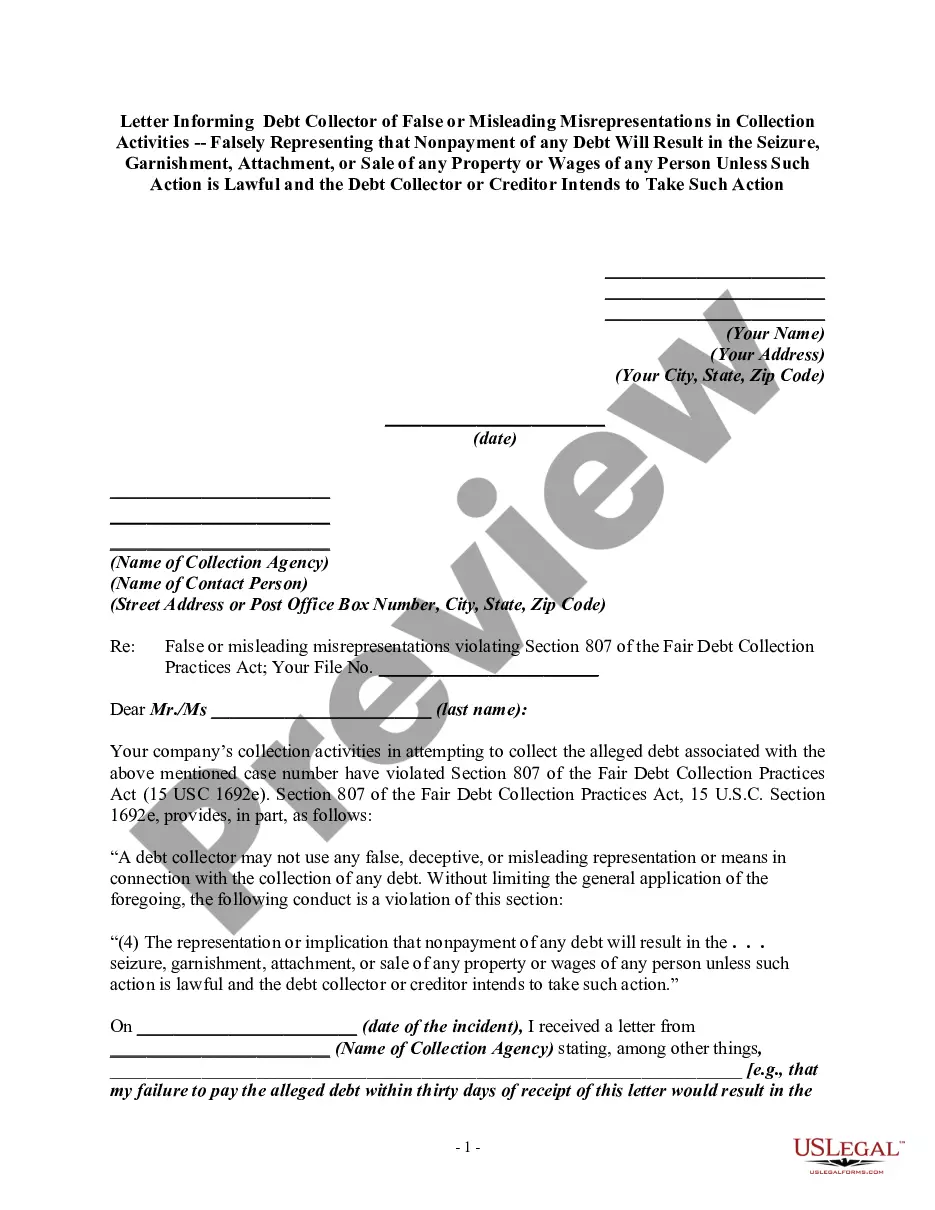

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(4) The representation or implication that nonpayment of any debt will result in the . . . seizure, garnishment, attachment, or sale of any property or wages of any person unless such action is lawful and the debt collector or creditor intends to take such action."

