Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

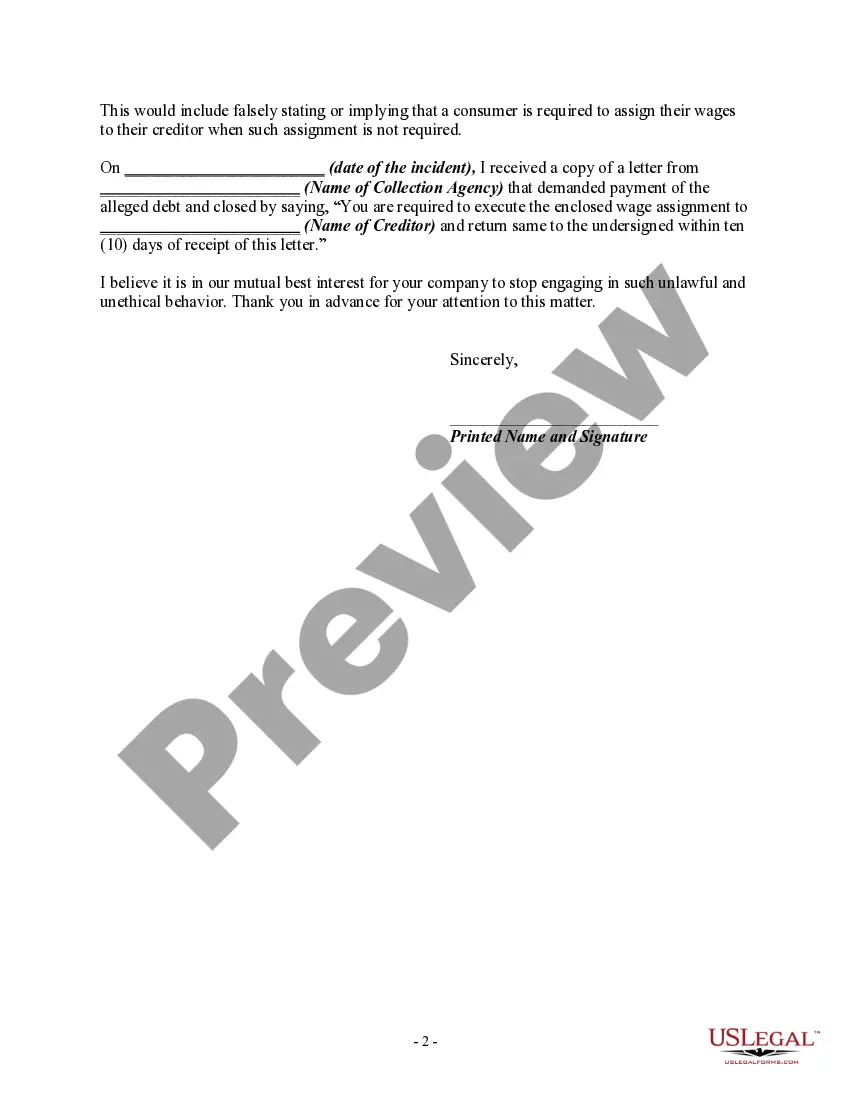

This would include falsely stating or implying that a consumer is required to assign their wages to their creditor when such assignment is not required.

