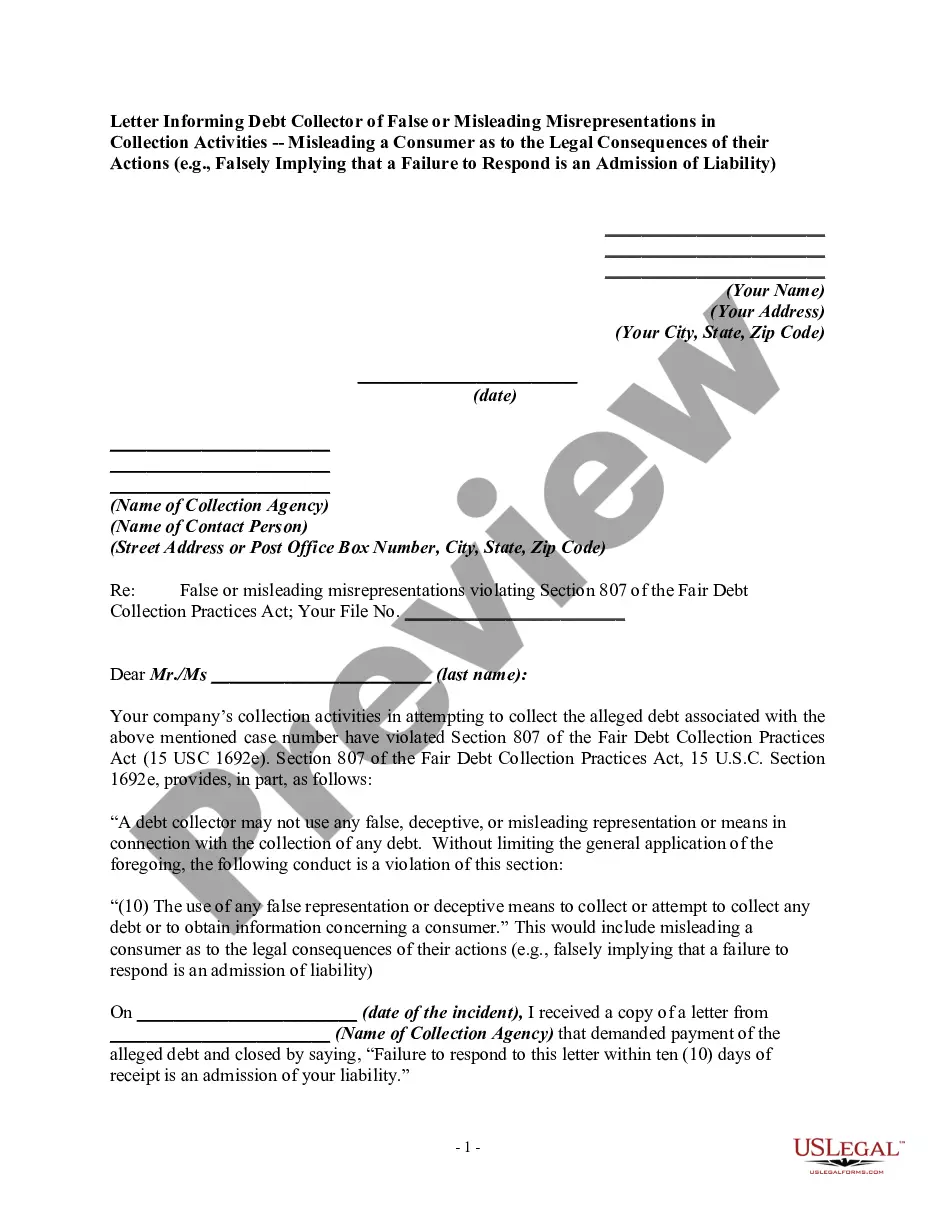

Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

This would include misleading a consumer as to the legal consequences of their actions (e.g., falsely implying that a failure to respond is an admission of liability).

