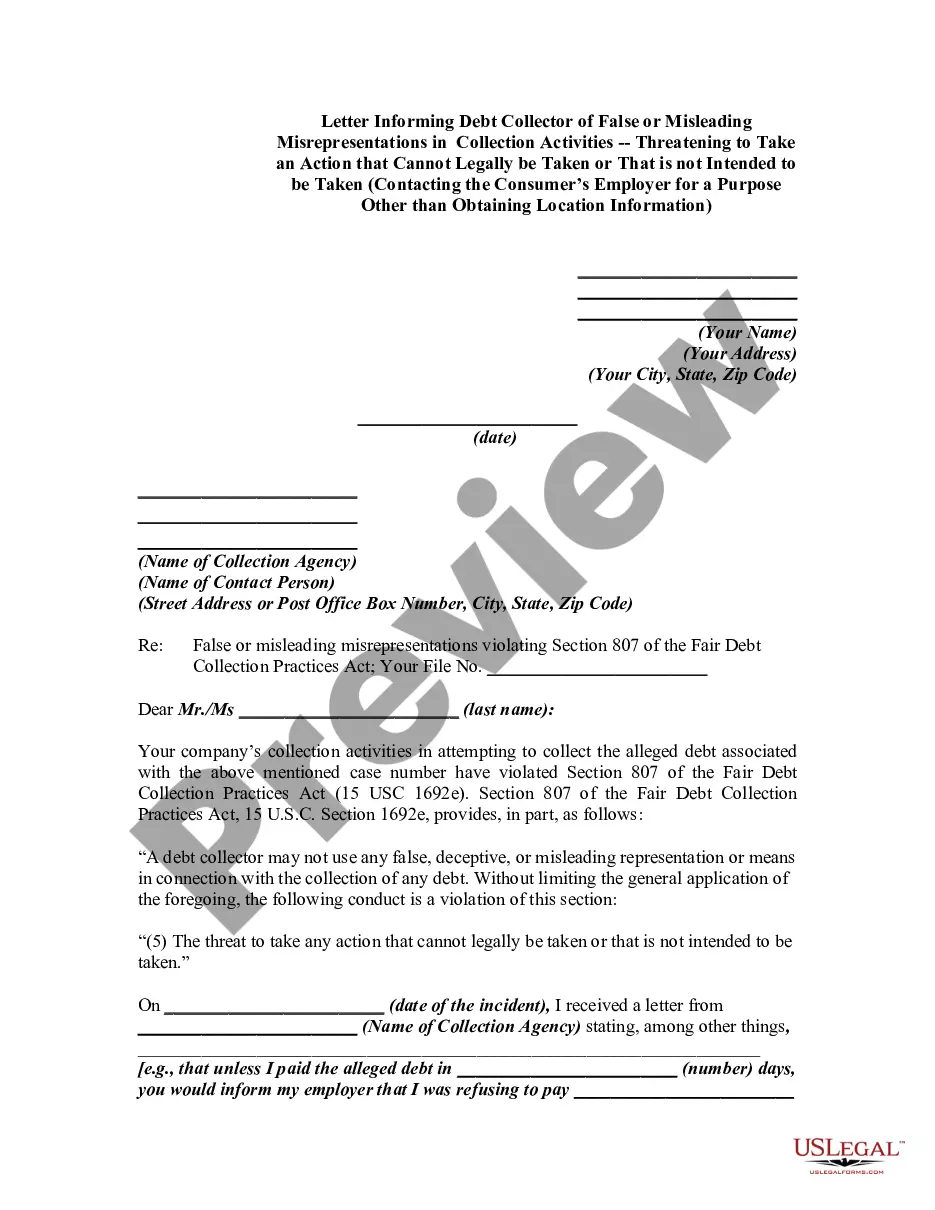

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(5) The threat to take any action that cannot legally be taken or that is not intended to be taken."

It is a violation of the Fair Debt Collection Practices Act to contact a consumer debtor's employer for a purpose other than to obtain location information.

