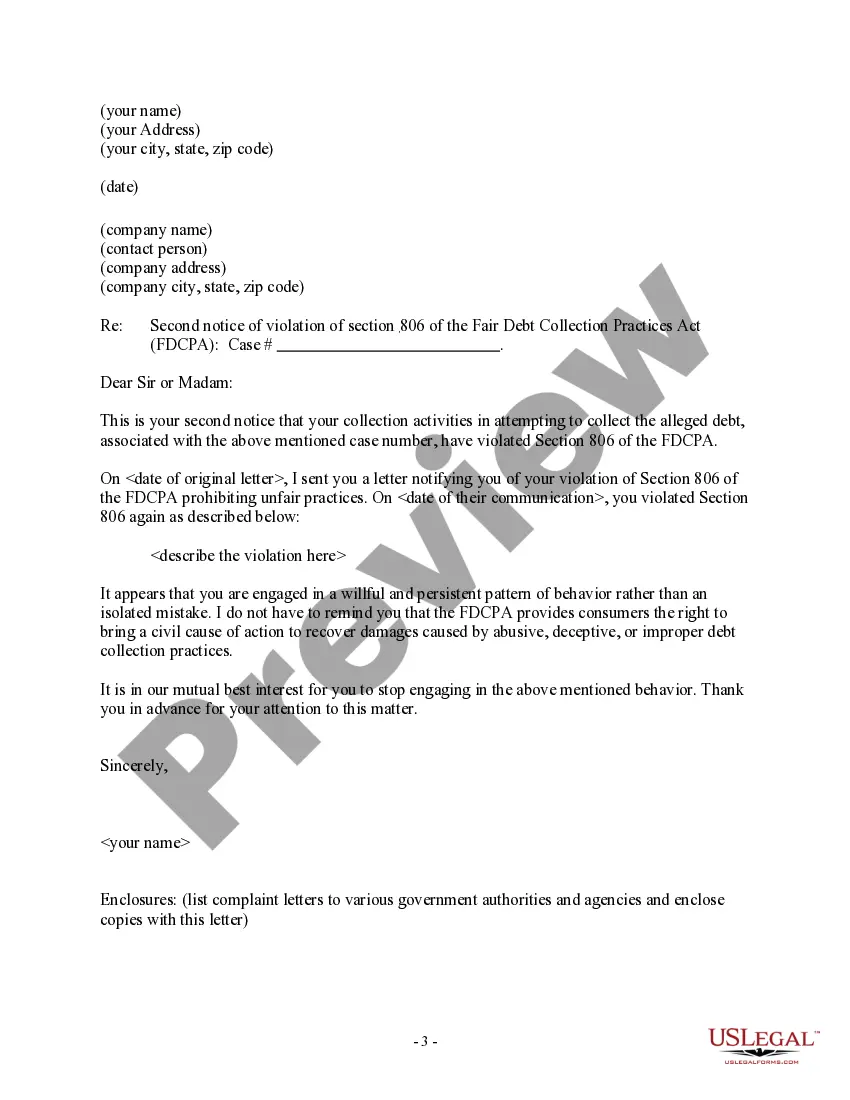

This form also also includes follow-up letters containing a warning that the debt collector may face going to court if they continue engaging in behavior that violates the FDCPA. Title: Wake North Carolina Notice Letter to Debt Collector: Section 806 Violation — Harassment Introduction: Debt collection practices fall under specific regulations that protect consumers from harassment and unfair practices. In Wake, North Carolina, individuals have the right to send a notice letter to debt collectors who violate Section 806 of the Fair Debt Collection Practices Act (FD CPA). This article provides a detailed description of what constitutes a Wake North Carolina Notice letter, its purpose, and explains the different types of notice letters based on specific violations. Content: 1. Overview of Section 806 Violation Harassmenten— - Explain Section 806 of the FD CPA, which prohibits debt collectors from engaging in any conduct that harasses, oppresses, or abuses consumers in connection with the collection of a debt. — Emphasize that consumers have the right to send a notice letter to debt collectors who violate this section. 2. Purpose of Wake North Carolina Notice Letter — Highlight the primary purpose of the notice letter: to demand that the debt collector cease the harassing behavior and provide evidence of such violation. — Stress that sending a notice letter is an important step to protect one's rights and potentially seek legal action against the debt collector. 3. Essential Components of the Notice Letter — Name and contact information of the debtor (sender) — Name and contact information of the debt collector (receiver) — Date of thletterte— - A detailed account of the harassing behaviors experienced — Reference to Section 80tradedFPAPAP— - A clear request for the debt collector to cease unlawful actions — Mention of potential legal consequences if the harassment continues — Deadline for the debt collector to respond (usually around 30 days) — Signature of the debtor 4. Different Types of Section 806 Violation — Harassment Notice Letter— - Initial Notice Letter: This type of notice is the first formal communication sent by a debtor to a violating debt collector, clearly outlining the violation and demanding an immediate cessation of harassment. — Follow-up Notice Letter: If the initial notice is ignored or the harassment continues, a follow-up letter can be sent to remind the debt collector of their legal obligations and escalate the matter further. — Legal Action Notice Letter: In cases where the debt collector persists despite previous notices, a letter threatening legal action can be sent, emphasizing the debtor's willingness to take the matter to court if necessary. Conclusion: Sending a Wake North Carolina Notice Letter to a debt collector who violates Section 806 of the FD CPA is a crucial step in protecting one's rights as a consumer. By describing the specific violation and demanding an end to the harassment, debtors can exercise their rights and potentially take legal action if the debt collector fails to comply. It is essential to follow the required format and include all necessary information in the notice letter to ensure its effectiveness.

