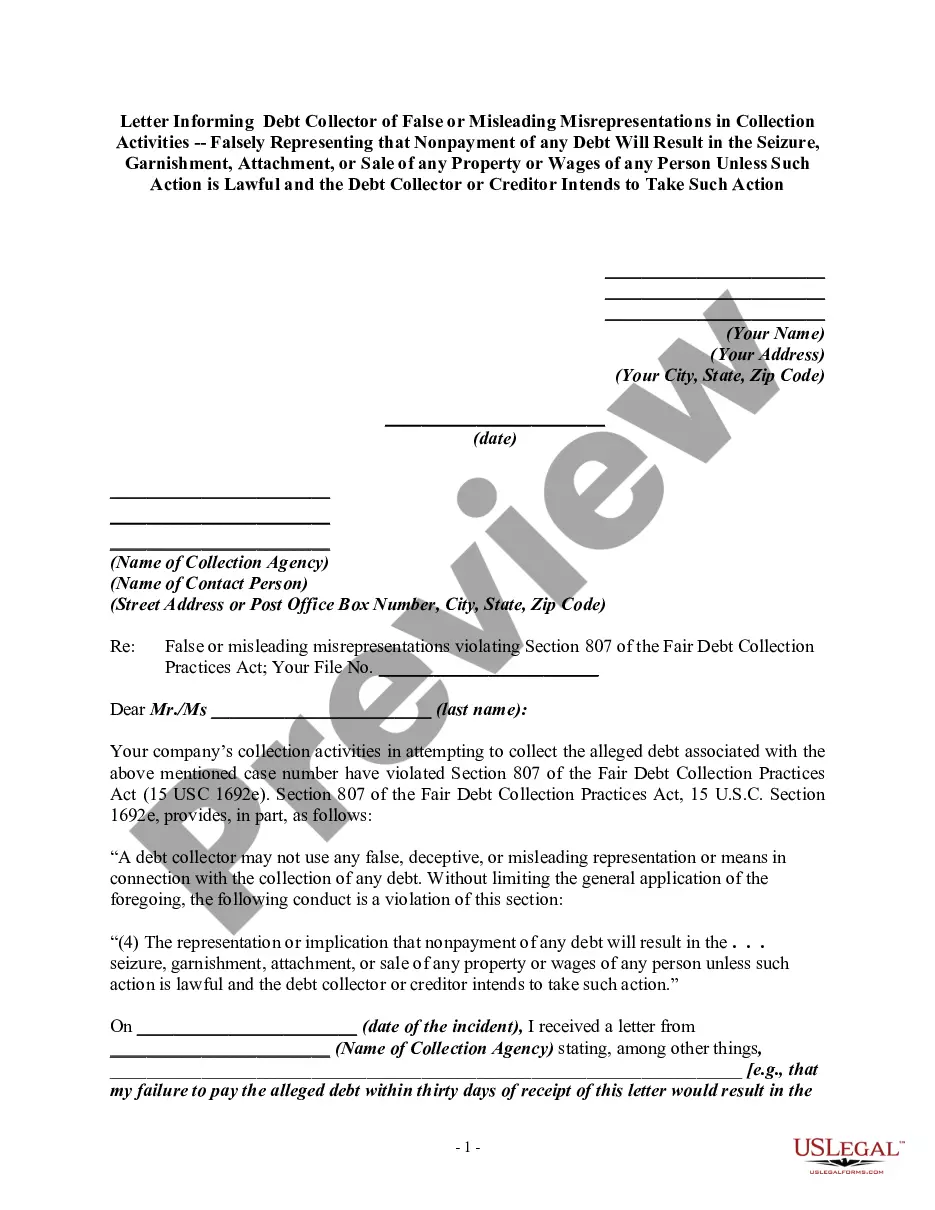

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

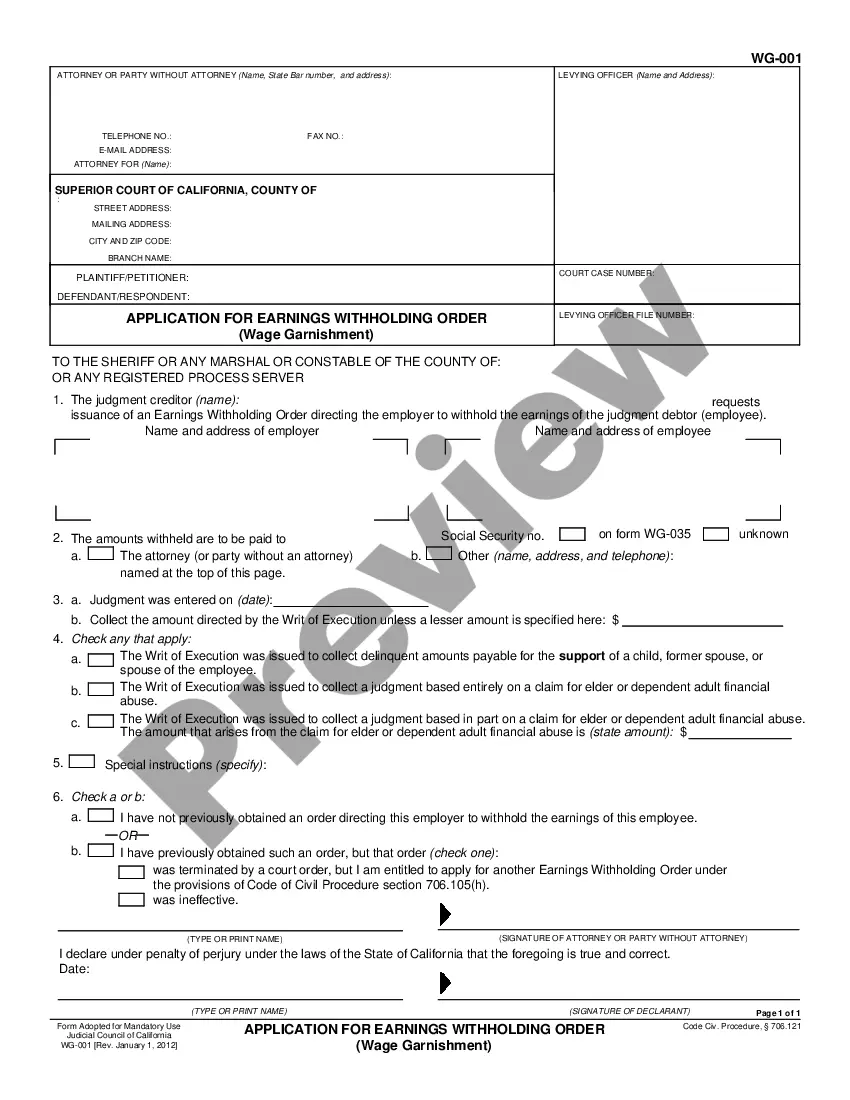

"(4) The representation or implication that nonpayment of any debt will result in the . . . seizure, garnishment, attachment, or sale of any property or wages of any person unless such action is lawful and the debt collector or creditor intends to take such action."

