Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) The representation or implication that nonpayment of any debt will result in the . . . seizure, garnishment, attachment, or sale of any property or wages of any person unless such action is lawful and the debt collector or creditor intends to take such action."

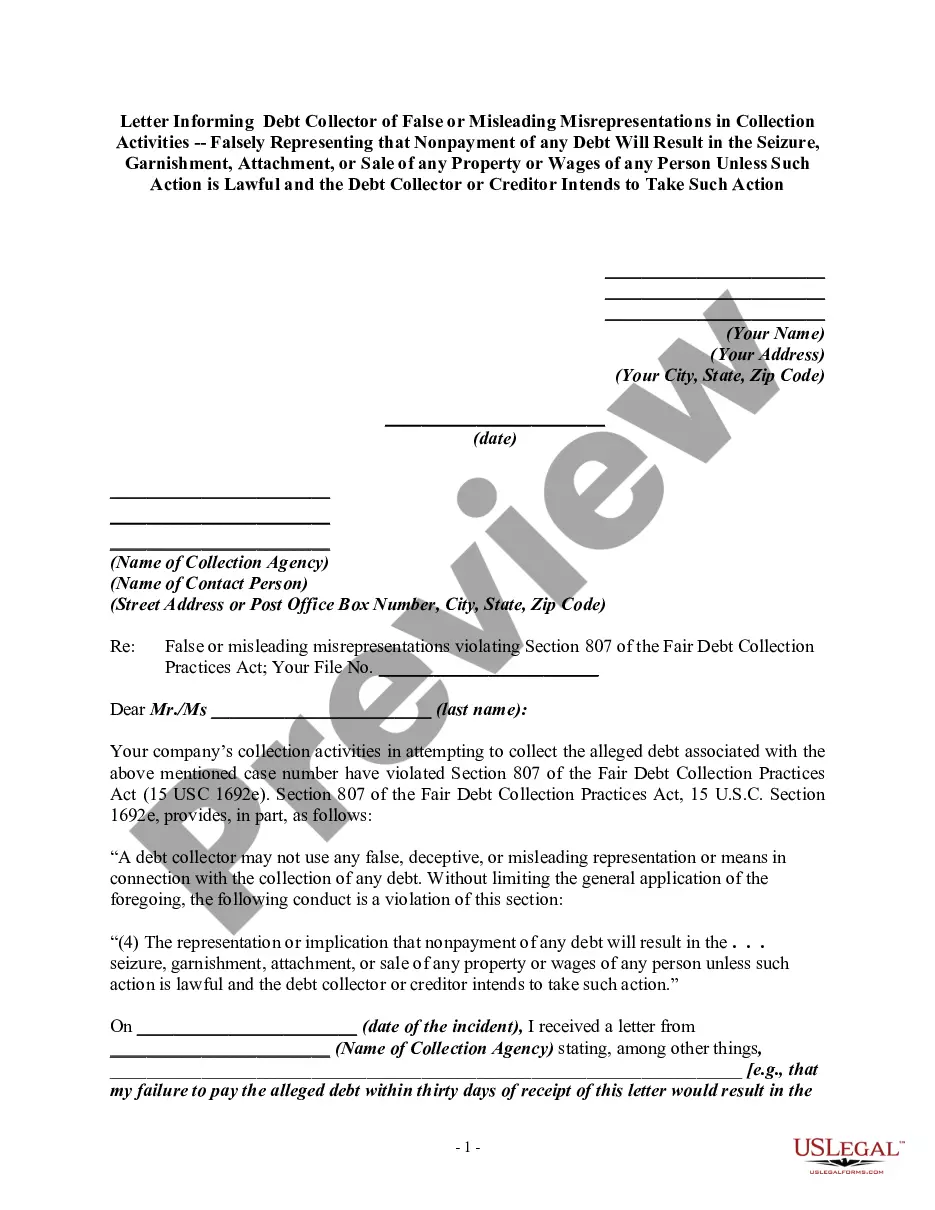

Fairfax Virginia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Falsely Representing that Nonpayment of any Debt Will Result in the Seizure, Garnishment, Attachment, or Sale of any Property or Wages In Fairfax, Virginia, consumers are protected by various laws against false or misleading representations made by debt collectors. One such protection is the ability to write a letter to inform a debt collector of any false or misleading statements regarding the consequences of nonpayment of a debt. It is crucial to address these misrepresentations promptly to safeguard your rights and prevent any further harassment or deceptive practices. When drafting a Fairfax Virginia letter informing a debt collector of such false or misleading claims, there are a few key points to consider. First, clearly state your name, address, and contact information at the top of the letter. This ensures that the debt collector can easily identify you and respond accordingly. Next, provide a concise overview of the specific misrepresentations made by the debt collector. In this case, focus on the representation that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of any property or wages. Be sure to mention any instances where this information was provided in writing, over the phone, or during any communication with the debt collector. To strengthen your case, include references to relevant laws and regulations that prohibit such false or misleading representations. These might include the Fair Debt Collection Practices Act (FD CPA), which outlines specific rules for debt collectors, and any specific consumer protection laws in Fairfax, Virginia. Furthermore, clearly state your expectation that the debt collector immediately cease making such false or misleading representations regarding the consequences of nonpayment. Request written confirmation from the debt collector that they have received your letter and will comply with your demands. Proof of delivery is crucial. Send your letter via certified mail with return receipt requested, ensuring that you have evidence of receipt by the debt collector. Keep a copy of the letter, as well as the receipt, for your records and potential future legal action if the debt collector fails to comply. Lastly, conclude your letter with a reminder of your rights as a consumer and the potential consequences the debt collector may face for violating those rights. Mention the possibility of taking legal action if necessary. Remember, it is essential to consult with a legal professional or a consumer protection agency in Fairfax, Virginia, to ensure that your letter is tailored to your specific case and compliant with