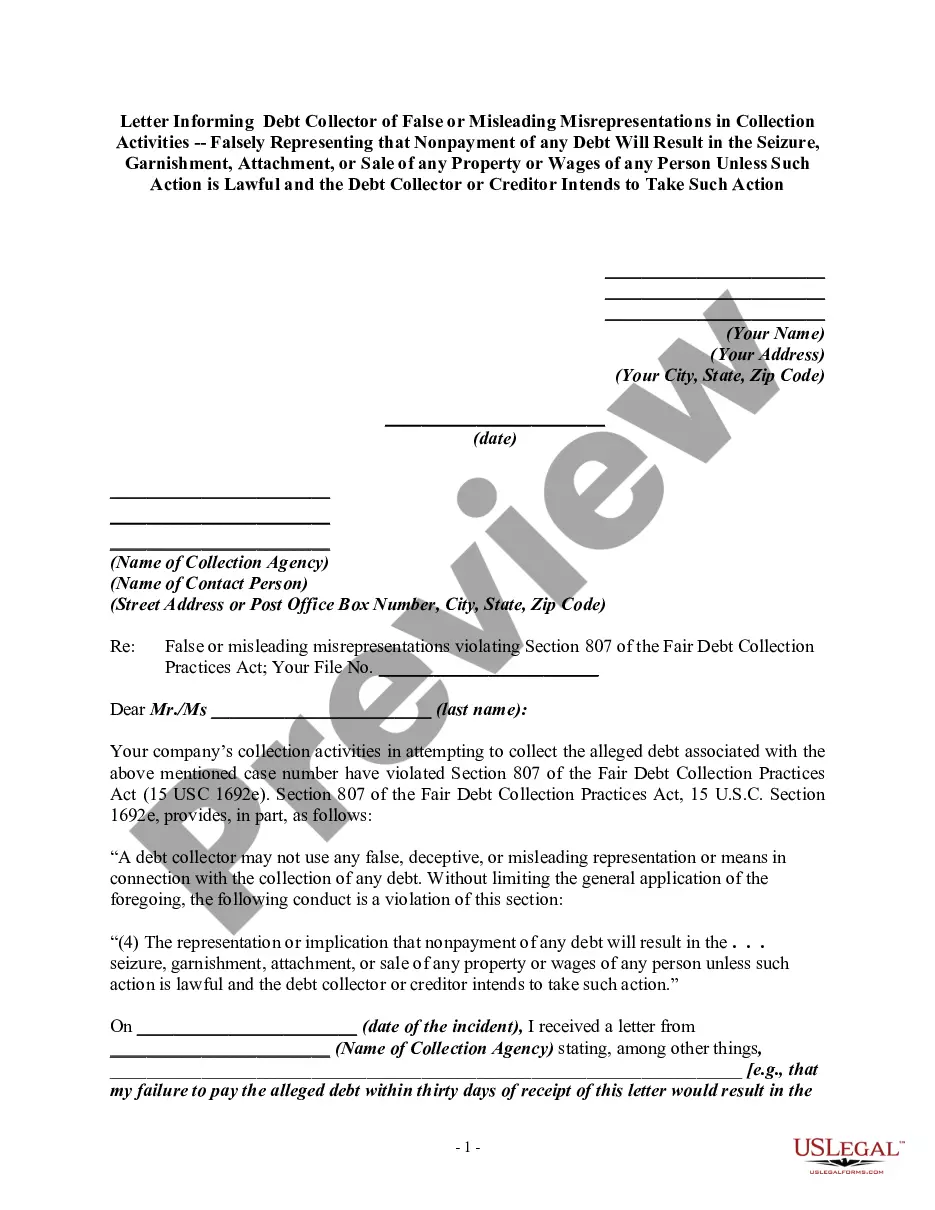

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) The representation or implication that nonpayment of any debt will result in the . . . seizure, garnishment, attachment, or sale of any property or wages of any person unless such action is lawful and the debt collector or creditor intends to take such action."