Keyword: Fulton Georgia, Debt collector, False or misleading misrepresentations, Collection activities, Seizure, Garnishment, Attachment, Sale of property, Sale of wages Title: Understanding Fulton Georgia Debt Collection Laws: Correcting False Representations Regarding Debt Payments Introduction: In the state of Fulton, Georgia, individuals facing debt collection efforts are protected by consumer rights laws. These laws prohibit debt collectors from engaging in false or misleading misrepresentations during their collection activities. One common misrepresentation is the false claim that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of property or wages. This letter serves as notice to debt collectors engaging in such practices, informing them of the inaccuracies in their claims and demanding adherence to the law. Body: 1. Identifying the Debt Collector and the Debtor: Clearly state the name and contact information of the debt collector, as well as your own details as the debtor. Mention any previous communications or encounters with the debt collector. 2. False or Misleading Misrepresentations: Point out specific instances where the debt collector falsely represented that nonpayment of debts results in the seizure, garnishment, attachment, or sale of property or wages. Provide dates, times, and any supporting evidence (if available), such as recorded phone calls or written correspondence. 3. Understanding Fulton Georgia Debt Collection Laws: Explain that under Fulton Georgia laws, debt collectors are prohibited from making false, deceptive, or misleading representations regarding the consequences of nonpayment of debts. Outline relevant sections of the law that apply to the debt collector's actions. 4. Correcting the Misrepresentations: Clearly state that the debt collector's claims mentioned earlier are false and misleading under Fulton Georgia debt collection laws. Emphasize that nonpayment cannot automatically result in seizure, garnishment, attachment, or sale of property or wages without proper legal processes. 5. Demand for Compliance: Demand that the debt collector immediately ceases all false or misleading representations regarding the consequences of debt nonpayment. Specify a reasonable time frame within which the debt collector must provide written confirmation of their intent to comply with the law. 6. Warning of Legal Action: Inform the debt collector that failure to comply with the demand may result in legal action, including reporting the violation to the appropriate regulatory bodies, filing a complaint with the Attorney General's office or seeking redress through a civil lawsuit. Highlight that monetary damages, attorney's fees, and court costs may be sought if necessary. Conclusion: Reiterate the importance of adhering to Fulton Georgia debt collection laws and emphasize the seriousness of the false or misleading misrepresentations made by the debt collector. Encourage them to rectify their practices promptly to avoid any further legal consequences. Remember to consult legal professionals or consumer protection agencies for further guidance on addressing and rectifying debt collectors' false or misleading misrepresentations in Fulton Georgia.Keyword: Fulton Georgia, Debt collector, False or misleading misrepresentations, Collection activities, Seizure, Garnishment, Attachment, Sale of property, Sale of wages Title: Understanding Fulton Georgia Debt Collection Laws: Correcting False Representations Regarding Debt Payments Introduction: In the state of Fulton, Georgia, individuals facing debt collection efforts are protected by consumer rights laws. These laws prohibit debt collectors from engaging in false or misleading misrepresentations during their collection activities. One common misrepresentation is the false claim that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of property or wages. This letter serves as notice to debt collectors engaging in such practices, informing them of the inaccuracies in their claims and demanding adherence to the law. Body: 1. Identifying the Debt Collector and the Debtor: Clearly state the name and contact information of the debt collector, as well as your own details as the debtor. Mention any previous communications or encounters with the debt collector. 2. False or Misleading Misrepresentations: Point out specific instances where the debt collector falsely represented that nonpayment of debts results in the seizure, garnishment, attachment, or sale of property or wages. Provide dates, times, and any supporting evidence (if available), such as recorded phone calls or written correspondence. 3. Understanding Fulton Georgia Debt Collection Laws: Explain that under Fulton Georgia laws, debt collectors are prohibited from making false, deceptive, or misleading representations regarding the consequences of nonpayment of debts. Outline relevant sections of the law that apply to the debt collector's actions. 4. Correcting the Misrepresentations: Clearly state that the debt collector's claims mentioned earlier are false and misleading under Fulton Georgia debt collection laws. Emphasize that nonpayment cannot automatically result in seizure, garnishment, attachment, or sale of property or wages without proper legal processes. 5. Demand for Compliance: Demand that the debt collector immediately ceases all false or misleading representations regarding the consequences of debt nonpayment. Specify a reasonable time frame within which the debt collector must provide written confirmation of their intent to comply with the law. 6. Warning of Legal Action: Inform the debt collector that failure to comply with the demand may result in legal action, including reporting the violation to the appropriate regulatory bodies, filing a complaint with the Attorney General's office or seeking redress through a civil lawsuit. Highlight that monetary damages, attorney's fees, and court costs may be sought if necessary. Conclusion: Reiterate the importance of adhering to Fulton Georgia debt collection laws and emphasize the seriousness of the false or misleading misrepresentations made by the debt collector. Encourage them to rectify their practices promptly to avoid any further legal consequences. Remember to consult legal professionals or consumer protection agencies for further guidance on addressing and rectifying debt collectors' false or misleading misrepresentations in Fulton Georgia.