all relevant laws. By promptly addressing false or misleading representations by debt collectors, you can protect yourself and assert your rights as a consumer in Fairfax, Virginia.Fairfax Virginia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Falsely Representing that Nonpayment of any Debt Will Result in the Seizure, Garnishment, Attachment, or Sale of any Property or Wages In Fairfax, Virginia, consumers are protected by various laws against false or misleading representations made by debt collectors. One such protection is the ability to write a letter to inform a debt collector of any false or misleading statements regarding the consequences of nonpayment of a debt. It is crucial to address these misrepresentations promptly to safeguard your rights and prevent any further harassment or deceptive practices. When drafting a Fairfax Virginia letter informing a debt collector of such false or misleading claims, there are a few key points to consider. First, clearly state your name, address, and contact information at the top of the letter. This ensures that the debt collector can easily identify you and respond accordingly. Next, provide a concise overview of the specific misrepresentations made by the debt collector. In this case, focus on the representation that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of any property or wages. Be sure to mention any instances where this information was provided in writing, over the phone, or during any communication with the debt collector. To strengthen your case, include references to relevant laws and regulations that prohibit such false or misleading representations. These might include the Fair Debt Collection Practices Act (FD CPA), which outlines specific rules for debt collectors, and any specific consumer protection laws in Fairfax, Virginia. Furthermore, clearly state your expectation that the debt collector immediately cease making such false or misleading representations regarding the consequences of nonpayment. Request written confirmation from the debt collector that they have received your letter and will comply with your demands. Proof of delivery is crucial. Send your letter via certified mail with return receipt requested, ensuring that you have evidence of receipt by the debt collector. Keep a copy of the letter, as well as the receipt, for your records and potential future legal action if the debt collector fails to comply. Lastly, conclude your letter with a reminder of your rights as a consumer and the potential consequences the debt collector may face for violating those rights. Mention the possibility of taking legal action if necessary. Remember, it is essential to consult with a legal professional or a consumer protection agency in Fairfax, Virginia, to ensure that your letter is tailored to your specific case and compliant with all relevant laws. By promptly addressing false or misleading representations by debt collectors, you can protect yourself and assert your rights as a consumer in Fairfax, Virginia.