Broward County, Florida is home to millions of residents and encompasses various cities such as Fort Lauderdale, Hollywood, and Pompano Beach. It is vital for individuals in Broward to be aware of their rights when dealing with debt collectors who may engage in false or misleading misrepresentations in collection activities. One specific type of letter that can be used to address deceptive debt collection practices involves false representations indicating that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of property or wages. This is an illegal and unethical practice employed by some debt collectors to intimidate and mislead individuals facing financial difficulties. When drafting a Broward Florida Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities, it is important to include relevant information to strengthen your claim. Begin by clearly stating your name, address, and contact information. Address the letter to the specific debt collector and include their name, company, and address. It is crucial to mention the specific communication that contained the false or misleading misrepresentations regarding the consequences of nonpayment. Reiterate the deceptive statements that have been made by the debt collector. This could include claims such as the immediate seizure of bank accounts or assets, wage garnishment without proper legal proceedings, or threats of property auctions. Mention any documentation or evidence you have to support your claim, such as copies of misleading letters or recordings of phone conversations. Emphasize that these misrepresentations are in direct violation of the Fair Debt Collection Practices Act (FD CPA), a federal law meant to protect consumers from abusive debt collection practices. State that you are aware of your rights under the FD CPA and will not tolerate any further deceptive actions. Demand that the debt collector cease all false or misleading misrepresentations immediately. State that any further communication containing such misrepresentations will be documented and necessary action will be taken against them, which may involve reporting their actions to the Federal Trade Commission, the Consumer Financial Protection Bureau, and the Attorney General of Florida. Close the letter by requesting written confirmation that they have received and understood your message. Include a deadline for their response and provide your preferred method of contact for their reply, whether it be by mail or email. It is crucial to remain professional throughout the letter and maintain accurate and clear records of all communication with the debt collector. Remember to keep copies of any letters or emails sent and received, as well as any other relevant documentation. By asserting your rights and addressing the false or misleading misrepresentations of debt collectors, you can protect yourself and contribute to a fair and transparent debt collection process in Broward County, Florida.Broward County, Florida is home to millions of residents and encompasses various cities such as Fort Lauderdale, Hollywood, and Pompano Beach. It is vital for individuals in Broward to be aware of their rights when dealing with debt collectors who may engage in false or misleading misrepresentations in collection activities. One specific type of letter that can be used to address deceptive debt collection practices involves false representations indicating that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of property or wages. This is an illegal and unethical practice employed by some debt collectors to intimidate and mislead individuals facing financial difficulties. When drafting a Broward Florida Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities, it is important to include relevant information to strengthen your claim. Begin by clearly stating your name, address, and contact information. Address the letter to the specific debt collector and include their name, company, and address. It is crucial to mention the specific communication that contained the false or misleading misrepresentations regarding the consequences of nonpayment. Reiterate the deceptive statements that have been made by the debt collector. This could include claims such as the immediate seizure of bank accounts or assets, wage garnishment without proper legal proceedings, or threats of property auctions. Mention any documentation or evidence you have to support your claim, such as copies of misleading letters or recordings of phone conversations. Emphasize that these misrepresentations are in direct violation of the Fair Debt Collection Practices Act (FD CPA), a federal law meant to protect consumers from abusive debt collection practices. State that you are aware of your rights under the FD CPA and will not tolerate any further deceptive actions. Demand that the debt collector cease all false or misleading misrepresentations immediately. State that any further communication containing such misrepresentations will be documented and necessary action will be taken against them, which may involve reporting their actions to the Federal Trade Commission, the Consumer Financial Protection Bureau, and the Attorney General of Florida. Close the letter by requesting written confirmation that they have received and understood your message. Include a deadline for their response and provide your preferred method of contact for their reply, whether it be by mail or email. It is crucial to remain professional throughout the letter and maintain accurate and clear records of all communication with the debt collector. Remember to keep copies of any letters or emails sent and received, as well as any other relevant documentation. By asserting your rights and addressing the false or misleading misrepresentations of debt collectors, you can protect yourself and contribute to a fair and transparent debt collection process in Broward County, Florida.