Title: Wake North Carolina Notice Letter to Debt Collector: Section 806 Violation — Harassment Introduction: Debt collection practices fall under specific regulations that protect consumers from harassment and unfair practices. In Wake, North Carolina, individuals have the right to send a notice letter to debt collectors who violate Section 806 of the Fair Debt Collection Practices Act (FD CPA). This article provides a detailed description of what constitutes a Wake North Carolina Notice letter, its purpose, and explains the different types of notice letters based on specific violations. Content: 1. Overview of Section 806 Violation Harassmenten— - Explain Section 806 of the FD CPA, which prohibits debt collectors from engaging in any conduct that harasses, oppresses, or abuses consumers in connection with the collection of a debt. — Emphasize that consumers have the right to send a notice letter to debt collectors who violate this section. 2. Purpose of Wake North Carolina Notice Letter — Highlight the primary purpose of the notice letter: to demand that the debt collector cease the harassing behavior and provide evidence of such violation. — Stress that sending a notice letter is an important step to protect one's rights and potentially seek legal action against the debt collector. 3. Essential Components of the Notice Letter — Name and contact information of the debtor (sender) — Name and contact information of the debt collector (receiver) — Date of thletterte— - A detailed account of the harassing behaviors experienced — Reference to Section 80tradedFPAPAP— - A clear request for the debt collector to cease unlawful actions — Mention of potential legal consequences if the harassment continues — Deadline for the debt collector to respond (usually around 30 days) — Signature of the debtor 4. Different Types of Section 806 Violation — Harassment Notice Letter— - Initial Notice Letter: This type of notice is the first formal communication sent by a debtor to a violating debt collector, clearly outlining the violation and demanding an immediate cessation of harassment. — Follow-up Notice Letter: If the initial notice is ignored or the harassment continues, a follow-up letter can be sent to remind the debt collector of their legal obligations and escalate the matter further. — Legal Action Notice Letter: In cases where the debt collector persists despite previous notices, a letter threatening legal action can be sent, emphasizing the debtor's willingness to take the matter to court if necessary. Conclusion: Sending a Wake North Carolina Notice Letter to a debt collector who violates Section 806 of the FD CPA is a crucial step in protecting one's rights as a consumer. By describing the specific violation and demanding an end to the harassment, debtors can exercise their rights and potentially take legal action if the debt collector fails to comply. It is essential to follow the required format and include all necessary information in the notice letter to ensure its effectiveness.