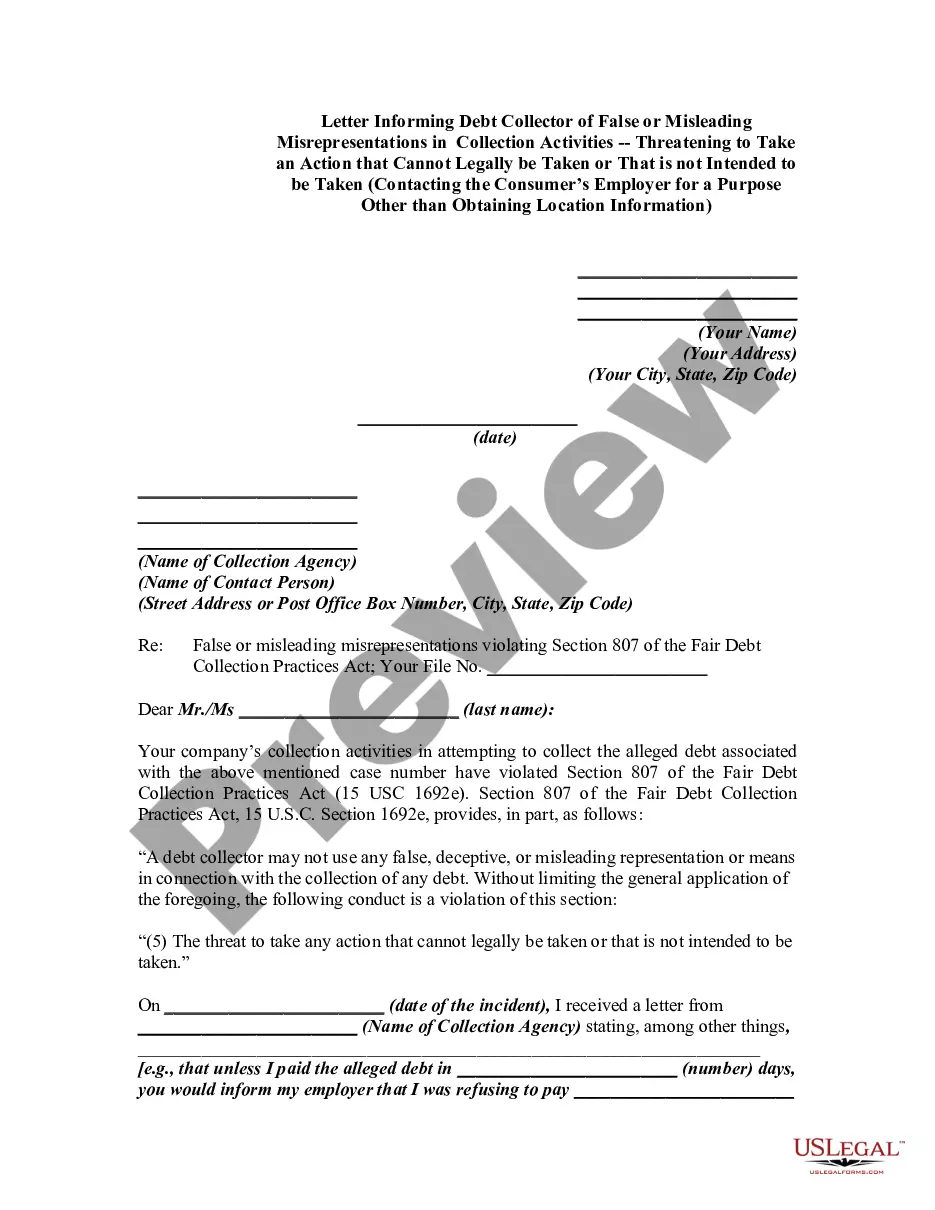

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(5) The threat to take any action that cannot legally be taken or that is not intended to be taken."

It is a violation of the Fair Debt Collection Practices Act to contact a consumer debtor's employer for a purpose other than to obtain location information.

