Creating forms, like Orange Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt, to take care of your legal affairs is a difficult and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. However, you can consider your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms intended for a variety of scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Orange Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt template. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Orange Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt:

- Ensure that your form is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

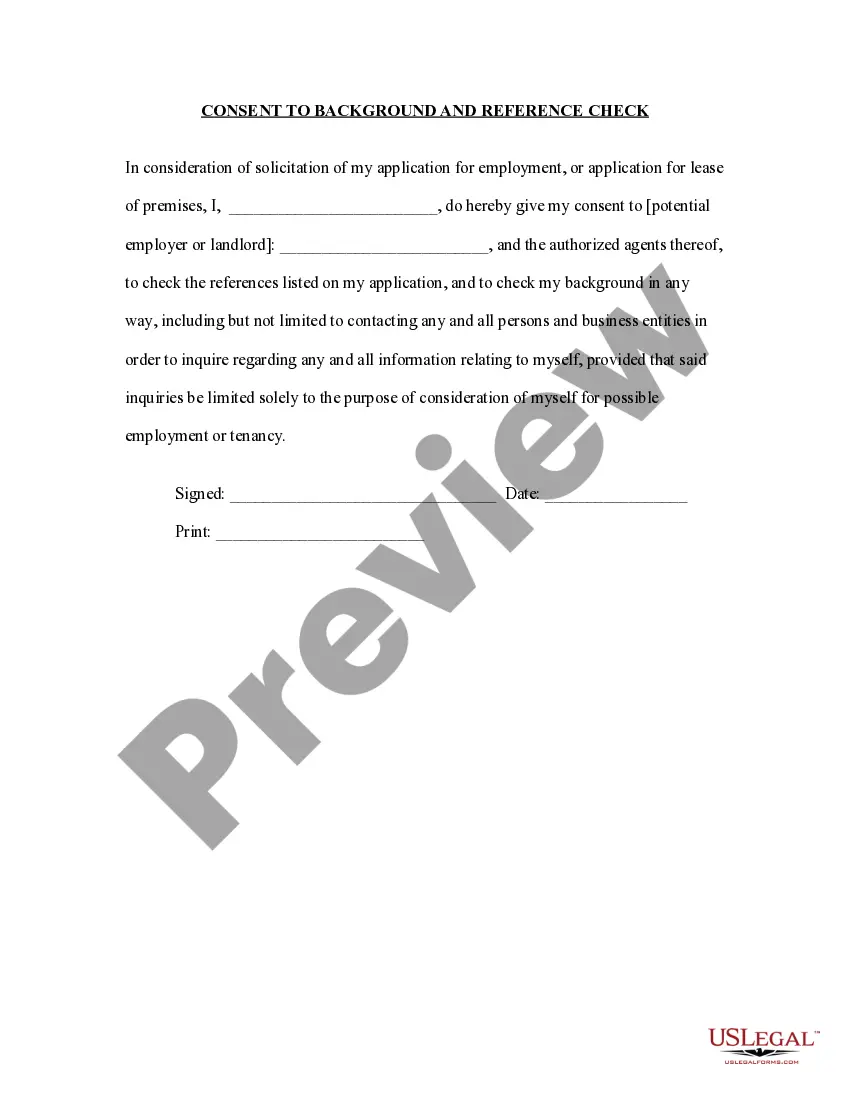

- Find out more about the form by previewing it or going through a quick description. If the Orange Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Failure to Disclose to Debtor in Initial Communication that Debt Collector was Attempting to Collect a Debt isn’t something you were hoping to find, then use the header to find another one.

- Sign in or create an account to begin utilizing our website and get the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

San Francisco — Attorney for Debt Collector, Inc. — Failure to Disclose that Debt Collector in Deceased Person's Estate was Attempting to Collect a Debtor's Debt. San Jose — Attorney for Debt Collector Inc. — Failure to Disclose that Debt Collector in Deceased Person's Estate Was Attempting to Collect a Debtor's Debt. San Diego — Attorney for Debt Collector, Inc. — Failure to Disclose that Debt Collector in Deceased Person's Estate Was Attempting to Collect a Debtor's Debt. San Antonio — Former Tax Collector for City of San Antonio — Failure to Disclose that Debt Collector in Deceased Person's Estate Was Attempting to Collect a Debtor's Debt. San Diego County — Attorney for Tax Collector — Failing to Disclose in a Deceased Person's Estate a Debt Collector is Attempting to Collect. San Diego — Attorney for Tax Collector — Failing to Disclose in a Deceased Person's Estate a Debt Collector is Attempting to Collect.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.