Oakland, Michigan is a vibrant county located in the southeastern region of the state. With its diverse communities, thriving economy, and stunning natural landscapes, Oakland offers a high quality of life to its residents. This bustling county is home to numerous townships, cities, and villages, each with its unique charm and character. One of the pressing concerns that individuals in Oakland, Michigan may face is dealing with debt collectors who engage in false or misleading misrepresentations in their collection activities. When debt collectors falsely represent that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of any property or wages, it is essential to address this issue promptly and assertively. To combat this unethical behavior, individuals can draft a letter informing the debt collector of their false or misleading misrepresentations. This letter aims to assert the rights of the debtor and bring attention to the debt collector's deceptive practices. By using relevant keywords, the purpose of the letter is effectively communicated and its impact maximized. Some different types of letters that can be used in Oakland, Michigan to address this misleading collection activity may include: 1. Formal Letter: This type of letter should be written in a professional tone, addressing the debt collector by name and providing clear details of the false or misleading representations made. It is important to include specific instances and dates to support the claim. 2. Cease and Desist Letter: This letter emphasizes the debtor's request for the debt collector to immediately cease all misleading collection activities. It serves as a warning and asserts the debtor's rights under the Fair Debt Collection Practices Act. 3. Dispute Letter: If the debtor believes that the debt is erroneous or wants to dispute the amount owed, a dispute letter can be drafted. In addition to addressing the false representations made, this letter also requests validation of the debt and suggests proper resolution methods. 4. Consumer Complaint Letter: If the debt collector continues engaging in false or misleading misrepresentations despite previous letters, a consumer complaint letter may be necessary. This letter can be sent to appropriate regulatory agencies, such as the Consumer Financial Protection Bureau or the Michigan Attorney General's Office, to report the debt collector's unlawful activities. Regardless of the specific type of letter, it is crucial to clearly state in the content that the debtor is aware of their rights under the Fair Debt Collection Practices Act and that any further false or misleading practices will not be tolerated. Additionally, individuals should seek legal advice or consult with a debt relief professional to ensure that their rights are protected and that they can navigate the debt collection process effectively. In conclusion, individuals in Oakland, Michigan who find themselves victims of debt collectors making false or misleading misrepresentations should take immediate action. By drafting a well-crafted letter using relevant keywords, debtors can assert their rights and put an end to these unscrupulous practices. Remember to keep copies of all communication and consult with legal professionals for guidance throughout the process.Oakland, Michigan is a vibrant county located in the southeastern region of the state. With its diverse communities, thriving economy, and stunning natural landscapes, Oakland offers a high quality of life to its residents. This bustling county is home to numerous townships, cities, and villages, each with its unique charm and character. One of the pressing concerns that individuals in Oakland, Michigan may face is dealing with debt collectors who engage in false or misleading misrepresentations in their collection activities. When debt collectors falsely represent that nonpayment of any debt will result in the seizure, garnishment, attachment, or sale of any property or wages, it is essential to address this issue promptly and assertively. To combat this unethical behavior, individuals can draft a letter informing the debt collector of their false or misleading misrepresentations. This letter aims to assert the rights of the debtor and bring attention to the debt collector's deceptive practices. By using relevant keywords, the purpose of the letter is effectively communicated and its impact maximized. Some different types of letters that can be used in Oakland, Michigan to address this misleading collection activity may include: 1. Formal Letter: This type of letter should be written in a professional tone, addressing the debt collector by name and providing clear details of the false or misleading representations made. It is important to include specific instances and dates to support the claim. 2. Cease and Desist Letter: This letter emphasizes the debtor's request for the debt collector to immediately cease all misleading collection activities. It serves as a warning and asserts the debtor's rights under the Fair Debt Collection Practices Act. 3. Dispute Letter: If the debtor believes that the debt is erroneous or wants to dispute the amount owed, a dispute letter can be drafted. In addition to addressing the false representations made, this letter also requests validation of the debt and suggests proper resolution methods. 4. Consumer Complaint Letter: If the debt collector continues engaging in false or misleading misrepresentations despite previous letters, a consumer complaint letter may be necessary. This letter can be sent to appropriate regulatory agencies, such as the Consumer Financial Protection Bureau or the Michigan Attorney General's Office, to report the debt collector's unlawful activities. Regardless of the specific type of letter, it is crucial to clearly state in the content that the debtor is aware of their rights under the Fair Debt Collection Practices Act and that any further false or misleading practices will not be tolerated. Additionally, individuals should seek legal advice or consult with a debt relief professional to ensure that their rights are protected and that they can navigate the debt collection process effectively. In conclusion, individuals in Oakland, Michigan who find themselves victims of debt collectors making false or misleading misrepresentations should take immediate action. By drafting a well-crafted letter using relevant keywords, debtors can assert their rights and put an end to these unscrupulous practices. Remember to keep copies of all communication and consult with legal professionals for guidance throughout the process.