Title: Hennepin Minnesota Letter: Protecting Consumers from False Collection Practices Introduction: The Hennepin Minnesota Letter serves as a powerful tool for residents to address false or misleading collection activities, specifically pertaining to debt collectors threatening actions that cannot legally be taken or actions not intended to be taken. This detailed description will outline the importance of this letter, common examples of misleading collection tactics, and steps to draft an effective Hennepin Minnesota Letter to inform debt collectors of such misrepresentations. 1. Understanding False or Misleading Misrepresentations: a) Threatening Actions that Cannot Legally be Taken: Debt collectors sometimes employ intimidating tactics, such as claiming to possess legal authority to seize property, initiate legal proceedings without proper grounds, or make baseless threats of wage garnishment or asset seizure. b) Threatening Actions That Are Not Intended to be Taken: Misleading debt collectors may employ deceptive strategies, falsely implying they will take legal actions, penalize the debtor's credit score, or contact their employer in an attempt to coerce payment. 2. Impact of False Collection Practices: a) Consumer Harassment: False or misleading misrepresentations can cause extreme anxiety, stress, and frustration for consumers, leading to a diminished quality of life and mental well-being. b) Legal Violations: Such misrepresentations by debt collectors often violate state and federal laws, including the Fair Debt Collection Practices Act (FD CPA). Knowing these violations can empower individuals to protect their rights. 3. The Importance of the Hennepin Minnesota Letter: The Hennepin Minnesota Letter is designed to establish communication with a debt collector engaging in unlawful practices and provide an opportunity for resolution. Sending this formal letter notifies the collector of their violations while also documenting the consumer's intent to protect their rights. 4. Drafting an Effective Hennepin Minnesota Letter: a) Contact Information: Provide personal and contact details, including full name, address, and phone number. b) Debt Collector Information: Include the name, address, and contact information of the debt collector, agency, or law firm involved. c) Description of Violations: Clearly articulate each instance of false or misleading representation made by the debt collector, mentioning the specific threats made and any supporting evidence available. d) Request for Action: Demand the immediate cessation of such deceptive tactics, along with a written confirmation of their compliance with the request. e) Legal Reminders: Reference relevant state and federal laws, such as the FD CPA or state laws governing debt collection practices, to reinforce the severity of the violations. f) Maintain a Professional Tone: Remain composed and professional throughout the letter, ensuring language remains respectful and concise. 5. Common Types of Misleading Collection Tactics: a) Threats of Wage Garnishment: falsely suggesting garnishing wages is imminent or using it as an intimidation tactic. b) False Claims of Legal Action: making baseless claims about initiating legal proceedings or taking legal action that is unlikely to transpire. c) Misleading Statements Regarding Credit Scores: claiming that non-payment will result in a significant, negative impact on the debtor's credit score. d) Unauthorized Discussions with Employers: contacting an employer to discuss the debtor's debt situation without proper authorization. Conclusion: The Hennepin Minnesota Letter is a powerful resource for individuals facing false or misleading collection activities. By addressing specific violations and maintaining a professional tone, this letter can effectively deter debt collectors from engaging in unlawful practices and ensure the protection of consumer rights.Title: Hennepin Minnesota Letter: Protecting Consumers from False Collection Practices Introduction: The Hennepin Minnesota Letter serves as a powerful tool for residents to address false or misleading collection activities, specifically pertaining to debt collectors threatening actions that cannot legally be taken or actions not intended to be taken. This detailed description will outline the importance of this letter, common examples of misleading collection tactics, and steps to draft an effective Hennepin Minnesota Letter to inform debt collectors of such misrepresentations. 1. Understanding False or Misleading Misrepresentations: a) Threatening Actions that Cannot Legally be Taken: Debt collectors sometimes employ intimidating tactics, such as claiming to possess legal authority to seize property, initiate legal proceedings without proper grounds, or make baseless threats of wage garnishment or asset seizure. b) Threatening Actions That Are Not Intended to be Taken: Misleading debt collectors may employ deceptive strategies, falsely implying they will take legal actions, penalize the debtor's credit score, or contact their employer in an attempt to coerce payment. 2. Impact of False Collection Practices: a) Consumer Harassment: False or misleading misrepresentations can cause extreme anxiety, stress, and frustration for consumers, leading to a diminished quality of life and mental well-being. b) Legal Violations: Such misrepresentations by debt collectors often violate state and federal laws, including the Fair Debt Collection Practices Act (FD CPA). Knowing these violations can empower individuals to protect their rights. 3. The Importance of the Hennepin Minnesota Letter: The Hennepin Minnesota Letter is designed to establish communication with a debt collector engaging in unlawful practices and provide an opportunity for resolution. Sending this formal letter notifies the collector of their violations while also documenting the consumer's intent to protect their rights. 4. Drafting an Effective Hennepin Minnesota Letter: a) Contact Information: Provide personal and contact details, including full name, address, and phone number. b) Debt Collector Information: Include the name, address, and contact information of the debt collector, agency, or law firm involved. c) Description of Violations: Clearly articulate each instance of false or misleading representation made by the debt collector, mentioning the specific threats made and any supporting evidence available. d) Request for Action: Demand the immediate cessation of such deceptive tactics, along with a written confirmation of their compliance with the request. e) Legal Reminders: Reference relevant state and federal laws, such as the FD CPA or state laws governing debt collection practices, to reinforce the severity of the violations. f) Maintain a Professional Tone: Remain composed and professional throughout the letter, ensuring language remains respectful and concise. 5. Common Types of Misleading Collection Tactics: a) Threats of Wage Garnishment: falsely suggesting garnishing wages is imminent or using it as an intimidation tactic. b) False Claims of Legal Action: making baseless claims about initiating legal proceedings or taking legal action that is unlikely to transpire. c) Misleading Statements Regarding Credit Scores: claiming that non-payment will result in a significant, negative impact on the debtor's credit score. d) Unauthorized Discussions with Employers: contacting an employer to discuss the debtor's debt situation without proper authorization. Conclusion: The Hennepin Minnesota Letter is a powerful resource for individuals facing false or misleading collection activities. By addressing specific violations and maintaining a professional tone, this letter can effectively deter debt collectors from engaging in unlawful practices and ensure the protection of consumer rights.