Title: Fairfax Virginia Letter: Exposing False or Misleading Debt Collection Activities Introduction: As a consumer in Fairfax, Virginia, it is essential to be aware of your rights when dealing with debt collectors. The Fair Debt Collection Practices Act (FD CPA) prohibits debt collectors from engaging in false or misleading misrepresentations during the collection process. This comprehensive letter template will help you inform a debt collector about any false or misleading tactics they have employed, specifically by misleading you regarding the legal consequences of your actions. By using this letter, you can assert your rights as a consumer and hold debt collectors accountable for their misleading conduct. Letter Content: [Your Name] [Your Address] [City, State, Zip Code] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, Zip Code] Subject: False or Misleading Misrepresentations in Collection Activities Dear [Debt Collector's Name], I am writing to inform you of the false or misleading misrepresentations I have encountered during your debt collection activities concerning the alleged debt [reference account number or any other relevant information]. Firstly, I would like to express my concern regarding the misleading statements you made regarding the legal consequences of my actions. It has come to my attention that your agency has been implying that a failure to respond to your communication is an admission of liability. This representation is both false and misleading under the regulations set forth by the Fair Debt Collection Practices Act (FD CPA). According to the FD CPA, a failure to respond to a debt collection notice does not in any way imply an admission of liability. Federal law clearly protects consumers from such false implications used to coerce or deceive them into making payments or admitting responsibility for an alleged debt. I kindly request that you immediately cease and desist from making false or misleading statements, including any statements suggesting that my silence or failure to respond will be construed as an admission of liability. Failure to comply with this request will result in my filing a complaint with proper authorities, as permitted under the FD CPA. Furthermore, I kindly request that you formally investigate this matter within 30 days of receiving this letter. I expect a written response from your agency, indicating the actions taken to address this issue, and a confirmation that you will refrain from engaging in such misleading practices in the future. Please understand that I take this matter seriously and will exhaust all available legal avenues to protect my rights, should your agency persist with such false or misleading activities. Thank you for your immediate attention to this matter. I look forward to a prompt and satisfactory resolution to this dispute. Sincerely, [Your Name] Keywords: Fairfax Virginia, debt collector, false or misleading misrepresentations, collection activities, misleading consumer, legal consequences, admission of liability, debt collection notice, Fair Debt Collection Practices Act (FD CPA), cease and desist, filing a complaint, investigate the matter, protect consumer rights, prompt resolution, debt dispute.Title: Fairfax Virginia Letter: Exposing False or Misleading Debt Collection Activities Introduction: As a consumer in Fairfax, Virginia, it is essential to be aware of your rights when dealing with debt collectors. The Fair Debt Collection Practices Act (FD CPA) prohibits debt collectors from engaging in false or misleading misrepresentations during the collection process. This comprehensive letter template will help you inform a debt collector about any false or misleading tactics they have employed, specifically by misleading you regarding the legal consequences of your actions. By using this letter, you can assert your rights as a consumer and hold debt collectors accountable for their misleading conduct. Letter Content: [Your Name] [Your Address] [City, State, Zip Code] [Date] [Debt Collector's Name] [Debt Collector's Address] [City, State, Zip Code] Subject: False or Misleading Misrepresentations in Collection Activities Dear [Debt Collector's Name], I am writing to inform you of the false or misleading misrepresentations I have encountered during your debt collection activities concerning the alleged debt [reference account number or any other relevant information]. Firstly, I would like to express my concern regarding the misleading statements you made regarding the legal consequences of my actions. It has come to my attention that your agency has been implying that a failure to respond to your communication is an admission of liability. This representation is both false and misleading under the regulations set forth by the Fair Debt Collection Practices Act (FD CPA). According to the FD CPA, a failure to respond to a debt collection notice does not in any way imply an admission of liability. Federal law clearly protects consumers from such false implications used to coerce or deceive them into making payments or admitting responsibility for an alleged debt. I kindly request that you immediately cease and desist from making false or misleading statements, including any statements suggesting that my silence or failure to respond will be construed as an admission of liability. Failure to comply with this request will result in my filing a complaint with proper authorities, as permitted under the FD CPA. Furthermore, I kindly request that you formally investigate this matter within 30 days of receiving this letter. I expect a written response from your agency, indicating the actions taken to address this issue, and a confirmation that you will refrain from engaging in such misleading practices in the future. Please understand that I take this matter seriously and will exhaust all available legal avenues to protect my rights, should your agency persist with such false or misleading activities. Thank you for your immediate attention to this matter. I look forward to a prompt and satisfactory resolution to this dispute. Sincerely, [Your Name] Keywords: Fairfax Virginia, debt collector, false or misleading misrepresentations, collection activities, misleading consumer, legal consequences, admission of liability, debt collection notice, Fair Debt Collection Practices Act (FD CPA), cease and desist, filing a complaint, investigate the matter, protect consumer rights, prompt resolution, debt dispute.