Section 807 of the Fair Debt Collection Practices Act, 15 U.S.C. Section 1692e, provides, in part, as follows: "A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt. Without limiting the general application of the foregoing, the following conduct is a violation of this section:

"(10) The use of any false representation or deceptive means to collect or attempt to collect any debt or to obtain information concerning a consumer."

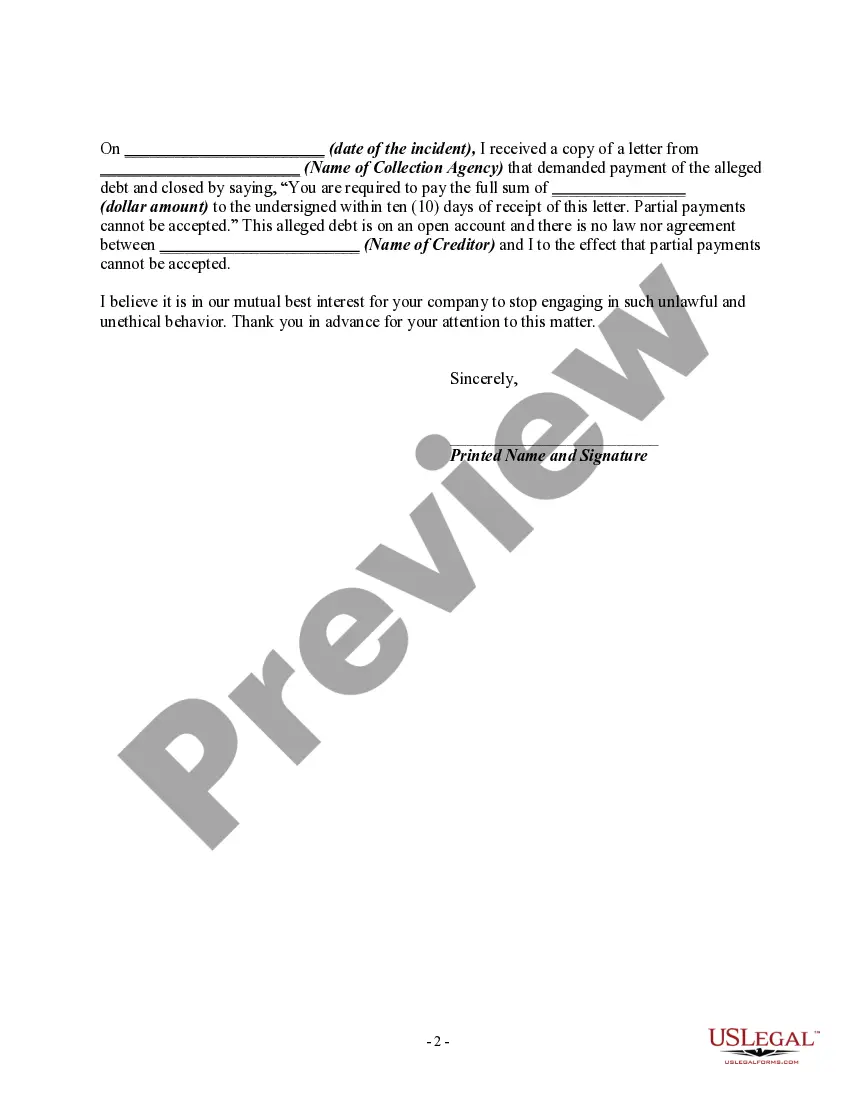

This would include asserting that the debt collector cannot accept partial payments when they have been authorized.

Title: Collin Texas Letter Exposing False Claims by Debt Collectors and Asserting the Right to Partial Payments Introduction: In the state of Texas, consumers are protected by laws that prohibit debt collectors from using false representation or deceptive means to collect a debt. This letter template serves as a detailed description of a Collin Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities. Specifically, we will address instances where debt collectors assert that they cannot accept partial payments, even though they are legally obligated to do so. Key Points to Include: 1. Header: Clearly state the sender's name, address, and contact information. Include the date of the letter and the debt collector's information as well. 2. Address the Misrepresentation: Give a concise description of the false representation made by the debt collector, such as stating that they cannot accept partial payments. 3. Reference the Texas Debt Collection Act: Mention the relevant section(s) of the Texas Debt Collection Act that outline the prohibition of using deceptive means to collect a debt. This emphasizes the debtor's knowledge of their rights. 4. Assert Legal Right to Partial Payments: Inform the debt collector that, regardless of their misleading claim, the debtor is fully aware that partial payments are legally acceptable and can be used as a tool for debt resolution. Stress the importance of reaching a reasonable agreement. 5. Request Confirmation in Writing: Ask the debt collector to provide written confirmation of their understanding that partial payments are acceptable and that they will no longer misrepresent this fact to the debtor or in any future collection activities. 6. Potential Consequences: Mention that continued false representation or deceptive means by the debt collector may lead to reporting the issue to regulatory authorities and pursuing legal remedies available under the Texas Debt Collection Act. 7. Obtain Proof of Receipt: Request the debt collector to acknowledge this letter and provide proof of receipt within a specified timeframe. This ensures accountability and allows tracking in case of any subsequent dispute. 8. Conclusion: Express the debtor's hope for a resolution that adheres to the law and emphasizes the importance of maintaining open and honest communication. Closing: Sincerely, [Debtor's Name] Note: This template can be customized to address additional false or misleading representations made by debt collectors, apart from the specific assertion that partial payments cannot be accepted.Title: Collin Texas Letter Exposing False Claims by Debt Collectors and Asserting the Right to Partial Payments Introduction: In the state of Texas, consumers are protected by laws that prohibit debt collectors from using false representation or deceptive means to collect a debt. This letter template serves as a detailed description of a Collin Texas Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities. Specifically, we will address instances where debt collectors assert that they cannot accept partial payments, even though they are legally obligated to do so. Key Points to Include: 1. Header: Clearly state the sender's name, address, and contact information. Include the date of the letter and the debt collector's information as well. 2. Address the Misrepresentation: Give a concise description of the false representation made by the debt collector, such as stating that they cannot accept partial payments. 3. Reference the Texas Debt Collection Act: Mention the relevant section(s) of the Texas Debt Collection Act that outline the prohibition of using deceptive means to collect a debt. This emphasizes the debtor's knowledge of their rights. 4. Assert Legal Right to Partial Payments: Inform the debt collector that, regardless of their misleading claim, the debtor is fully aware that partial payments are legally acceptable and can be used as a tool for debt resolution. Stress the importance of reaching a reasonable agreement. 5. Request Confirmation in Writing: Ask the debt collector to provide written confirmation of their understanding that partial payments are acceptable and that they will no longer misrepresent this fact to the debtor or in any future collection activities. 6. Potential Consequences: Mention that continued false representation or deceptive means by the debt collector may lead to reporting the issue to regulatory authorities and pursuing legal remedies available under the Texas Debt Collection Act. 7. Obtain Proof of Receipt: Request the debt collector to acknowledge this letter and provide proof of receipt within a specified timeframe. This ensures accountability and allows tracking in case of any subsequent dispute. 8. Conclusion: Express the debtor's hope for a resolution that adheres to the law and emphasizes the importance of maintaining open and honest communication. Closing: Sincerely, [Debtor's Name] Note: This template can be customized to address additional false or misleading representations made by debt collectors, apart from the specific assertion that partial payments cannot be accepted.