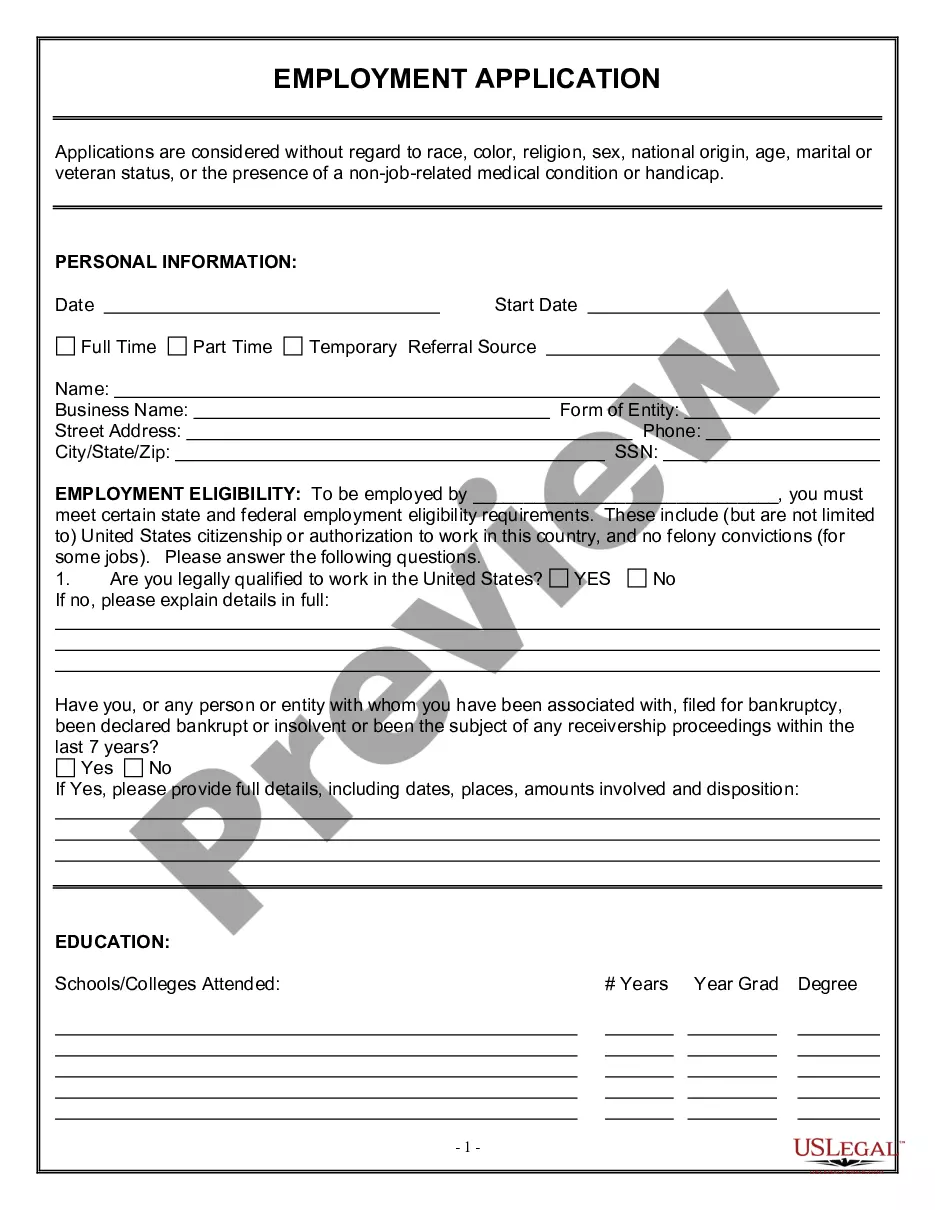

Title: Franklin Ohio Letter Informing Debt Collector of False or Misleading Representations and Unauthorized Employer Contact Introduction: In Franklin, Ohio, individuals facing debt collection activities may encounter situations where debt collectors resort to false or misleading misrepresentations to pressure consumers unjustly. This letter template provides a detailed description of such tactics, specifically focusing on threatening actions that cannot legally be taken or actions not intended to be taken, including unauthorized contact with the consumer's employer. By using this letter, individuals can inform debt collectors of their violations and demand immediate cessation of these unlawful activities. Dear [Debt Collector's Name/Agency], I am writing to inform you of my concerns regarding your recent debt collection activities related to an alleged debt. I have become aware of several false or misleading misrepresentations made, as well as your unauthorized contact with my employer, which is in direct violation of my rights under the Fair Debt Collection Practices Act (FD CPA). 1. False or Misleading Misrepresentations: In recent communications with your agency, you have made false or misleading statements regarding the consequences I may face if I do not immediately satisfy the alleged debt. These include threats of actions that cannot legally be taken or are not intended to be taken. Such misrepresentations are deceptive and in direct violation of the FD CPA. Examples of false or misleading representations employed by your agency include: — Misrepresenting the legal consequences, such as arrest or imprisonment, for not paying the alleged debt. — Falsely claiming that legal action has been taken or that a lawsuit has been filed against me when it has not. — Threatening to garnish wages, seize property, or take other actions not permitted under applicable laws without a court order. — Falsely representing that your agency is affiliated with a government agency or a licensed attorney. 2. Unauthorized Employer Contact: Your agency's recent attempt to contact my employer regarding the alleged debt is both unauthorized and a clear violation of the FD CPA. Contacting my employer not only exposes my personal financial situation but also goes against the statutory provisions protecting consumer privacy. The FD CPA explicitly prohibits debt collectors from engaging in any communication with non-consenting third parties, including my employer. I demand that you immediately cease all unauthorized communication with my employer and refrain from involving them in any further debt collection activities. Compliance Demands: I expect your agency to address the following demands promptly: 1. Confirm in writing that you acknowledge receipt of this letter. 2. Cease all false or misleading misrepresentations used to pressure me unlawfully. 3. Terminate any unauthorized contact with my employer or any other non-consenting third parties. 4. Refrain from any future threats or actions that cannot legally be taken or are not intended to be taken regarding the allegedly owed debt. Failure to comply with these demands will be considered a willful violation of the FD CPA, and I will not hesitate to take appropriate legal action to protect my rights. Please be aware that I am keeping a record of all communication to provide evidence of your agency's misconduct. I expect a written response within 30 days of your receipt of this letter, confirming your compliance with my demands. Any failure to do so will prompt me to report your agency's activities to the relevant regulatory authorities. Your immediate attention to this matter is greatly appreciated. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address]