Title: Contra Costa California: Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt Introduction: In Contra Costa County, California, individuals have legal protection against debt collectors who engage in false or misleading practices while attempting to collect a debt. This article provides a detailed description of the letter informing debt collectors of false or misleading misrepresentations in collection activities, specifically focusing on the use of false representation or deceptive means to collect a debt. Understanding and utilizing this letter can help individuals safeguard their rights and prevent deceptive debt collection practices. Keywords: Contra Costa California, debt collector, false or misleading misrepresentations, collection activities, false representation, deceptive means, collect a debt, letter informing, debt collection practices, legal protection, safeguard rights. Types of Contra Costa California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt: 1. Formal Notice: This type of letter is a legally structured document that serves as a formal notice to debt collectors, making them aware of false or misleading misrepresentations used during collection activities. It outlines specific instances where the debt collector employed false representation or deceptive means in an attempt to collect a debt. 2. Cease and Desist Letter: This letter requests that the debt collector immediately stop engaging in false or misleading misrepresentations while collecting a debt. It clearly communicates that such practices are deceptive and in violation of the law, demanding that the collector cease their activities. 3. Complaint Letter to Regulatory Authorities: In cases where a debt collector persistently engages in false or misleading misrepresentations, it may be necessary to escalate the matter by filing a complaint with the relevant regulatory authorities. This letter outlines the violations committed by the debt collector and requests an investigation into their practices. 4. Demand for Verification: This type of letter challenges the debt collector's claim and requests substantial evidence to prove the validity of the debt. It emphasizes that engaging in false representation or using deceptive means to collect a debt is unacceptable and provides a deadline for the debt collector to provide the required proof. 5. Notice of Intent to Take Legal Action: In situations where debt collectors continue to use false representation or deceptive means despite receiving earlier correspondence, this letter warns them of the intended legal action. It spells out the consequences they may face if they persist in their illegal collection tactics. Conclusion: By utilizing appropriately crafted letters, individuals in Contra Costa County, California, can notify debt collectors about false or misleading misrepresentations used during collection activities. The types of letters mentioned above help assert legal rights and protect against continued deceptive debt collection practices. It is crucial to consult with legal professionals or seek guidance from consumer protection agencies to ensure the effectiveness and compliance of these letters.Title: Contra Costa California: Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt Introduction: In Contra Costa County, California, individuals have legal protection against debt collectors who engage in false or misleading practices while attempting to collect a debt. This article provides a detailed description of the letter informing debt collectors of false or misleading misrepresentations in collection activities, specifically focusing on the use of false representation or deceptive means to collect a debt. Understanding and utilizing this letter can help individuals safeguard their rights and prevent deceptive debt collection practices. Keywords: Contra Costa California, debt collector, false or misleading misrepresentations, collection activities, false representation, deceptive means, collect a debt, letter informing, debt collection practices, legal protection, safeguard rights. Types of Contra Costa California Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities — Using False Representation or Deceptive Means to Collect a Debt: 1. Formal Notice: This type of letter is a legally structured document that serves as a formal notice to debt collectors, making them aware of false or misleading misrepresentations used during collection activities. It outlines specific instances where the debt collector employed false representation or deceptive means in an attempt to collect a debt. 2. Cease and Desist Letter: This letter requests that the debt collector immediately stop engaging in false or misleading misrepresentations while collecting a debt. It clearly communicates that such practices are deceptive and in violation of the law, demanding that the collector cease their activities. 3. Complaint Letter to Regulatory Authorities: In cases where a debt collector persistently engages in false or misleading misrepresentations, it may be necessary to escalate the matter by filing a complaint with the relevant regulatory authorities. This letter outlines the violations committed by the debt collector and requests an investigation into their practices. 4. Demand for Verification: This type of letter challenges the debt collector's claim and requests substantial evidence to prove the validity of the debt. It emphasizes that engaging in false representation or using deceptive means to collect a debt is unacceptable and provides a deadline for the debt collector to provide the required proof. 5. Notice of Intent to Take Legal Action: In situations where debt collectors continue to use false representation or deceptive means despite receiving earlier correspondence, this letter warns them of the intended legal action. It spells out the consequences they may face if they persist in their illegal collection tactics. Conclusion: By utilizing appropriately crafted letters, individuals in Contra Costa County, California, can notify debt collectors about false or misleading misrepresentations used during collection activities. The types of letters mentioned above help assert legal rights and protect against continued deceptive debt collection practices. It is crucial to consult with legal professionals or seek guidance from consumer protection agencies to ensure the effectiveness and compliance of these letters.